Peter Epstein is a business analyst who gets it. I had a great exchange of opinions and ideas with him earlier in the week about several companies we each like. He’s real into this one, and when I put forth my usual ‘green concepts always take ten years and make no money’ routine, he stood firm against all suggestions of weakness and reiterated that he thinks there’s something really interesting here, and something green investors can get behind.

Also, he has no commercial relationship with the company, which puts his opinion even higher in the legitimacy stakes.

So, I asked him to tell the story to you guys. — Editor

—

How many times have I invested in renewable, energy-saving / recycling companies? Way too many. Each seems so promising, so refreshingly intuitive, in the right place, at the right time…. Yet, they never seem to work out. The biggest pitfall? Competition. Typically, the competitive landscape is unfathomable to all but the management teams, who mistakenly believe it to be fathomable. Pre-revenue, working capital starved enterprises are the norm. Looking to be recognized, but with no budget to advertise, and relying on market share gains from word-of-mouth to grow into their capital structures.

Yet, here I am writing about another small-cap company in the renewable, energy-saving / recycling space. So which kind is it this time? The reader asks half-heartedly … wind, solar, hydro-electric, geothermal, tidal or wave power, bio-mass? Nope, none of those. The company I speak of designs and builds proprietary wastewater / sewage{heat} recovery systems, in which heat in the form of thermal energy is captured & recycled. This is truly a win-win-win outcome, the systems save energy, money & water, while avoiding the emission of measurable amounts of greenhouse gases, “GHG.”

Introducing Wastewater / Sewage {heat} Recovery Systems, by International Wastewater Systems

Never heard of wastewater / sewage {heat} recovery? Look what pops up on a Google search for, “wastewater heat.” Note, it’s not just the topic that appears, but the actual company, Canadian-listed International Wastewater Systems, Canadian Ticker: IWS. For those questioning the value of Google Search due diligence, trust me, it can be quite telling. For example, search for anything with the words, “solar” or “wind” or “recycle,” and prepare to be inundated with hundreds & hundreds of product & service offerings, and news.

How Risky is an Investment in Wastewater / Sewage {heat} Recovery?

IWS is highly speculative, but no more so than early-stage biotech or emerging metals/mining/minerals companies. In fact, IWS is already generating millions in revenue, with minimal cash burn. The Company has 12 systems in the field and a solid pipeline of engineering work underway in support of many more.

By winning just a few contracts from global water utilities, town or city municipalities, multi-unit residential housing & commercial buildings, IWS could generate run-rate annual revenue in the $10’s of millions, as soon as next year.

Management is in active discussions with numerous parties in North / South America & Europe. Large contract wins, if achieved, would take time to design and construct, so the booking of potential revenue would be difficult to pin down. However, since larger mandates would be with high-quality entities, the market’s reaction to news would likely be positive. Even without knowing or being able to estimate revenues, I believe the market opportunity is immense and the blue-sky potential for the Company is strong.

So How Do These Things Work?

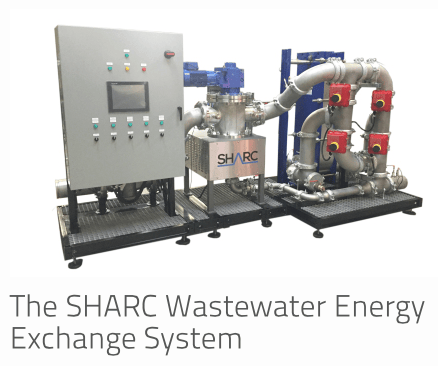

Evidence of proprietary IP can easily be found in IWS’ installed base. There are no cookie-cutter solutions, each system is expertly engineered and tailor fit. Please take the time to view 3 brief videos, the Corporate Video, Latest Installations and About Sewage Heat Recovery. These do an excellent job of demonstrating, describing & explaining the technology. Essentially, the technology diverts wastewater / sewage coming from say, taking a hot shower, and passes it through a heat exchanger, where the heat (not the water itself) is converted to thermal energy to be re-used. The energy and monetary savings derives from the temperature of ambient water heading into a hot water boiler, being significantly warmer than otherwise, thereby requiring less energy (and fewer GHG) to heat it in the boiler.

What’s the market opportunity? Massive. Solar & wind energy have passed the tipping point, proving that the demand for renewable, energy-saving / recycling solutions is robust. It’s nearly impossible to overstate the strength of the green energy movement to reduce GHG, globally, at the residential & commercial building, corporate, local & federal levels.

IWS is to wastewater / sewage {heat} recovery, what grid-scale Energy Storage Systems are to Lithium-ion batteries, i.e. hugely important, potentially ubiquitous, with double-digit CAGRs as far as the eye can see.

The proprietary, patent-pending technology produces tremendous results. Savings range from 30% to 70%+. Yet, cash savings is just the start. How about also seamlessly reducing one’s carbon footprint by using less energy & water? This factor is incredibly important, many entities targeted by IWS have explicit missions to reduce GHG emissions. IWS’s products & services represent a compelling, easy, cheap and fast way to achieve those goals.

Note, wastewater / sewage {heat} recovery both saves & recycles thermal energy, which is key. Switching from fossil fuel to renewable energy is awesome, but only conservation of energy is 100% efficient. Nothing beats using LESS energy, without diminished benefit.

Why is the Investment Case in IWS a Strong One?

From an investor’s point of view, adoption of wastewater / sewage {heat} recovery methods by a wide range of users, would lead to the visibility of longer-term revenue. Predictable revenue & earnings allows for flexibility in the Company’s business plan. IWS is already operating under 3 different scenarios. First, it sells systems outright, and collects modest recurring revenue from routine maintenance. Second, it can Build, Own & Operate (BOO) systems to lock-in a portion of customer savings. Lastly, it can tap into long-lasting (20 years), government incentives, tax rebates & credits, a strategy being aggressively pursed in the UK.

This third scenario is especially interesting. Steady, sustainable, long-lasting cash flow is highly valued in the market. Revenue from existing and planned installations can be tracked, analyzed & forecast. Further, unlike intermittent renewables, wastewater / sewage {heat} recovery is base-load energy savings, generated without fail,24/7/365. Cash flow in the form of operational savings or royalty payments could be attractive to pension plans & insurance companies, Private Equity & Hedge Funds.

The List of Favorable Investment Attributes Continues…

Other factors that I particularly like about IWS is the potential forsustainable long-term revenues, (20 years). As good as solar & wind projects are, there’s a risk that 10-15 years out, superior technology and lower cost solutions could disrupt cash flows that third-party investors are locking in today. I don’t see the same risk for the Company’s installed wastewater / sewage {heat} recovery systems, as they’re lower-cost specialized undertakings, with high switching costs.

In addition, wastewater / sewage {heat} recovery systems face less regulatory, compliance, permitting & environmental scrutiny. Therefore, in many cases, they can be designed, constructed & activated in months, not years. Less upfront capital from customers is also a selling point. Perhaps what really resonates most for me is that it’s not a question of wind or solar or wastewater / sewage {heat} recovery, IWS compliments other renewable paradigms, it does not compete with them.

But wait, there’s more…. these systems work anywhere on the planet, they do not require pesky conditions like wind or sun. Think of hydro-electric energy; green, base-load, efficient… but only available where one can build a dam!

For these reasons, I believe that IWS is poised to capture a lot of business. Valuations of well-established companies with steady cash flows can be high. For example, gold/silver streaming & royalty companies Franco-Nevada & Silver Wheaton trade at 12 & 20 times annual revenue. Admittedly, IWS is years from potentially becoming that well-established, but clear evidence of the wide-scale adoption of wastewater / sewage {heat} recovery would ensure that an important, or even leadership role would be played by International Wastewater Systems, Canadian Ticker: IWS.

Again, please take the time to view these 3 brief videos, the Corporate Video, Latest Installations and About Sewage Heat Recovery.

Disclosures: Peter Epstein, CFA, MBA, has no prior or existing relationship with International Wastewater Systems or any of its employees, executives & Board. IWS is a small cap company. As such, it’s highly speculative and not appropriate for all investors. Readers should consult with their own investment advisors before buying or selling small cap securities.

For more of Peter Epstein’s research, visit EpsteinResearch.com