There are two kinds of mining guys in the public markets – the market-friendly corporate guy, who can raise money, navigate a boardroom, and put out a nice news release, and the dusty booted technical mining guys who know where to stick the drill, don’t mind camping out under the stars, and look downwards as they walk in case they spot something shiny sticking out of the soil on the way to develop a gold project.

You almost ever find folks who are both.

Jason Bahnsen is both. He’s got decades of real world mining experience, a degree in mining engineering, and has worked extensively in mining services for a cavalcade of other companies, which has put him in just about every situation a mining guy might end up in. But he’s also got a Masters in Business Administration, so he knows which I’s to dot and T’s to cross, he can handle a balance sheet, and if money needs raising, he’s going to raise it. He’s got experience in contract mining, mine management, and investment banking.

He’s the sort of guy you’d hire if you were a big company looking for broad core competencies and deep sector knowledge. Which you always are.

So when he decided instead to wrangle a small gold explorer in Tempus Resources (TMRR.V), it wasn’t because he didn’t have other options. Instead, it was because he saw what he thinks is the perfect coming together of qualities in a gold project.

“It’s close to the city – four and a half hours from Vancouver, to be exact,” he tells me. “So you’re right on the highway. And it’s got a fully permitted mill already built that would have cost around $80 million or so to do from scratch,” he adds.

“We’ve got a 25 man exploration camp on site. We’ve been finding new veins. We’ve got visible gold in drill cores and big players around us spending big money on exploration. We’ve got shareholders in Australia and Canada because of our dual listing, which means extended trading hours and capital availability, and we’re updating the original resource estimate with 129 new drill holes as we speak. All we need to move things forward is a little road, local buy-in, and more drilling.”

Bahnsen has his sights firmly set on those last items. Recent and ongoing community dinners with local First Nations groups to share updates on what’s happening at Tempus have been well attended and received. The road needed to connect the two ends of Tempus’ property consists of 4km of new road and 25kms of upgrades, which is all very doable.

And the drill results, well they’ve been eye-catching.

Take the SW Vein:

- Significant intersections from the SW Vein include::

- EZ-21-04:- 31.2 g/t gold over 4.0m from 122.0m,

- EZ-20-06:- 61.3 git gold over 5.0m at from 116.5m

- EZ-20-10:- 28.1 g/t gold over 3.2m from 184.0m, including 178.0 g/t gold over 0.5m from 184.5m

- EZ-10-67:- 54.9g/t. gold over 5.00m including 444.0g/t gold over 0.50m

- EZ-10-69:- 71.3g/t gold over 5.49m

Blue Vein showed 523 g/t gold over 0.42m and 32.7 g/t gold over 0.45m in one hole, and 310.7 g/t gold over 1.05m including 1,572 g/t gold over 0.20m in another.

The #9 Vein showed a chunky 28.1g/t gold over 28.50m.

If you’re not the type that understands drill results and usually cross your eyes when the technical stuff gets talked about (I feel you), the picture above tells a story. Gold can often be pretty tiny in a drill core, sometimes flaky or miniscule and buried in the rock. This pic shows enough that if you walked past it in the field, the glint would likely stop you in your tracks.

Of course, such things do not a gold mine make. Having a glint in your eye is part of the equation, but so too is accessibility (check), having permits in place (check), access to a mill (check), and enough ground under your control that the economics can be good (check).

Speaking of that mill, get a load of this:

That’s not a mill, that’s a MILL. Clean, big, complete.

“We’ve added a few things to it,” says Bahnsen. “But, all told, I reckon we’ve got this back up and running for under $5 million when the time is right.”

The time might be right soon. With the number of major players around Tempus, the ability to mill rock for others might be a nice little earner.

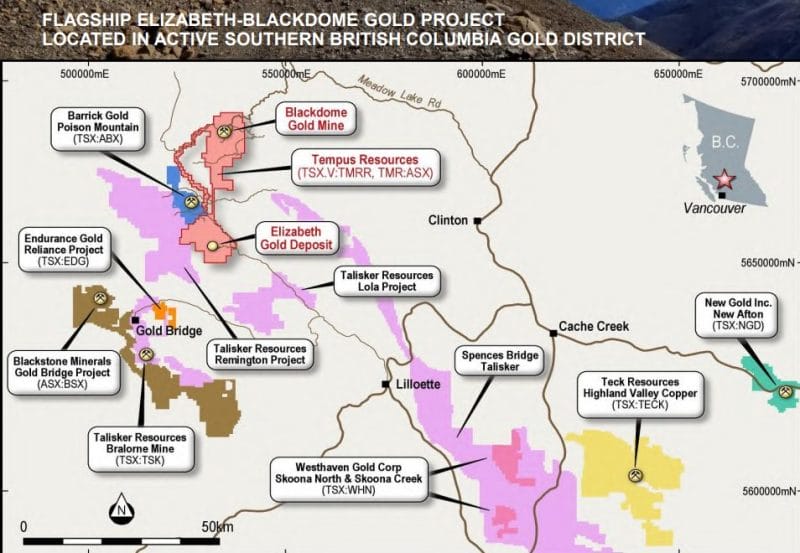

That list includes some big fish; Teck Resources (T.TECK.B), Barrick Gold (ABX.T), Talisker Resources (TSK.T), Westhaven Gold (WHN.V), New Gold, Blackstone Minerals, and Endurance Gold (EDG.V) butt up against the Tempus-held Elizabeth Blackdome Project.

Talisker in particular is neck deep in the region, with properties spanning from Cache Creek to Lillooet and Gold Bridge, with their Bralorne project just south of Tempus registering 1.63 million ounces inferred in their most recent NI 43-101, with 86 veins identified..

“I think this has the potential to be a really strong mining region,” says Bahnsen, “which will be great for us. Every time someone builds, or makes a discovery, or starts mining, it lifts everyone. Not everyone sees mining in BC as being easy work, traditionally its been harder to permit here, but we’re seeing real movement in this area.”

Bralorne has produced over 4 million ounces historically so there’s definitely gold in them thar hills, and activity from the years of 1986 to 1991 at the Tempus Elizabeth project saw 330,000 tonnes of ore processed through the mil at a grade of 21.9 g/t.

So the technicals are solid, which leaves buy-in from the local community as the next item on the checklist. On that end, Bahnsen isn’t leaving anything to chance.

The Elizabeth-Blackdome project is located within the traditional and unceded lands of the St’át’imc, Secwépemc and Tsilhqot’in First Nations so, immediately after acquiring the Elizabeth-Blackdome project in 2019, Tempus established dialogue with affected communities from each of the three First Nations.

“Nothing is more important than our connection to the local bands,” he says. “In August 2020, we signed an agreement with the Bridge River Indian Band (Xwisten). The Elizabeth project is located in Xwisten’s traditional territory. As part of that, we pledged to put on a community dinner every year where we can share information about the project with our neighbours. We want the Xwisten to feel like this is something they’re a part of, and they are in a very real way. It only takes a moment to ruin a good reputation and I’ve seen plenty of reputations damaged with First Nation groups by other companies trying to take that relationship unseriously.”

The Blackdome project is on land of the Dog Creek/Canoe Creek First Nation (Stswecem’c Xget’tem) of the greater Secwépemc Nation. Negotiations continue with the Tsilhqot’in National Government on behalf of the Tsilhqot’in communities of Tl’esqox and Yuneŝit’in.

Look, man, small cap mining exploration is a finnicky business often populated by folks who have no real desire to get a mine into operation if they can instead tread water year after year on a financing/drilling/financing/drilling carousel that never ends. Bahnsen isn’t on that roundabout.

“We’re here because this thing can move fast,” he says. “There’s been mining here before, when gold was worth half what it is today, and we don’t need to raise much to get it back into business. A little infill drilling to get a better sense of the potential, a new resource estimate, some light work getting the mill back, and agreements with the local bands, and we’re literally in business here.”

At an $11 million market cap, there’s undeniably room for this one to grow with a little good news and some drill results that match what they’ve already had so far.

That upcoming resource estimate update will be an important one, as it will look to make the case that the economics of this gold project are bankable.

The downside risk? For mine, the risk is that Tempus, being a small company in a greater industry that has been kicked around a bit over the last few years, is maybe forced to grind out small wins for a while as the institutional boys hang on to their pennies a while longer.

Certainly, if that resource estimate shapes up like Bahnsen hopes, that risk might be minor.

“I’ve see great properties get stuck in the mud because fnancing is hard, and I’ve seen crappy properties get money thrown at them when times are good,” says Bahnsen. “We’ve got a good property in a good place with good bones and a low cost road to production, so I’m just going to keep showing up to work and put it together the best way possible, and make sure we get this done.”

Count me as a believer.

— Chris Parry

Learn more about Bahnsen and Tempus Resources:

FULL DISCLOSURE: Tempus Resources is an Equity.Guru marketing client, and we’re buying.