Things escalated over the weekend with some Russian banks, and Russia’s central bank, being kicked out of swift. If you were short the Ruble (long USDRUB, long EURRUB), you were quite happy with your trade:

Trading off of suffering isn’t something I, or anybody else, like to talk about. But since I am a trader and investor, I do need to analyze all of this. There are plenty of ways to trade this situation. A lot of people automatically think of energy. Oil and natural gas. And for good reason. However, I suggest people look at Platinum and Palladium, where Russia is the second largest exporter after South Africa. You guys know I am an Agriculture guy, and both Russia and Ukraine are big players. In my opinion we are already seeing the impact on wheat and potash. I think a lot of us will feel this come the Spring planting season.

However, in this Market Moment, the way to play this whole thing can be summed up by the words “go long Russia Ukraine”. Meaning, go long the stock markets.

Why? It is all about the Federal Reserve and the central banks. Let’s not forget that. It seems like the Fed may not be aggressive in rate hikes here. The Europeans are already looking that way.

Here’s why:

Many EU nations are buying weapons and sending them to Kiev.

Deputy Prime Minister of the Netherlands: “inflation is the price we have to pay to battle Putin.”

— Jan Nieuwenhuijs (@JanGold_) February 27, 2022

Nations are willing to have higher inflation to combat Putin. What this means is new arms deals. Some are already calling it a new cold war. One thing is for certain, a new global arms race is beginning. Belarus turning into a nuclear power might get some other European nations to start spending more on defense. So where does this money come from? Either governments will raise taxes, or they will print.

With governments going into more debt to increase defense expenditures, interest rates will need to remain low for a bit longer. I think we can discount the 7 rate hikes this year. I still expect the Fed to hike come March, but more eyes and ears will be on the dot plot and if the Fed becomes less hawkish.

As long as the cheap money continues, money will look to the stock market for yield. As long as inflation persists, money will run into stock markets as they provide the best yield in real terms. Expect stock markets to make new all time record highs in the US.

So knowing this, we need to take a look at the charts of US military companies. A new arms race will be bullish for them. This play reminds me of the vaccine play last year, where investors and traders began pricing in big earnings for Pfizer, Moderna, AstraZeneca etc.

Four come to mind: Raytheon (RTX), Lockheed Martin (LMT), Northrop Grumman (NOC), and General Dynamics (GD). And their charts are already going:

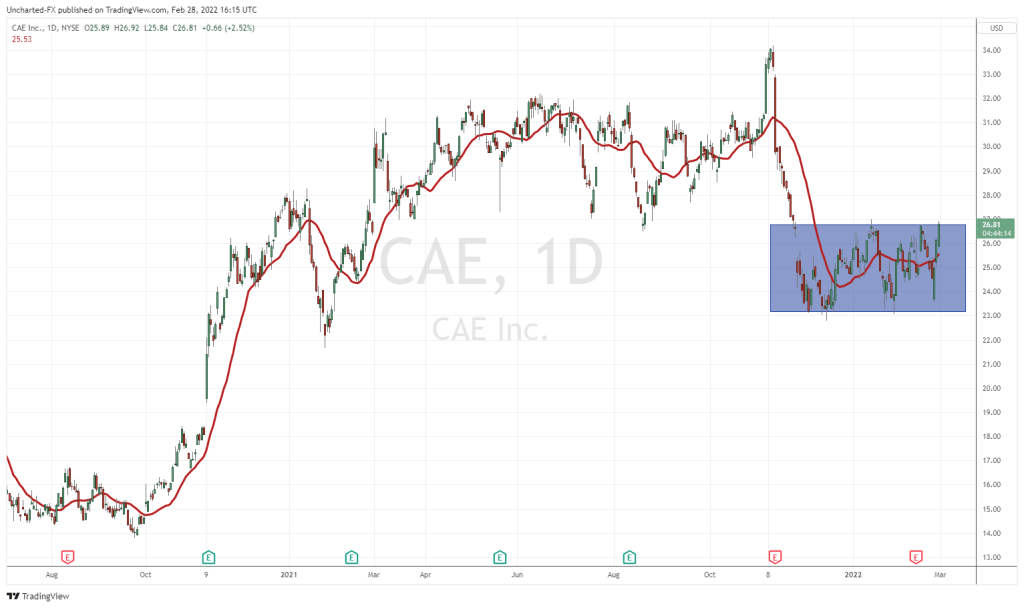

I personally am watching a Canadian company, CAE. It can also be traded on the US market.

I don’t think I need to say much. We are just waiting for a breakout confirmation. If we can get a daily close above $34.05, we get our trigger.

The S&P 500 and other markets are recovering from their overnight sessions. We spoke about the daily closes above resistance on Friday. Bullish signs all around…and when more of the market begins to price in more cheap money, we will have a winner. I am sure markets will also pop on any sort of deal/truce/ceasefire that comes out in this Russia-Ukraine meeting held in Minsk.