Azincourt Energy Corp. (TSXV: AAZ) recently announced its acquisition of a lithium project in Newfoundland, signaling a strategic expansion of its portfolio beyond uranium. In an interview with Equity Guru, Azincourt Energy CEO Alex Klenman discussed the company’s decision to diversify its portfolio. As the world moves towards a green energy revolution, the demand for both lithium and uranium surges, highlighting the importance of addressing fragile supply chains and resource concentration.

Big Hill Lithium Project acquisition:

Azincourt Energy was established to accommodate multiple materials, and this acquisition falls well within their purview. Klenman emphasized that the company’s mission statement, which has been in place since 2017, remains unchanged. The lithium project is located just south of the Kraken Deposit by Benton and Sokomon, a significant discovery in Newfoundland. Klenman believes that Newfoundland has a lot of potential for lithium exploration, given the lack of work done in the area.

Big Hill was acquired from a group of experts who were involved in the Alcan merger, a $6 billion deal. These experts, with experience in making big discoveries and managing large lithium deposits, will now work closely with Azincourt Energy’s VP of Exploration, Trevor Perkins, to develop the lithium project. Klenman is confident that this acquisition will deliver shareholder value and provide the company with year-round news flow.

So what does the future hold for lithium?

The International Energy Agency (IEA) warns that the world could face lithium shortages by 2025 as global supplies are strained due to rising EV demand. Lithium supply faces challenges not only from surging demand but also from resource concentration and production in areas with high water stress.

Why is the lithium supply chain fragile?

China currently dominates the battery and minerals supply chains, producing three-quarters of all lithium-ion batteries and housing 70% of production capacity for cathodes and 85% for anodes. Experts suggest that governments should leverage private investment in sustainable mining and ensure clear and rapid permitting procedures to avoid potential supply bottlenecks.

Is Azincourt overextending itself?

Klenman commented on shareholders’ questions regarding any potential conflict between Big Hill and East Preston, “No. And that’s what I’ve been trying to explain to people over the last since we made the announcement…If lithium is really roaring and we make some decent discovery here, we’re going to see benefit. If uranium gets back to where we all know it’s going to be, at what point we don’t know, but it’s going to come back. When it does and we make Impactful discovery and we’re really close at East Preston, then we get lift from that, our market cap will benefit. But if they both are going at the same time, you’re going to get double the bang for your buck.”

Is the uranium market coming back?

Even though prices are hovering around $50, Klenman stated that he would like to see them return to $60. He acknowledged the difficulty of predicting when that might happen, citing the sudden surge in uranium equities in August 2021 as an example of the market’s unpredictability. “If it happens, when it happens. Look, I was in California in August of 21 and I was waking up and checking the markets every morning and bang, I’m looking at all the uranium equities and they’re just going crazy. Millions and millions of share volume. From what? No catalysts.”

So what about East Preston?

The winter 2023 exploration program at East Preston, located in Saskatchewan’s storied Athabasca Basin, is now complete. This program has been significant in identifying strong alteration zones along conductor trends, a crucial step in locating key areas that demand further attention.

East Preston’s location near the southern edge of the western Athabasca Basin offers near-surface targets, which are relatively shallow but can have significant depth extents when discovered.

The 2023 exploration campaign was focused on the G, K, H, and Q zones, with a total of 3,066 meters drilled across 13 holes. The drill program identified several encouraging results, including extensive hydrothermal alteration in the G and K zones and the presence of illite and dravite clays, both significant vectors for the recent Patterson Lake North discovery by F3 Uranium. Additionally, elevated radioactivity was intersected in multiple holes, further emphasizing the project’s potential.

Is Azincourt funded for more exploration?

“We have 5 million in the bank and we’re in good shape. We may take more money, but again, I know there’s some money out there.”

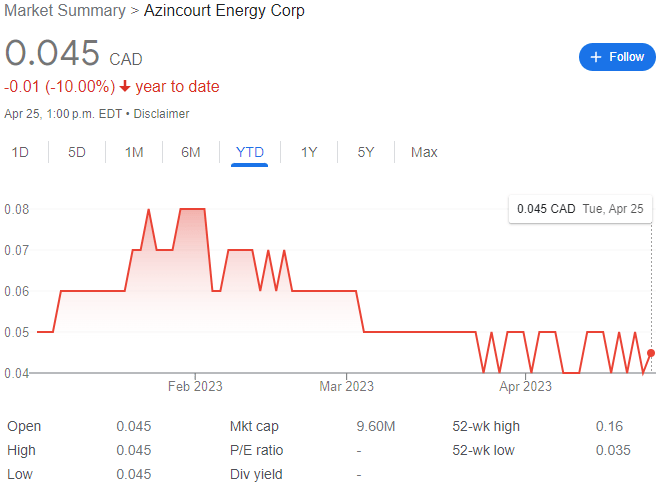

Despite the company’s progress, Azincourt’s stock price has remained low. However, Klenman believes that this is more a reflection of the overall market conditions rather than the company’s performance. He emphasized the importance of staying transparent and communicative with investors, stating, “If anybody ever wants to reach out and ask me the hard questions, you’re going to get answers. It’s not always easy, Chris, and you know that.”

Conclusion:

Azincourt Energy’s East Preston project and its recent acquisition of the lithium project in Newfoundland represents a strategic move to address the fragility of supply chains for both lithium and uranium. As the company continues to work these assets, Klenman is confident that Azincourt will eventually see an increase in value. With a strong financial position, upcoming news releases, and a dedicated CEO, Azincourt Energy is positioned to take advantage of the growing demand for clean energy resources.

The company currently trades at $0.045 CAD per share for a market cap of $9.60 million.

Full disclosure: Azincourt Energy is an Equity Guru marketing client

Azincourt Energy (AAZ.V) Athabasca growth story in the making