With last week’s epic price action on the stock market, the volatility will continue this week. A few weeks ago, I told readers to circle November 2nd 2022 on their calendars. We will hear from Jerome Powell and the Federal Reserve. Interest Rates are expected to rise but how much is a debate.

Oh but wait. There is a bigger debate. The Fed Pivot.

Markets right now are pricing in a Fed Pivot. Expectations are that the Federal Reserve will slow the pace of interest rate hikes come December.

But keep in mind that certain Fed Presidents have been saying that interest rates will be required to go higher because there has been no impact on inflation. Even the Bank of Canada admitted this last week:

The Bank of Canada’s preferred measure of core inflation is not yet showing any meaningful evidence that underlying price pressures are easing. Near term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched.

Given elevated inflation and inflation expectations, as well as ongoing demand pressures in the economy, the Governing Council expects that the policy interest rate will need to rise further. Future rate increases will be influenced by our assessments of how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding. Quantitative tightening is complementing increases in the policy rate. We are resolute in our commitment to restore price stability for Canadians and will continue to take action as required to achieve the 2% inflation target.

However, the Bank of Canada only raised rates by 50 basis points even when they said all these things. Many think the Fed will follow, and it just begs the question of whether there are already problems in the debt market.

The plot thickens as today we heard European inflation came in at its highest levels. Euro zone inflation rose above the 10% level in the month of October, highlighting the severity of the cost-of-living crisis in the region and adding more pressure on the European Central Bank. This represents the highest ever monthly reading since the euro zone’s formation.

Higher prices, particularly in food and energy, are the main cause. Country by country here are some numbers: Italy’s inflation came in at 12.8%, Germany’s inflation came in at 11.6%, France saw inflation reach 7.1%. Baltic states such as Estonia, Latvia and Lithuania saw inflation rise by more than 20%.

The European Central Bank raised interest rates by 75 basis points for a second time… and are clearly way behind the curve. Inflation is driving off like a Ferrari and the ECB is chasing in a golf cart.

Central banks need to raise rates and will cause a recession. But will a recession be demand killing enough to bring down inflation? If not, then we will see a situation where interest rates will rise albeit slowly (25 basis point hikes perhaps) even in a recession.

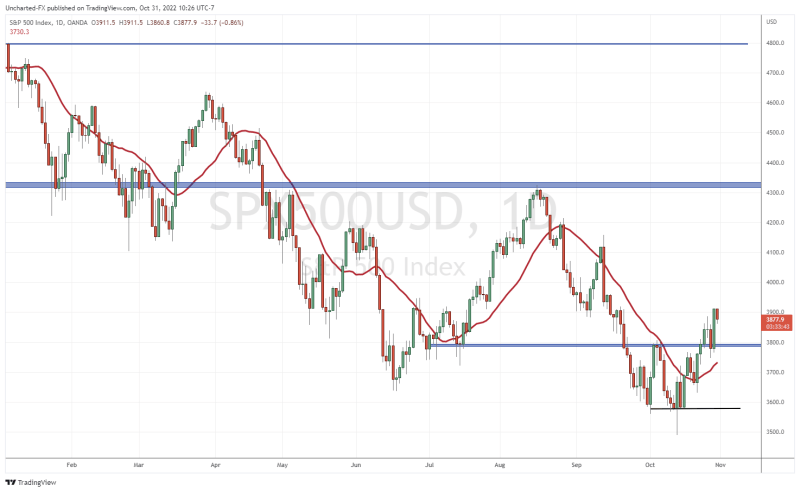

The S&P 500 and other US markets plus most global markets had a monster day on Friday. The S&P 500 was just following technical analysis with a retest. Buyers jumped in on the breakout retest, and we expect this market to move higher as long as we remain above 3800.

If the Fed comes out and remains ultra hawkish, expect markets to take a huge dump. If the Fed hikes and then says something similar to a ‘wait and see’ approach, markets will take this as a pivot and the Fed hiking in smaller amounts. This is what the markets are pricing in.

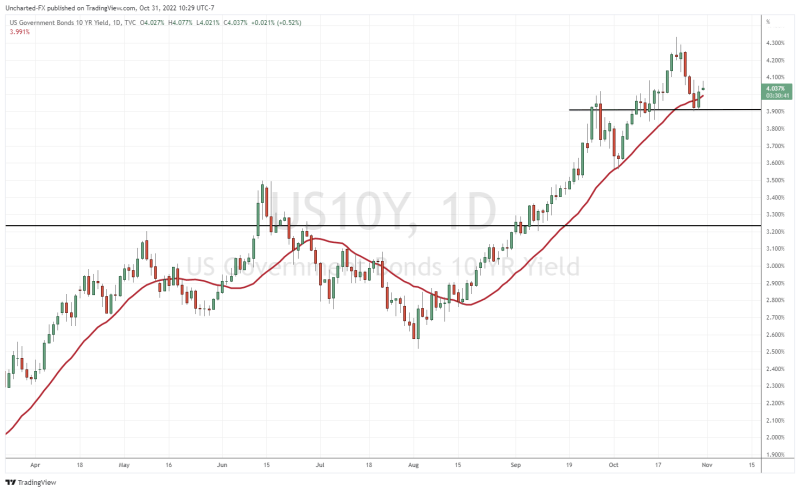

As always, the 10 year yield is the most important chart to be following. This has given us the signs where markets are going. We are currently still above 4%, but a drop below will see the markets continue their uptrend.

But things don’t just end with Wednesday’s Fed meeting. US non-farm payrolls will be released on Friday for the month of October. Employment data has been strong, and the Fed has been saying a strong labour market does not point to a recession. If NFP comes in weaker than expected, the probability of a Fed pivot increases.

We will also hear from the Bank of England on Thursday, who are also expected to raise interest rates. This decision could also impact the markets given the recent price action in the British Pound and political developments in the UK.

So will the Fed actually pivot? Or will they surprise markets with a hawkish tone? Central banks do not want to surprise markets. A pivot is priced in, but the Fed may disappoint if they truly are adamant in taming inflation. A pivot too early would mean inflation runs away.

As a trader, I would be cautious this week. Personally, if I am in a market or US dollar trade, I will close it before the Fed just because the volatility could cause me to lose my profits. Even hit my stop loss. I tend to re-enter the day after, giving traders and the market a chance to digest the Fed statement.