Plucky little battery tech research company Nano One (NNO.V) [stock_quote symbol=”NNO.V”] is starting to take hold with investors with news it has received a patent in Taiwan, home to much of the world’s lithium battery production, “related to batteries utilizing the proprietary lithium mixed metal oxides developed by Nano One.”

I’ve said since I clambered into the last financing of NNO that this is absolutely an IP play, and that the company may never license a thing to any lithium battery producer, developer, end user or seller. What this company is doing is nailing down their intellectual property before they commit to moving from bench to commercial, and having a patent lawyer on the board of directors indicates this is very much by design.

This patent approval joins the other two broad patents they’ve been approved for that arguably make anyone who wants to substitute existing ingredients in a lithium battery for something cheaper/better, have to deal with NNO.

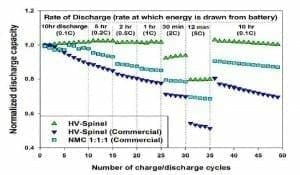

The company is committed to rolling in grant dollars (it’s already nabbed several million in non-dilutive funds for it’s pilot plant plans), it has demonstrated its tech just in the last few weeks when it showed it “successfully produced high-voltage cobalt-free lithium ion battery cathode materials” that “over 10 times less energy fade,” and “up to 50% more energy at high rates of discharge.”

The company went on to say, “This material is remarkably stable and could be very competitive with existing commercial materials in terms of its high voltage performance and its cobalt free cost advantages.”

That green run in the chart above? That’s the Nano One materials.

Now, let’s project a little. Let’s say, in the next year, we get more testing like that shown above. Let’s say there’s more patents coming. And that more grants are granted. None of this is anywhere near as pie in the sky as a drill program on a gold project because we’re talking process here.

The test results will likely bring more grant funds. The grant funds will bring more testing. And the patents, well they’re being applied for in a thick and fast basis right now. As battery tech develops, any one of those could become ‘Research In Motion’-like in their importance.

In the last week, the stock price at NNO has risen markedly. Steadily increasing volume followed by a 12% yank today. Those involved in the recent private placement (myself included) got in at $0.32. Even while that financing was rolling, the stock was jumping towards $0.40, and today rocketed through that barrier to $0.44.

That’s a 37.5% jump DURING A FINANCING.

Legendary returned on investment Paul Matysek is in at the Chairman spot, and he’s been well known for picking sectors just as they’re about to go mondogreen.

I’m not going to tell you to buy Nano One, because that’s not my jam. But I will tell you I’m really enjoying watching these guys work, and they’re quickly putting the runs on the board.

And I’ll say one other thing – when you develop a technology that can remove cobalt from the rechargeable battery process, what do yo think the powers that be in the cobalt industry are going to do about that?

Will they watch as their net worth tanks? Or will they make a run at NNO stock and either own, or bury, the technology for a fat premium to market value?

Long.

–Chris Parry