The land beyond price targets

Price targets are an animal I’ve never really taken seriously. This artificially created number gets taken as a realistic goal for many investors, which I guess has value, but price targets are often backed in more ways than one from the funds/investment banks like Cannacord or Eight Capital who put up the big bucks. It’s in their best interest to give a high price target as they want to generate investor interest to take their shares higher. It’s tea leaves stuff.

There are certain things any normal person can do to look under the hood of a company by using free online tools. Unfortunately with the way the system is set up, this isn’t a 100% foolproof method. for example for insider transactions, it’s commonplace for people to use family members and trade under their names, so you may not be getting a totally accurate picture. That said, these free online tools I’m about to talk about will get you as close to the truth as possible minus setting up spyware around the Howe and Burrard Street areas.

SEDAR – your ugly best friend

Everyone knows what a pitch deck is. Every word, title, phrase, and image are passed around between management and looked at under a microscope. This is like showing up to a first date and the other person is covered in makeup and doused in cologne/perfume, this is their best foot forward so to say.

Underneath the makeup – The MD&A

Finding a company’s MD&A is a simple process on an outdated and sometimes difficult website to manage. Once you’re on SEDAR’s homepage, follow these steps:

- Click search database (top menu)

- Click search company documents (black button in the middle of the page)

- Enter company name in the field on the left-hand side, hit search

- Look for most recent MD&A

- Fill CAPTCHA, download

A company’s MD&A is like stripping all the makeup and perfume out of the pitch deck and really just seeing things for how they are. Some companies will load their MD&A with persuasive marketing, or, they will be on the other end of the spectrum and make it so boilerplate that it’s completely indisdinguinshable from any other MD&A, but that said, usually around 75%-80% of companies get it right, so it is a good resource. Your average pitch deck will usually be anywhere from 20-30 pages, whereas an MD&A can be anywhere from 25-65 pages.

Inside the MD&A you will find tons of legal jargon. Terms like pursuant, closing, terms, acquisition, share-based payments are sprayed all over the document and it’s up to you to dig through that to find what’s really going on. It’s important to read things like how a subsidiary was acquired, was it through cash or stock? Or both? This is an important detail you likely wouldn’t find in a pitch deck.

You will also find a much more detailed outline about capital raises, where that money is going, what the business looks to accomplish, and how they plan on doing that over the next 2-5 years, as well as what the potential risks are.

Finding how clean the shell is – the filing/listing statement

Now, if you really wanna go for it, I would suggest finding the listing/filing statement. Follow the same steps as with the MD&A just look for filing/listing statement after the search, it’s usually the fattest document by size on the right-hand side. I try and read any document over 1000 k in size. The filing statement is like the MD& on steroids, it usually comes in at around 200-300 pages. It’s loaded with legal jargon. But, it’s also loaded with more crucial information about how the company was formed, and who was involved.

This is where you can usually start to see some red flags. This is important information that is usually not in the MD&A, and it is definitely not in the pitch deck. For me, if I see a company has been spun out and merged 10 times before its current form that’s usually enough for me to tap out.

If the shell isn’t clean the folks running the thing probably aren’t either.

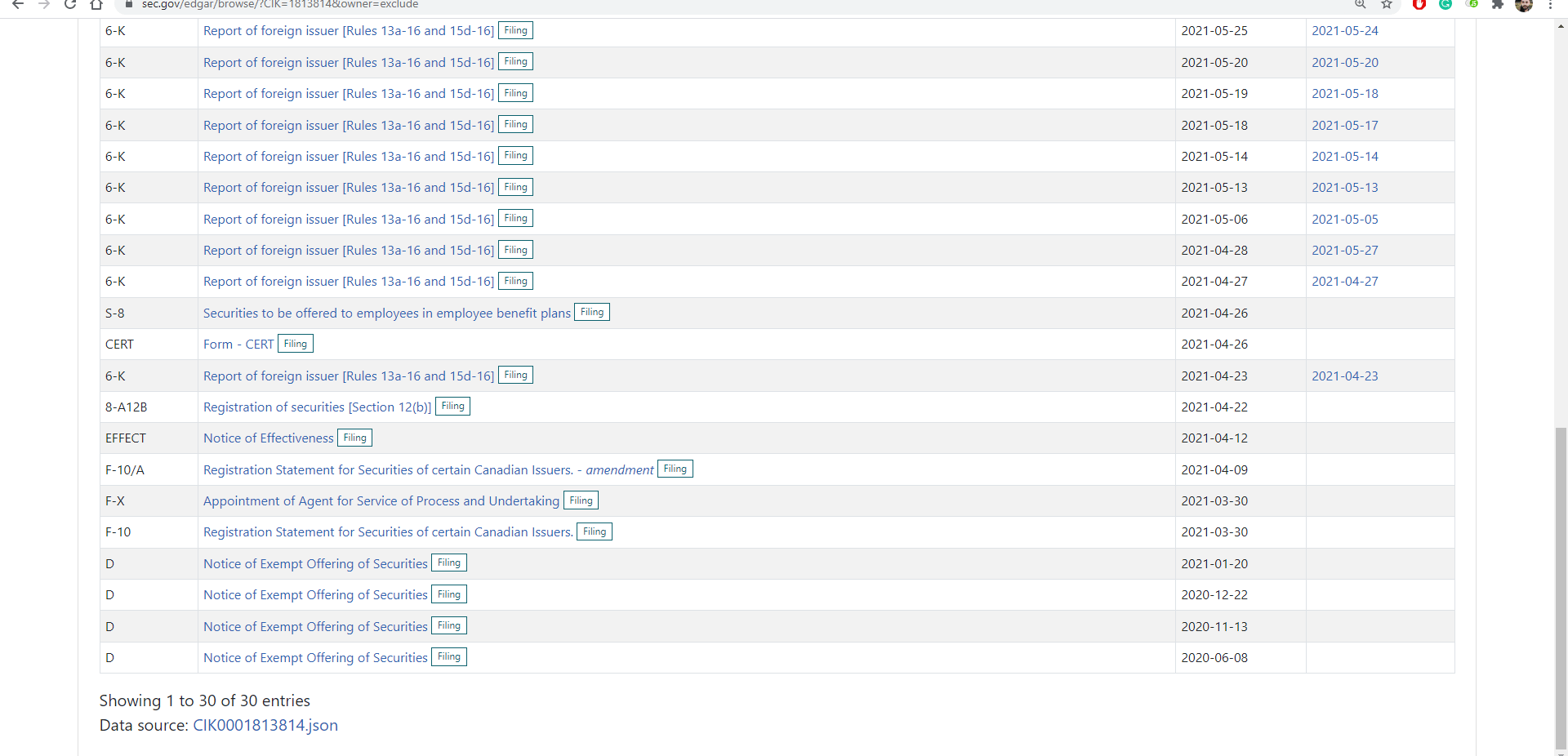

For the US exchanges like Nasdaq and NYSE use the edgar database, it’s much simpler to use than SEDI and SEDAR. To find a company’s listing statement look for F-10, or F-10A (the amended version). If the F-10 is out of date, look for a more recent 8-k to cross-reference any differences. T

his is an interesting way to find out if the company has stuck to its plans, and if they not, what happened? In a press release or pitch deck, a company may say they ‘pivoted’ with favorable reasoning as to why it happened, but you will find the real answer as to why by digging through these documents. The same technique could be done with an old filing statement and a more recent MD&A.

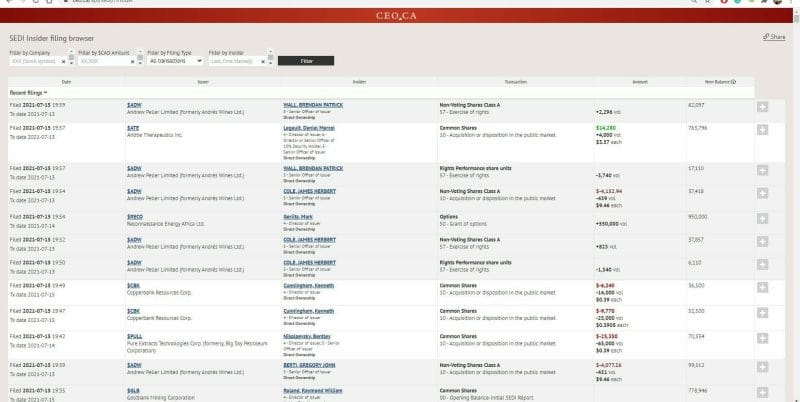

Insider buying & selling habits via SEDI/CEO.com

Now that you know who management is and what role they are playing, it’s time to see what other deals they have been in and how they bought and sold shares. SEDI is a website that holds this vast database of information pertaining to the Canadian market. But the website is even worse than SEDAR, but luckily ceo.ca has a free API on its website that makes accessing SEDI about 100x quicker.

Simply search the company’s ticker or any management’s last name. Now you can see their trading patterns, again, it’s not perfect as some people will use family members to trade through, but it’s as close as you’re going to get. Now you can see if they are prolific traders dumping their past company’s stock, or maybe this is their very first go at being inside of anything. If you really want to go deep go find past press releases that correspond with the date of the transaction, that’s what I did with weed companies. It was shocking how many awful mining deals so many of the cannabis folk were in back in say 2007-2017. If one or two deals went sideways and they’ve been active in the market for 20 years I can usually let that slide, but if I see patterns that are usually red flags and I tap out.

One thing to look for when matching pressers with transactions is – did the company make some big announcement or raise right before or after the CEO sold? This is a sure way to get inside the head of an insider you are investing with. The insiders are the ones who make the big decisions at the company, trying to figure out their psychology and what motivates them is an important component to analyzing a company.

One of Warren Buffets’ top rules for investing is: if you had the funds to buy the company outright would you do it? If not, why buy a single share with the money you do have?