Studying clinical studies

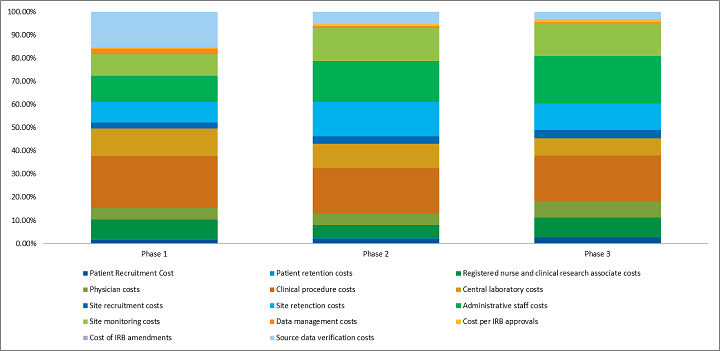

For many psychedelics companies, clinical trials are the most expensive part of their business model and the reason they need to raise so much capital. Finding an average cost for clinical trials is tough as many factors weigh in like therapy designation, size, length, study amendments, and insurance to name a few. I will include multiple studies to outline how ambiguous of a topic this is.

A 2014 study done by Tufts looked at the costs of 106 randomly selected drugs first tested in human subjects between 1995 and 2007. The study pegged the cost of developing a prescription drug that gains market approval at $2.6 billion USD, a 145% increase over the estimate the center made in 2003. Factors cited in the report contributing to the $2.6 billion USD figure included more complex clinical trials and high failure rates for other drugs in testing.

The group plugged in data from 101 new drugs approved from 2015 to 2017. For the 225 individual trials reviewed, the study concluded the median cost of each was $19 million USD. When breaking down the estimated trial cost per patient in the trial, the average total came in at $41,413 USD.

A 2018 study published in JAMA Internal Medicine looked at 138 pivotal trials assessing 59 new therapies that received FDA approval between 2015 and 2016. It found that a central cluster of trials had estimated costs of $12.2 million USD to $33.1 million USD.

Another JAMA study included 63 of 355 new therapeutic drugs and biologic agents approved by the US FDA between 2009 and 2018, the estimated average R&D cost per product was $985 million USD, also counting expenditures on failed trials. Quite a bit less than the Tufts study but still a considerable amount of capital.

In a report submitted to the U.S. Department of Health and Human Services the average cost of phase 1, 2, and 3 clinical trials is around $4, $13, and $20 million USD respectively.

To put this into context we will look at 4 major drug developers in the psychedelics space, all of which are hopeful that their compounds will become FDA approved.

Psychedelic drug developers

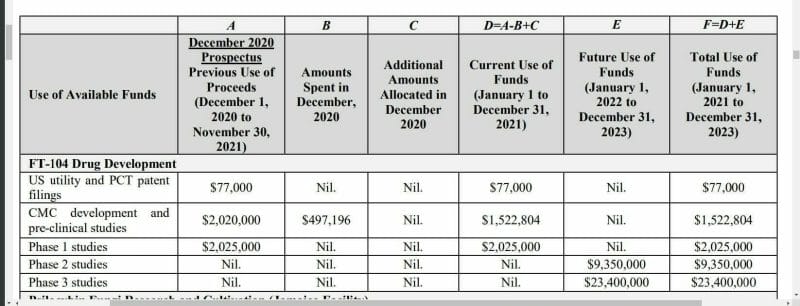

Field Trip (FTRP.C) expects to spend $2 million CAD to complete its Phase 1 studies for its FT-104 compound by calendar Q1 2022. FT-104 mimics a psilocybin trip but is much shorter in duration, typically around 2 hours.

Phase 2 for FT-104 is set to cost $9.3 million CAD, with Phase 3 coming in at $23.4 million CAD. Last year Field Trip spent approximately $885,000 CAD on the pre-clinical development of FT-104.

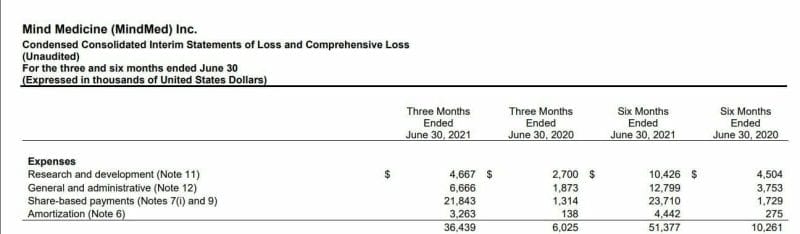

MindMed (MNMD.Q) is currently spending roughly $8.5 million CAD per month on R&D expenses, which I imagine is largely weighted by clinical trials based on how many drugs the company is actively developing.

MindMed boasts 17 ongoing and future clinical trials, so that $8.5 million CAD figure although already large, will likely jump as the years go on and MindMed gets deeper into its clinical trials.

And that’s true for all of the companies in this piece, and for the psychedelics sector at large. The further in we go, the more it’s going to cost. But, with solid Phase 1 & 2 results raising capital for those costly Phase 3 trials becomes easier.

For Compass Pathways (CMPS.Q) R&D expenses sit at $18.2 million USD for the six months ended 30 June 2021. This is an increase from last year that saw $18.8 million USD going out for the nine months ended 30 September 2020, compared with $8 million USD during the same period in 2019. The change was primarily related to the development of Compass’ flagship project – COMP360, a psilocybin-derivative NCE (new chemical entity).

So Compass has been roughly spending $2-3 million USD a month on R&D, more than 4 times less than that of MindMed. This is somewhat surprising as Compass is cashed up just about as well as anyone while also being drug developers. In March they had $180 million USD cash on the books and raised an additional $144 million USD in May, so I do expect that R&D budget to ramp up.

For Atai (ATAI.Q), R&D expenses were $16.0 million USD and $21.6 million USD for the three and six months ended June 30, 2021, compared to $2.9 million and $5.0 million for the prior year. Atai is spending roughly $5 million USD per month on R&D. They are the most cashed-up psychedelics company with roughly $453 million USD in the bank currently, Atai also owns about 20% of Compass Pathways, down from 26% in 2020.

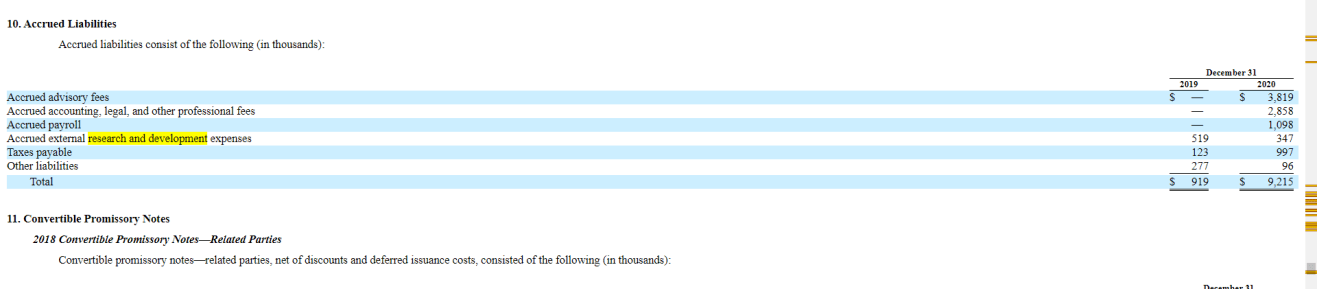

As you can see, Atai’s R&D expenses early on were peanuts in relation to their bigger plans as pre-clinical work isn’t super cash-intensive. Only $347,000 USD and $519,000 USD in 2019 and 2020 respectively.

See also: The 7 most interesting clinical trials happening in the psychedelics sector

These numbers aren’t always perfect, all companies do their financial statements somewhat differently. What one company calls promotion another company calls marketing.

Sometimes R&D refers to expenses outside of clinical trials like developing apps, websites and tech platforms, but I tried to separate that from the drug development and clinical trial costs.

Biotech companies also use CRO’s (contract research organizations)which can make tracking this data even more difficult as every CRO and CRO agreement varies greatly.

CRO’s

Many companies use CROs to cut costs of clinical trials, rather than doing them in-house.

There are significant cost savings in hiring a CRO. A faster trial process alone offers medical institutions a reduction in costs. There are also financial savings in each long-term purchase an entity would incur in order to run sufficient research trials. Full-time staff and medical facilities are costly year-round, especially when they are not needed during all parts of the year.

Working with a CRO gives hiring companies access to the most advanced technology and systems for data management, product development, research analysis, and other clinical research services. Clinical research is a rapidly changing industry. It is essential that software and hardware IT capabilities, as well as Internet-based applications, are the best in the industry to facilitate the acceleration of clinical trials while maintaining comprehensive quality control.

CROs are able to provide a wide range of clinical research services to medical sponsors, including, but not limited to:

Project Management

Procedures and Logistics

Resource Allocation Management

Data Management

Database Design

Data Entry and Validation

Database Maintenance and Archival

Security Procedures

Clinical Study Management

Site Recruitment

Patient Recruitment

Study Monitoring

Site Management

Research Compliance

Audits/FDA inspection support

Research Education

Clinical SOP Development

GCP Seminars

Medicine and Disease Coding

Validation Programming

Product Development Planning

Market Assessments

Market Research

Strategic Planning Consultation

Medical Product Registration

Product Commercialization

Market Research

Product Launch

Product Marketing

Product Sales

Safety and Efficacy Summaries

Quality Reporting

Biostatistics

CRF review

Statistical Methodology Consultation

Statistical Analysis Plan Development

Statistical Analysis Reports

Final Study Reports

Medical Writing

Clinical Study Protocol Documents

“Instructions for Use”

Manuscripts

Posters

PowerPoint Presentations

White Papers

Outsourcing to a CRO saves critical time in the trial and development phase. Working with a CRO to conduct a trial often significantly reduces the time it takes compared to completing the trial in-house. CROs are already set up with all of the necessary tools and resources needed as well as a team of in-house experts who are experienced in all areas of clinical testing, development, and compliance.

Barrier to entry

Companies pour a lot of money into clinical trials for good reason. Getting an FDA-approved drug is going to be the major value driver in this space. Drug development is the highest barrier entry subsection of the psychedelics sector.

Many companies will make it through pre-clinical studies with less than a million spent, and some will get to Phase 1 and Phase 2 with a few million, but most won’t.

But if companies can successfully patent their NCE’s they might not need to worry about copycats and can enjoy their first to market status. Although, as we saw with Johnson & Johnson (JNJ.Q) and their ketamine derivative Sparvato – data protection from copycats isn’t a guarantee, at least not in Canada.

In order to justify even starting these trials companies have to show significant enough findings from the previous stage. Developing a new drug has a failure rate of around 65-70%, and the companies who raised a couple million and who don’t get significant findings will have a hard, or impossible time finding the funds to complete further trials. That means any valuable IP they created along the way will likely be bought out by the bigger companies with deeper pockets. These are the ones who are most likely to be successful in this cash intensive race.