I value my reputation. It’s been built over two decades in the journalism business, first at the Vancouver Sun newspaper, then Stockhouse, then Equity.Guru, a media outlet I started with a view to finding the middle ground between stock promoters flinging bullshit on one side, and journalists hunting bad guys on the other.

For me, companies are allowed to make mistakes – even expected to – and shouldn’t be overly punished for doing so. What they SHOULD be punished for is not giving a shit, or refusing to acknowledge mistakes, or excusing mistakes without learning lessons from them.

Brascan Resources (BRAS.C) recently provided a corporate update concerning its plans for lithium exploration in Brazil or, rather, it’s non plans for lithium exploration in Brazil.

The company has relinquished its rights to explore two properties in Minas Gerais to an independent third party. In return, these companies will handle the exploration and compensate Brascan with a low six-figure sum for each property. If they discover over 1% lithium in the spodumene rocks, Brascan will receive a similar amount again. In total, Brascan will obtain approximately $250,000 in the short term, with a potential extra $200,000 if the lithium threshold is met down the road. The company also had to provide $225,000 in stock to its former Brazilian partners for this agreement which, I think you’ll agree, isn’t a great look.

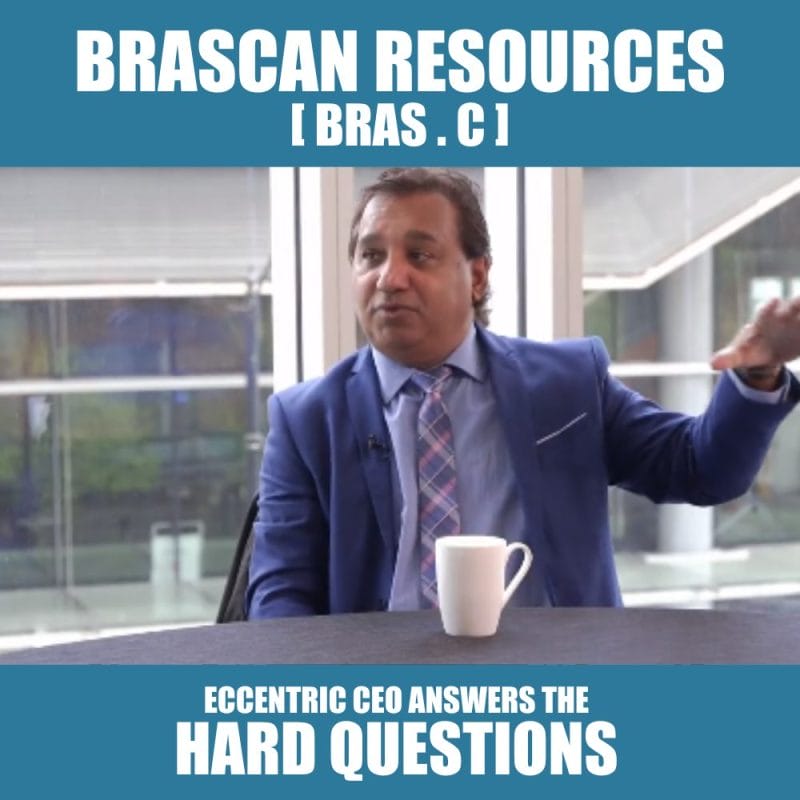

So I said so, publicly. I’ve said in the past that I like now former CEO Bal Johal, who is as much a renegade weirdo as any I’ve met in the business.

Renegades can colour outside the lines in ways the average management suit can’t, and that sometimes brings them success others will never reach. They can also be frustrating. If picking my poison, I’ll usually take a chance on crazy because I like the chance for upside. See Dev Randhawa and the Fission collective of uranium explorers.

Anyhow, I called Balbir this past weekend and asked him some prickly questions because I did not like the last corporate update, and his answers follow:

Me: WTF with giving those former partners BRAS stock in the property deals?

Balbir: They already had shares owing to them as part of the original deal so this just executes that now. We couldn’t move the properties without making that happen and we’re pretty confident they’ll both explore the properties quickly and find the numbers needed to share the second part of those cash deals.

Me: Okay, so basically you used the properties to do a financing?

Balbir: Not really, the reality is that, in this market, unless you’re sitting on something insane it’s really hard to raise capital and, with our stock where it is, I’m not sure you’d want to. This cashes us up a little and relieves us of non-core assets and doesn’t commit any more stock than was owed.

Me: Do you think there are shareholders that had their eye on the potential of those properties that’ll be pissed off now?

Balbir: I’m not sure, let’s be honest, I’d talked about maybe spinning them out in the past and made clear that our Canadian properties were where we saw the most short term potential, and this move frees us up to focus on those and gives us some cash to do so. We like the Brazilian properties but the best return for them was going to be the partners who know those properties best.

Me: The gold property in Brazil? You’ve let that go?

Balbir: Yeah, to hold onto it we would have needed to do work there and, to be honest, the gold explorer game isn’t crying out for that to happen. If we, at some point, see the market switch up, we think we can get the property back easily enough but there’s no point in spreading ourselves too thin.

Me: Spreading yourself thin was the pitch earlier, no?

Balbir: Yes, but you have to roll with the tide sometimes and smart people around me have been pointing out that we have something important in Canada and that’s really where we need to focus our fire. I’m smart enough to know when smarter people than me have a point.

Me: So the plan now?

Balbir: Focus on the Canadian properties, go hard in Quebec, right now, with the cash we now have in hand.

Me: Does that mean you or [new CEO] Johan Shearer?

Balbir: Johan. I’ve had some health news that I really need to take care of. I don’t want a jammer on the side of a mountain, so I’m here helping, guiding, ussing my network of contacts, but I’ve also got to focus on living for a few more years. I told you before, this company is my legacy, and I’m not leaving it.. I just need to make some life changes and having less properties to think about will help in that respect. More focused, less travel, and let’s do this thing.

A cynic will read the above as a capitulation of sorts, and I’m not enough of an optimist to suggest I disagree. But capitulation to a bad set up is sometimes necessary before one can properly right the ship.

One thing I like: Balbir didn’t complain about my laying out where I thought he was going wrong, didn’t ask for changes in the narrative, and didn’t lose patience at my suggesting he had questions to answer. Considering he’s a client of mine, it’s encouraging that he both understands why people would ask questions and has the balls enough to answer them honestly and openly – and be paying money to do so.

That’s a real quality sign. He stood up to the beating, he explained his position, and he didn’t hide. That’s what, as a shareholder, I’m looking for in a junior miner. Take your licking, lay out your new plan, and execute.

Okay Balbir, show us what you’re made of. And look after your ticker.

— Chris Parry

FULL DISCLOSURE: Brascan Resources is an Equity.Guru marketing client and we own stock in the company.