Put Your Trust In Zero Trust

- $25.107M Market Capitalization

Plurilock Security Inc. (PLUR.V) today has provided a corporate update and strategy outlook for 2022. As outlined by Ian L. Paterson, Plurilock’s CEO, the Company plans to focus on advancing three primary objectives, including the sale of Plurilock’s high-margin zero trust identity platform, developing new technology, and strategically searching for acquisition opportunities.

“We anticipate 2022 to be a transformational year for PlurilockTM as we scale our technology offerings to a diverse and growing base of enterprise customers…As the global cybersecurity market continues to shift toward zero trust architecture, we feel our suite of continuous authentication, behavioral-biometric products will continue to gain traction in the face of the growing cyber threat,” said Ian L. Paterson, CEO of Plurilock.

What is Zero Trust?

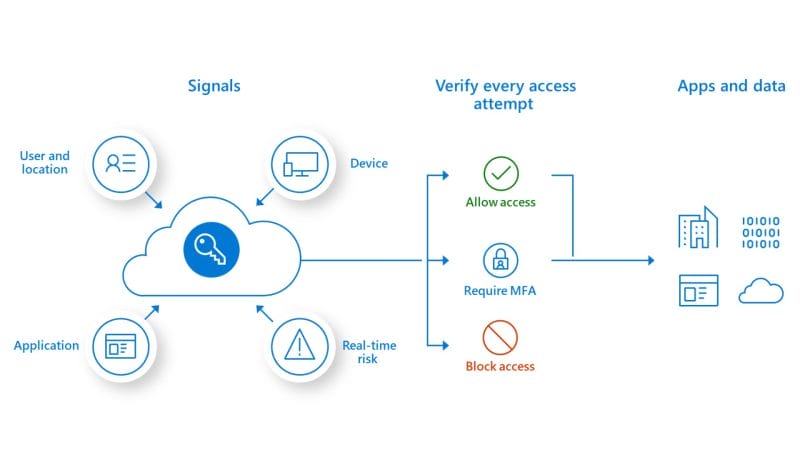

Zero trust refers to a security framework requiring all users, whether inside or outside of an organization’s network, to be authenticated, authorized, and continuously validated before receiving access to applications and data. In response to an increasing frequency of cyberattacks, zero trust is intended to address security challenges associated with modern businesses.

Keep in mind, more than 80% of all attacks involve credentials use or misuse in a network. In order to combat this, zero trust technology utilizes multiple security technologies such as risk-based multi-factor authentication, identity protection, next-generation endpoint security, and cloud workload technology to verify a user’s identity.

In summary, zero trust solutions are used to secure remote workers, hybrid cloud environments, and ransomware threats. According to a report from Check Point Research (CPR), a provider of cyber threat intelligence, at the end of 2021, the number of cyberattacks a week per organization peaked at 925, globally. To put things into perspective, researchers observed 50% more attacks per week on corporate networks in 2021 compared to 2020.

Unfortunately, some sectors are disproportionately targeted by cyber attacks. In particular, in 2021, the Education & Research sector experienced the highest volume of attacks, with an average of 1,605 attacks per organization every week, representing a 75% increase from 2020. Following just behind the Education & Research sector, the Government & Military sector experienced 1,136 attacks per week, representing a 47% increase compared to 2020.

As a result, 50% of large enterprises positioned in a variety of sectors spend $1 million or more annually on security. In fact, the White House and the U.S. Office of Management and Budget recently announced that federal agencies will be required to adopt zero trust technology and policies by the fiscal year 2024. Furthermore, a survey of security and risk professionals indicated that 80% of their organizations intend to implement zero trust in 2022.

Plurilock Security’s Response

As organizations begin shifting towards zero-trust solutions, the demand for these products has increased substantially, with the Global Zero Trust Security Market expected to generate $66.74 billion in revenue by 2027. Needless to say, equipped with a growing portfolio of zero-trust solutions, Plurilock intends to capitalize on the opportunities within this market, which is expected to drive revenue growth and margin expansion for the Company.

“We have invested in this segment of our business by acquiring distribution through our subsidiary, Aurora Systems Consulting Inc., and training our sales staff to accelerate our pipeline growth to secure the direction of Plurilock,” continued Ian L. Paterson.

Currently, Plurilock is in active discussions with organizations across North America for both ADAPT and DEFEND, from the Company’s existing sales strategy as well as through its distribution network established following the acquisition of Aurora Systems Consultion Inc. It is worth noting that through Aurora, Plurilock has secured multiple U.S. government contracting vehicles.

As such, the Company has access to numerous federal civilian and defense agencies, as well as over 170 state agencies in California. With this in mind, Plurilock intends to leverage its existing distribution streams to cross-sell its Technology Division’s proprietary AI-driven, identity-centric continuous authentication solutions. Keep in mind, these same solutions generated impressive gross margins of 84.1% for the nine months ended September 30, 2021.

Technology Division Overview

DEFEND is Plurilock’s Invisible Multi-Factor Authentication (MFA) Solution. DEFEND is capable of detecting compromised sessions and credentials in real-time by offering full-session detection and real-time identity confirmation. Using Plurilock’s patented biometric and machine learning technology, DEFEND is able to recognize a user based on how they work. Furthermore, DEFEND requires no new hardware and is completely invisible to users.

ADAPT refers to Plurilock’s Behavioral-Biometric, Continuous Authentication Solution. ADAPT was made for idiots like me who can’t remember their one of 500 passwords. With credentials ranging from hard tokens, OTP, touch ID, and mobile push, to name just a few, remembering a password can be quite the task. With this in mind, similar to DEFEND, ADAPT is able to verify a user by analyzing typing biometric, geolocation, time of day, and device ID, among others.

Overall, Plurilock has demonstrated consistent and strong sales growth in its Solutions Division. This is emphasized by USD$1.16 million in sales captures from all of the Company’s announced contracts and orders since January 2022. With this in mind, as of September 30, 2021, Plurilock had $7.05 million in cash, suggesting that the Company is well-positioned to deliver on its initiatives.

In addition to developing new zero-trust technologies, Plurilock intends to submit patent filings in the future. Currently, Plurilock holds six provisional and issued patents through the U.S. Patent and Trademark Office, including the Company’s recently submitted non-provisional U.S. patent application for new technology enhancements in combatting insider threats.

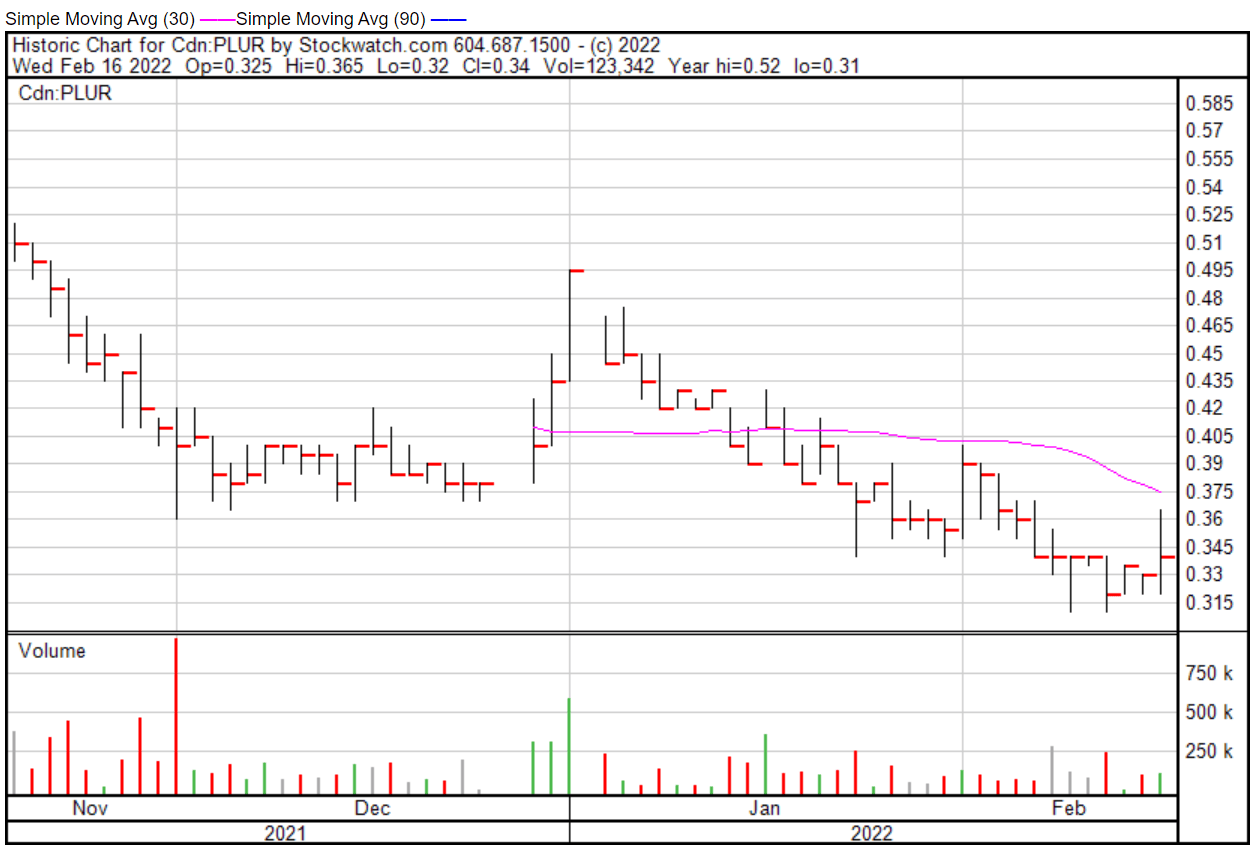

Plurilock’s share price opened at $0.325 today, down from a previous close of $0.33. The Company’s shares were up 9.09% and were trading at $0.36 as of 11:59 AM EST.

Full Disclosure: Plurilock Security Inc. (PLUR.V) is a marketing client of Equity Guru.