Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) is an emerging specialty metals company focused on its Rose Lithium-Tantalum (“RL-T”) project near James Bay, in northern Quebec. Last year the Company signed a strategic Collaboration Agreement with leading global chemical company HELM AG that includes 100% take-or-pay off-take for all products produced, at market prices.

Watching the lithium industry develop, the only thing that’s certain is change. The fact that HELM will take-or-pay all that the Company makes, is a really big deal. A take-or-pay agreement with a giant, creditworthy counter-party, will facilitate the Company’s efforts in obtaining debt financing. I think the HELM Collaboration Agreement is the best strategic partner arrangement in the lithium juniors sector.

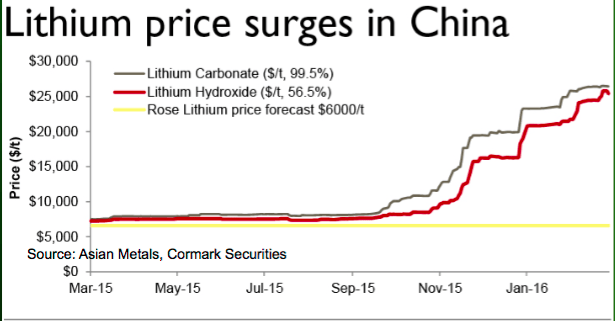

Critical Elements Corp.’s (“CEC”) PEA highlights a 99.98% purity, low-cost, hard rock lithium project with a pre-tax NPV(8%) & IRR of C$488 million & 33%, respectively (assuming a US$6,000/Mt Lithium Carbonate (“LC”) price). The RL-T project benefits from a source of very low-iron spodumene concentrate, ideally suited for the glass & ceramic markets. Both technical & battery-grade lithium production is planned, with technical grade likely available in 2019 and in battery-grade markets 18 months thereafter. If successful, this would allow CEC to generate earlier cash flow to support development and commercialization of battery-grade lithium products. [See: October Corp Presentation]

Another attribute of the RL-T project worth reiterating is its high purity, low-iron spodumene concentrate. With minimal processing, technical grade LC will be well positioned to serve the glass & ceramics markets. Currently, that segment is overly reliant on Talison’s Greenbushes lithium operations in western Australia. All CEC need do is deliver products, HELM will spearhead marketing, sales & distribution activities. What other lithium junior has the luxury of largely bypassing such critical functions to remain laser-focused on production growth, cost control and product quality?

Is Critical Elements undervalued due to a PEA done nearly five years ago?

Like the other developers, CEC stands to benefit greatly from soaring lithium prices. Marking-to-market the Company’s Preliminary Economic Assessment (“PEA”) for LC prices that are well above the base case of long-term assumption of US$6,000/Mt, would more than double the NPV. Six months ago, investors were comfortable increasing their view of the long-term price to US$7,500/Mt.

Today, many investors, analysts, consultants & pundits are saying that figure is closer to US$10,000/Mt. For example, in an interview of world renowned lithium expert Joe Lowry, CEO of Global Lithium LLC that appeared here on October 19th, Mr. Lowry responded to a question about lithium pricing by saying,

“The global average carbonate price (outside China) will likely settle between US$10 and US$14 per kilogram (US$10,000 – US$14,000/Mt) over the next few years. I think China pricing will be higher than that. Longer term, carbonate stays in the low double digits to low teens outside of China–and a little bit higher inside of China–just because of the supply and demand dynamics. This seems the situation until at least 2021.”

Above is a chart showing NPVs across a range of pricing assumptions

Consider this, (TSX-v: CRE) traded as high as C$0.75 in early June. Back then, an increased LC price assumption of US$7,500/Mt (up from US$6,000/Mt), indicated that the NPV in the PEA would increase by ~110%. NOTE: {prospective NPV adjusted for lower tantalum price}. At a prospective US$10,000/Mt LC price, the NPV would be ~180% higher, yet the share price is 30% lower at C$0.53.

Less recognized than the spike in LC is the impact of a major move in the C$/US$ FX rate assumption in the PEA, from parity (C$1.00/US$1.00), to about (C$1.00/US$0.76). That means all else equal, the Company’s C$ denominated costs (relative to the US$/Mt LC price) are effectively 23.5% lower. Of course, this oversimplifies the PEA’s economics, but nonetheless, the weaker C$ is a significant factor. Plugging in US$10,000/Mt (if that’s the number that were to appear in the Bank Feasibility Study (“BFS”), could allow the NPV to rise by 200%+ to more than US$1.4 billion. NOTE: {entirely my own calculations, based on publicly available data} NOTE: {BFS expected in next 2-3 months}

Sell-off in lithium juniors could offer attractive entry point

Lithium stocks are down across the board, I count 50 that are down 50% – 91.3% from 52-week highs. The reason is simple, there’s a bubble in lithium juniors (but not in lithium). Clearly, some air is leaking out, actually, a lot of air. However, the sector-wide downdraft has punished potentially viable companies as well as the terminally ill. This could represent an attractive buying opportunity.

Look no further than Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12). Shares are down from C$0.75, but up 26% from C$0.42 to C$0.53 in the past week. The next 3 months will be very interesting.

Please see the following links for further information:

Corporate Website + Corp Presentation + Flagship Lithium Project + Latest News + 2011 PEA

++++

Disclosures: Readers fully understand and agree that nothing contained in this article authored by Peter Epstein, or on EpsteinResearch.com, [ER] including but not limited to, interviews, analysis, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered in any way whatsoever, implicit or explicit, investment advice or guidance. Further, nothing contained herein is a recommendation or solicitation to buy, hold, or sell any public security. Mr. Epstein has never been, and is not currently, a registered or licensed financial advisor. His article(s) on Critical Elements Corp must be considered carefully in this context.

Any comparison between or among stocks is purely for illustrative purposes and should not be taken as fact or relied upon. Readers understand and agree that they must conduct their own investment due diligence. An investment in any small cap stock, including Critical Elements Corp, can deliver a 100% loss. While the author believes that he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein is not responsible for any perceived, or actual, errors including, but not limited to, analysis, commentary, opinions, views, assumptions, reported facts & financial calculations, or for investment actions taken.

At the time this article was posted, Critical Elements Corp. was a sponsor of EpsteinResearch.com and the author had stock options in the Company, The shares of Critical Elements Corp. are highly speculative, not suitable for all investors. Readers are urged to consult with their own licensed or registered financial advisors before making investment decisions.