If there are two things that are predictable in mining exploration, it’s that a rollback will bring a short term stock price drop (it shouldn’t, but it does), and that an under-priced financing will see the stock price fall to the financing price.

The reason for that second one is simple.. if the stock is priced at $0.55 but you can buy into the financing at $0.40 AND get a nicely priced warrant into the bargain, you’ve every reason to sell your existing stake and buy it back cheaper.

See Emeritas Resources (EMO.V).

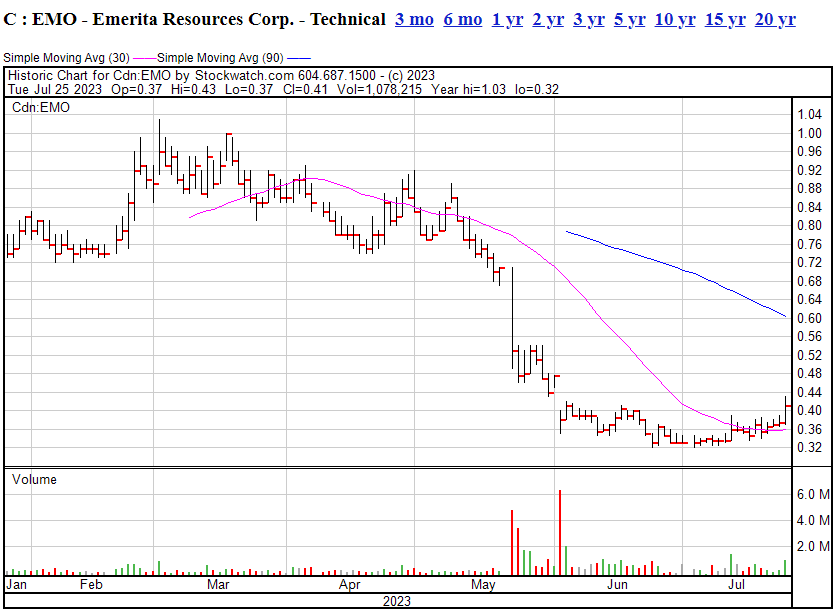

When you look at that price chart and see the big waterfall, and wonder ‘what happened there, did they drill a hole and fall to the centre of the earth, or unleash a zombie horde, or did the drill explode and kill a small village?

Not really, but Emerita has a court issue in Spain that it appears may bring about a win for the company in time, but that won’t be heard until 2025. So those holding out for a payday slipped off for a bit. Stock price duly dropped, and other weak hands may have got weaker.

Turns out, around that time, the company was looking for a financing and had some big fish on the hook so, in order to get that financing done (which was necessary to keep working while that court case drags on) the company elected to do it at a discount.

Thus, a stock selling for $0.485 could now be bought with warrants attached at $0.40, and 6 million shares were duly traded in a single day.

In the months since, a floor has settled in under that financing, and the stock has begun to rise, day by day, from $0.33 to now $0.41. Volume is rising. Confidence returning.

And management, to their credit, appears to now have $11 million cash in the bank.

So what are they buying into? Let’s take a quick look.

Mining explorers have a lot of metrics by which to figure out if a project has promise or not, but the one thing that market participants really look to is the NI 43-101 resource estimate, because it brings all the numbers into one place, is put together by a qualified person who hs a long set of rules and guidelines to work with, and it should be clear, understandable, and transparent. It’s also usually conservative; it’ll tell you what amount of metal is ‘indicated’ (or considered reliably present), and ‘inferred’ (what may be there, but in worst care might not be)

I won’t bore you with the fine technical details, but Emerita Resources has submitted an NI 43-101 technical document for their Iberian Belt West (IBW) project (the one not in dispute), and the numbers are stacking nicely.

This project involves two significant areas with mineral deposits; La Romanera and La Infanta. The report was crafted by Wardell Armstrong International Limited, with the help of professionals Dr. Phil Newall and Frank Browning. The official document can be found online at www.sedar.com and at Emerita’s own website, www.emeritaresources.com.

In the IBW project area, they found 14.07 million tons of indicated material with various amounts of different minerals like Zinc (3.29%), Lead (1.66%), Copper (0.46%), Silver (75.2 grams per ton), and Gold (1.39 grams per ton). They also have predictions for another 4.71 million tons inferred with similar concentrations of these minerals.

For La Romanera, there’s about 13 million tons of indicated material. This contains Zinc (2.98%), Lead (1.45%), Copper (0.42%), Silver (74.1 grams per ton), and Gold (1.48 grams per ton). They infer another 3.14 million tons of material containing similar amounts of these minerals. Emerita got these numbers by drilling 144 holes that reached up to 52,750 meters deep in total.

In the La Infanta, they found about 1.07 million tons of indicated material, but in more concentrated doses – they found more Zinc (7.10%), Lead (4.24%), Copper (1.03%), Silver (88.5 grams per ton), and less Gold (0.32 grams per ton). They infer another 1.56 million tons of material with slightly less concentrations of these minerals. This estimation came from drilling 86 holes, totaling about 19,565 meters in depth.

Emerita used a standard called the “Zinc equivalent” to help judge how much valuable stuff is in the deposit. For example, if they have less Zinc but more Gold, the Zinc equivalent can still be high. The report says that these minerals could continue deeper or extend further along the belt. So, they’ve got a good start, but there’s still plenty to explore.

THE BLUE SKY UPSIDE:

Emerita is involved in a LONG court case that we’ve covered for a while, involving the Aznalcollar mine, near Seville in Spain.

The basics:

- Emerita bidded for the right to operate the Los Frailed mine after, in the 1990s, the mine in Aznalcóllar was closed after 1.5 years when a combination of a tailings dam failure and low metal prices brought it into peril. The government reclaimed ownership of the site and was to award a contract for resuming mining operations.

- Emerita offer $641.5 million for the contract, while the of Minorbis-Grupo México bid was $304.6 million – yet, somehow, M-GM was selected as the winner of the bid. Emerita realized quickly something wasn’t right.

- If corruption is found in the process of awarding the contract, Spanish law dictates that the contract should go to the next qualifying bidder, and corruption allegations arose against members of the Grupo México-Minorbis consortium and local politicians, who were subsequently found guilty of prevarication.

- Emerita has counter-appealed against appeals filed by the accused parties seeking to halt their sentencing and dismiss some of their cases. The recent court ruling supports Emerita’s counter-appeal.

- Emerita is the only remaining qualified bidder if Grupo México-Minorbis is disqualified for corruption. This would enable them to operate the Los Frailes mine by default, which has already seen production and considerable exploration and would be a massive win for the company.

- The Los Frailes mine’s historical open pit mineral resource was calculated to have an estimated 71 million tonnes (5x more than the above mentioned Iberian Belt West project) grading 3.86% zinc, 2.18% lead, 0.34% copper, and 60 ppm silver. Emerita believes that there’s potential for a higher-grade resource, targeting an unmined area through underground mining efforts.

- Emerita is highly determined to complete the acquisition of the Aznalcollar project, with the CEO of Emerita stating the company is well-positioned to develop the project quickly and to modern standards. They had already completed about $1 million in engineering studies two years back and have the strategic financial backing necessary for the project, even moreso after this most recent financing.

In all likelihood, it would appear Emerita will get a win here, but.. the Spanish legal system is in no hurry, so a steady bet that you don’t mind riding for a few years might be good here. That’s certainly my way of thinking.

So Emerita has a good little deal going with the IBW project, and a massive blue sky win looking likely in two years, in the opinion of many, on the Aznancollar deal, which propelled the stock price to over $4 back when the markets thought that lawsuit was about to pay out. That’d be a 10x on today’s prices, if it got back to that valuation.

Analysts like the stock from here, I do too.

Not a client. Just a check-in on an old story, at a time when people with memories are starting to see how big this could theoretically be.

— Chris Parry