If you thought last week was bad. It’s another day in EV hell as carnival barkers continue to bring in the bucks while legitimate manufacturers are left to dangle. The whole market is as murky as Mitch McConnell’s ethics. It’s time once again to wade through the swamp of broken promises and see what shines in the EV sector.

Arcimoto (FUV.Q) is the nail to short seller hammers. The EV manufacturer dog paddles to keep its neck up in a 32.28% shorted float. That hasn’t stopped management from increasing their stake in the company. In the last week, Arcimoto reported that Mark Frohnmayer, chairman, president and CEO, Terry Becker, COO and director, Nancy Calderone, independent director, Galileo Russell, director, Jesse Eisler, independent director, and Joshua Scherer, independent director, grabbed a total of 8,473 common shares in the company. One can only wonder if this is an effort to spook short sellers. There is a darkening sky over Arcimoto unless their November financials impress beyond belief. The company is right-sizing transportation which will be the eventual trend of personal travel, but from what I’ve seen of their finished products, they are indeed made for fun and don’t have a lot of utilitarian functionality. After all, who wants to drive an open-door vehicle in Vancouver during the nine months of liquid sunshine? Therefore, Arcimoto is relegated to the tourist crowd in sunny climes. Not a huge market and highly dependent on the economy. While I admire the intent, the execution leaves a lot to be desired. I don’t know if this one has the substance to power through to brighter days. The company slid 5.24% over the last five days to trade at $10.68 USD per share for a market cap of $399.35 million.

Arcimoto (FUV.Q) is the nail to short seller hammers. The EV manufacturer dog paddles to keep its neck up in a 32.28% shorted float. That hasn’t stopped management from increasing their stake in the company. In the last week, Arcimoto reported that Mark Frohnmayer, chairman, president and CEO, Terry Becker, COO and director, Nancy Calderone, independent director, Galileo Russell, director, Jesse Eisler, independent director, and Joshua Scherer, independent director, grabbed a total of 8,473 common shares in the company. One can only wonder if this is an effort to spook short sellers. There is a darkening sky over Arcimoto unless their November financials impress beyond belief. The company is right-sizing transportation which will be the eventual trend of personal travel, but from what I’ve seen of their finished products, they are indeed made for fun and don’t have a lot of utilitarian functionality. After all, who wants to drive an open-door vehicle in Vancouver during the nine months of liquid sunshine? Therefore, Arcimoto is relegated to the tourist crowd in sunny climes. Not a huge market and highly dependent on the economy. While I admire the intent, the execution leaves a lot to be desired. I don’t know if this one has the substance to power through to brighter days. The company slid 5.24% over the last five days to trade at $10.68 USD per share for a market cap of $399.35 million.

![]() Canoo (GOEV.Q) remains at 32.94% short interest, so it seems that any attempt at a short squeeze by the hucksters and bag holders over at WallStreetBets hasn’t produced the desired result. The entire EV industry led by the lunacy of Tesla is a veritable playground for SPAC manipulation, rainmaker capitalists and clueless retail investment. Canoo has a good idea or is at least based on a good idea of skateboard chassis that can be swapped out after the first owner and repurposed for a second and third round of revenue generation. However, the EV manufacturer is a long way off from production and worlds away from justifying its $1.58 billion valuation. Once it hits its stride in 2022, it will be playing catchup to major auto manufacturers and other more advanced EV start-ups. That said, I like the company, if it can only sidle up to reality, drop its recreation segment and get on the deal train with Fortune 500 companies and government organizations. The company announced at the end of September that it would be partnering with AVL, an independent company which provides development, simulation and testing for the automotive industry. The deal will see AVL develop, test, and validate Advanced Driver Assistance Systems software for Canoo’s Lifestyle Vehicle. More money and effort on a line that is only destined to distract the company from its goal of becoming a solvent revenue generator. As such, Canoo sank 13.47% on the boards over the preceding five days to trade at $6.64 per share for an insane market cap of $1.58 billion.

Canoo (GOEV.Q) remains at 32.94% short interest, so it seems that any attempt at a short squeeze by the hucksters and bag holders over at WallStreetBets hasn’t produced the desired result. The entire EV industry led by the lunacy of Tesla is a veritable playground for SPAC manipulation, rainmaker capitalists and clueless retail investment. Canoo has a good idea or is at least based on a good idea of skateboard chassis that can be swapped out after the first owner and repurposed for a second and third round of revenue generation. However, the EV manufacturer is a long way off from production and worlds away from justifying its $1.58 billion valuation. Once it hits its stride in 2022, it will be playing catchup to major auto manufacturers and other more advanced EV start-ups. That said, I like the company, if it can only sidle up to reality, drop its recreation segment and get on the deal train with Fortune 500 companies and government organizations. The company announced at the end of September that it would be partnering with AVL, an independent company which provides development, simulation and testing for the automotive industry. The deal will see AVL develop, test, and validate Advanced Driver Assistance Systems software for Canoo’s Lifestyle Vehicle. More money and effort on a line that is only destined to distract the company from its goal of becoming a solvent revenue generator. As such, Canoo sank 13.47% on the boards over the preceding five days to trade at $6.64 per share for an insane market cap of $1.58 billion.

ElectraMeccanica (SOLO.Q) hit the ground running this week as it announced the company commenced deliveries of its flagship SOLO EV at the invite-only unveiling event in Los Angeles, California on Monday. It’s first fleet customers included Skechers USA, Faction Technology, Cyber Yogurt and renowned Southern California franchise, Ruby’s Diner. EM plans to ramp up production with its manufacturing partner and strategic investor, Zongshen Industrial Group, so that the company can strengthen its retail footprint in 10 major markets spanning five western states. The EV manufacturer also announced it remains on track to complete its new U.S. Assembly and Engineering Technical Center in Mesa, Arizona in the summer 2022. The new facility will be able to produce up to 20,000 vehicles annually. EM has a similar challenge as Arcimoto, it will have to convince SUV drivers to abandon all that useless space for an economically sized alternative, but unlike Arcimoto, EM’s product looks like a car for adults with doors and everything. I could get behind this company and not just because the EV manufacturer is headquartered out of Vancouver. I like the vehicles; I like the business plan and I like the performance. This could realize some sweet potential. However, do your due diligence and talk to an investment professional! EM edged down 3.20% over the last five days to land at $3.33 per share for a market cap of $371.27 million.

ElectraMeccanica (SOLO.Q) hit the ground running this week as it announced the company commenced deliveries of its flagship SOLO EV at the invite-only unveiling event in Los Angeles, California on Monday. It’s first fleet customers included Skechers USA, Faction Technology, Cyber Yogurt and renowned Southern California franchise, Ruby’s Diner. EM plans to ramp up production with its manufacturing partner and strategic investor, Zongshen Industrial Group, so that the company can strengthen its retail footprint in 10 major markets spanning five western states. The EV manufacturer also announced it remains on track to complete its new U.S. Assembly and Engineering Technical Center in Mesa, Arizona in the summer 2022. The new facility will be able to produce up to 20,000 vehicles annually. EM has a similar challenge as Arcimoto, it will have to convince SUV drivers to abandon all that useless space for an economically sized alternative, but unlike Arcimoto, EM’s product looks like a car for adults with doors and everything. I could get behind this company and not just because the EV manufacturer is headquartered out of Vancouver. I like the vehicles; I like the business plan and I like the performance. This could realize some sweet potential. However, do your due diligence and talk to an investment professional! EM edged down 3.20% over the last five days to land at $3.33 per share for a market cap of $371.27 million.

Fisker (FSR) announced at the beginning of the month that it would open a specialty engineering division in the U.K. with industry veteran David King at the helm. The facility, entitled The Fisker Magic Works, will focus on low-volume, rapid development vehicle programs and specialized versions of the Fisker product line. As part of its mandate this new Fisker segment will instill futuristic design, technology and innovation into high-profile products supporting the mainstream business. King will bring more than 30 years of vehicle engineering and product development leadership experience primarily at Aston Martin, including the role as president of Aston Martin Racing. Responsible for the DB7 V12 Vantage as well as the clean-sheet development of the DB9 and Vantage, King’s also worked on multiple joint-OEM, rapid development platform-sharing projects with Ford, Jaguar and Daimler. Recently, he lead a team of 100 engineers to launch a series of specialty vehicles and develop the ‘Q by Aston Martin’s bespoke and customization service. Fisker is embracing its luxurious niche image and going all the way to making high-end personalized creations for the well-shod consumer. This narrow focus is what Canoo lacks and will probably propel Fisker forward toward its milestones. However, such a small market may not justify its $4.13 billion valuation and disprove the short sellers who currently control 30.21% of the company’s float. This risk is compounded by the fact that much of the EV manufacturer’s potential success is hinged on Foxconn securing manufacturing space in Ohio and assisting Fisker in production as agreed to in May. The company fell 4.45% over the last five days to trade at $13.96 per share.

Fisker (FSR) announced at the beginning of the month that it would open a specialty engineering division in the U.K. with industry veteran David King at the helm. The facility, entitled The Fisker Magic Works, will focus on low-volume, rapid development vehicle programs and specialized versions of the Fisker product line. As part of its mandate this new Fisker segment will instill futuristic design, technology and innovation into high-profile products supporting the mainstream business. King will bring more than 30 years of vehicle engineering and product development leadership experience primarily at Aston Martin, including the role as president of Aston Martin Racing. Responsible for the DB7 V12 Vantage as well as the clean-sheet development of the DB9 and Vantage, King’s also worked on multiple joint-OEM, rapid development platform-sharing projects with Ford, Jaguar and Daimler. Recently, he lead a team of 100 engineers to launch a series of specialty vehicles and develop the ‘Q by Aston Martin’s bespoke and customization service. Fisker is embracing its luxurious niche image and going all the way to making high-end personalized creations for the well-shod consumer. This narrow focus is what Canoo lacks and will probably propel Fisker forward toward its milestones. However, such a small market may not justify its $4.13 billion valuation and disprove the short sellers who currently control 30.21% of the company’s float. This risk is compounded by the fact that much of the EV manufacturer’s potential success is hinged on Foxconn securing manufacturing space in Ohio and assisting Fisker in production as agreed to in May. The company fell 4.45% over the last five days to trade at $13.96 per share.

![]() Green Motor Power Company (GPV.V) announced another delivery on Monday. This time it was the city of Temecula’s Mary Phillips Senior Center that picked up GMPC’s ADA-accessible EV Star. The senior’s facility leveraged the VW Mitigation Trust to the tune of $160,000 to foot the bill. According to the release, city council member Zak Schwank commented,

Green Motor Power Company (GPV.V) announced another delivery on Monday. This time it was the city of Temecula’s Mary Phillips Senior Center that picked up GMPC’s ADA-accessible EV Star. The senior’s facility leveraged the VW Mitigation Trust to the tune of $160,000 to foot the bill. According to the release, city council member Zak Schwank commented,

“By leveraging VW Mitigation funding…, we’ll see an immediate positive impact on the operational costs and emissions reduction, so it’s a win for the entire community.”

This is another feather in GMPC’s cap, but the company’s sales are still heavily relying on government incentives to move product. Perhaps when production ramps up and EV technologies become more commonplace, GMPC will be able to ship without financial assistance. The EV manufacturer isn’t alone, almost the entire sector leans on government incentives to make sales. This crutch impacts the stability and sustainability of most players in the space. That said, GMPC is financially secure with undrawn credit facilities, unlike many of its counterparts. When deals like the Forest River partnership ramp up deliveries, GMPC may be able to reduce costs and further ween itself off subsidized sales, empowering the company and solidifying its bottom line. Despite the good news, the company slid 14.57% over the last five days to rest at $12.78 CAD per share for a market cap of 358.45 million.

![]() Kandi Technologies (KNDI.Q) remains quiet on the news front. Like its Chinese EV manufacturing compatriots, it is caught up in economic uncertainty, power constraints and chip supply chain issues. Too bad as the company produces product for the common person who works for a living. Hopefully things clear up soon because this company has legs. Kandi walked a fairly straight line on the boards, edging down 0.45% for the week to trade at $4.38 USD per share for a valuation of 332.49 million.

Kandi Technologies (KNDI.Q) remains quiet on the news front. Like its Chinese EV manufacturing compatriots, it is caught up in economic uncertainty, power constraints and chip supply chain issues. Too bad as the company produces product for the common person who works for a living. Hopefully things clear up soon because this company has legs. Kandi walked a fairly straight line on the boards, edging down 0.45% for the week to trade at $4.38 USD per share for a valuation of 332.49 million.

Li Auto (LI.Q) saw some love in the market this week rising 7.99% in trading value. It’s production update at the beginning of the month seems to have fueled interest in the company’s shares. The EV manufacturer upped its deliveries by 102.5% in September over the same period last year and quarterly numbers were up 190% year-over-year. As of September 30, 2021, Li Auto had cumulative deliveries of 88,867 for the year. The company experience supply chain pressure in September but with rising orders, co-founder and president, Yanan Shen stated,

Li Auto (LI.Q) saw some love in the market this week rising 7.99% in trading value. It’s production update at the beginning of the month seems to have fueled interest in the company’s shares. The EV manufacturer upped its deliveries by 102.5% in September over the same period last year and quarterly numbers were up 190% year-over-year. As of September 30, 2021, Li Auto had cumulative deliveries of 88,867 for the year. The company experience supply chain pressure in September but with rising orders, co-founder and president, Yanan Shen stated,

“…we are taking multiple measures to ensure the supply of the (sic) auto parts, aiming to shorten the waiting time of delivery to our users.”

Li Auto has built an impressive network with 153 retail stores in 85 cities, as well as 223 servicing centers and authorized body and paint shops operating in 165 cities.

Again, the EV manufacturer is tied to the challenges in China, but it continues to push forward with product superior to Tesla. Unfortunately, with Elon flooding the market with his poorly assembled products, it may take some time for Li to get enough optics to shine through Musk’s incessant hype. The company trades at $28.78 per share for a market cap of 28.16 billion.

![]() Lordstown Motors’ (RIDE.Q) deal with Foxconn didn’t bring investors to the table, in fact Morgan Stanley analyst, Adam Jonas, cut the company off at the knees by downgrading it to SELL while slicing his price target from $8 to $2. Jonas hated the Foxconn deal, stating the $230 million-dollar purchase price was less than 20% of the Ohio plant’s value. Jonas is not alone in his feelings as more and more analysts are stamping the EV manufacturer with a SELL rating. The desperation to raise cash for the production and release of its Endurance Truck has unnerved the market and since its scandal, short seller frenzy and management shuffle, there isn’t much certainty in the company’s prospects and with analysts turning up their nose, Lordstown is taking a beating on the boards. Shares were down 42.33% to $5.04 per, toppling market value for a diminished total of $891.97 million. Stay away from this one for a while.

Lordstown Motors’ (RIDE.Q) deal with Foxconn didn’t bring investors to the table, in fact Morgan Stanley analyst, Adam Jonas, cut the company off at the knees by downgrading it to SELL while slicing his price target from $8 to $2. Jonas hated the Foxconn deal, stating the $230 million-dollar purchase price was less than 20% of the Ohio plant’s value. Jonas is not alone in his feelings as more and more analysts are stamping the EV manufacturer with a SELL rating. The desperation to raise cash for the production and release of its Endurance Truck has unnerved the market and since its scandal, short seller frenzy and management shuffle, there isn’t much certainty in the company’s prospects and with analysts turning up their nose, Lordstown is taking a beating on the boards. Shares were down 42.33% to $5.04 per, toppling market value for a diminished total of $891.97 million. Stay away from this one for a while.

![]() Lucid Group (LCID.Q) lost some ground this week, slipping 4.50% to $24.38 per share. Despite the quality of its Lucid Air line and the fact it took Tesla to town in terms of product care and vehicle range, it continues to range most likely until deliveries commence at the end of the month. I still think this one is a potential winner in the space, but it will take some time to establish its manufacturing footprint and sales network. Currently the company has a market value of $39.46 billion. Do your due diligence!

Lucid Group (LCID.Q) lost some ground this week, slipping 4.50% to $24.38 per share. Despite the quality of its Lucid Air line and the fact it took Tesla to town in terms of product care and vehicle range, it continues to range most likely until deliveries commence at the end of the month. I still think this one is a potential winner in the space, but it will take some time to establish its manufacturing footprint and sales network. Currently the company has a market value of $39.46 billion. Do your due diligence!

Nikola (NKLA.Q) slipped at the beginning of week but has recovered most of that loss. The EV manufacturer announced it would be publishing its Q3 2021 financial results on Thursday, November 4, 2021. The company intends to hold a conference call and webcast at 9:30 am EST to discuss details and future plans. If you are so inclined, the webcast will be on https://nikolamotor.com/investors/news?active=events. Nikola also announced on Thursday it had signed a joint development agreement with TC Energy for the co-development of large-scale clean hydrogen hubs. The project is intended to service heavy-duty fuel cell EV vehicles as well as serving TC Energy customer’s clean energy needs in North America. Both companies intend to evaluate opportunities to optimize excess hub supplies for third parties under a joint marketing and services agreement. Pablo Koziner, Nikola president of Energy and Commercial commented,

Nikola (NKLA.Q) slipped at the beginning of week but has recovered most of that loss. The EV manufacturer announced it would be publishing its Q3 2021 financial results on Thursday, November 4, 2021. The company intends to hold a conference call and webcast at 9:30 am EST to discuss details and future plans. If you are so inclined, the webcast will be on https://nikolamotor.com/investors/news?active=events. Nikola also announced on Thursday it had signed a joint development agreement with TC Energy for the co-development of large-scale clean hydrogen hubs. The project is intended to service heavy-duty fuel cell EV vehicles as well as serving TC Energy customer’s clean energy needs in North America. Both companies intend to evaluate opportunities to optimize excess hub supplies for third parties under a joint marketing and services agreement. Pablo Koziner, Nikola president of Energy and Commercial commented,

“This collaboration with TC Energy is intended to enable the production of hydrogen at quantities and costs that are required to support customer adoption and use of FCEVs. TC Energy also offers pipeline distribution capabilities that will be essential for cost-efficient movement of hydrogen in the future. Today marks a major step by Nikola in accordance with its stated energy strategy for the provision of hydrogen fuel solutions to future Nikola FCEV customers and to public network fueling stations.”

This news was the catalyst that buoyed share value to 0.56% under the start of the week at $10.67 per share and a market cap of 4.29 billion. That’s a lot of market value for Nikola’s current performance, but at least it isn’t an insane multiple like Tesla. Still, not much confidence in the company, it has tons to do before it earns my trust. Of course, its your money, but do your due diligence and talk to an investment professional.

Nio’s (NIO) hasn’t said anything since its Q3 delivery update. The company had a bad midweek but pulled up yesterday to a report a share price slightly down from Monday. Like Li Auto, it has much to contend with domestically, but it continues to outperform year-over-year. The real proof of the pudding will become apparent over the next six months, however. Currently the EV manufacturer trades at $35.99 per share for a market cap of $58.97 billion.

Nio’s (NIO) hasn’t said anything since its Q3 delivery update. The company had a bad midweek but pulled up yesterday to a report a share price slightly down from Monday. Like Li Auto, it has much to contend with domestically, but it continues to outperform year-over-year. The real proof of the pudding will become apparent over the next six months, however. Currently the EV manufacturer trades at $35.99 per share for a market cap of $58.97 billion.

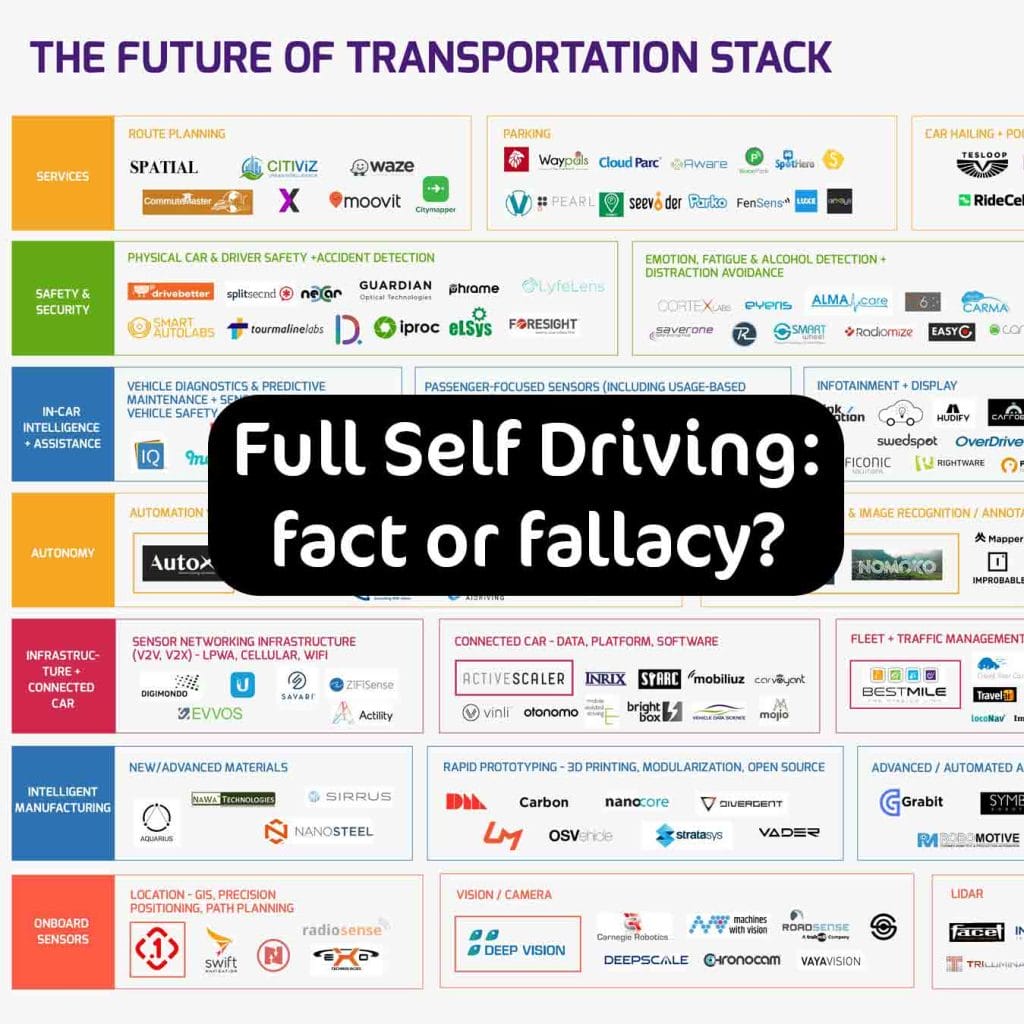

Tesla’s (TSLA.Q) announced Q3 2021 production and delivery numbers with the production of 238,000 vehicles and the delivery of 240,000 vehicles. Despite spotty quality, mounting litigation, studies proving the mislabeled ‘FSD’ is dangerously ineffective, the over-toothed belligerent sham that is Musk continues to flog his product and the ignorant continue to buy his flagrantly false narrative. I will be the first to admit that the world now sits on its ear, so the bluff and bravado of this walking fraud may actually push the company forward despite his constant hyperbole and the company’s near-criminal valuation. Elon announced this week that he would rather do business in a state that has basically outlawed abortion than operate in the state of California, because Texas doesn’t give a shit about proper taxation or covid 19. When asked why he made the switch to the bighorn state when government legislation had put the right to abortion in jeopardy, the governor was questioning election results and letting a pandemic run rampant because “freedom”, the morally bereft sycophant known as Musk, praised Texas for bending over to big business and stated he doesn’t get into politics. I call bullshit. Musk is about as political as it comes, making jabs at both state and federal government over public policies, cutting regulatory agencies for rules and safety measures. However, when his asshole nature doesn’t suit his purpose, he blows smoke up the ass of authoritarian regimes and backwards state governments and pretends to be above the very real and very nasty politics that ruin peoples’ lives. He is a smug business bobble-head that needs to be pulled to the carpet, because he is destroying what is left of proper business ethics and corporate best practices to serve his mammoth and delusional ego. He hops around the crypto currency space like a schizophrenic rabbit, pumping random coins for his own benefit. Musk is a true market-manipulator and as well as a fraud and a braggart, end of story. No, I won’t put a dime into Tesla – ever.

Tesla’s (TSLA.Q) announced Q3 2021 production and delivery numbers with the production of 238,000 vehicles and the delivery of 240,000 vehicles. Despite spotty quality, mounting litigation, studies proving the mislabeled ‘FSD’ is dangerously ineffective, the over-toothed belligerent sham that is Musk continues to flog his product and the ignorant continue to buy his flagrantly false narrative. I will be the first to admit that the world now sits on its ear, so the bluff and bravado of this walking fraud may actually push the company forward despite his constant hyperbole and the company’s near-criminal valuation. Elon announced this week that he would rather do business in a state that has basically outlawed abortion than operate in the state of California, because Texas doesn’t give a shit about proper taxation or covid 19. When asked why he made the switch to the bighorn state when government legislation had put the right to abortion in jeopardy, the governor was questioning election results and letting a pandemic run rampant because “freedom”, the morally bereft sycophant known as Musk, praised Texas for bending over to big business and stated he doesn’t get into politics. I call bullshit. Musk is about as political as it comes, making jabs at both state and federal government over public policies, cutting regulatory agencies for rules and safety measures. However, when his asshole nature doesn’t suit his purpose, he blows smoke up the ass of authoritarian regimes and backwards state governments and pretends to be above the very real and very nasty politics that ruin peoples’ lives. He is a smug business bobble-head that needs to be pulled to the carpet, because he is destroying what is left of proper business ethics and corporate best practices to serve his mammoth and delusional ego. He hops around the crypto currency space like a schizophrenic rabbit, pumping random coins for his own benefit. Musk is a true market-manipulator and as well as a fraud and a braggart, end of story. No, I won’t put a dime into Tesla – ever.

![]() Workhorse Group (WKHS.Q) keeps getting hammered, dropping 15.20% in the market since the beginning of the week. The executive shuffle didn’t instill the desired confidence within the investment community, and I don’t blame jaded investors. This is another entity drowning in shorts with 38.90% of its float shorted. I don’t see a lot of blue sky for this one. The SEC investigation and product recalls have put a serious wrench in the works. Also, not sure about the drone integrated approach, it reads like a “say anything to make us sound interesting”, because in all reality, it dilutes the business, spreads management and resources too thin and doesn’t really serve a need besides adding a ‘cool’ gadget to the offering. The company needs to streamline, get its ship in order and push forward with real, not imagined, progress. Will it accomplish this awesome task? I’m not in the positive camp. Do your due diligence, talk to an investment capital and slap your face before investing in this one. Workhorse currently trades at $6.36 per share for a market cap of $788.31 million.

Workhorse Group (WKHS.Q) keeps getting hammered, dropping 15.20% in the market since the beginning of the week. The executive shuffle didn’t instill the desired confidence within the investment community, and I don’t blame jaded investors. This is another entity drowning in shorts with 38.90% of its float shorted. I don’t see a lot of blue sky for this one. The SEC investigation and product recalls have put a serious wrench in the works. Also, not sure about the drone integrated approach, it reads like a “say anything to make us sound interesting”, because in all reality, it dilutes the business, spreads management and resources too thin and doesn’t really serve a need besides adding a ‘cool’ gadget to the offering. The company needs to streamline, get its ship in order and push forward with real, not imagined, progress. Will it accomplish this awesome task? I’m not in the positive camp. Do your due diligence, talk to an investment capital and slap your face before investing in this one. Workhorse currently trades at $6.36 per share for a market cap of $788.31 million.

![]() XL Fleet Corp (XL) hasn’t had much to say since the end of August and the stock is sliding because of it. As I have said before, I like the idea of the company providing EV upgrade services to ICE fleet vehicle platforms instead of designing an EV from the ground up, the company has remained stalled and the quiet doesn’t foretell a good story when the company is scheduled to release Q3 financials. That said, it may be working hard on deals it can’t talk about and could pull a rabbit out of its hat come November. Company shares were down 8.88% this week to sit at $5.54 per share for a market cap of $776.27 million.

XL Fleet Corp (XL) hasn’t had much to say since the end of August and the stock is sliding because of it. As I have said before, I like the idea of the company providing EV upgrade services to ICE fleet vehicle platforms instead of designing an EV from the ground up, the company has remained stalled and the quiet doesn’t foretell a good story when the company is scheduled to release Q3 financials. That said, it may be working hard on deals it can’t talk about and could pull a rabbit out of its hat come November. Company shares were down 8.88% this week to sit at $5.54 per share for a market cap of $776.27 million.

Xpeng (XPEV) climbed 4.22% on the boards this week. The company announced vast increases in deliveries for Q3 and shows no sign of stopping that trend. However, it too is surrounded by China’s current troubles and could be affected. As I said before, the company produces fine automobiles that rival and even best what Tesla has to offer. Out of China’s EV manufacturers, I like this one the best. Will it be a safe investment, considering trade tensions between the U.S. and the CCP? Good question and I have no crystal ball on this one. I can only hope it remains a going concern and gives Tesla the ass-kicking it deserves. Xpeng trades at $38.26 per share for a market cap of $30.59 billion.

Xpeng (XPEV) climbed 4.22% on the boards this week. The company announced vast increases in deliveries for Q3 and shows no sign of stopping that trend. However, it too is surrounded by China’s current troubles and could be affected. As I said before, the company produces fine automobiles that rival and even best what Tesla has to offer. Out of China’s EV manufacturers, I like this one the best. Will it be a safe investment, considering trade tensions between the U.S. and the CCP? Good question and I have no crystal ball on this one. I can only hope it remains a going concern and gives Tesla the ass-kicking it deserves. Xpeng trades at $38.26 per share for a market cap of $30.59 billion.

Now back to the traditional auto makers:

GM (GM) leaders announced this week that the iconic auto manufacturer’s pivot to EV could double its revenues by the end of the decade which amounts to approximately $244 billion in sales. On the heels of that ballsy statement, company officials unveiled its new Chevrolet Equinox SUV EV at its annual Investor Day presentation. The new EV offering is priced at an affordable $30,000 and is geared to stick a finger in Tesla’s eye. GM management also proclaimed they would have a new truck and battery plant in the U.S. soon. Even though it is running headlong into the EV space, GM doesn’t plan to kill its best-selling ICE vehicle platforms any time soon. Yes, things are about to get very interesting in the EV market.

GM (GM) leaders announced this week that the iconic auto manufacturer’s pivot to EV could double its revenues by the end of the decade which amounts to approximately $244 billion in sales. On the heels of that ballsy statement, company officials unveiled its new Chevrolet Equinox SUV EV at its annual Investor Day presentation. The new EV offering is priced at an affordable $30,000 and is geared to stick a finger in Tesla’s eye. GM management also proclaimed they would have a new truck and battery plant in the U.S. soon. Even though it is running headlong into the EV space, GM doesn’t plan to kill its best-selling ICE vehicle platforms any time soon. Yes, things are about to get very interesting in the EV market.

![]() Ford (F) hasn’t announced anything since it stated last week it was moving into Tennessee and Kentucky with $11 billion and a plan to build pickup truck manufacturing facility and massive battery plants. Does it need to say anything?

Ford (F) hasn’t announced anything since it stated last week it was moving into Tennessee and Kentucky with $11 billion and a plan to build pickup truck manufacturing facility and massive battery plants. Does it need to say anything?

![]() Toyota nothing new to report.

Toyota nothing new to report.

![]() Volkswagen announced this week it had gained 70,000 new customers due to its best-selling ID.3 in the first year. Since the launch of the vehicle the company reported receiving more than 144,000 orders for the ID.3 with around 50% of the buying coming from new Volkswagen customers. In fact, the ID.3 was Europe’s best-selling EV in August. With the company’s growing market share and safety rating for its ID.4 which currently doesn’t run into cement pillars or emergency vehicles, the German traditional auto manufacturer is giving Tesla a good hiding.

Volkswagen announced this week it had gained 70,000 new customers due to its best-selling ID.3 in the first year. Since the launch of the vehicle the company reported receiving more than 144,000 orders for the ID.3 with around 50% of the buying coming from new Volkswagen customers. In fact, the ID.3 was Europe’s best-selling EV in August. With the company’s growing market share and safety rating for its ID.4 which currently doesn’t run into cement pillars or emergency vehicles, the German traditional auto manufacturer is giving Tesla a good hiding.

Nissan has friends in Australia. According to a Driven.io article, owners of the first Nissan Leaf e+ reported that after a year of driving, they have broken even on the cost of owning the vehicle. The happy owners stated that they had zero range anxiety taking a 350 km trip to arrive home with 4% remaining on the battery. All this without sacrificing power and acceleration. Nissan is a bit of an old-timer in the space, but it continues to impress. Take that Tesla.

Nissan has friends in Australia. According to a Driven.io article, owners of the first Nissan Leaf e+ reported that after a year of driving, they have broken even on the cost of owning the vehicle. The happy owners stated that they had zero range anxiety taking a 350 km trip to arrive home with 4% remaining on the battery. All this without sacrificing power and acceleration. Nissan is a bit of an old-timer in the space, but it continues to impress. Take that Tesla.

So, it’s close to morning and I should stop typing and get some much-needed sleep. Yes, the EV sector is riddled with less-than honest blowhards, but the revolution is real and unstoppable. There are gems that deserve your support even though many deserve your ire. That said, do your research, identify your picks, and make this a better world. Good luck to all!

–Gaalen Engen