So I had planned something clever to say to open this Market Moment. I was going to say, ‘we went from avoiding World War III to worrying about Fed interest rate hikes’. But the ‘avoiding world war III’ bit is now a big ‘sort of’. We heard reports yesterday that Russian troops were pulling back from the border. Stock Markets liked it. The fear was subsiding. But now this:

NATO says Russia is increasing troop numbers at Ukrainian border, calls for talks

Things aren’t over yet on the geopolitical sphere. And the markets are feeling it. Precious metals are up, and oil is beginning to catch a nice bid as expected.

Energy is the strongest sector today, but some value stocks are also getting a nice bid up.

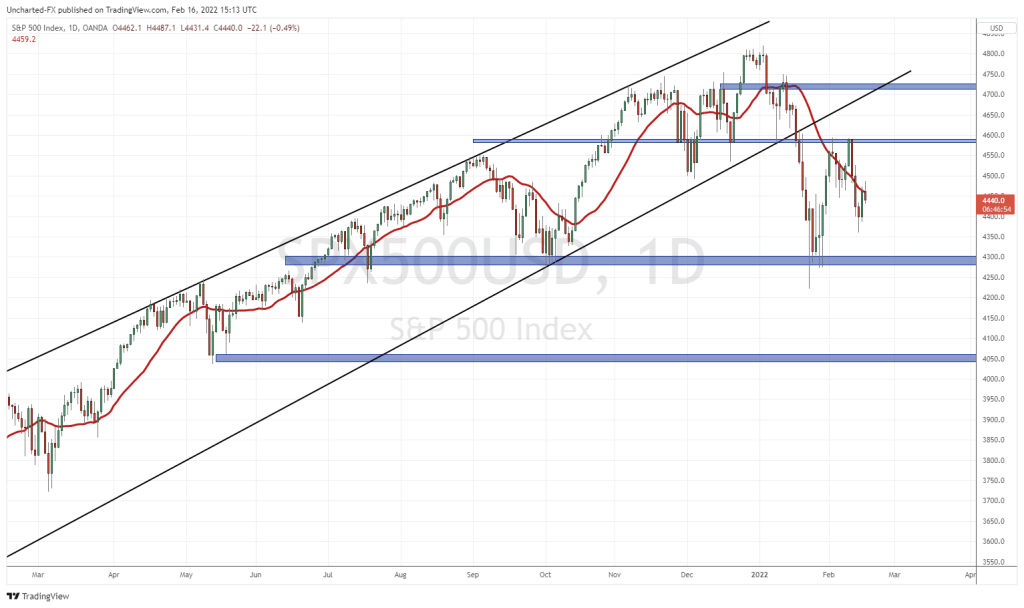

In terms of Stock Market price action, I cannot say much. Technically, we remain in no man’s land. Markets are still battling to determine whether we take out the previous lower high to neutralize the current downtrend, or if we break below recent lows to continue the downtrend. The downside is favored, but we are having a tough time getting back to those recent lows.

Stock Markets have been feeling the heat from geopolitical tensions, but we cannot forget inflation and interest rate hikes! The contrarian in me is actually considering the saber rattling is actually more of a distraction. To keep people distracted from inflation, and maybe even be used as a reason for the Fed to turn less hawkish.

This brings us to today’s FOMC minutes, which will be released at 11 am PST/ 2 pm EST. These are the meeting minutes from last month’s Fed meeting. We get to read about what Fed Presidents are thinking. Investors and traders will be scanning to determine the scope of rate hikes. How many committee members are favoring multiple rate hikes and how large. The headlines will be important, but I stress some caution.

Since the last Fed meeting in January, Fed President’s have changed their tune. We had Atlanta Fed President Bostic lean less hawkish, saying he expects 3 rate hikes, but maybe 4 to 5 depending on how things go.

While St Louis Fed President Bullard has been the bane of stock markets. His comments have caused markets to sell off recently. Bullard is quite hawkish, even saying the Fed’s credibility is on the line here. He believes the Fed must hike quickly, and markets are now even thinking of a 50 basis point hike come March 2022.

So the algo’s and mainstream media will definitely be hyping up the FOMC minutes, but I think as prudent investor’s it is important to remember what Fed Presidents are saying AFTER the January meeting. The dot plot that comes out will be discussed a lot. It will give us insight to how many rate hikes committee members are expecting in 2022.

So what markets will I be watching? As usual, the US Dollar and the 10 year yield. The thing is that these markets are also being impacted by geopolitical fears. A risk off environment tends to see money move into bonds and cash (US Dollar). So this makes things tricky.

I have said in previous articles that the 10 year yield is the one chart to watch if you want to know where markets are going. If you believe markets are rising due to cheap money, higher rates would be negative. The 10 year yield is in an uptrend and is looking like rates will climb. This can see a bump on a hawkish Fed…but also drop on a less than hawkish Fed.

The tricky thing is the risk off environment. If money runs into bonds for safety, then yields will be dropping. Currently, it looks like the bond markets are more worried about the Fed than Russia.

The Dollar is another tricky one. If the Fed is hawkish, we should expect to see the Dollar climb on pricing in interest rate differentials. Some say this has already happened with the recent move up in the Dollar. But on the geopolitics side, the Dollar should also get a bid on the risk off/safe haven trade. Very tricky.

So what’s the takeaway? Don’t be too distracted from the Fed and inflation. Those are still the primary drivers, while yes, a geopolitical move could be a black swan impacting financial markets.

In terms of gauging fear, perhaps it will be best to look at the VIX (which indicates how volatile markets are), and the Oil markets, which will drop if Russia-Ukraine tensions simmer down.