Contrarian headline, I know. But as we start the week off, the US Dollar is picking up an early bid. A bid which could have been foreseen on the technicals after Friday’s close.

Before we get to the charts, let’s talk a bit about the US Dollar. We all know it is the reserve currency, but recent headlines in the media has been stating what many gold and bitcoin bulls have been saying for years. “The death of the dollar” and various headlines implying the same thing have been circulating more than usual. Even mainstream media and financial media have been putting out these headlines.

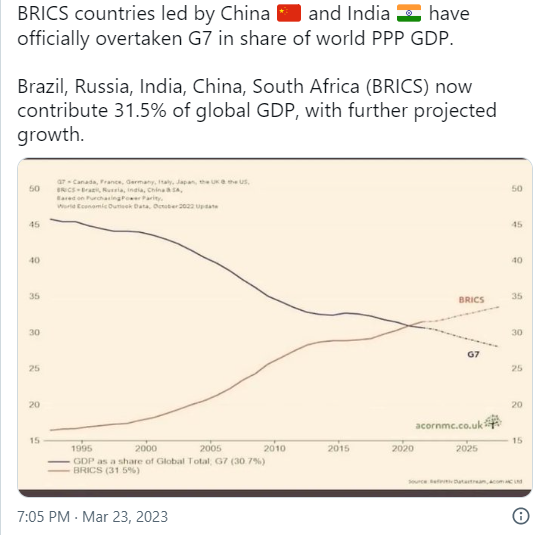

This has resulted due to the moves we have been seeing from BRICS. BRICS, or Brazil, Russia, India, China and South Africa is an acronym for the powerful grouping of emerging market economies. The five countries account for roughly 31.5% of the global GDP and roughly 40% of the world population with member nations having a total population of nearly 3 billion.

If you consider purchasing power parity, then BRICS nations hold the top spot and form the largest GDP bloc.

The above tweet illustrates the recent media headlines. Is the West falling and a new bloc emerging? Or to add a Ray Dalio twist to it, is the US empire and dollar hegemony about to fall, while China rises. Oh and the added element of a Thucydides Trap!

More BRICS headlines have been circulating even on social media after China, Brazil, and India announced bilateral trade deals with other nations. But here’s the kicker: these deals were announced in local currencies and bypassed the US Dollar.

Because the US Dollar is the reserve currency, and because of the Petrodollar system, all commodities are priced and settled in US Dollars. After Russian sanctions due to the invasion of Ukraine, the Russians dropped the Dollar and announced they would accept Euros and other currencies for their commodities. Some people laughed at this saying the Russian economy was dead in the water. Others said that this move would initiate others to drop the Dollar.

It does seem that BRICS nations are following Russia. The big question now is will others follow? Recent headlines about China brokering an Iran and Saudi Arabia deal have led to speculation that these two Middle Eastern nations will be the next to join BRICS. The acronym wouldn’t have to change much, it would be called BRIICSS with the addition of Iran and Saudi Arabia.

But of course the Saudi Arabia move would be key since they back the Petrodollar system, where they price their oil in dollars, and then use the excess dollars to buy US treasuries and invest in US markets all for US military protection. It seems that the Saudi’s are reading the tea leaves, and realize that the next major growth will come from the East, hence why they are aligning with China and Russia.

I know I have babbled on here, but being a contrarian, when I saw these “Dollar death” headlines I immediately thought, “oh boy, we are likely going to see a dollar bounce”.

Now I must say that there is a difference in the death of the dollar and a fall in dollar demand. Many state that the Chinese Yuan will be the next reserve currency. I don’t think that would happen, nor do I think the CCP wants it. For the Yuan to actually be the reserve currency, the Yuan would have to be free floating and Chinese markets would have to be open and easily accessible. Until those things happen, the Yuan will not become the next reserve currency.

Dollar demand may fall with nations not needing US Dollars for trade, and this could lead to some interesting things. Nations perhaps won’t buy the same amount of US treasuries which is how the US stays afloat with the amount of debt it has… but perhaps the Fed will just step in and buy treasuries.

Gold bulls believe that if US Dollar demand falls, all the excess dollars will come back to the US and the Dollar will hyperinflate, but currently, the drop in demand is not enough. Most nation’s and people still want US Dollars, and until that changes, Dollar demand won’t take a hit.

But perhaps going to infobrics.org might give you insight of BRICS’ intentions:

I have also recently just been speculating on the Dollar’s future and I want to put my thoughts here. Again, just me thinking.

If the US wants dollar demand to persist (if they believe there is a threat to demand) perhaps the best thing to do would be to make the US Dollar rise and make it the best performing currency so nations will need to hold dollars. This could be achieved by raising interest rates. Conversely, this could backfire. And backfire big time. With a stronger dollar, other currencies would take a major hit where it would make it more of an incentive to bypass the dollar for trade.

Just food for thought.

Now let us get to that dollar chart.

Above is the daily chart of the US Dollar index, DXY. The Dollar was in a strong uptrend printing higher lows and higher highs all throughout 2022 hitting highs around 115 before reversing. At the end of November 2022, a breakdown below 110 triggered the end of the uptrend and the beginning of a new downtrend.

The dollar got a brief bounce from early February 2023 to early March 2023, before giving up all those gains.

The 101 zone is key support. This zone is where the previous bounce occurred, and the US Dollar recently tested this zone.

Is a new uptrend about to begin?

I want to zoom in to show readers that Friday’s candle was of high importance. The candle printed an engulfing candle, the most powerful single candle price action. Friday’s green candle was so large that it engulfed Thursday’s candle.

Engulfing candles shouldn’t be traded anywhere. They provide better signals when certain criteria are met. First off, we play engulfing candles at major support or resistance zones. Secondly, engulfing candles must be printed at support in a downtrend or resistance in an uptrend.

The engulfing candle on DXY meets both of these requirements. Bulls are likely long with a stop loss placed below Friday’s engulfing candle.

Going forward, the next resistance target comes in at 105.50. However, if the DXY closes above 103, it would signal a major trend shift with the US Dollar closing above the previous lower high. Watch to see how price reacts at this level in the coming days. If the Dollar bears are still around, 103 is the area they would enter on a short.