Azincourt Energy (AAZ.V) is a uranium exploration company with assets in the Athabasca Basin and Peru. The company is currently focusing on their Canadian assets.

Azincourt’s most advanced project is East Preston, neighboring some really high-grade uranium deposits such as Nexgen’s Arrow, and Fission’s Triple R.

The company controls a >70% interest in the project and a lot of money has been spent in the last number of years exploring it, with exploration investments as high as $4.5m in 2022 versus 2021’s $1m (Canadian dollars). The total amount since they’ve signed the deal has been over $7m.

The findings so far have been somewhat encouraging, but they haven’t hit it out of the park.

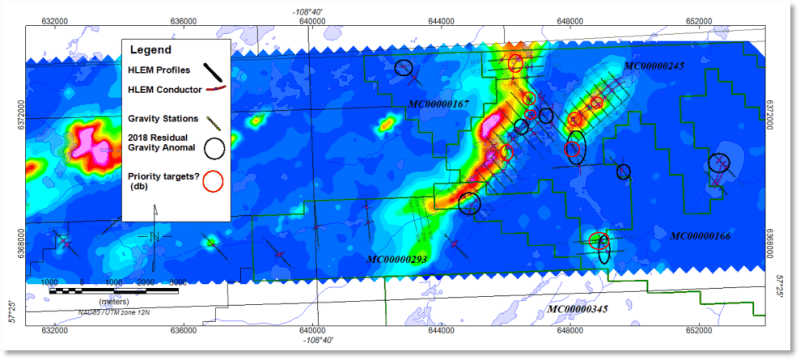

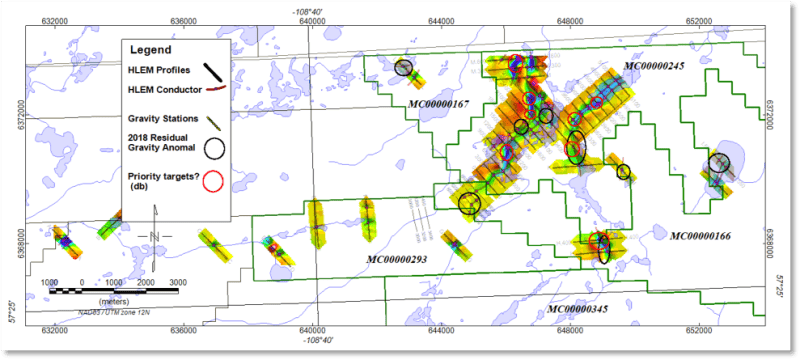

In the 2017/2018 season, gravity geophysical surveys and HLEM targets were identified over a large area spanning over 40km.

Drilling has confirmed the right basement unconformity uranium setting – rocks, structure and alteration, however not enough concentration of uranium has been found to consider it a new discovery and the share price has suffered immensely, even after a 2.5-to-1 consolidation in the spring.

Can they hit it big in the Athabasca Basin?

Azincourt is currently a bet on discovery, which is as close as you get in the mining world to a lottery ticket. While the experience of the team may influence the odds, at the end of the day, Lady Luck plays a much bigger role than any other factor.

In order to ascertain if it’s cheap or expensive, you have to ask yourself what you’re getting for what price. And when you look at cash levels versus market cap, it’s hard to argue against the idea it looks cheap right now. The chart shows we’ve hovered around 5c to 8.5c and it seems like many shareholders have thrown in the towel.

Management was holding on to 10m cash at the end of June and current market cap is a tad over 11m. The market is valuing their projects at a very low premium.

But watch out, many people have lost their shirts going all-in on companies that look cheap but couldn’t create intrinsic value faster than they burned money, and this brings us to something I believe Azincourt could work on.

We love to see East Preston being drilled at a pace of 4m in one season, but now the company must also deal with the fact that Hatchet Lake must be drilled at a rate of 1-2m per year from 2022 to 2024, which may increase the likelihood of a uranium discovery, but there’s also the opportunity cost of not concentrating on one prospective project.

In this situation, and in line with inflation-adjusted costs in a region that has always been expensive and laborious to drill, the best way to improve your chances of not destroying shareholder value in the search for the next high-grade deposit is to watch your expenses like a hawk.

There is a lot of shareholder value that can be created by bringing awareness of the company’s potential to hungry investors, but this only buys time for the company to be able to go back to the drill pad – that’s where the real money can be made.

The fact they won’t have to go back to the market at this level is a big thumbs up and we’ll be keeping a very close eye on the upcoming 1500m drill program at Hatchet Lake before the end of year and the 6000m winter program for East Preston.

Equity Guru founder, Chris Parry, sat down at the beginning of August broke down Azincourt and outlined what he felt was the company’s value proposition:

–Fabi Lara