Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

It seems there every week we hit a historic record, and last week we hit a record that many would not have expected back in March. In fact, many were still calling for another bottom to be put in: to continue the downtrend/ bear market. Well folks, the Nasdaq has hit record ALL TIME HIGHS.

This is something I have spoken about many times in the past. Let’s discuss the ‘fundamental’ reasons. The mainstream media has been attributing the green day rallies to things like a vaccine being closer, economies re-opening, possibility of a US-China phase 1 deal still on the table, and now just recently, signs of a “insert a letter here (V,L take your pick)” type of recovery.

This was buoyed with the unexpected, and unbelievable job data that were released on Friday by both the US and Canada. Canada added 290,000 jobs for the month of May with the unemployment rate remaining high at 13.7%, while in America, the economy added an outstanding 2.5 million jobs for the month of May with the unemployment rate dropping to 13.3%. The US job data was expected to see a loss of 7.5 million jobs… so yea this data was very surprising. Economists are now talking about a misclassification error. This data is giving more hope that we are in the recovery now, and it may be quick.

You all know my opinion. Been saying markets will move up as they remain the only place to go for yield. The central banks have created an environment where everything will have to be, and is, being propped up. Unlimited money printing and easing policies means money is being forced into stocks. You need to think about this aspect as well. If the US economy is recovering well, why is there still talk of more printing and stimulus from both the central banks and governments. Well, this week we have the Fed meeting on Wednesday, and it will be interesting to hear Fed chair Powells take on this. Do not expect anything to change. We should expect to hear that rates will still remain low for a very long time, and the Fed will continue to implement unprecedented policies if required. The big surprise would be the Fed saying they will taper their purchases and programs…but will be interesting to see how the market reacts especially given the employment data signifying a recovery.

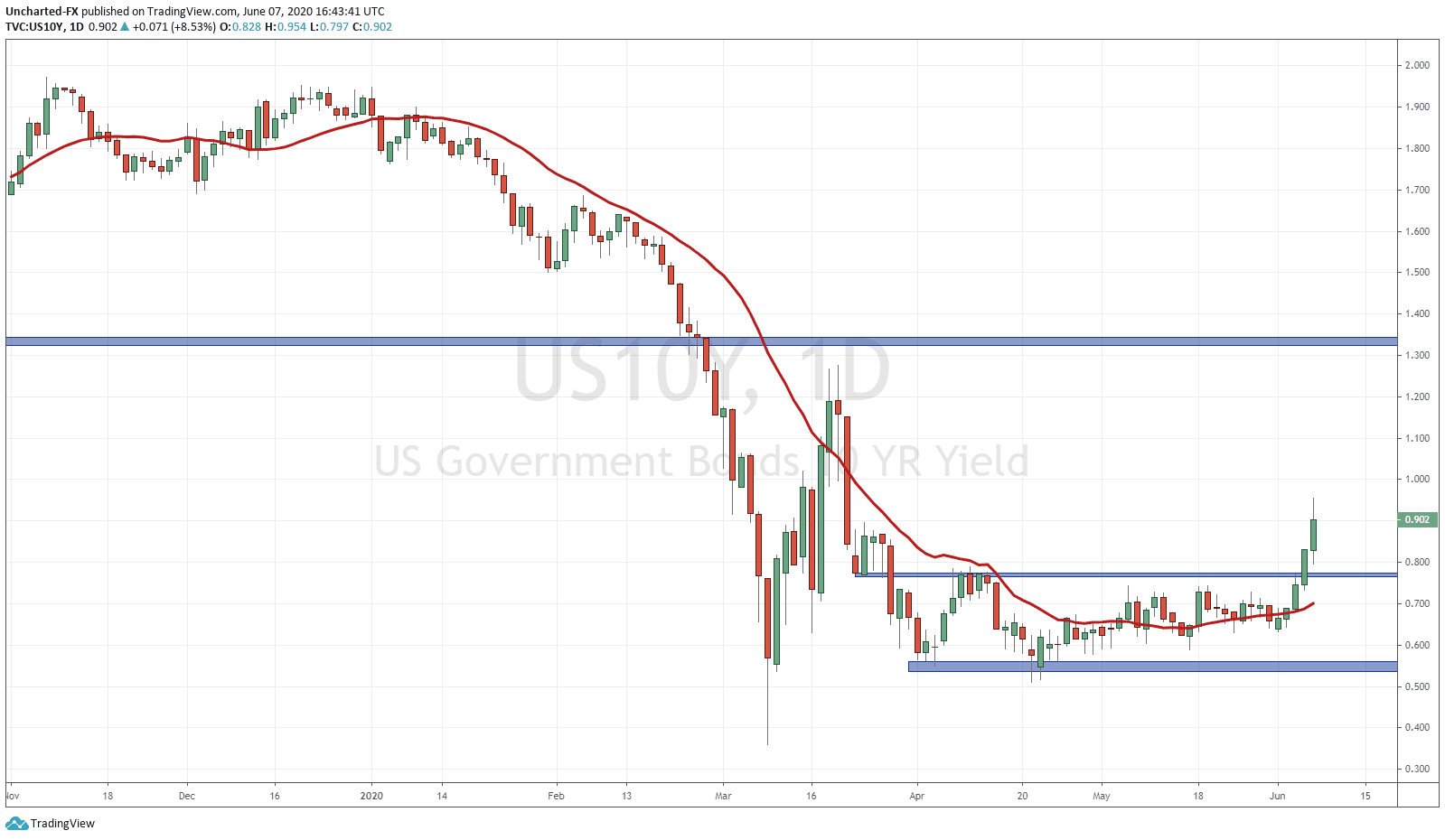

My followers and readers also know the significance of the bond markets. The largest markets in the world. If there is one chart to look at to understand the markets, it is the chart of the Ten Year Yield. When the yield is rising, it means bonds are selling off, and vice versa. Many fund managers use the asset allocation strategy. Where money switches from stocks to bonds and back when one is overvalued and the other is undervalued. This morphed into risk off and risk on trades during the Great Financial Crisis of 2008. When money runs into bonds, we are in a risk off environment, when money runs into stocks, we are in a risk on environment.

On the 10 year yield, we saw a basing pattern and great market structure. This was alerted to our members over on the Equity Guru Discord Channel. This was telling us that money was leaving bonds…but where was this money going? Remain in Cash? No because you would just keep it in bonds. Gold? Perhaps but the Gold charts were moving down, not indicating money entering the Gold market. Stocks? Bingo. We seem to be back in a risk on environment. Money is now leaving the safety of the bond markets, and is now entering stocks.

What I will be personally paying attention to is if foreign money will run into the US market. If foreign funds think the US economy is well on recovery, I believe we will see foreign money enter to buy US stocks. They may want to chase this breakout move here on the Nasdaq. My eyes will be on the US Dollar chart, which has been taking a hit. To buy US stocks, one needs to convert their currency into US Dollars before buying US equities. If we see a large amount of foreign money moving in, the US Dollar chart will show us.

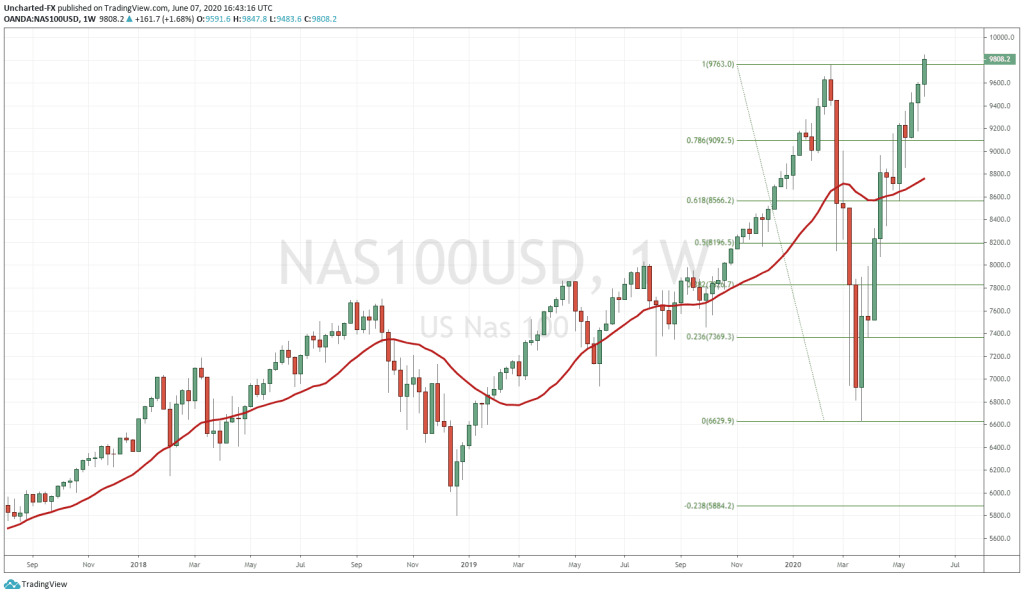

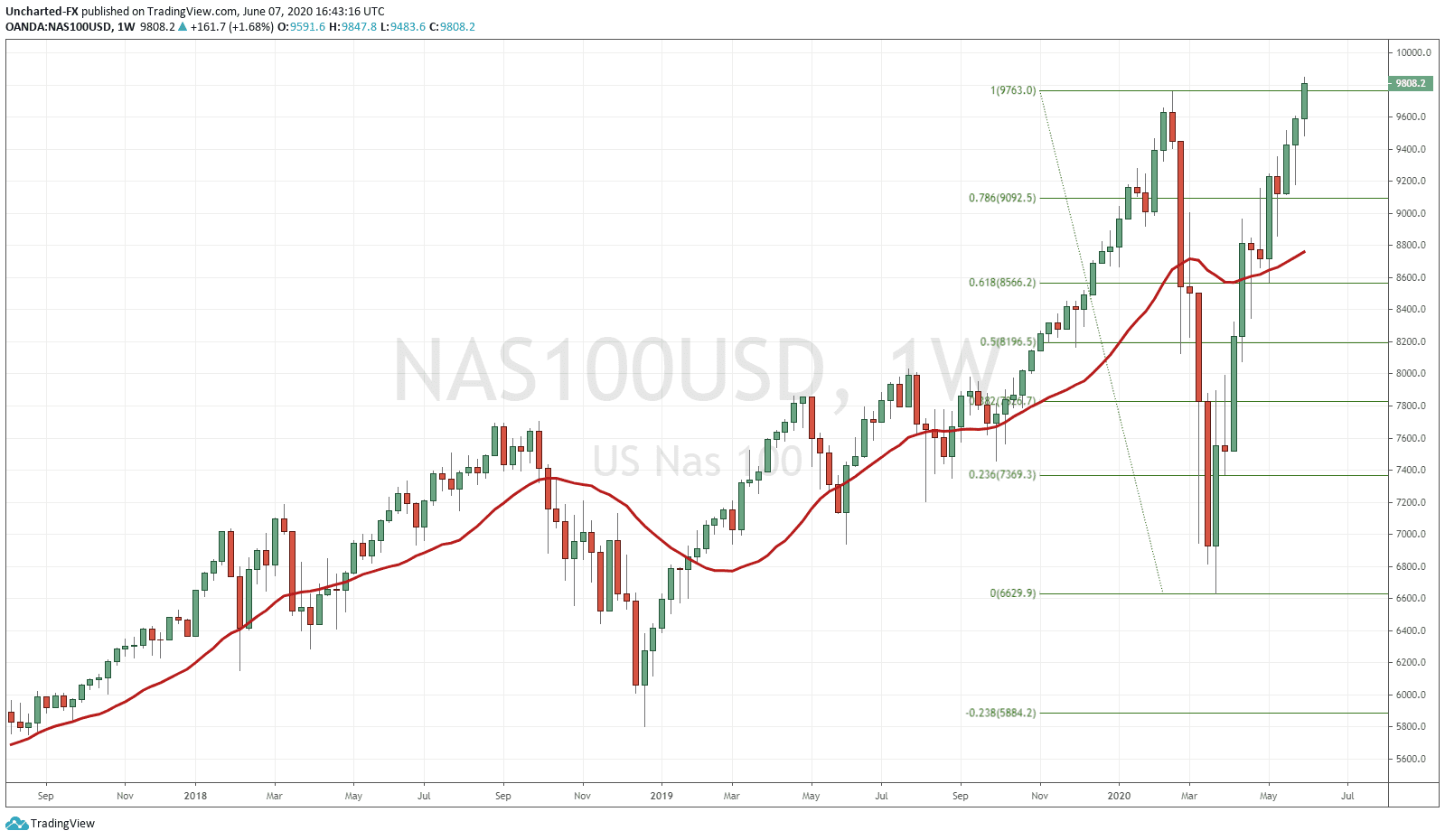

Onto the technical side. I have posted on the importance of the fibonacci levels on the weekly charts for US equities. The 61.8 fib being the KEY level, and the test and reaction there, would be important for where we are heading in this world. You can read my summary for what markets would do at this zone here. Markets do not move in a straight line. When they are in a trend, they pullback before resumption, and these pullback areas are called swings. In the case of a downtrend, a lower high swing. The fibonacci levels are where price moves to for a reaction to create a possible lower high. If the move is very strong, we should expect to see a rejection at the 38.2. You can see we saw two weeks of rejection at the 38.2 but not enough to take us lower. 50 is also a zone, but the line in the sand is the 61.8 fibonacci level.

I have spoken about this 61.8 fibonacci and its importance in previous posts. In fact, the Nasdaq was the first of the US equity markets to break and close above the 61.8 fibonacci. Just as I said back in those posts: if we break and close above the 61.8 fibonacci, the likelihood of new all time record highs is greater than making new lows. In other words, the downtrend/ bear market that many have been predicting is nullified. My other posts showed the S&P and the Dow break above the 61.8 fibonacci level. Look at the reaction so far.

In summary, these markets will be moving up because they are the only place to go for yield. To beat real inflation in this world with crazy fiscal and monetary policies, equities will be the only place to go to get ahead. More funds are now realizing this, and will lead to money running into equities. Not to mention these fund managers need to make yield in order to keep their jobs.

In the past I have discussed what could bring these central bank guided equity markets down. It can only be a black swan event. Something so unexpected, it causes a large sell off (that would overwhelm bank and central bank orders). There are many candidates for this but it seems for now, the Fed has done a good job in propping everything up. I would keep my eyes on the geopolitical side, perhaps with Hong Kong and China. And of course, the closer we get to the elections, the more uncertainty there could be.

This market has shrugged off a pandemic, great depression like unemployment, millions of layoffs, and now riots and protests in American cities. There is a huge difference in the real economy and the stock market. The stock market is just guided by this hunt for yield. Central banks are well on the way to becoming the most powerful institution in human history. Well on the way to becoming the buyers of last resort.