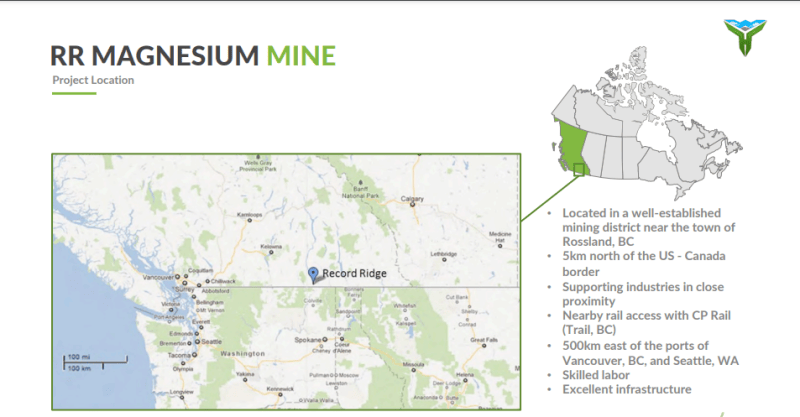

West High Yield resources (WHY.V) is a company with the objective to bring into production one of the world’s largest, greenest deposits of high-grade magnesium. The Record Ridge magnesium deposit is located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report.

The company is in the process of obtaining its mining permit, with an application already submitted. A key meeting occurred on June 27 2023, where the provincial mining development review committee (MDRC) in Rossland unveiled the technical review process for the WHY project. Representatives from the government, technical experts, and groups representing first nations and indigenous peoples participated in the meeting. The meeting was overseen by British Columbia’s Ministry of Energy, Mines, and Low Carbon Innovation, and it marked the initiation of the MDRC’s technical review of WHY’s permit application process.

As shareholder’s wait for further news, today the Company provided a comprehensive update on major strategic developments that are shaping the magnesium market.

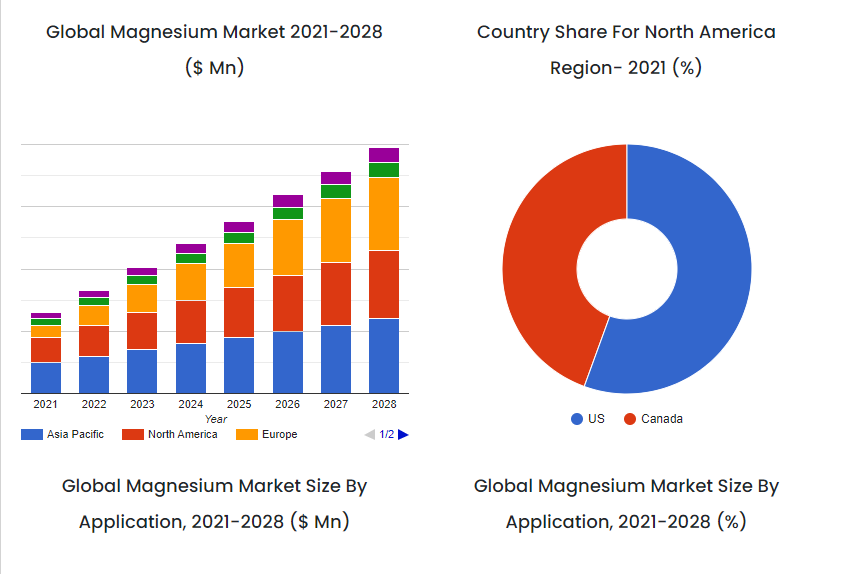

In terms of growth projections, the global magnesium market is projected to be valued at USD $7.25 billion by 2030. Substantial growth given the 2022 value is USD $4.8 billion. These figures primarily consider direct metal applications, such as iron and steel making, die casting, aluminum alloys, and titanium reduction. The estimates do not account for secondary higher value applications such as extruded foams, structural cladding and fireproofing, medical devices, pharmaceutical applications and supplements, industrial coatings and metamaterials and other emerging cases.

There is also an exciting potential for the use of magnesium in the energy storage sector as an alternative to lithium batteries. Magnesium ions have a double positive charge, which theoretically allows a magnesium battery to store almost twice as much energy as a lithium battery of the same size. Magnesium is more abundant and less expensive than lithium making it a potentially more sustainable and cost-effective solution.

Recently, researchers have overcome previous challenges related to the stability and efficiency of magnesium electrolytes, which have historically hindered the commercialization of this technology. Newly developed magnesium based electrolytes are stable, non-toxic and efficient paving the way for the next generation of high-energy density batteries.

Several companies are in the advanced stages of developing magnesium-ion batteries. Companies such as Pellion Technologies (US), Magnotec (Australia), MagPower Systems (Canada) and Magpie Technologies (US). The batteries are to hit the market in a few years and are projected to have a higher energy density, longer lifespan, and better safety profile, with lower risk of overheating and combustion.

In terms of geopolitics, Canada recognizes the role Canada must play in ensuring a geopolitical resource of Western democracies, securing full access to critical minerals including magnesium. The country’s critical minerals strategy, backed by a substantial federal budget allocation of $3.8 billion for mineral exploration and mining, sets a clear path for bolstering Canada’s capability to supply both domestic and global markets with high-priority minerals. This includes magnesium.

There is also collaboration with the US. Collaborating on the production of lithium, cobalt, magnesium, and other critical minerals will empower both nations to reduce economic dependence on China, which currently dominates the market.

West High Yield is set to benefit from this macro environment given it can potentially provide onshore safe and secure access to a substantial magnesium resource being in a friendly jurisdiction with reliable infrastructure. The Company is now focusing on working collaboratively with regulators to advance the Project while ensuring environmental friendliness and ethical practices.

The stock is currently holding above a support zone at the $0.30 zone. This support has held since April of this year, and you can see the large wick candles the three times the stock tested $0.30. We know there are buyers at this zone as evident from these wicks.

The stock recently has been held within a small range with $0.325 being the upside resistance. A close above this level could get the stock momentum going again. The major resistance comes in around the $0.37 zone. A close above this would see us target the psychologically important $0.50 zone.