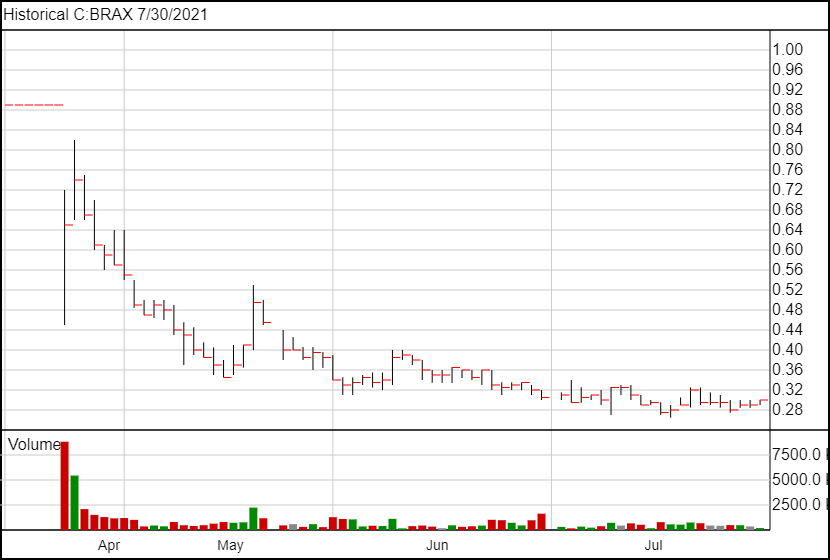

Braxia Scientific (BRAX.C) filed their Q4 and full year-end results for the three and twelve month periods ending on March 31, 2021.

At the end of March 2021, Braxia reported $11,395,899 in cash and $18,490,005 in assets, which is up significantly from March 2020, when they had $3,063,693 in cash and assets. That being said, over $5 million of their Non-current assets were marked as “Goodwill”, which they mostly attribute to their acquisition of Canadian Rapid Treatment Centre of Excellence (CRTCE). However, even without their $5 million in good will, Braxia has still improved their financial situation considerably in the last year, even after a tumultuous year that eventually saw them re-brand from Champignon Brands to Braxia Scientific.

The company also reported $2,600,468 in liabilities and $15,889,537 in shareholder equity. Braxia’s revenue for the year was just over $1 million, which brought in $145,666 in profits. Unfortunately for BRAX, that was a small number compared to their more than $10.6 million loss from operating expenses, with a loss and comprehensive loss of $88,828,146. Yikes.

“Braxia Scientific has a very strong and very qualified team that is focused on the research, development, and implementation (RD&I) of new treatments and delivery systems to combat depression and other brain-based disorders,” said Dr. McIntyre. “We are prioritizing the expansion of our clinics in North America and the development of ketamine derivatives and IP-capable delivery systems in order to create value for shareholders through this RD&I approach, while building upon a strong foundation with good corporate governance at its core.”

But those financials reflect the dark days of Champignon Brands, and it’s Braxia Scientific’s day now. Since these filings, Braxia has been busy, increasing their focus on their Ketamine clinics, and spending less energy on the mushroom teas and supplements that were once the main focus of their business.

Since the switch, they’ve been more concerned with things like giving military veterans and RCMP officers ketamine (something I still find somewhat ironic) for PTSD treatment, or getting a near $1 million grant from the Canadian government to study the effects of ketamine of on iCBT.

So, while this financial filing provides an interesting window into Braxia’s past, the most interesting filings are yet to come, as the next quarter’s filings will pertain to their transition from Champignon to Braxia, and the filing after that will explore how the company is managing their new business model.

Following the filing, Braxia shares are up 1 cent and are currently trading at $0.30.