We always know, at Equity.Guru, that a sector is going to be hot in about a month when we start getting unsolicited phone calls from companies in a sector that wasn’t answering the phone previously. This past month, we’re getting a LOT of phone calls from gold companies, and from companies of a pretty nice pedigree.

Even Equitas (EQT.V), which is one of our founding sponsors, has recently announced a big financing, after a period of rebuilding through 2016.

We noticed Nexus Gold Corp (NXS.V) when its share chart suddenly looked like the chem trail behind a space shuttle launch.

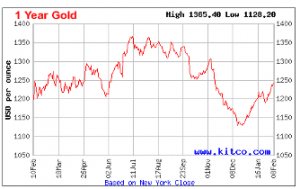

The $29 million market capper has been around for a while, but 2016 appeared to be a year of long, slow base firming, with players taking large positions over several months. To be sure, gold wasn’t in vogue in 2016, but with an election coming in the US at that time, and a certain stompy oompa loompa threatening to win on one side, and armed revolution likely upon a victory from the other side, the smart long term money was noting how cheap gold was and simply, slowly, quietly, gobbling it up.

The $29 million market capper has been around for a while, but 2016 appeared to be a year of long, slow base firming, with players taking large positions over several months. To be sure, gold wasn’t in vogue in 2016, but with an election coming in the US at that time, and a certain stompy oompa loompa threatening to win on one side, and armed revolution likely upon a victory from the other side, the smart long term money was noting how cheap gold was and simply, slowly, quietly, gobbling it up.

When the world feels like it may descend into war, folks buy gold. That’s just the way it’s been since back in the days when tulips and bird poop were all the craze on the markets. When currencies collapse, you hide in gold. When stocks go down, you take refuge in the shiny.

We’ve been waiting for that moment when gold would suddenly get serious again, and it happened last month. A full house at the Cambridge House Vancouver Resource Investment Conference was a good sign, and the entire city emptying out to travel to Toronto for this week’s PDAC conference backs that notion.

Our phones ringing from gold company calls confirms it. Gold is back.

So with that in mind, when you can look at a gold stock and see ’52 week low: $0.035, 52 week high: $0.35′, and it’s at the $0.35 mark right now, you ought to pay attention.

So with that in mind, when you can look at a gold stock and see ’52 week low: $0.035, 52 week high: $0.35′, and it’s at the $0.35 mark right now, you ought to pay attention.

So we called Nexus, and they called us back, and, bottom line: we’re going to tell you many things about this company going forward.

But first, let’s go with today’s news:

Nexus Gold Corp is pleased to announce initial assay results from its phase one diamond drill program conducted on the 178-square kilometer Niangouela exploration permit located approximately 85 kilometers north of Ouagadougou, Burkina Faso.Significant gold mineralization was encountered in four of the eight holes reporting gold intercepts. NGL-17-DD-008 returned 26.69 grams per tonne (“g/t”) gold over 4.85 metres (including 8.50 g/t gold over 0.62 metre, and 120.00 g/t gold over 1.03 metres). Hole NGL-17-DD-006 returned 4.00 g/t gold over 6.20 metres (including 20.50 g/t gold over 1.00 metre). NGL-17-DD-009 returned 2.61 g/t gold over 4.00 metres (including 5.92 g/t gold over 1.00 metre), and NGL-17-DD-003 returned 1.80 g/t gold over 5.10 metres (including 6.14 g/t gold over 1.10 metres).

SO WHAT DOES THIS ALL MEAN?

Mining guys often disagree on drill results, but those who are in to a resource stock for the first time in their investing lives will almost always just follow the market while they figure out what it all means, and there are a few first timers out there right now.

There’s been a bit of a sell-off on NXS’ news, but not one that puts more than a dent in the share price and, for many people, they’ll wait for the end of the day and grab more stock on the cheap.

Here’s the positive and the negative views on these results, in terms that the layman can understand.

First, and purists would argue this because local Burkina Faso-based individuals have been crawling all over this rock tossing nuggets in buckets for the last few decades – this qualifies as a ‘discovery’, in that NXS has confirmed gold is present and in quantities worth exploring further. It’s the first drilling done on what is a 178 sq. km property that has historically featured artisan mining aplenty.

They hit gold on eight of nine holes, with four of those being classed as ‘significant’. The best intercept was 4.85 metres of 26.69 grams per tonne. That’s almost an ounce per tonne across an almost 15-foot section at a depth of about 165 feet, for you imperialist Yankee types that can’t see the picture in metric.

We like that hole a lot. We want more of that hole. And we’re going to get it going forward.

Two of the holes are classed as ‘high grade’ hits, and the beast of the bunch was hit only 50 metres from the surface.

You don’t want to have to dig down 500 feet to get at your gold, because that’s expensive and takes time. If you can drive a Caterpillar through a few metres of soil and be pulling up shiny stuff, that’s boss. So that close to surface high grade hit is worth holding up to the light.

The other thing to note is that high grade strike came from the shear zone, not the quartz vein, so this opens the strike up in all directions. It means a lot more holes are going to be plonked down going forward, and they’ll likely be able to open up that strike.

Look at it this way. We’re playing Battleship here.

NXS tosses out eight missiles, four of them hit boats, and one of those hit an aircraft carrier.

We don’t know if that carrier is going north/south or east/west, and we don’t know if it hit the middle of the boat or the far end of it.

So what will NXS do next? They’ll bombard that strike and see where it goes.

Unlike in Battleship, however, the aircraft carrier can also go up/down. It could expand outwards in all directions. We just don’t know yet.

So, in general terms, the results do not portray any sort of failure, even if the market only really looks at the headline and says ‘one high grade in eight holes? BAH!”

What are the negatives beyond that?

Rotary Air Blast (RAB) drilling is shallow, so they didn’t test any real depth, which would be more expensive and likely done later, based around whichever holes here showed a reason to do so. That high grade turn? Guaranteed they’ll start pushing deeper into that bad boy.

Nexus also didn’t have any seriously large intercepts, which would generally suggest a massive ore body. Had they reported 140 metres of 1.80 gpt, the shares would have blown a hole in the stratosphere. And they still may.

But this is a decent place to start. In fact, it’s pretty much what you want to help move further drilling into the right places.

The disconnect comes from a new months back when the market sprung to life for Nexus on other results. The stock was halted at $0.12 on January 11 when they announced:

“It has received geochemical results from Actlabs Burkina Faso SARL, an ISO 9001:2008-certified independent lab, from its initial exploration program at the Niangouela gold concession located 60 kilometres north of Ouagadougou, Burkina Faso, West Africa.”

- Selected sample from sheared intrusive returns 23.9 grams per tonne gold;

- Primary quartz vein strike length identified over 1,000 metres

- RAB (rotary air blast) drilling identifies secondary mineralized trend over 500 metres in length.

“The highlights of the program include sample NG005 taken from the primary quartz vein at 46 metres below surface, which returned a value of 2,950 grams per tonne gold. In addition, sample NG006 was collected from the artisanal dumps of the sheared intrusive, which returned a value of 23.9 grams per tonne gold. These results indicate the presence of high-grade gold occurring within the primary quartz vein and the sheared intrusive envelope. These samples were selected and may not be representative of the mineralization hosted on the concession.”

For most African mines the idea of the play is low grade massive tonnage. I think the quartz vein sample returning 2,950 grams per tonne gold sparked much speculation, and a strike length of 1,000 metres suggested a potential very rich find.

While today’s results were, by themselves, fine, when people who bought in as a result of those earlier pulls and thought they were sitting on a straight up bonanza look at the new data and they’re disappointed the thing isn’t shooting to five bucks. Frankly, 2950 grams per tonne? That’s mental and nobody with an ounce of sense should figure that would be representative of the whole play.

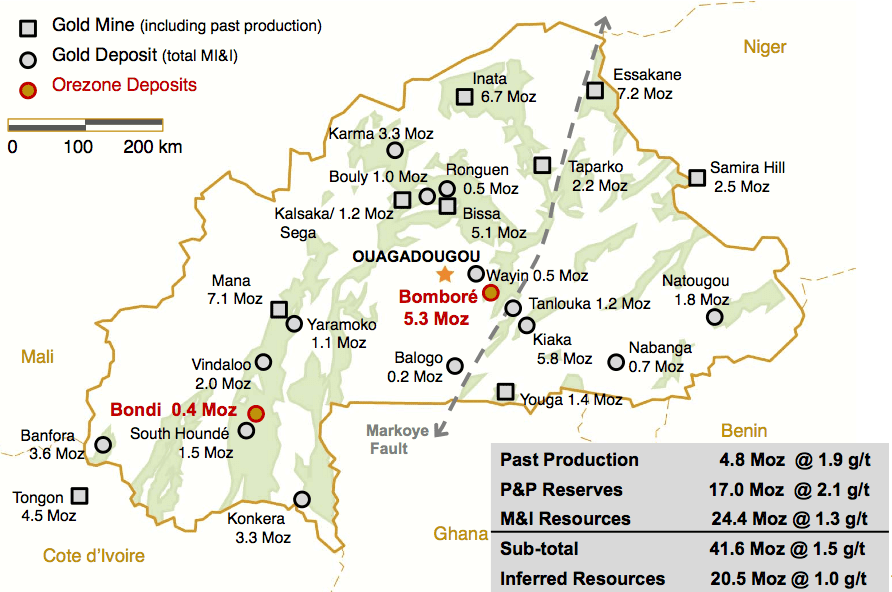

As for Burkina Faso, it appears to have a history of producing decent deposits as evidenced in the image map below. (courtesy of Orezone).

If NXS sellers keep at it, might be worth taking their cheap paper from them today and tomorrow. Either way, the opening shots of this game of Battleship are intriguing enough to not throw the board on the floor.

– Chris Parry

FULL DISCLOSURE: Nexus Gold is an Equity.Guru marketing client, and we hold stock in the company that, frankly, we’re going to be adding to.