Medexus Pharmaceuticals (TSX: MDP; OTCQX: MEDXF), a leading specialty pharmaceutical company, has been making waves with record annual revenues, a new credit agreement, and the acquisition of the Canadian rights to commercialize terbinafine hydrochloride nail lacquer. The company’s strong performance is due in part to its focus on hematology, oncology, auto-immune diseases, and allergy therapeutics.

Last month, Medexus announced that it expects record fiscal 2023 revenue. Annual revenue is expected to exceed US$107 million for the fiscal year ended March 31st 2023, an all time record high. This represents a year over year increase of at least 39%. Fiscal Q4 2023 revenue is expected to be at least US$28 million, representing a year-over-year increase of at least 38.1%.

One of the key product highlights for fiscal Q4 2023 is Gleolan, the first and only optical imaging agent approved by the US Food and Drug Administration (FDA) for use in people with high-grade glioma as an adjunct for the visualization of malignant tissue during surgery. Its active ingredient, aminolevulinic acid HCl, is a natural metabolite in the human body that is produced within the hemoglobin metabolic pathway.

Today, Medexus presented data demonstrating a 33% cost savings with Gleolan® (aminolevulinic acid HCl) oral solution, compared to conventional white light surgery, in US patients with high-grade glioma. This data was presented at ISPOR 2023, the annual meeting of the Professional Society for Health Economics and Outcomes Research in Boston, Massachusetts.

Use of Gleolan has been associated with improved imaging complete resection (ICR). In the pivotal trial leading to its approval, the ICR rate for Gleolan-guided surgery was 64%, compared to 38% for conventional white light surgery.

The study compared the cost per ICR with Gleolan-guided surgery to that of conventional white light surgery in patients with high-grade glioma. In reviewing data from facilities representing 80% of all Gleolan utilization in the United States, the investigators calculated an average adjusted total cost savings per ICR of US$38,292 for Gleolan-guided surgery when compared to conventional white light surgery.

“These latest data reinforce that the efficiencies from Gleolan clearly justify the costs in all appropriate patients in whom imaging complete resection, or ICR, is a goal of surgery,” commented study investigator Andrew E. Sloan, MD, a neurosurgeon at Piedmont Healthcare in Atlanta, Ga.

“Although Gleolan is additive to the cost of surgery, its use results in lower cost per ICR, and therefore is a more efficient use of resources in the surgical resection of high-grade glioma,” said Mark Fosdal, DHSc, PA-C, Director of Scientific Communications at Medexus.

The stock is up over 3.50% on the news at time of writing.

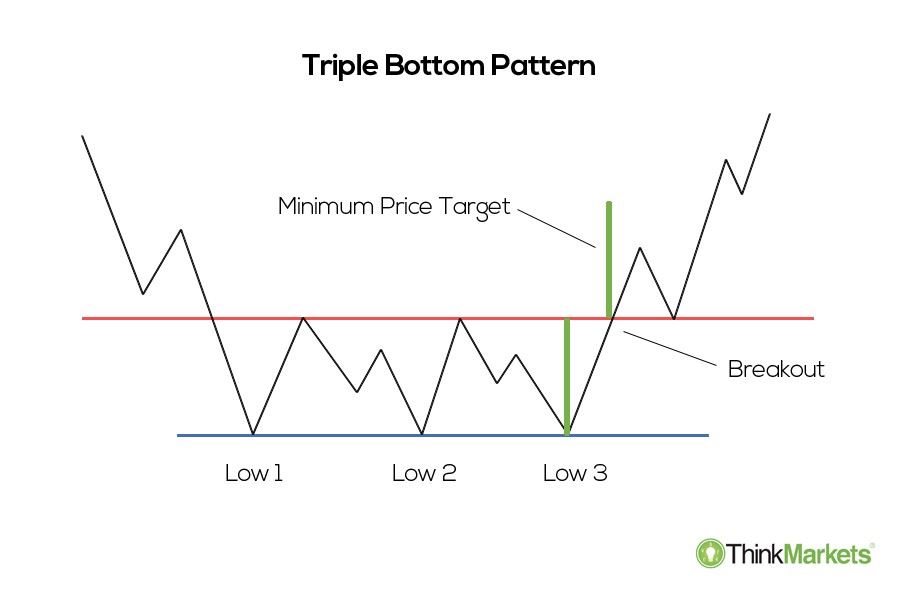

Medexus saw a reaction at the major resistance zone at $1.70. The reaction is evident by the long wick candle printed on April 11th 2023. However, a positive for bulls is the stock has not broken below the recent lows printed at the $1.23 zone. Instead, buyers stepped in at this support zone and wicks on candles printed from April 28th-May 2nd 2023 indicate a strong presence of buyers who are protecting this support.

Going forward, a break and close above the $1.70 zone would be bullish. Not only would this take out a resistance zone, but also see us close above the downtrend line which I have drawn out. This downtrend line is connecting all the lower highs, meaning the stock is in an interim downtrend. Given the three times we have tested $1.23, and seeing buyers jump in and a bounce, it is pointing to a bottoming here. Potentially a triple bottom pattern.

In terms of catalysts, today’s news is big and could lead to an increased sales push of Gleolan. Earnings are also expected to be record breaking. Just recently, ROTH capital has given a stock price target of US$3 for Medexus (US ticker MEDXF).