The Federal Reserve meeting has come and gone. Earlier this week, I stated on Market Moment that I was not expecting much from the Federal Reserve. But there were some key shifts and Fed Chair Jerome Powell seems to be moving the puck when it comes to the economic recovery and what the Fed is going to do. Expect the remainder of this week to be a big digestion. Traders will take what the Fed said while the rest of the economic data comes out as well as earnings.

In terms of economic data, we don’t need to wait much longer. US Jobless Claims and US preliminary GDP came out. Stock Markets inched higher even on weaker economic data. We’ll get to why this is a little later.

US Jobless claims for the week ended July 24th came in at 400,000 people claiming first time unemployment benefits. This number is double the pre-pandemic norm, missed analyst expectations (who were expecting 380,000), but is lower from last weeks Jobless Claims number at 424,000. This is still a high number. Just think about it for a second. We are still seeing many people lose their jobs.

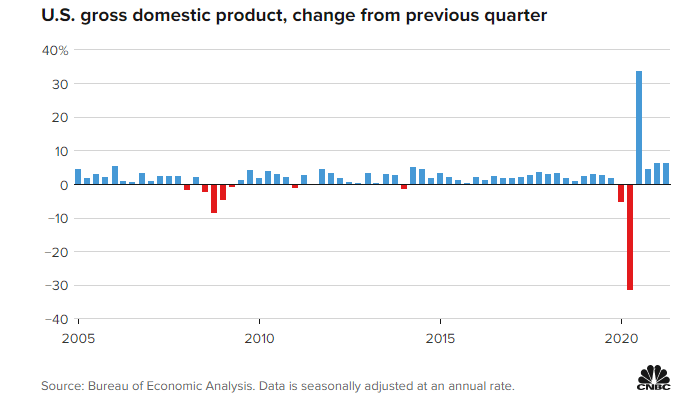

On the GDP front, the US economy rose at a disappointing pace, missing analyst expectations of 8.4%:

Gross domestic product, a measure of all goods and services produced during the April-to-June period, accelerated 6.5% on an annualized basis. That was slightly better than the 6.3% gain in the first quarter, which was revised down narrowly.

While that would have been strong prior to the pandemic, the gain was considerably less than the 8.4% Dow Jones estimate.

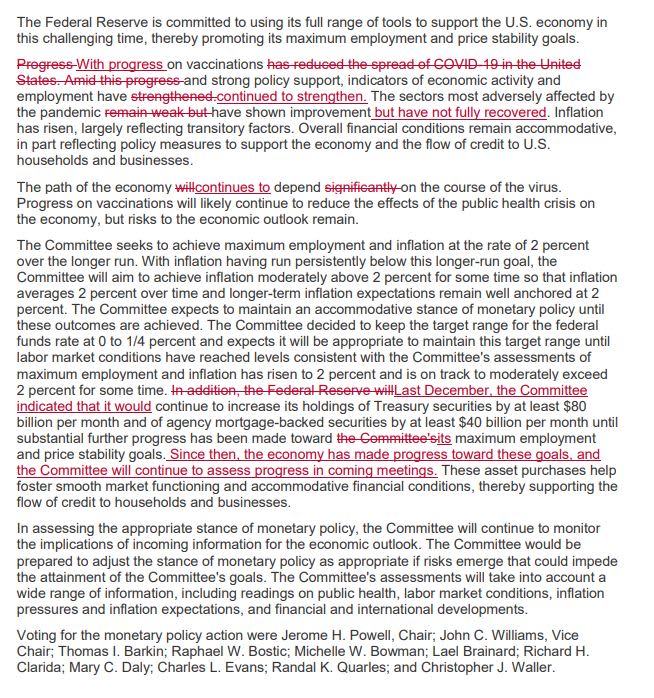

Onto the Federal Reserve. Traders listen to every word the Fed Chair says. They then compare it to the previous meeting to determine whether the Fed is more Hawkish or Dovish. Essentially, whether the Fed WILL taper and change policy or not.

CNBC did a great job in accounting for the changes in the new Fed statement. Here is what has changed:

Text removed from the June statement is in red with a horizontal line through the middle.

Black text appears in both statements.

The big take away is economic progress. The Fed is finally admitting that there is some economic progress. The economy is making progress towards the Feds goals. Goals that need to be met before the Fed tapers.

In previous meetings, we heard the Fed is “talking about thinking of tapering”. Well now we can confirm that the Fed is taking a “deep dive” into how to go about scaling bond purchases. The “T” is coming.

This is quite hawkish. There will be no interest rate hike until next year, but the Fed may scale down on its bond purchases. Remember, the Bank of Canada became the first central bank to taper, reducing their bond purchases by 25%. Recently, the Reserve Bank of New Zealand said they would end their asset purchasing program on July 24th. Currently, the Fed is purchasing $120 Billion a month in Bonds, with $80 Billion going to Treasury’s and $40 Billion going to Mortgage Backed Securities (MBS). And yes. Critics are saying the Fed is fueling another housing bubble by purchasing MBS’.

The Fed may have started the tapering clock yesterday, but there is one more announcement which is worth noting. New repo facilities.

The Federal Reserve is launching new facilities designed to provide liquidity to big Wall Street banks and foreign institutions like central banks, which could help ensure market stability at times of stress.

The central bank on Wednesday said it would put a so-called standing repo facility in place, effective Thursday. The Fed said the new tool would take in Treasury, agency-debt and agency-mortgage-backed securities from primary dealer firms in exchange for one-day loans of cash, at a rate of 0.25%. It said there is a daily cap of $500 billion on the facility, and it offered a similar tool to foreign official institutions.

Repo is something that has been discussed by many analysts. Some would say mainly the uber bears. I won’t discuss repo too much in depth, but some are taking this as things not looking to rosy behind the scenes, in the money markets.

Technical Tactics

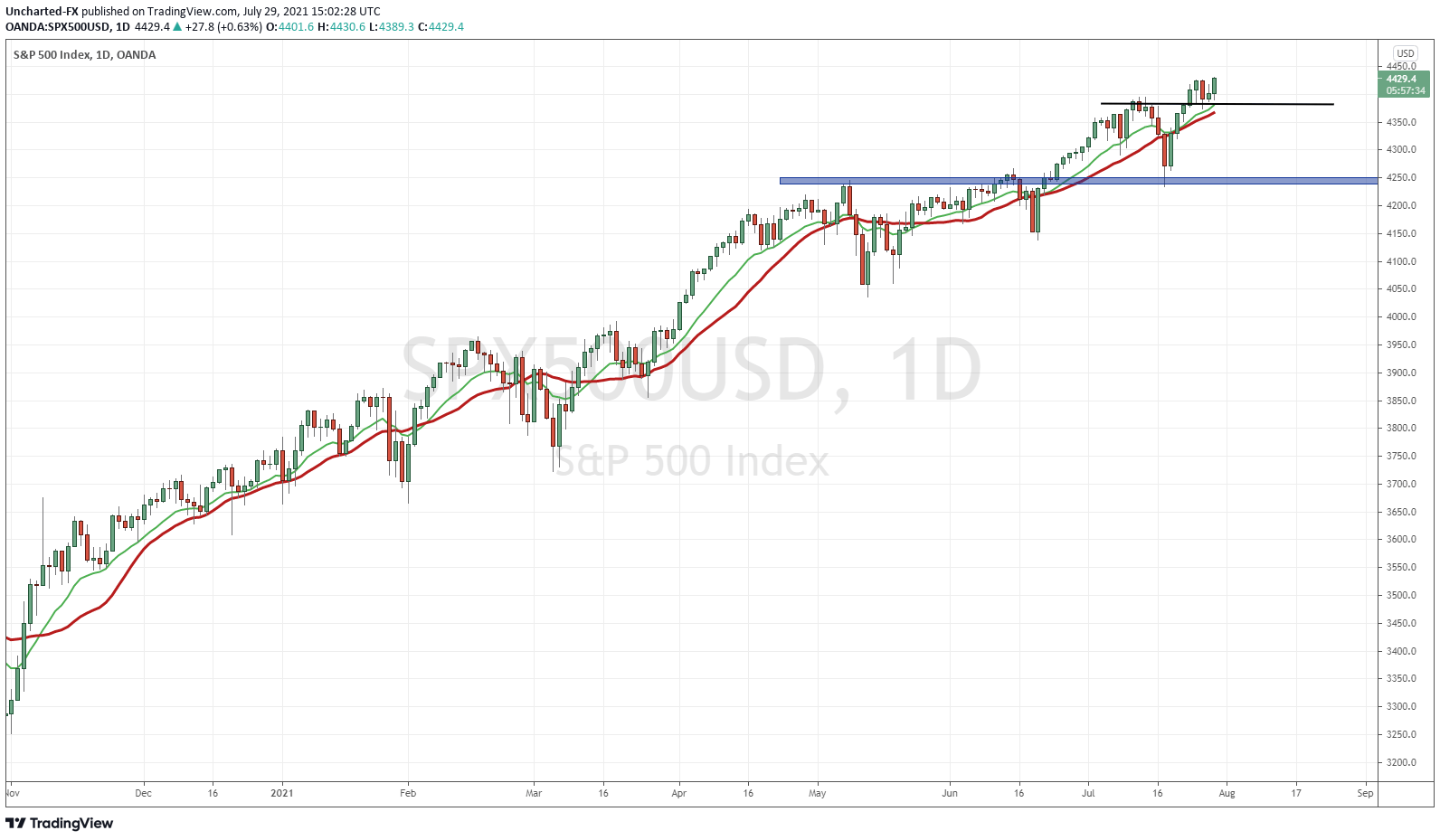

So the Federal Reserve is admitting to progress. Economic progress. But what about the economic data that came out today that MISSED expectations? Bad economic news is good news for stock markets as it means more cheap money going forward. Investors are not pricing in a taper tantrum anytime soon.

The key decisions for me are next months (August) and September. I think the Market expects the Fed to be more Hawkish. Especially if the market stops believing the ‘transitory’ temporary inflation narrative. Right now it seems the Fed is just dragging this down the road, and the markets might call Powell’s bluff down the road. It should be noted that there was no mention of the Delta variant in yesterday’s meeting.

Stock Markets gained after the Fed meeting. At time of writing, all US markets are green. The S&P 500 made new record highs, and there is a good chance the Nasdaq and the Dow Jones print record highs by the end of the week.