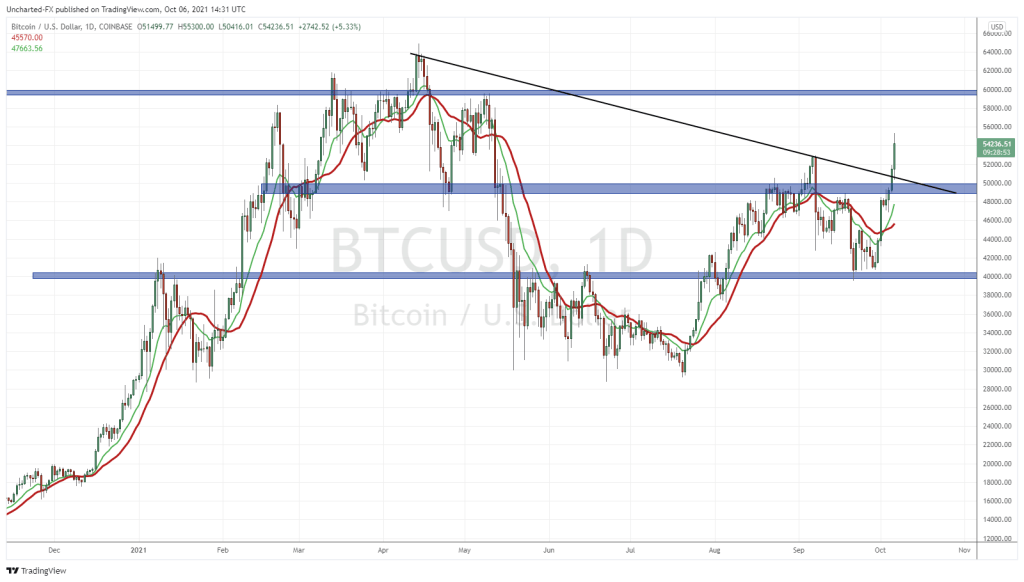

Cryptocurrencies are exploding higher this morning with no obvious catalyst but some are saying this is a short squeeze. I would say the technicals were telling us a big move was in the cards. Bitcoin overtaking $50,000 was important, especially since Ethereum had broken out above $3200. We will take a look at both charts in a second.

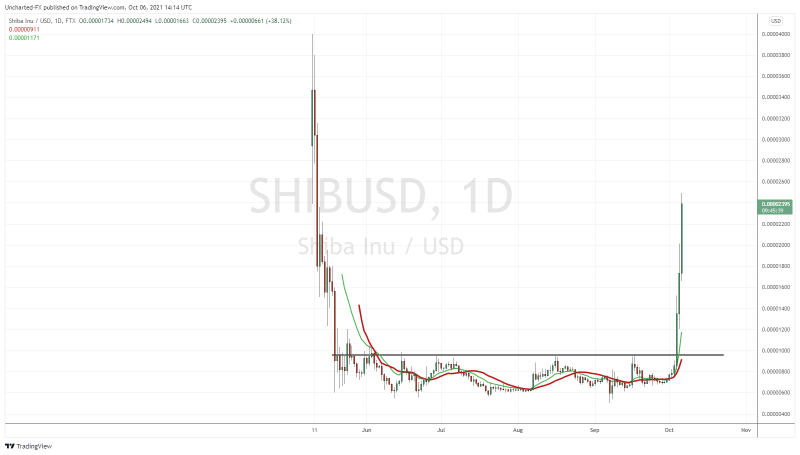

Yesterday was all about Shiba Inu. It keeps climbing after breaking above a range. For those who follow my posts, Shiba Inu has all market structure phases: downtrend, range, and uptrend. These are the only three ways ALL markets move. You master those, and you are good to go! Shiba Inu is up over 200% for the week…with a little help from Elon Musk being the breakout catalyst.

For those NEEDING some fundamentals, I guess you can say that both Fed Chair Jerome Powell, and SEC chairman Gary Gensler provided good news. Both said there would not be any China like crypto ban in the United States.

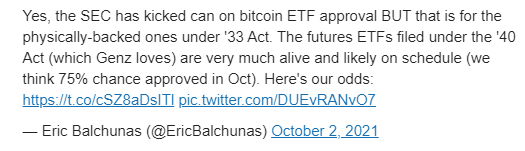

Optimism about a Bitcoin ETF are high. There is a very good chance the SEC will finally approve a Bitcoin ETF in two weeks, on October 18th. A big date as that is even the US debt ceiling deadline. The kicker? This will be a future-based Bitcoin ETF and not a spot backed ETF. The latter probably comes later down the road, which would then allow ordinary people to include the asset easily.

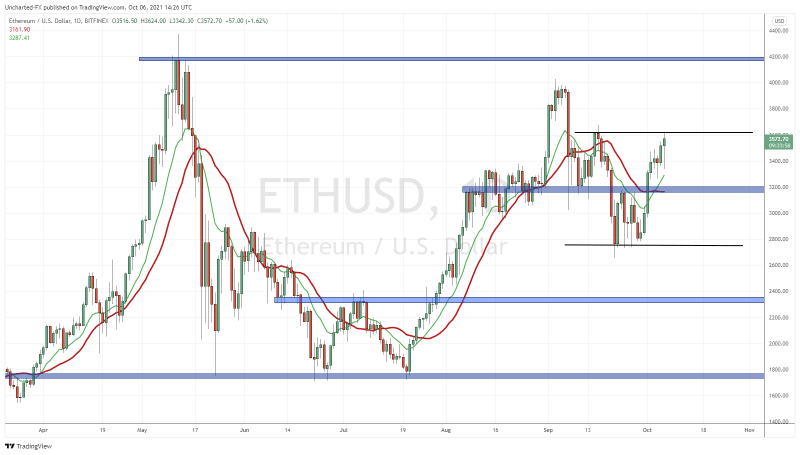

On the technical side of things, it is very exciting, and we can begin to forecast higher moves if our criteria are met. Let’s start off with Ethereum.

In previous Market Moment posts, I highlighted the $3200 zone as resistance. Price was ranging between that level and $2800 below. We were just awaiting the break to give us direction. The break came on the first of October. And Ethereum has steadily risen since then. We are now at an interim resistance zone, and await the break. Price could pullback to retest $3200, but we remain bullish Ethereum above this price zone.

I find Ethereum fascinating because it could break off from the Bitcoin correlation. Some argue it already has due to NFT and DeFi popularity.

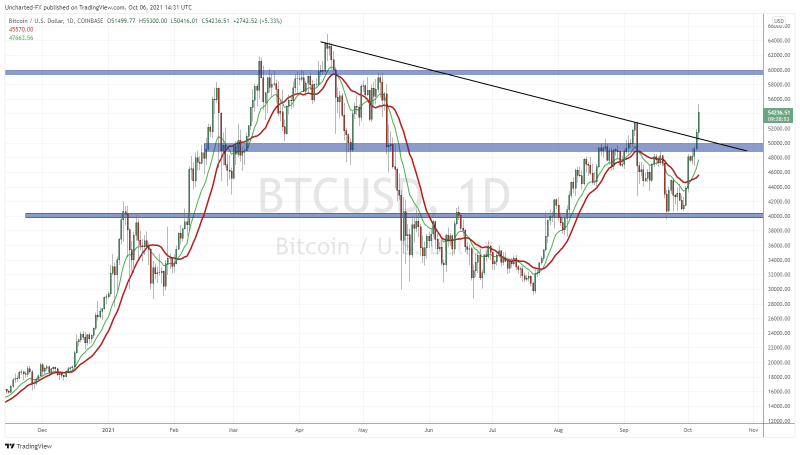

Bitcoin closing back above $50k is huge. A very important zone has now been overtaken once again. A highly psychological number to Bitcoin. You can see from my chart above that things are looking exciting. If today’s daily candle closes just like this, we have a trendline break AND a close above an interim resistance at $52,800. We can then begin targeting the $60,000 zone…and then yes, new record highs.

I know there are those who are very bearish crypto’s but I say this: in my opinion it is better to hold a little than none at all. Yes, it is more risky and volatile, but we accept that. Some argue crypto is a currency, others say it is an asset and a store of value. If you see it as a currency, you would be a fool to spend it if the price keeps going up. It seems crypto’s are now becoming a whole new asset class with a chance money sees it as a safe haven/store of value. Crypto’s have not gone through a financial crisis yet, so we need to see how they would respond when one occurs. Once that happens, we will get a better idea on it being a risk off or a risk on asset.

I remain bullish long term for a few reasons. I do believe in this world where one is chasing yields, money will flow to cryptos and commodities. Things that are relatively cheap. People say Bitcoin is expensive, but remember, one can buy $100 or less amounts. But what will confirm this is a bear stock market. When money leaves stocks, where will it go? Bonds and cash? Commodities and Cryptos?

Finally, the big elephant in the room (world) is central bank digital currencies (CBDC). It is coming, we all know this. History of central banks shows us that they want the monopoly on money. If Bitcoin and other cryptos are treated primarily as an asset class, then no problem. But if it is treated as actual currency, then it goes up against central banks. In my opinion, Central Banks have not even used 1% of their power to combat cryptos. If they want to make it tough for the average person to hold and trade it, they can. We shall wait and see, but as of now, Powell has promised no ban on Bitcoin or cryptos.