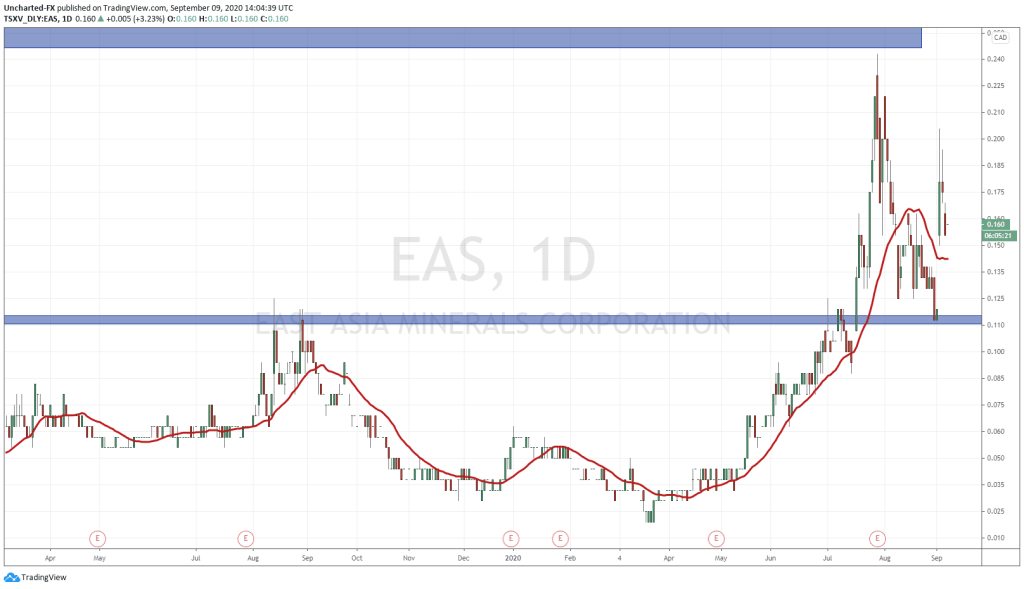

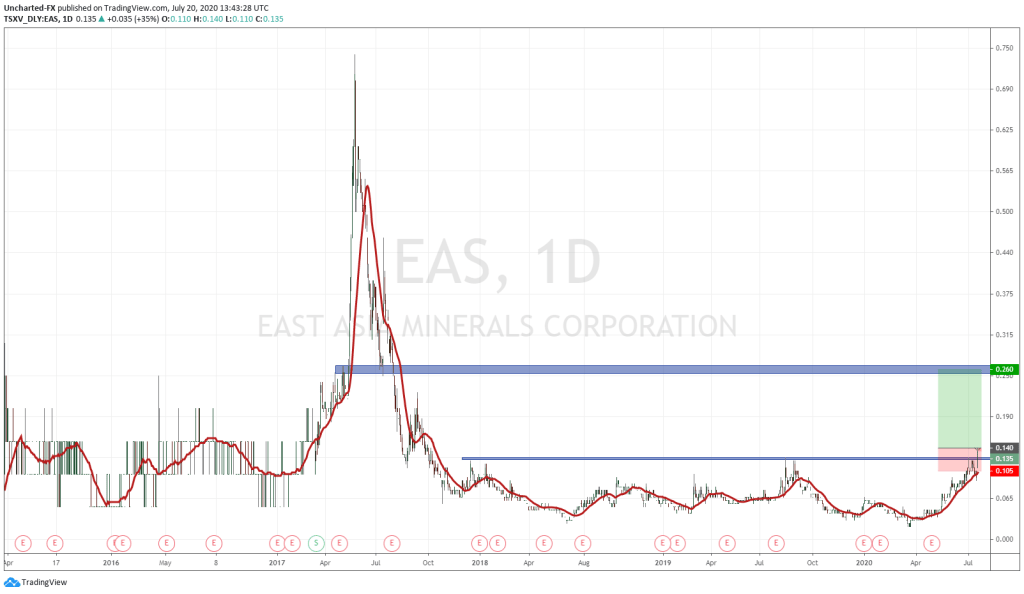

East Asia (EAS.V) was one of the better story stocks from the previous bull cycle in gold, staging an epic rally, from penny-stock-status to a market cap north of $600M before collapsing back in on itself.

The story is still intact, but the focus has changed.

East Asia is still an Indonesian story.

Indonesia is a young country—the median age is estimated at 28.6 years.

Indonesia is a young country—the median age is estimated at 28.6 years.

An archipelago of many thousands of islands, no one can really agree on just how many there are (some islands appear only at low tide, and different surveying techniques yield different counts). The Indonesian government claims 17,504 islands (the CIA says 17,508).

As a mining destination, as measured by the esteemed Fraser Institute in their most recent “investment attractiveness” survey, Indonesia is climbing the charts, demonstrating an improving climate for mining executives and investors, attracting renewed exploration and investment activity from mining-types around the world.

Currently ranked 27th out of the 76 countries profiled, this densely populated nation beats out five Canadian provinces and a territory.

Of interest to speculators in the junior exploration arena, the country boasts some truly spectacular Tier-1 deposits, Freeport-McMoRan’s Grasberg being the standout with over 67 million ounces in gold reserves. I believe that particular ounce-count, spread out across three operating mines—the Grasberg open pit, the Deep Ore Zone underground mine, and the Big Gossan underground mine—is the largest on the planet.

East Asia – Out with the old, in with the new

East Asia – Out with the old, in with the new

The old management team at East Asia is out… gone. There’s a fair bit of drama surrounding the ousting. I’m tempted to go into the details here, but it’s in the past, where it’s perhaps best left.

Long story short, by invitation of John Hathaway (Sprott)—a major EAS shareholder (14% fully diluted)—new management picked up the reigns in March of 2017. And this new crew knows Indonesia, not to mention the exploration/mining game, inside out.

Terry Filbert, CEO & Chairman: Terry is an American who has lived in China and Indonesia for the past 25 years, the last 9 of those working in Indonesia, first in coal, and then in gold mining. He identified the Sangihe Gold Project near a heap leach gold project he developed in Ratatotok in North Sulawesi, Indonesia. When he offered to buy the project from East Asia to expand his own operation, he was urged by Tocqueville Asset Management (now Sprott), East Asia’s largest shareholder, to take over the Company in order to develop Sangihe, and bring the Miwah Gold Project current. Though he had always bootstrapped projects with his own private funds, he agreed to take over East Asia in 2017.

Garry Kielenstyn General Manager – Sangihe Project – Director: Garry brings over 40 years of experience in the Indonesian mining and civil contracting industries, and has been living and working in Indonesia exclusively since 1990. Currently, he is the Indonesian Country Manager and President of PT Cokal Limited (ASX: CKA), and has been a senior executive with Cokal since 2013. Garry has a strong track record of driving projects through the construction phase, to production, in some of Indonesia’s more remote locales.

Todotua Pasaribu – Government Relations ‒ Director TMS: Todotua brings considerable local industry experience to help manage the Sangihe and Miwah assets. He has more than 15 years of extensive experience in the Indonesian Financial, Mining and Power Industry, including the roles of Director, Commissioner, Advisory Board Member, and Business Analyst for various large companies.

Frank Rocca, Chief Geologist & Qualified Person: Frank has over 25 years of experience in international exploration and mine development (Indonesia, Australia, Africa, USA, and Chile), including 8 years with Barrick Gold (ABX.T). He earned a Bachelor of Applied Science in Geology from Curtin University of Technology, Perth, Western Australia. Frank is a member of the Australian Institute of Geoscientists and the Australian Institute of Mining and Metallurgy with 12 years of experience in NI 43 101 compliant Resources and Reserves reporting.

Management’s in-country experience adds heaps of legitimacy to this play.

Management’s in-country experience adds heaps of legitimacy to this play.

Without this crew on board, I wouldn’t be penning this article right now.

Two projects – Two significant resources – Two regions with considerable exploration upside

Sangihe

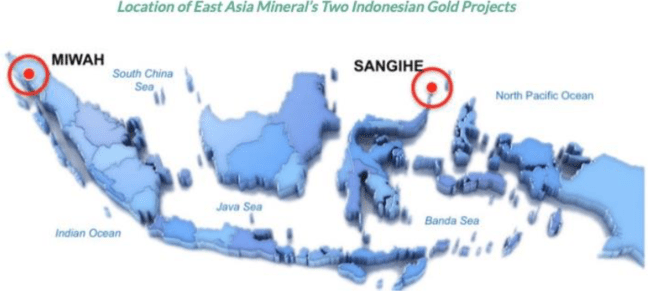

The Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—currently bears flagship status.

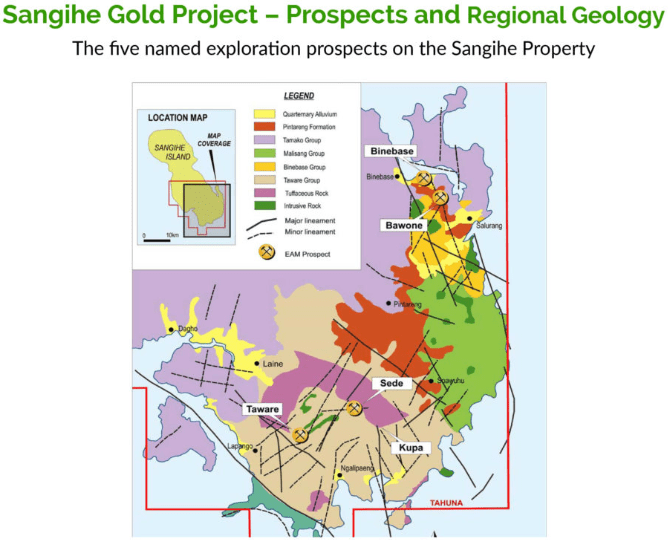

This 42,000 hectare land package consists of three main areas of interest: the Bawone and Binebase prospects on the eastern part of the island, and the Taware prospect to the south.

There is good infrastructure throughout the region.

Companies operating large gold and gold-copper deposits in the region represent a who’s who of the mining world: Xstrata Copper (Tampakan), Newcrest Mining (Gosowong), St. Augustine (King-king), and Newmont (Mesel).

For those who know their rocks, Binebase and Bawone are contained in ash tuffs overlain and underlain with andesite flows and localized clay-pyrite alterations contained in an epithermal body of mineralization.

Taware is dominantly a clay-pyrite alteration setting with andesitic lava flows hosting shallow intrusions.

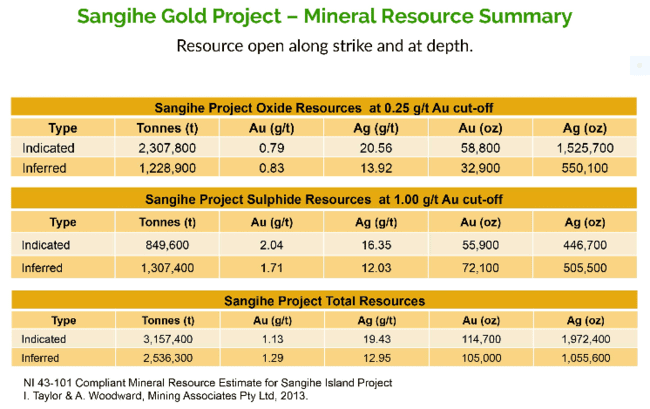

Sangihe boasts the following near-surface resource….

Important to note: there’s an Inferred resource of some 835,000 oz. of gold and 11,926,000 oz. of silver in direct proximity to the ounce count highlighted above. A planned phase one drilling campaign along the Binebase-Bawone Corridor will bring these additional ounces into play (more details re future exploration plans further down the page).

Important to note: there’s an Inferred resource of some 835,000 oz. of gold and 11,926,000 oz. of silver in direct proximity to the ounce count highlighted above. A planned phase one drilling campaign along the Binebase-Bawone Corridor will bring these additional ounces into play (more details re future exploration plans further down the page).

As noted above, Sangihe’s near surface oxides are what initially attracted CEO Filbert to the area. A mining man at heart, he’s targeting this oxide material for near-term production cash flow.

The plan

First, it’s important to note that East Asia holds a CoW (Contract of Works) for the Sangihe project.

As per the company’s i-deck:

- East Asia owns 70% of PT Tambang Mas Sangihe which holds the Sangihe CoW;

- The Sangihe CoW is a 6th generation CoW issued in 1997 and acquired by EAS in 2007;

- A CoW is far more secure and inclusive than the current IUP licenses issued by the Indonesian Mining Dept today;

- A CoW offers other opportunities that a IUP license does not, such as granting both a Refinery License and Export License, among other benefits;

- The CoW is valid for 30 years after production starts (if production begins in 2020, the CoW is valid until 2050);

It’s also important to note that there are no taxes on the sale of gold in Indonesia, and the Indonesian “Rupiah” is not bound by currency controls.

East Asia expects to receive its production license from the Indonesian government after completing the ‘Environmental Presentation and Permit‘ (AMDAL), and as soon as funding is closed—this week or early next.

The next round of funding will pay off the taxes owed on the mining license—THE last outstanding issue on the Indonesian Mining Department’s checklist before the 30-year Production License is issued to the company.

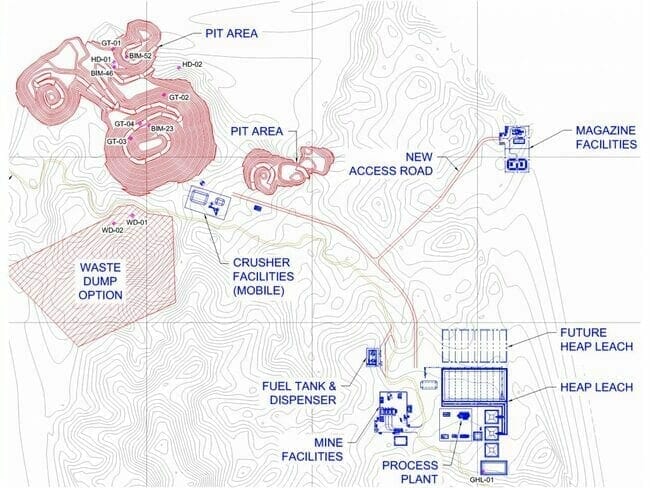

Breaking ground will be the next step, with a goal of heap leach production within 6 months.

Stage one production will see 1,000 ounces of gold per month when the production plant is fully operational (roughly 12 months from the funding event).

Estimated all in costs = approx $700 per ounce. This will throw off free cashflow of roughly $1,000 per ounce, or $1,000,000 a per month once in Stage one (based on current spot Au prices).

With indicated Oxides representing 114,700 oz. Au of the Resource and with an at surface Oxide pit of 58,000 oz. Au. The company will initially be in heap leach production at 1,000 oz Au a month production starting from a 50,000 ton heap leach pad. After our recovery has been stabilized, we will load on the pad our higher grade material to produce 2,000 oz. Au for 6 months in this period as well a build a 2nd 50,000 ton pad for the mid term production at 2,000 oz. Au per month using 1gt material. Our long term objective as the drilling program bears more target material, we plan to bring production to 4,000 oz. per month to the end of the project.

CEO Filbert’s comments from a May 19, private placement related press release:

“With the proceeds from this financing we are excited to start executing and advancing our announced milestones. With rising gold prices we believe the EAS assets will generate more interest as we start delivering on operational, environmental and strategic updates.”

Ramping up a new mine is rarely a seamless task. Anything that can go wrong, will. But the mineralization at Sangihe shows good continuity and is near surface. CEO Filbert is confident the project is economic, and scalable.

In a rising gold price environment, Sangihe’s oxide material could spin-off heaps a free cash flow—enough to drill off the project and add to the company’s already significant ounce count.

Sangihe Exploration

If the mine plan is successful, a three phase regional exploration and drilling campaign will target ‘hot spots’ along the 25,000 hectares where company geologist, Frank Rocca (former Barrick) estimates the potential of at least 2,000,000 ounces of Au.

The three phases of exploration and drilling:

- A phase one drilling campaign to upgrade the 835,000 Inferred ounces along the Binebase-Bawone Corridor;

- A phase two drilling program to test the mineralization potential from Bawone to the south of Salurang;

- A phase three exploration and drilling campaign designed to test the remaining 22,000 hectares of geologically prospective terrain around Taware , Sede, and Kupe.

Miwah

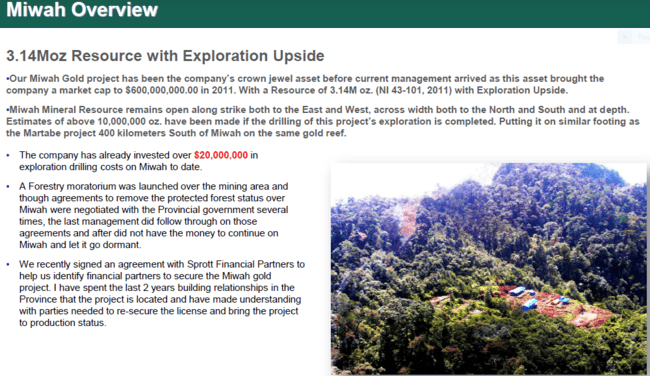

The Miwah Gold Project is what sent shareholders on a wild ride during the late innings of the previous gold bull cycle.

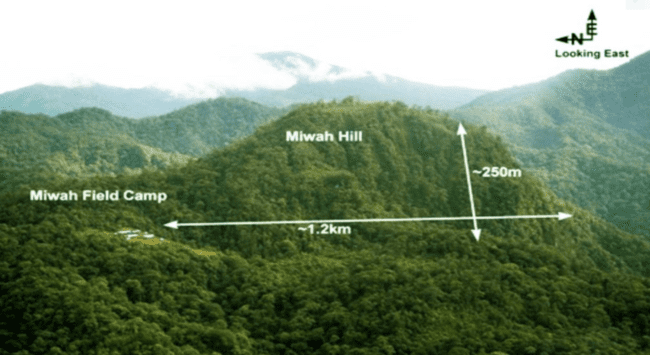

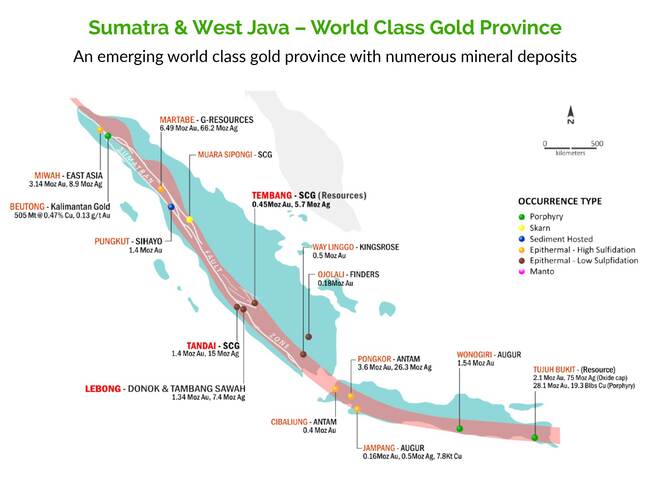

The 30k hectare road-accessible project is located at the northern tip of Sumatra Island, in Aceh Province within the Sumatran fault system.

This is one of Indonesia’s most prolific gold producing regions. Note the proliferation of mines along this emerging world-class gold province.

Miwah is a high-level, high sulphidation epithermal gold prospect where gold and copper mineralization is contained in andesitic and dacitic lavas and tuffs, with gold hosted mainly in andesite.

Miwah is a high-level, high sulphidation epithermal gold prospect where gold and copper mineralization is contained in andesitic and dacitic lavas and tuffs, with gold hosted mainly in andesite.

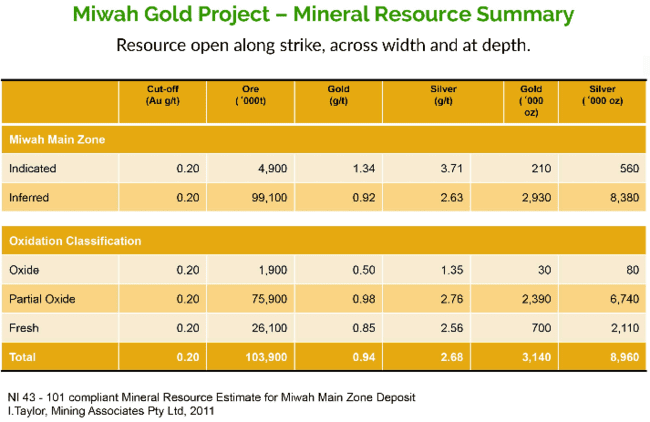

The project, located within a Protected Forest Reserve, currently boasts a resource of 3,140,000 ounces of gold.

The deposit is open on along strike, across width, and at depth.

The ‘Protected Forest Reserve’ status that currently shelters the project will be lifted once local stakeholders are confident that this crew is the real deal… that the East Asia team are serious and responsible project developers and operators.

The ‘Protected Forest Reserve’ status that currently shelters the project will be lifted once local stakeholders are confident that this crew is the real deal… that the East Asia team are serious and responsible project developers and operators.

Though Miwah does not currently bear flagship status, its 3.14 million ounces and considerable exploration upside could draw-in a deep-pocketed resource-hungry Producer for a working interest (JV). We could also see a deal (offer) drop for the entire project. Either way, Miwah gets monetized and shareholders see value creation.

Though Miwah does not currently bear flagship status, its 3.14 million ounces and considerable exploration upside could draw-in a deep-pocketed resource-hungry Producer for a working interest (JV). We could also see a deal (offer) drop for the entire project. Either way, Miwah gets monetized and shareholders see value creation.

Final thoughts

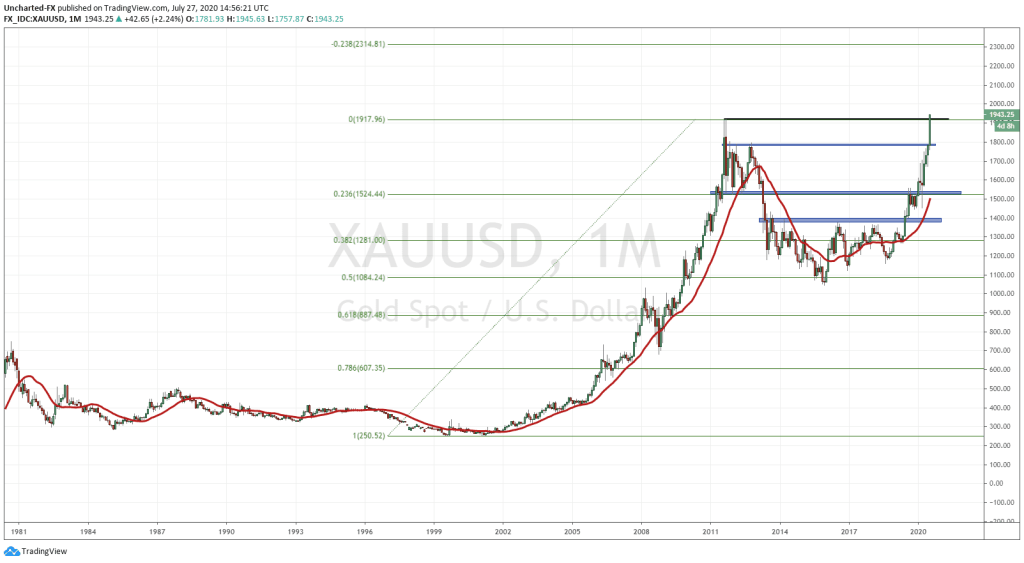

I suspect this bull run in gold is just getting started and the price trajectory we’ll witness over the next few years will shock even the most hardcore bull.

East Asia is currently valued at a mere $6.82M, based on its recent close at $0.065. With two significant resources (more than four million ounces if my math is true) and a fast track plan to production, a significant re-rating event could unfold in the coming weeks/months.

END

—Greg Nolan

Full disclosure: East Asia is an Equity Guru marketing client. We own shares.