As global economic uncertainties rise and the US dollar weakens, many investors are turning their attention to gold. In this in-depth analysis, Equity Guru’s Vishal Toora explores whether we are in the midst of a gold bull market and what the future holds for this precious metal.

Gold has long been seen as a safe haven for investors during times of economic and political turmoil. With recent headlines surrounding the dollar weakening, inflation, and oil prices, it’s no wonder gold is experiencing a surge in interest. Toora dives into the technicals, examining gold’s performance against various currencies and discussing the factors that contribute to its current uptrend.

In mid-March, gold broke out into new record highs against the Australian dollar, British pound, New Zealand dollar, Japanese yen, and Indian Rupee. While gold has yet to reach new record highs against the Euro, Swiss Franc, and Canadian dollar, it is inching closer to doing so. Toora believes this steady uptrend in gold against various currencies is indicative of a larger trend in the market.

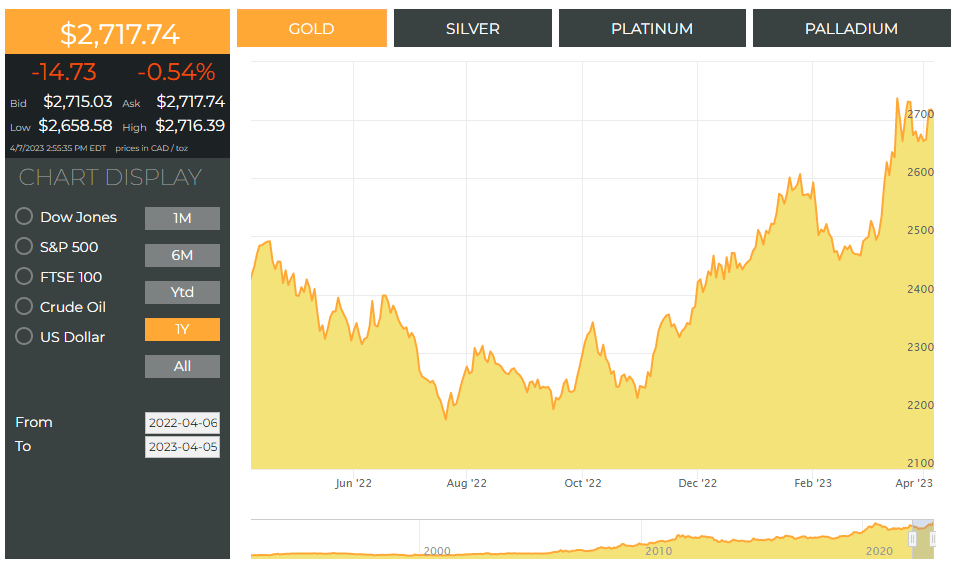

Gold’s performance against the US dollar is particularly noteworthy, as it is often seen as having a negative correlation with the greenback. As the dollar continues to weaken, gold prices are likely to rise. Toora points out that the US economy’s slowdown, the Federal Reserve’s potential pause in hiking interest rates, and global uncertainties are all contributing to the bullish outlook for gold.

Toora’s technical analysis of the gold market focuses on the weekly chart, which he believes is crucial for understanding the larger trends at play. In recent weeks, gold has experienced a significant breakout against the US dollar, breaking above the $2,000 per ounce mark. This strong uptrend is expected to continue, with Toora predicting that gold will reach new record highs above $2,075 in the coming weeks.

Silver is also experiencing a bullish breakout, with its price closely following gold’s upward trajectory. Toora highlights the significance of silver’s recent break above a key resistance zone and predicts that if it can maintain a daily close above $25, it will likely reach new highs around $26 and potentially even $28.

In conclusion, Equity Guru’s Vishal Toora’s technical analysis suggests that both gold and silver markets are currently experiencing bullish trends, with the potential for further gains in the near future. As global uncertainties continue to rise and the US dollar weakens, investors may find comfort in these precious metals as a means of protecting their purchasing power. Keep an eye on gold and silver’s performance in the coming weeks, as their upward momentum may be a harbinger of new record highs.