Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA

Our Silver trades have hit both of their targets. The original breakout and walkthrough was discussed on May.15th, and can be read here.

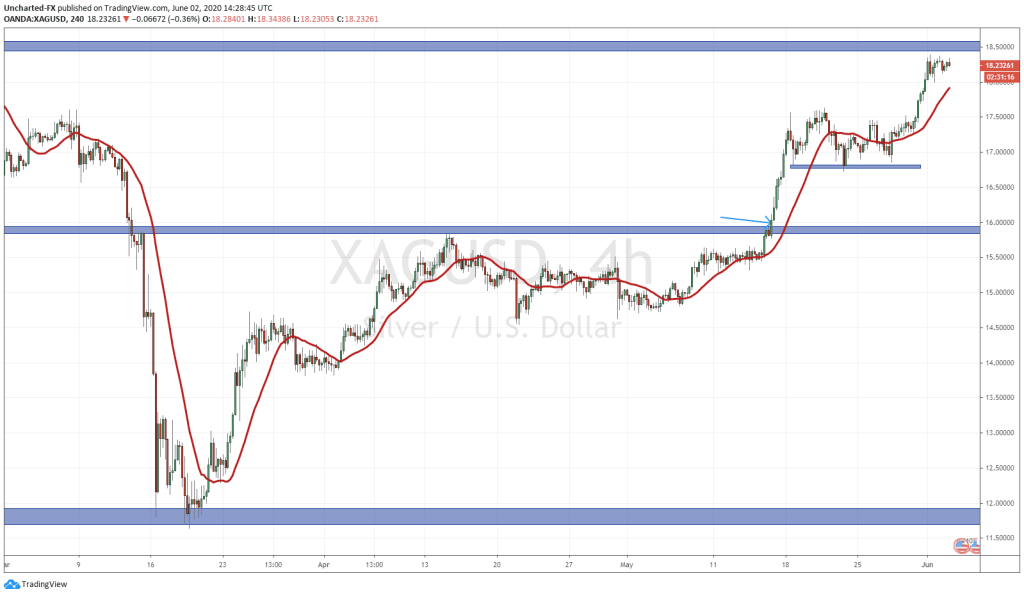

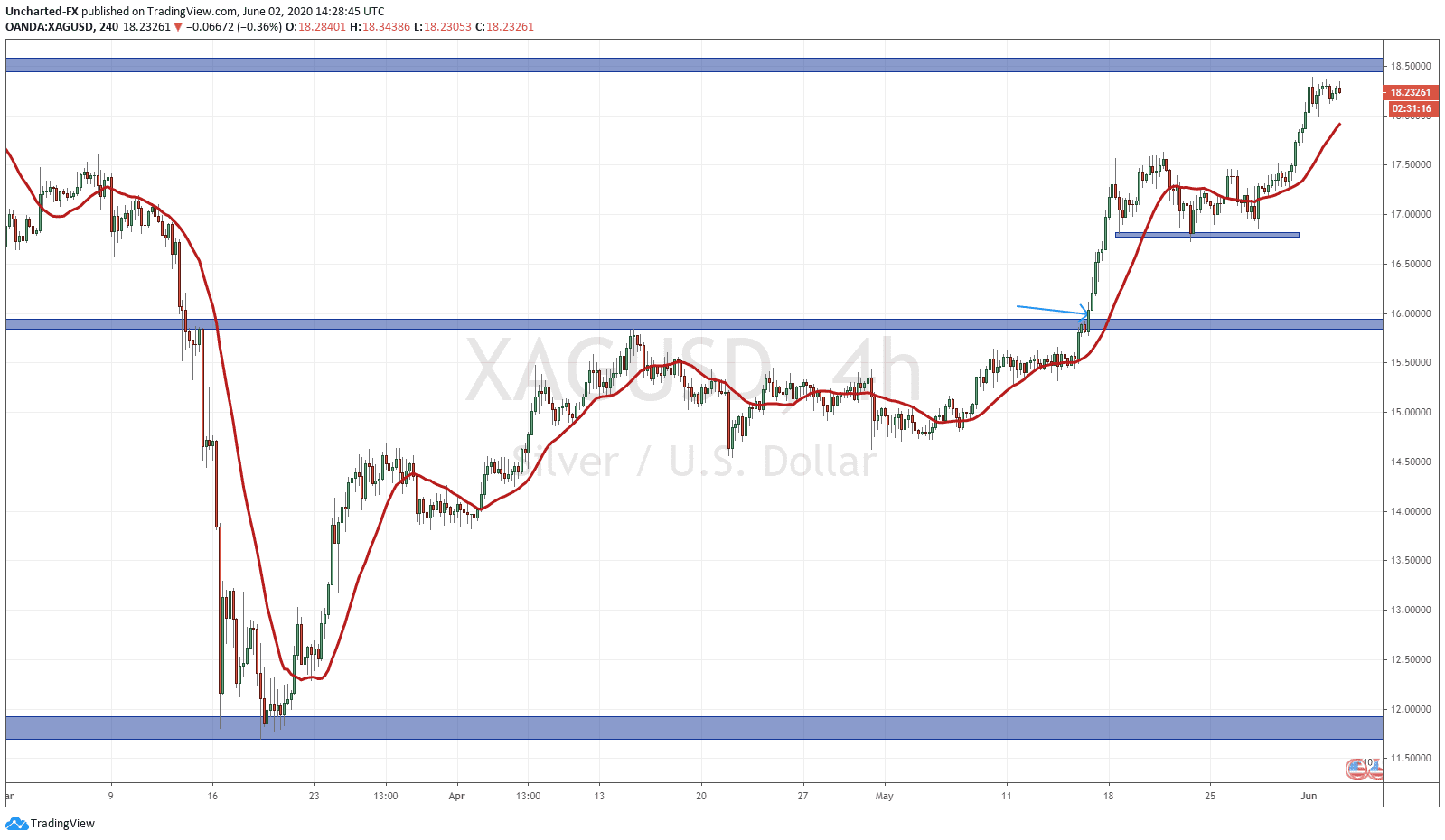

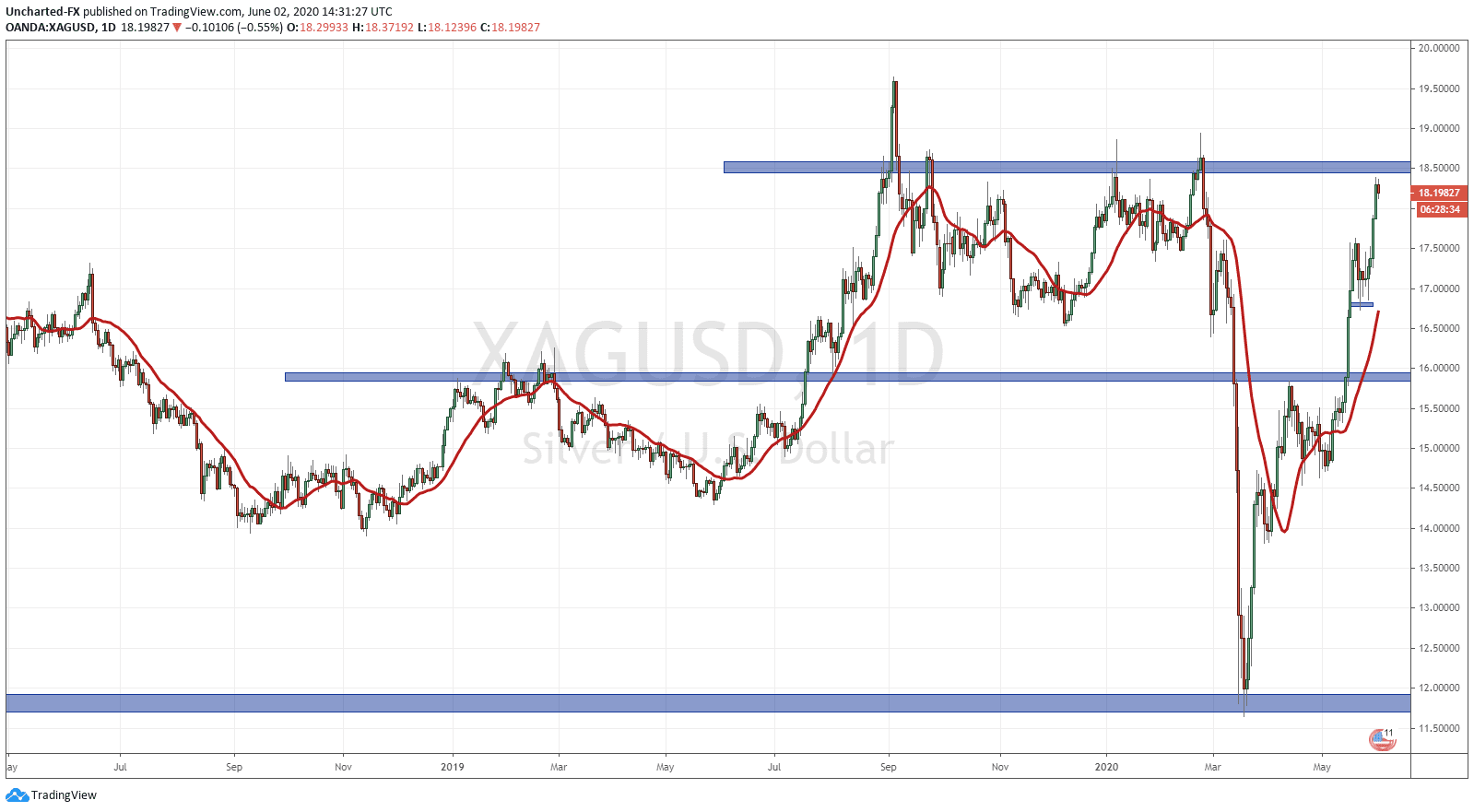

It was a breakout that I notified the Equity Guru Discord Channel members first, as it occurred at 10pm PST, right when I took a look at the 4 hour candle closes. If our readers recall, my first entry was actually way back in March. We had the bottoming pattern that we were looking for after multiple lower highs and lower lows (waves/swings) to the downside. A major support zone was hit, and I expected a reversal here. We got the quintessential reversal pattern, the inverse head and shoulders. My thought process on that trade can be read here. The important thing is that I expected multiple waves and swings to the upside and targeted what we call flip zones. Zones that have been both support and resistance in the past. A secret (or not so secret) tip is to use a line chart. We are so used to candlesticks that sometimes we forget the simplicity of the line charts and what they can offer. You can find flip zones easily and mark them on your chart this way.

17.50 was hit on May 20th, and then we reached our 18.50 zone just yesterday. Now technically we have not hit 18.50, but when we are targeting zones, it is best to place your take profit a few pips/ticks below the target zone. We know there are going to be many take profit orders as we approach that zone which do become sell orders on execution.

Now I must stress that this was a TRADE. As an investment, and for the long term, I do really like Silver, and continue to build my positions in the juniors and producers and of course the bullion. If you look at the Silver chart, we have made up all the losses since the everything sell off that occurred. This is strong price action! Especially for something as volatile as Silver. You need to be accumulating hard assets in this environment. I do believe Silver still maintains that monetary metal aspect and will climb with Gold. The Silver market is 1/10th the size of the Gold market (about 700-800 Billion compared to Gold at 7 Trillion). Large funds and institutions have allocated around 1% to Gold, although this is changing with Ray Dalio and other billionaire’s calls on Gold. When they speak, the funds listen, and I believe the surge we have seen in Gold ETF’s, the GLD ETF and the Royalty and Streamers has to do with larger funds increasing their exposure. I believe this is just the beginning as many other fundamental factors such as being in Gold rather than Bonds for risk off and making yield, plays a large factor. I have discussed this many times in my Gold posts.

On the technical/ market structure side. Looking at the daily chart, we have only made our FIRST higher low after the break out pattern at around 16.00. Generally, we should expect at least TWO swings/waves, meaning there is still one more higher low we can count on to be made. This would mean a break above this all important 18.50 zone! Going forward, I will assess the charts and risk to reward ratios for a trade. We would be targeting 20.50 next.

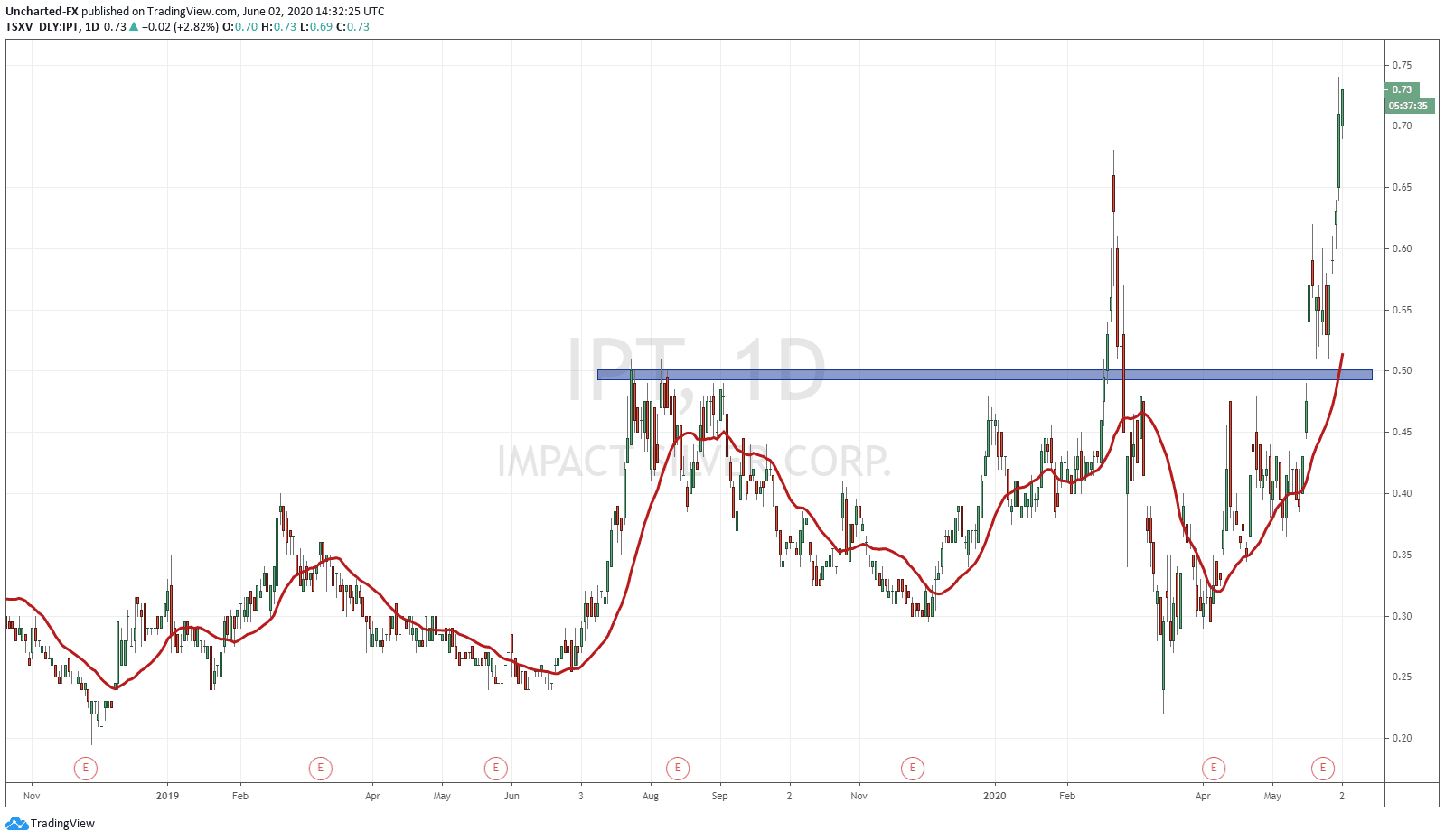

The juniors have also done well. Over on the Equity Guru Discord Channel, we do have a chat for junior miners. A lot of charts I have posted have rocketed so far. One of my favourites has been Impact Silver (IPT). I personally got in a while back, but on the chat I mentioned the break of 0.50 being significant and an entry signal. I like Impact because it is a PRIMARY Silver producer and will continue to follow the chart and company.

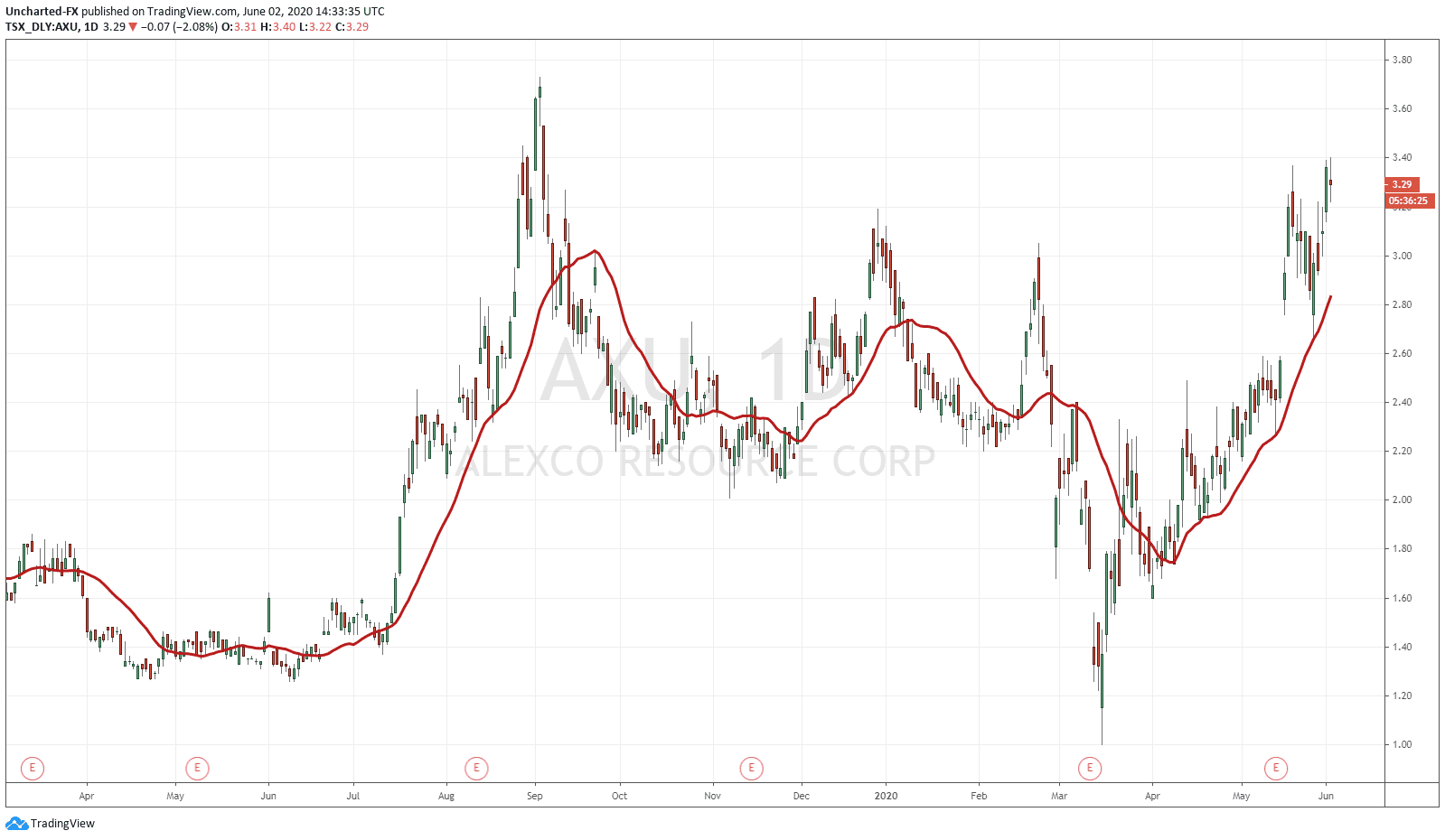

One of my other favourite bullish Silver play is Alexco. I do like the asset and the grades, but as a trader, Alexco has a high Beta to Silver. Meaning it moves more (larger than a factor of 1) when Silver moves up.

So Silver was a great trade, and I continue to believe it will be a great investment. Now my eyes are on some other charts. Over on the Discord Channel, we have had a lot of success on the Forex pairs and equity indices. We expect more upside on a few of the equities. Be sure to join us to find out more!