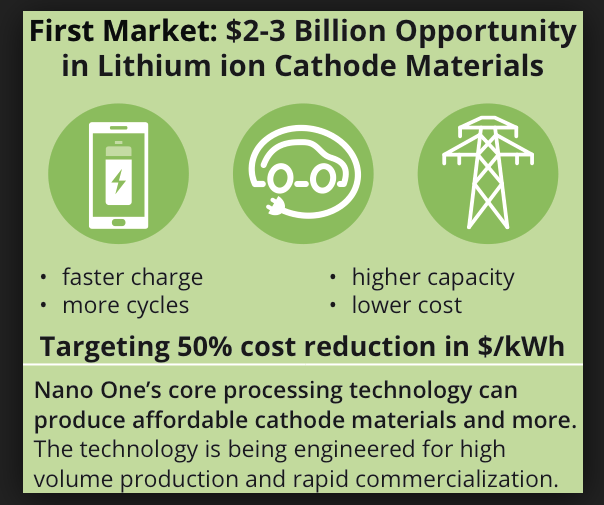

As a quick reminder, Nano One is developing patented, scalable and low-cost processing technology for the production of high performance battery materials used in Li-Bs powering EVs, energy storage systems & consumer electronics, and in a number of other end uses. The Company’s growing portfolio of patents and associated IP supports proprietary technology that can be configured for a wide range materials. Nano One is approaching the pilot plant stage.

People, Partners, Patents & Process

Nano One’s valuable IP is of paramount importance, so is its built-in operating flexibility, allowing it to seamlessly shift with battery material trends. The team’s novel, three-stage processing technology uses off-the-shelf equipment and is engineered with the anticipation of high volumes. Having recently been approved for a $2.1 million grant, and having collected another $2.9 million from the exercise of warrants, the Company is well funded as its processing technology approaches pilot plant stage. [NOTE: Nano One has applied for additional grants that may or may not be awarded this year]. Nano One Materials is all about People, Partners, Patents & Process. Collaborative relationships & partnerships include the National Research Council Canada NORAM & BC Research & 4D LABS at Simon Fraser University

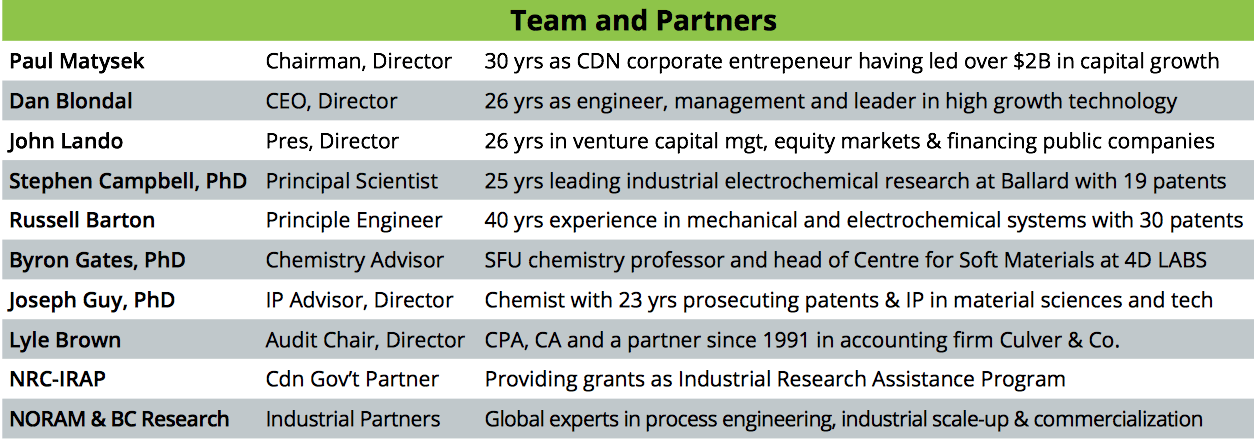

Anyone reading Nano One’s news releases and looking at images such as the one above, has no doubt encountered a lot of technical battery industry jargon. Honestly though, for 95% of investors in any high-tech firm, the secret sauce is mostly impenetrable. That’s why a dedicated, entrepreneurial team of scientists, process & mechanical engineers and electrochemists can come together to build a robust enterprise. An expert team that can develop valuable IP, a firm not easily replicated. While the Company is bound to face competition, in a global Li-B market that could top $100 billion by decade’s end, there should be plenty of room for all.

Don’t fear unknown technology, if it were easier, everyone would be doing it

Any potentially game-changing technology is, by definition, difficult to comprehend. Here’s how Chairman Paul Matysek described it to me in an interview,

Nano One’s processing technology could enable a new generation of batteries by making it economically viable to produce a wider range of advanced energy storage materials. We start with low cost raw materials, such as lithium carbonate, and blend it with other metals using a scalable, patented process. This reduces manufacturing complexity and cost, while delivering materials that are more robustly structured for longer lasting performance. We aim to license and partner with key players in the industry to commercialize our technology, and are already having meetings with a number of parties.

Nano One is in the enviable position of entirely sidestepping the myriad risks of mining for lithium or graphite. In fact, the Company is largely material and Li-B type agnostic. Instead of fearing change, Nano One stands to thrive from it. The Company need not care which cutting-edge battery is gaining traction, so the fundamentals & pricing of materials are irrelevant. The Company proposes to make low-cost, consistently high-quality, battery materials, enabling increased adoption of Li-Bs across an even wider range of end-uses.

“This battery patent is significant in a few ways, and marks another milestone in the growth and valuation of Nano One’s patent portfolio. The Taiwanese are global battery players and this issuance provides validation and positioning in the Asian market. This third patent also extends Nano One’s patent portfolio across the value chain to include processing, materials and now batteries.”

Nano One has the potential upside of Li-Bs, without the risks of mining

Second, as mentioned, the Company was approved for a $2.1 million grant, in a process described as involving detailed due diligence. Additional grants are actively being pursued, each involving more due diligence. Third, the recent announcement that lithium expert Joe Lowry is joining the Company as a Strategic Advisor is another vote of confidence. I personally know that his expertise, professionalism & credibility are second to none.

At this point, I’m excited to share with readers what I believe encapsulates a big part of what the Company is trying to achieve. On March 31st, Nano One announced that through its patented process, it successfully produced high-voltage cobalt-free, Li-B materials. Blondal reported,

At this point, I’m excited to share with readers what I believe encapsulates a big part of what the Company is trying to achieve. On March 31st, Nano One announced that through its patented process, it successfully produced high-voltage cobalt-free, Li-B materials. Blondal reported,

“Our patented process has produced material that shows better longevity with over 10 times less energy fade and we’ve measured up to 50% more energy at high rates of discharge. This material is remarkably stable and could be very competitive with existing commercial materials in terms of its high voltage performance and its cobalt free cost advantages.” Chairman Matysek added,

“Cobalt adds considerable cost and supply chain risk to most [Li-Bs]. The most recent battery material being produced by Nano One requires only lithium, manganese and nickel, no cobalt. This should be well received by the battery industry as it reduces costs, environmental footprint and supply chain risks, while providing high-voltage advantages for next generation [Li-Bs].”

The key takeaway here is profound. Cobalt is a, “conflict mineral,” because a very large portion of global supply comes from the Democratic Republic of Congo. Sourcing cobalt is fraught with a number of moral, economic & logistical challenges making it controversial, to say the least. Enter Nano One Materials. As the news release states, the scientists formulated a battery material that does not use cobalt. Further, the new concoction shows signs of possibly being superior to, “existing commercial materials.”

This is a win-win-win outcome that also highlights Nano One’s growing capabilities. Through the development of new materials or following a battery recipe for prospective customers, there are multiple reasons why larger players in the battery chain should want to work with Nano One. In a prior article, I described the Company’s potential product portfolio, operational flexibility and high-quality solutions as an outsourced R&D / contract manufacturing function.

Outsourcing certain manufacturing steps to Nano One would allow upstream players to concentrate on other important aspects of their businesses. Recall that the Company expects to be able to slash up to 50% from the cost of supplying critical battery-ready materials. This is extremely important because cutting costs at the battery manufacturing level is hard to do. The low hanging fruit has been eaten and eventually, economies of scale exhibit diminishing returns. However, Nano One will have its own economies of scale benefits, separate from that of its customers.

Conclusion

A parting quote from Chairman Matysek that reiterates the role that patents will play going forward,

A parting quote from Chairman Matysek that reiterates the role that patents will play going forward,Nano One’s patents cover a broad range of materials and were issued quickly with only minor revisions. This indicates to us that we have a unique technological edge with fertile ground to expand our IP portfolio. Broad patents like ours can provide freedom to operate and attract the attention of global players looking for strategic IP advantages. We will work with industrial partners in leveraging our technology and know-how to (i) improve on battery material recipes and (ii) enable a new generation of materials, while iii) maintaining a sustainable technology driven cost advantage.

Nano One Materials Corp. (TSX-V:NNO) (Frankfurt: LBMF) is not a lithium or graphite play, but it benefits directly from the stunning increase in Li-B demand. Think about that for a moment. Obviously, lithium & graphite juniors share substantial upside potential from being tied to Li-B demand, but picking the winners from that group is, and will be, difficult. Make no mistake the Company’s operating profile involves plenty of risks, but different risks from that of peer Li-B suppliers and aspiring battery material miners. Nano One represents a somewhat different way to articulate an investment position in the biggest technological change in a generation. Readers should consider taking a closer look at Nano One to determine its suitability and attractiveness.

Disclosures: The contents of this article are for informational purposes only. Readers fully understand and agree that nothing contained in this article authored by Peter Epstein, from EpsteinResearch.com [ER], including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. The content contained herein is not directed at any individual or group. Peter Epstein and [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Peter Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Peter Epstein and [ER] are not directly employed by any company, group, organization, party or person. The shares of Nano One Materials are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers of this article that they will consult with their own licensed or registered financial advisors before making any investment decisions. Everything contained within this article is in the public domain. The companies profiled have no control whatsoever in its content, opinions or sentiment.

At the time this article was posted, Peter Epstein owned shares of Nano One Materials and the Company was a sponsor of EpsteinResearch.com. Any comparison between or among stocks is for illustrative purposes only and should not be taken as fact or relied upon. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for its completeness, or for investment actions taken. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Why does NNO keep tanking inspite of good news? I’m currently down by quite a bit unfortrunately.