Altan Rio (AMO.V) is a Gold exploration company focused on the Southern Cross Greenstone Belt in Western Australia. A prolific Gold region which produces an excess of 12 million ounces. It is a top 5 Australian Gold production province.

The goal is to find the next big Gold discovery in the region, and become the dominant Gold producer in the Southern Cross region.

Currently, Altan Rio holds 15 granted prospecting licenses covering an area of 23.7 square kilometers, which is a large position in Western Australia’s premier producing Gold belt.

Now here is a big key: The company owns projects adjacent to numerous high-grade past producers including Frasers, Golden Pig and Copperhead.

We like that. Projects near past producing mines means the geology may favor the vein extending to Altan Rio’s land packages. Which means a higher chance of discovery.

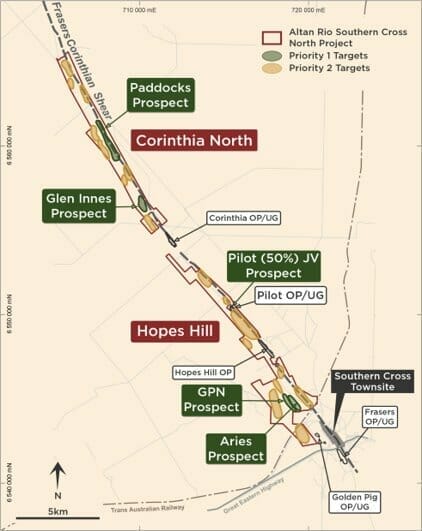

In terms of their projects, Altan Rio is earning up to an 80% interest in the Southern Cross North Project from a joint venture partner Surveyor Resources. Also, there is an exploration and mining agreement with Chinese backed Barto Gold over the Pilot mine. The project is divided into two discrete tenement projects:

Hopes Hill

Pilot – 50% Exploration and Mining JV – Barto Gold

- Resource / Reserve definition

- High grade

- Near term cashflow potential

Aries – 80% Earn in Joint Venture – Surveyor Resources Pty Ltd

- EIS – WA Government co- funded drilling approved 1st July 2020

- Historical drilling of 12m @ 4.51g/t

GPN – 80% Earn in Joint Venture – Surveyor Resources Pty Ltd

- Extension of the Golden Pig Mine (640 K0z)

- Golden Pig Underground working extend towards Altan Tenements.

Corinthia North

Glen Innes- 80% Earn in Joint Venture – Surveyor Resources Pty Ltd

- Altan Drilling in 2019 successfully discovered mineralisation North of the Corinthian Mine

- Follow up drilling 2021

Paddocks – 80% Earn in Joint Venture – Surveyor Resources Pty Ltd

- Covers 2.2km long area

- Historical drilling of 3m @ 9.51g/t

For more on the fundamentals, I suggest reading Greg Nolan’s deep dive on Altan Rio and the Geology which was released today. My focus is primarily on the charts and whether you should invest based on technicals.

Technical

My readers know I like Gold and Silver. I invest in them, and I think you should have a position too. Don’t want to listen to me, that’s fine. Ray Dalio, Paul Tudor Jones, and Staney Druckenmiller believe you should be in Gold too.

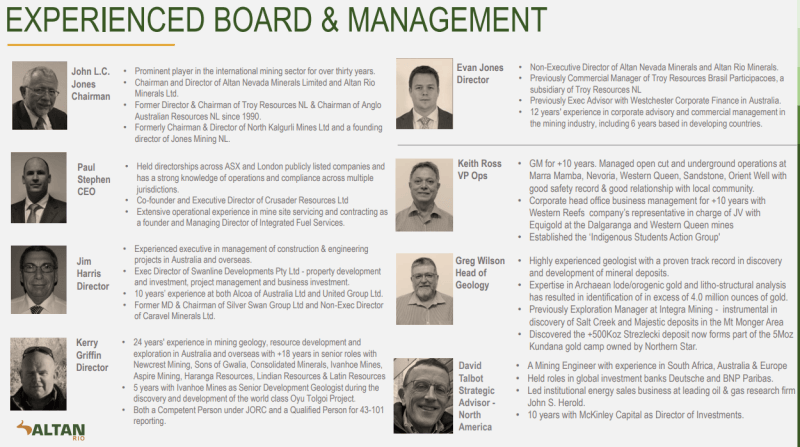

I prefer Royalty and Streamers, but the juniors are where the big gains are made. A lot of things need to be done for due diligence. Does the company have cash? What is the Management’s experience in the sector? Are they in a good jurisdiction?

In terms of jurisdiction, Australia is one of the top Gold producers. For any Forex traders out there, the Australian dollar actually has a positive correlation with Gold. Just as the Canadian Loonie moves with Oil, the Aussie Dollar does the same with Gold. Australia is not an ‘Ak-47’ country and we don’t need to worry much about political instability.

Cash. Looking at the latest balance sheet, I see a cash position of $109,192. It is likely they will have to raise money in the near future.

Management has years of experience in the sector. They will get things done.

When it comes to the next move, we need to look at Gold and the GDXJ.

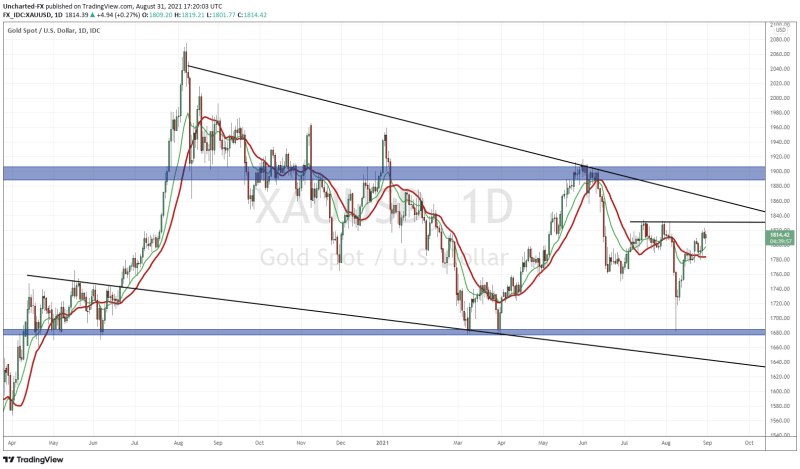

Gold is going. After Powell disappointed the markets by not giving a concrete taper timeline, stocks popped and the US Dollar fell. Interest rate hikes are far away. The market may in fact be pricing in more cheap money. With the Dollar dropping, that is positive news for Gold. We will be watching for a break above $1832. This will mean Gold takes out the previous lower high, and we back in uptrend territory. We then will have to deal with the flag trend line.

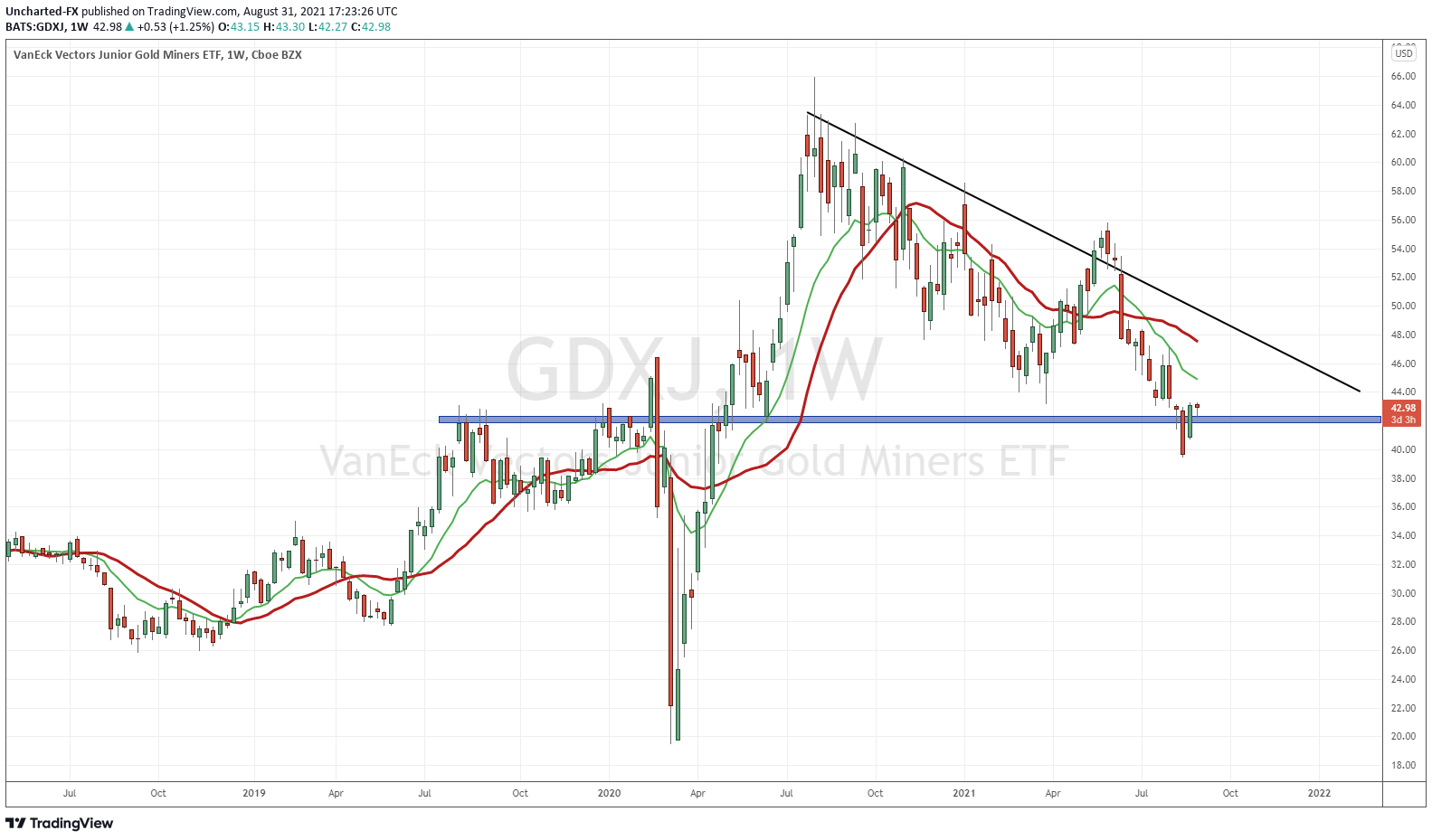

With the GDXJ, I need to go out to the weekly chart. It was worrying two weeks ago with a breakdown below our major support level. But then last week, we closed back above, meaning the breakdown was a fake out. Gold bulls rejoice! We want to see some basing here before moving higher. For this, you can move down to the lower daily time frame.

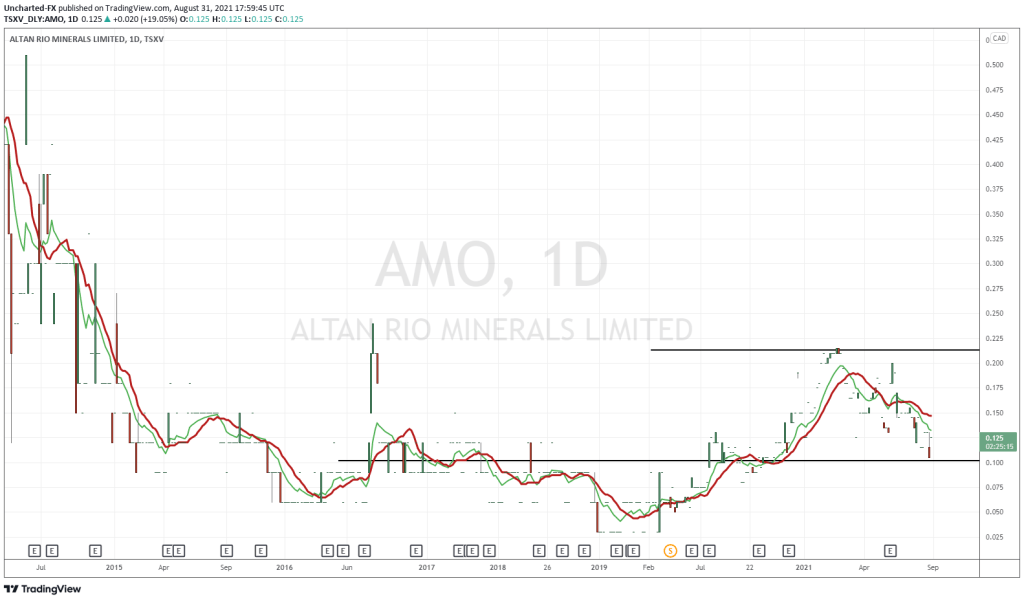

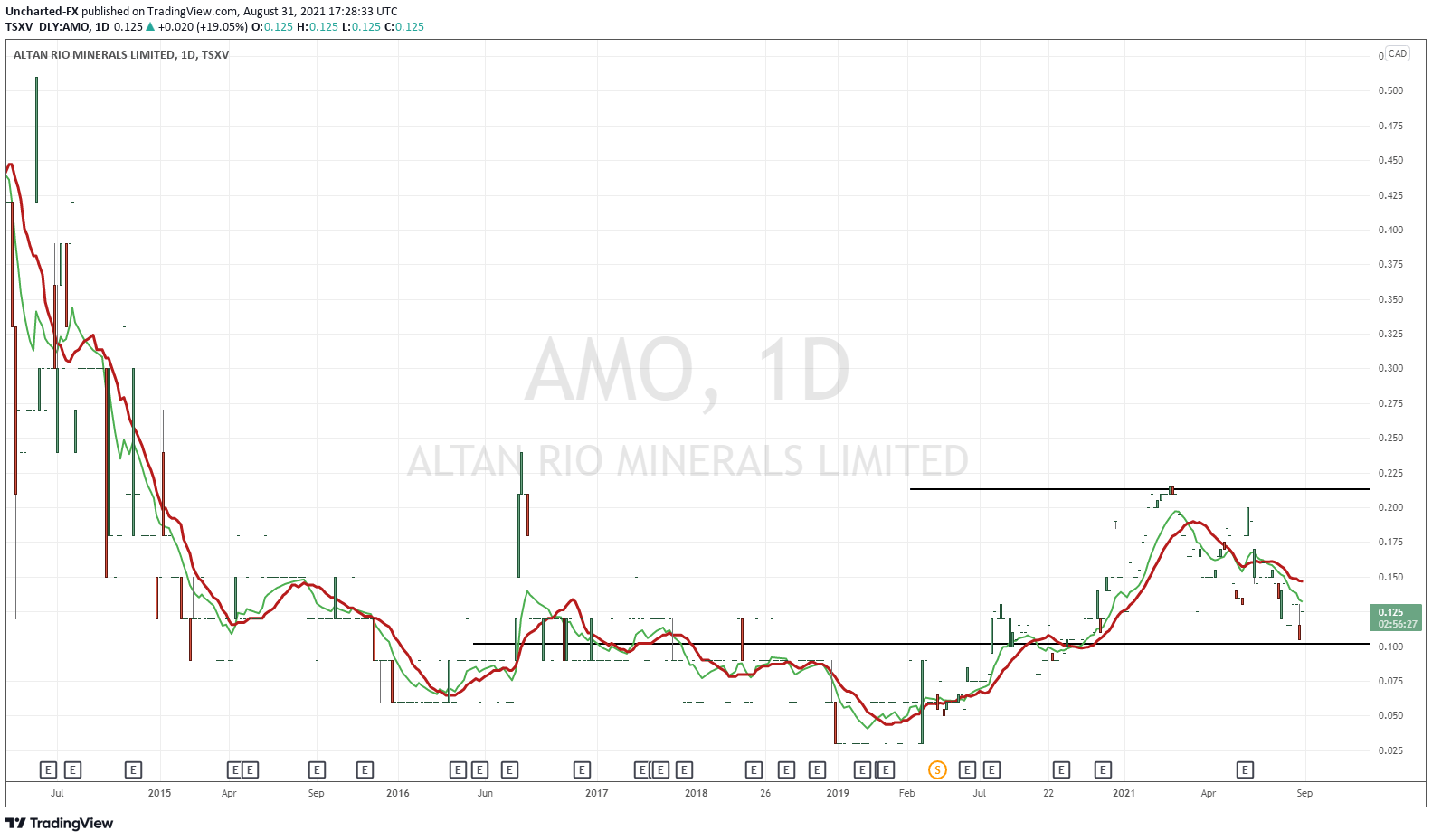

According to MarketWatch, the stock is down -16.67% year to date. We are approaching a major support zone at $0.10, and we hope to see buyers step in here. For further momentum to the upside, we need to see $0.22 break.

One thing is clear from the chart: not much trading volume. This is an issue if you want to buy a large amount…or get out of a position. On Yahoo Finance, it states the average shares traded per day is 6,772.

This would be a long term hold betting on a discovery and the land package. Once again, I highly suggest reading Greg Nolan’s deep dive on the land package and the prospects. For me, I would rather stick with GDXJ, GDX, Gold CFDs and Royalty and Streamers.