Quadron Cannatech (QCC.C) has reported a sharp increase in quarterly revenue over its performance in 2017.

Despite losses just south of $1 million, the rest of the numbers tell the story of a company that hasn’t been sitting on its laurels. Instead, Quadron has taken strides towards making optimal growth so they can eventually bring home value for their shareholders.

In the two quarters ending Oct. 31, 2018, Quadron reported revenue of $1,434,742, a 51 percent increase in revenue over the same period from 2017.

“It’s important to note that we’re in the infancy of the extracts market — while others have been focused on cultivation, we have been developing our turnkey extraction solutions. That solution includes more than just the sale of equipment (such as the CO2 [carbon dioxide] Boss or ethanol Beast) — it includes biomass preparation, extraction, filtration, distillation, formulation and the provision of ancillary products (such as vape pens). With the legalization of oils, edible products and topicals happening in Canada no later than Oct. 17, 2019, licensed producers and new applicants are now focusing their attention to extraction processes. Efficient extraction equipment, techniques, procedures and formulation are key to developing new cannabis products,” said Quadron Cannatech CEO Rosy Mondin.

Quadron Cannatech, formerly known as Quadron Capital, changed their direction as well as their name in May of 2017, aiming to carve out their place in the emerging cannabis industry.

Their moves to date in their first year of existence have been good ones, such as seeing viable products, such as the BOSS or the BEAST, from the R&D phase down to a series of sales that while they’re not exactly showing profits yet, still produce a fair amount of promise for the future.

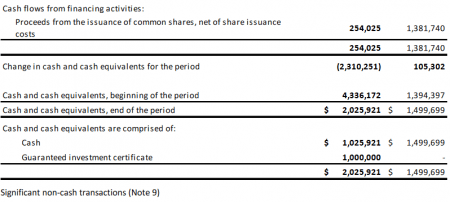

And having $2 million in cash in your pocket isn’t bad either.

Here are some second quarter financial highlights:

- Revenue of $465,959, a 7-per-cent increase over the second quarter ended Oct. 31, 2017. Revenue for the six months ended Oct. 31, 2018, totaled $1,434,742, a 51-per-cent increase over the same period ended Oct. 31, 2017.

- Gross margin of $157,514, or 34 per cent, compared with 53 per cent in the second quarter ended Oct. 31, 2017. Gross margins fluctuate as they are dependent upon the product mix.

- Loss of $972,099, compared with a loss of $367,602 for the second quarter ended Oct. 31, 2017. The increased loss for the quarter includes stock-based compensation of $197,146, an increase in depreciation of approximately $54,724 and the cost of leasing new facilities for the further development of extraction equipment and processes.

- Cash of $2,025,921 and working capital of $4,571,724 at the end of the quarter.

Quadron’s CEO, Rosy Mondin, is also worth noting.

Her success has landed her in the role of first ever female CEO atop a cannabis company, and landed her the first annual “Women-in-Weed – Trailblazer” award on Nov. 29 at the Canadian Cannabis Industry Awards.

Here’s Rosy Mondin discussing what it is Quadron Cannatech does:

What Quadron does, it does well.

On Oct. 25, Quadron announced the signing of a binding LOI to acquire up to one third of Genetic Properties (GPI), a private company based in Toronto. GPI has applied for a processing license and is currently conducting a build-out of its 25,000 square foot facility in anticipation of their approval.

Quadron has agreed to equip GPI’s facility and will supply cannabis extraction machinery necessary to accommodate the processing of 100,000 kilograms of cannabis annually.

2019 is going to be an interesting year in the cannabis space. In May 2017, Health Canada had only licensed 44 LPs, according to the The Canadian Press. Today, there are 140 cultivation, processing and sales licenses throughout Canada.

A large part of Quadron’s business is the supply of processing equipment. As more processing licenses come online–and as more companies like GPI start to become aware of the growing concentrates market–the more potential business partners they’ll have.

The market has been beating up on cannabis companies lately as a backlash against the shenanigans that have been going on, but at least it’s a comfort to know that there are some companies out there still looking to do honest business.

Full Disclosure: Quadron Cannatech is an Equity Guru marketing client.