Uranium remains hot with the retail crowd. And for good reason. Be prepared to hear about energy shortages in Europe come Winter. Nations like the UK, France and Germany are already telling their citizens that organized blackouts to conserve energy are likely coming. The German plan has been to reinstate coal plants… while telling their people to stop whining, wear two sweaters, and have flashlights and candles ready for Winter.

Uranium bulls have been saying, why not just prepare to turn on the nuclear reactors again? And they have a good point.

Nuclear energy works and will meet our energy demands unlike clean power sources like solar and wind. Nuclear energy is also good for the environment as they are CO2 free. Even people like Bill Gates and Elon Musk have said the world will need to look to nuclear energy to combat the climate crisis and address our energy needs.

The nuclear energy resurgence is coming because it is the best CO2 free energy source we have. The problem? The PR is bad. When many people think of nuclear power plants and nuclear energy they think Chernobyl and Fukushima. The words ‘meltdown’, ‘disaster’, ‘quarantine’ and ‘irreversible environmental damage’ come to mind. ‘Godzilla’ just in my mind. But here’s something the media doesn’t tell people: the nuclear reactors which meltdown were all old.

Modern day nuclear reactors are some of the safest buildings ever made. Marin Katusa likes to tell the story how the media did not tell the world that when the old Fukushima reactor fell, people ran to the modern reactor for safety.

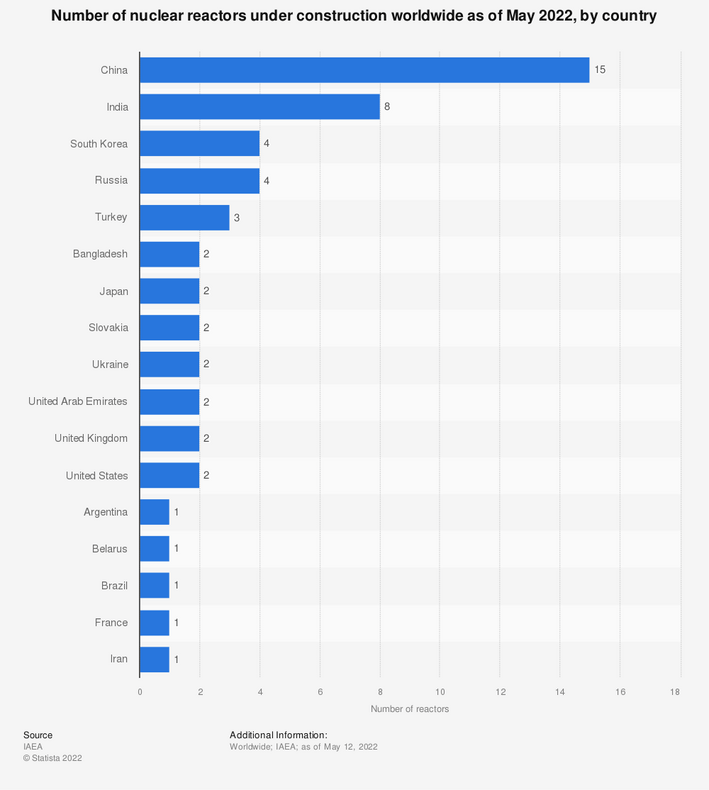

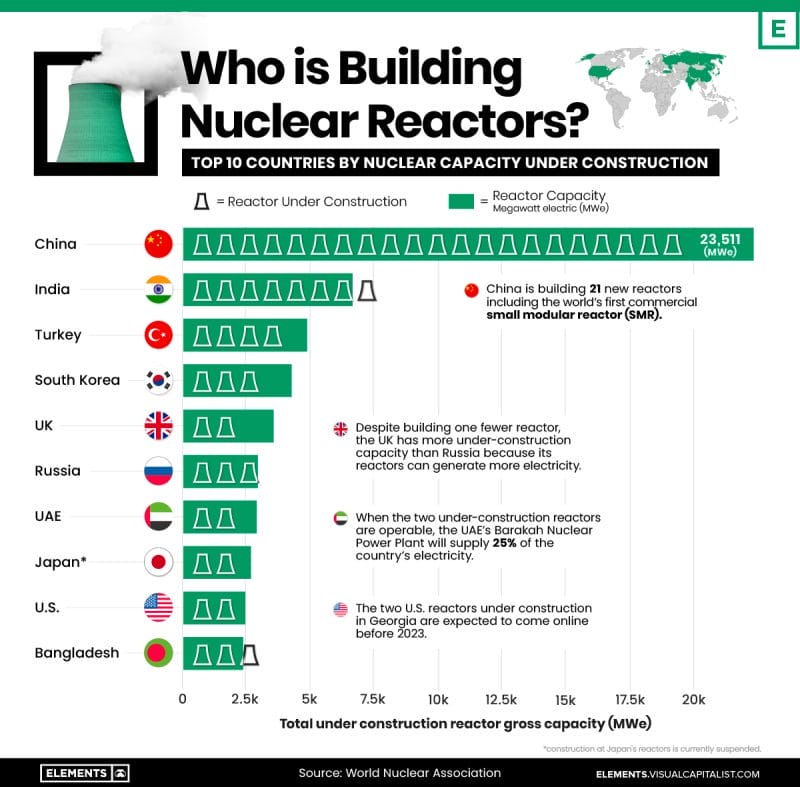

And many nations are looking towards nuclear energy to secure their future. China is leading the way with India following second. Both being the most populous nations on Earth. Nuclear energy is a no brainer.

With more reactors coming online, the demand for uranium will increase. Let’s not forget that current geopolitical events are also impacting supply.

Uranium prices are still up 6% for the year and are still holding above major support after pulling back from highs made in April when uranium hit over $65. Uranium remains in a range between $46.50 to the downside and $53.50 to the upside. Not too bad considering the falls we have seen in many other commodities. It does seem the supply side of the demand-supply equation will continue to be the primary driver for higher prices as demand increases.

As uranium ranges, there is a company which has a technical set up which is referred to as bottom picking.

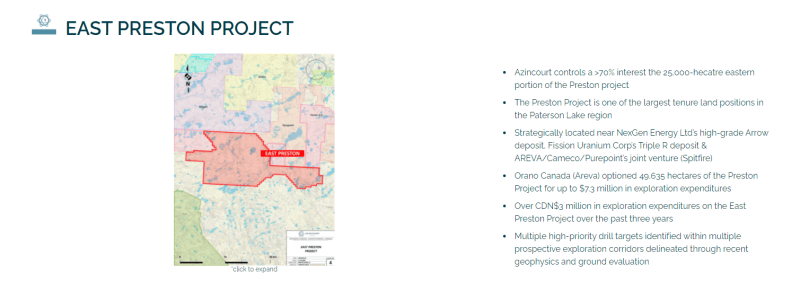

Azincourt Energy (AAZ.V) is a junior uranium explorer and developer. The company’s core projects are in the green energy space focusing on Uranium projects in the prolific Athabasca region. Good jurisdiction, and high grade Uranium. The place you want to be. Azincourt also holds lithium/uranium projects in Peru, on the Picotani Plateau.

Currently, Azincourt is developing the East Preston uranium project, located in the prolific Athabasca Basin, with partners Skyharbour Resources (TSX.V: SYH) and Clean Commodities Corp (TSX.V: CLE) , and the Escalera Group lithium/uranium project in Peru.

Azincourt controls a majority interest (72%) in the 25,000+ hectare East Preston project as part of a joint venture agreement with Skyharbour Resources (TSX.V: SYH), and Dixie Gold. Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified. Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

Azincourt Energy did drill 5,004.5 meters of drilling in 19 holes between January and March 2022. 420 samples were collected and analyzed.

Uranium enrichment was spotted within previously identified alteration zones along the G, K, and H target zones.

Average expected uranium and uranium/thorium values for the primary rock types in the G Zone alterations are 2-3 ppm and ratios of 0.25-0.3. A sample from Hole EP0037 returned 14.6 ppm U and a U/Th ratio of 1.5, approximately five times the expected values.

A sample from EP0041 in the H Zone returned 12.5 ppm U and a 0.5 U/Th ratio, while a sample taken from K Zone, where expected values were 0.5-1.5 ppm U and U/Th ratios of 0.25-0.5, returned 5.4 ppm U and 1.2 U/Th ratio.

These elevated levels have given Azincourt confidence that uranium-bearing fluids were present in the alteration zones identified. As a result of this, the company intends to further examine the alteration system to determine the extent of alteration, areas of fluid concentration and strong uranium enrichment.

President and CEO, Alex Klenman, added, “The results of this drill program continue to support our exploration model at East Preston. The alteration zones are considerable in both size and scope. The results now confirm uranium is present within these alteration zones, which is a significant and critical step in the exploration process. We are eager to get the next round of drilling completed as the knowledge gained from this winter’s program will aid immensely in vectoring toward areas of more significant mineralization.”

Azincourt then raised funds, and is now ready to embark on a fully funded Fall and Winter Field Season at the East Preston and Hatchet Lake Projects in the Athabasca Basin.

The primary target area on the East Preston Project is the conductive corridors from the A-Zone through to the G-Zone (A-G Trend) and the K-Zone through to the H and Q-Zones (K-H-Q Trend). The selection of these trends is based on a compilation of results from the 2018 through 2020 ground-based EM and gravity surveys, property wide VTEM and magnetic surveys, and the 2019 through 2022 drill programs, the 2020 HLEM survey indicates multiple prospective conductors and structural complexity along these corridors.

The Company is planning an extensive drill program for the fall and winter of 2022-2023. The program will consist of approximately 6,000 meters of drilling in 20+ diamond drill holes. The priority will be to continue to evaluate the alteration zones and elevated uranium identified in the winter of 2022.

Mobilization is anticipated to begin in December, with drilling to commence in January 2023. The permitting process is underway to obtain authorization for the fall and winter 2022-2023 drill programs on both projects.

“We’re of course eager to get back on the ground at East Preston and follow up the promising results from last winter,” said CEO, Alex Klenman. “The more work we do, the more compelling East Preston becomes. We’ve gone from grass roots to the development of top tier exploration targets on what is a large and highly prospective property. We have the right rocks, the right geochemistry, the right structures, and we’ve now produced evidence that uranium is present within large alteration zones. Step by step, we continue to progress East Preston in a very positive way. This next drill program is another important step towards our goal of meaningful discovery,” continued Mr. Klenman.

The Hatchet Lake Project is a recent addition to the Company’s portfolio. Hatchet Lake sits just outside the northeastern margin of the Athabasca Basin, situated along the underexplored northeast extension of the Western Wollaston Domain (WWD) within the Wollaston-Mudjatik Transition Zone (WMTZ). This highly prospective structural corridor hosts the majority of known high-grade uranium deposits and all of Canada’s operating uranium mines.

The first program the Company is proposing for the project will consist of ground reconnaissance to verify targets, ground geophysics (Horizontal Loop Electromagnetic HLEM) to verify conductor locations, and a helicopter supported diamond drill program to be conducted in the fall of 2022. The drill program is expected to consist of up to 1,500 meters in 8-10 diamond drill holes.

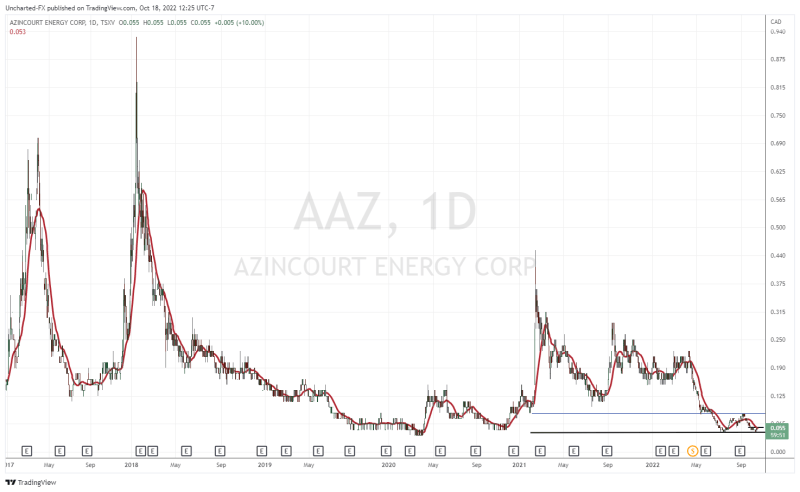

Now let’s take a look at the chart. Or rather charts. Let’s start off first with a wide view.

This stock is literally near its bottom. The all time lows came in just a tad bit lower at $0.04. The stock is currently trading at $0.055.

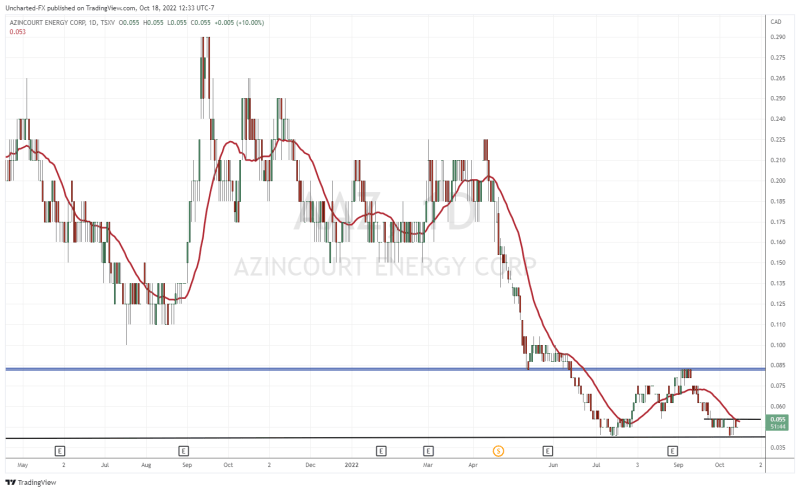

Zooming into the daily chart and we can see something that will get market structure investors excited. The stock really is in its base/range/consolidation phase. An uptrend tends to come next. For bottom pickers, this stock is likely on your watchlist.

I am watching for a few developments. One of which could occur very soon. Firstly, I am waiting for a candle close above $0.055, basically where we are testing right now. This would give us a breakout from the recent range the stock has been in.

The bigger move will happen when Azincourt takes out the $0.085 zone. Then we would have a double bottom reversal pattern triggered just as the stock was consolidating.

All that is needed is a catalyst. With drilling upcoming in Fall and Winter, that could be the catalyst to get the stock going.

Let’s not forget that uranium prices breaking above its range will also impact the uranium juniors and miners. A major uranium breakout rally could get the stock bouncing hard from its bottom support.

For traders, the stock sees a lot of consistent volume everyday.

At this price point, and with these technicals, this is a great point to enter from a risk vs reward perspective. It is an undervalued explorer and the company presents a potentially low entry on a strong growth story especially if you are bullish uranium. For uranium bulls, holding some juniors in addition to front runner producers such as Uranium Energy Corp (UEC) and Energy Fuels (UUUU) would be a prudent strategy for the upcoming uranium bull market.