“As a rule, it is amazing how even the most corrupt people don’t think of themselves as corrupt. When I write about people who seem obviously villainous, and it’s obvious to a neutral reader that they’re villainous, they themselves don’t agree. It’s not like there’s a bunch of people in each sphere saying, I’m going to make a bunch of money being corrupt. What happens instead is people just follow incentives. There’s a pattern that leads people to either corrupt behaviours, or stupid behaviours. There’s some little carrot out there that they’re following, and they just don’t stop themselves. The run up to the financial crisis, whatever laws were broken – probably not enough laws were broken – it was really the case where a lot of stuff that happened that was awful, was perfectly legal.” — Michael Lewis, author of The Big Short, Moneyball, and Flash Boys

It’s important to understand that, any time you’ve made money on the stock market, you’ve done so against the odds. You’re looking at ups and downs in share prices, and trying your best to gauge the worth of individual companies and whether they’ve overvalued or undervalued, and while you’re doing that, dark parties are betting against you.

Short sellers are betting against your bet, and sometimes putting out propaganda to support their stake. Stock promoters are putting out their own propaganda in the other direction, to convince you to hold or buy while they sell. High speed traders have their computers plugged into the exchange’s computers, stepping in front of your buy or sell with their own buys and sells, skimming a few percentage points of a penny off every trade without your knowledge, and with the market’s permission. Dealmakers start CPCs with half penny stock, waiting for a chance to roll in a company and get financing at $0.10 a share for their friends and families, and $0.25 for large investors, before it blows out to you at $0.50 a share while they exit. And CEOs of the companies you’re betting on are often fattening themselves up, at the expense of the companies they run, at the expense of your investment, doing deals with themselves so they can squeeze an extra few grand out of their deals beyond their salaries, and stock options, and ‘shares for debt’ deals.

In the understanding of this, it wouldn’t be a surprise if every small retail investor just bowed out and said, screw you all, I’m going to the racetrack.

That you don’t – and that none of the villains seem to really be too worried about getting busted for breaking the rules – is what allows this all to continue. Yes, you may be well-read and have studied the markets hard and you may have a system and you might get out right at your pre-set exits and beat the S&P 500 every year – but you’re being skimmed while you do it.

Even when you’re winning, you’re the mark. You’re the rube. The weak hand at the table.

If the playing field was honest, that 50% profit your investments are making each year might be 150% profits. But you’re the last kitten at the teat, boys, and any milk you might consume is the milk you’ve been allowed to consume by the bigger kitties.

I’ve had this particular article in draft mode for days now because every time I think I have it written in my head, reality smashes it with an elbow, some new piece of weird news drops, and the market gets crazy all over again. Stuff goes up that shouldn’t, others don’t go up that should, companies are swept up in market shifts entirely not of their making, and new investors who’ve not seen a downturn before litter Facebook with ‘market manipulation!’ cries that miss the entire fucking point of why the green world is suddenly red.

What I wanted to do was write a story about the shitty things those in the market are doing to you that is keeping your weed bet down. But that’s a Herculean task.

There are many reasons why your weed investment is down, some simple and obvious, some dark and twisted. In this article, I’m going to roll through them all, and name some names along the way.

- WHY IS MY WEED BET DOWN? BECAUSE IT’S TIME

A few days before Canada legalized weed, back in October, I started ringing the lifeboat bells because a tsunami was a-coming. Anyone who has been around the markets for a while knows the adage, ‘buy on rumour, sell on news.’

Basically, if you hear that something’s maybe happening with your target company, you might take a nibble on it. When the news drops that, indeed, something has been happening and it’s X, Y and Z and confirmation is given: you sell into that news.

As an example, I used to own Hiku (HIKU.C) stock. I’d heard that they were having discussions with big players a while back and figured maybe an acquisition was coming, so bought a bit more and, sure enough, in came Canopy (WEED.T) with a buy out. I didn’t wait for the day the executive washroom keys changed hands – I sold on the news coming out.

Buy the rumour, sell the news.

Or, if you prefer another Canadian market adage, “Bulls get rich, bears get rich, pigs get slaughtered.” Get in when it’s frothy, get out when the mission is accomplished.

But there’s a twist to that advice, and it comes when you’re not dealing with rumour, but rather distant fact. That is, when you know something is coming on a given date in the future.

If you know a company is doing a big deal, rather than suspect it, you’re buying with that news already baked into the share price. In that situation, you don’t wait for the big day to land – rather, you sell BEFORE the big day. Or the day before the day before.

As an example, back in the day, before Supreme Cannabis (FIRE.V) had a license, it’s likelihood of getting a license at some point was pretty much a given. The process had dragged on for a while but everyone invested in the company realized the big day was a when, not an if. So when it actually came to the day they received their paperwork, Supreme stock didn’t go up – it dropped as those long holders waiting for that event completed their mission and sold.

The same thing happened when they got their sales license. Brief up, bigger down, as investors who were in for that event specifically cycled out.

Here’s a more current real world example: Legal use of cannabis in Canada.

We knew it was definitely coming. We knew what day it was coming – October 17. And in March and June and early October, people were buying weed stocks specifically because, on that coming day, everything would change.

But we knew that day was coming way ahead of time, so who was going to buy a weed stock because cannabis was legal on October 18, who didn’t already have that stock before it was legal on October 17?

We knew legality was coming. We knew the day it was coming. We knew, pretty much, how it would look when it arrived. So why buy after the fact?

At Equity.Guru we got out of everything. And we told you about it.

On the site we said it, on social media we said it, on Facebook investment groups I said it, on stage at investor conferences I said it, and pointed to the fact that we said the same in January 2018, predicting an implosion of the market three days before it landed.

For the most part, people loudly mocked me for this.

‘I’m buying this for five years from now, when it’ll be a multi-billion dollar market cap!’ I don’t care what happens next week!’

‘Who’s paying you to beat down the SP? How much have you shorted it for?’

‘Med Men will be the best company in America! Best management, huge sales, i’m buying more.’

Good talk, kids. Then this happened.

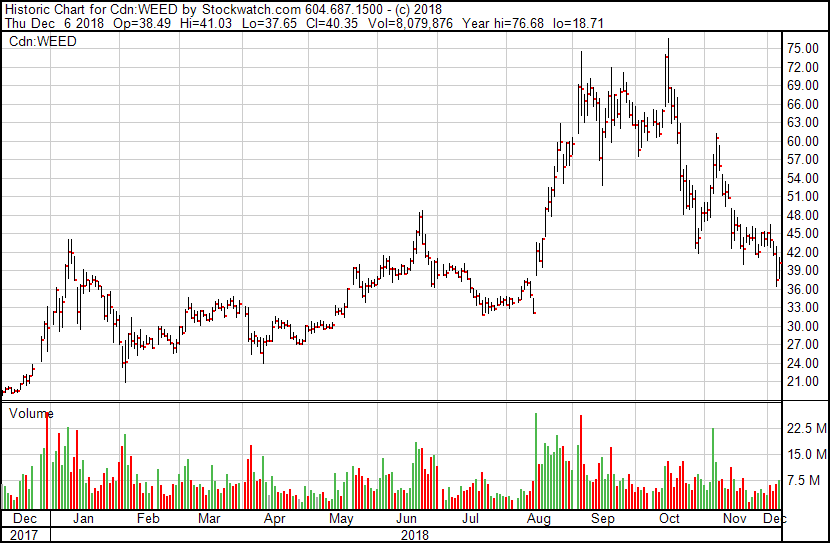

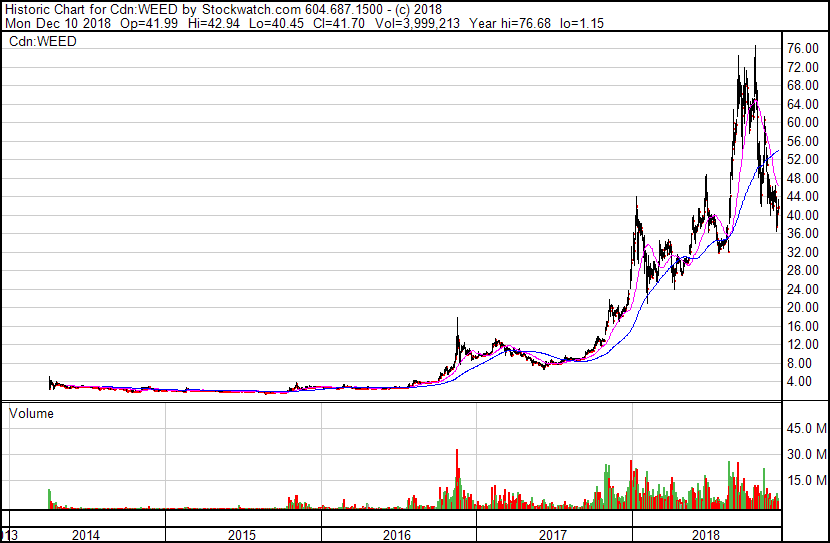

I use Canopy Growth Corp (WEED.T) as a bellwether for the cannabis market because it’s where people who don’t want to bother reading any due diligence park their money, expecting that the biggest deal is probably the one that’s the cleanest. It’s a defacto weed ETF.

And over the last five years, it’s share price has accurately served as a ‘health of the industry’ metric, because others compare themselves to it. Take into specific account the big end of year runs – and dips – that are central to Canopy’s price chart, like rings in the trunk of a cut-down maple tree pointing back to various eras of history.

- 2015 – October run

- 2016 – November run

- 2017 – December run

- 2018 – August/September run

What killed this year’s run?

Same thing that killed the last few: News. Folks bought in the expectation of news, then the news landed, then they sold.

So along comes legal use in Canada and, like clockwork, same same. Predictable as clockwork.

The difference this time is, this dip will stick a little.

Sorry, kids, you’re not going to see the weed market bounce back to previous levels for a long time, if ever, because a few things have landed that will make it a lot harder to justify.

- We’ve seen the dark side of some of these bigger companies now, and the absurd valuations they’ve paid for things that aren’t of much use. Aphria (APHA.T) can take a bow for letting their specific cancer grow too long, and now they’re at a place where not only will they struggle to effectively cut it out, they’re also now infecting others around them. Perhaps ebola is a better simile than cancer, considering. Either way, the sector is hurting.

- For years companies said, when legal use hit, the sky would open and dinero would plunge down upon them. That promise led to billion dollar valuations, but we haven’t seen anything close to what’s needed, revenue-wise, to justify those valuations so far. And in a regulatory framework that prevents the big players from actively marketing themselves, sales numbers are going to whatever product shows up first when you land on a government weed website, or whatever is cheapest, or whatever has the most CBD. That’s bad for the expensive plays.

- Maybe you can point to mergers and acquisitions and suggest that’ll fuel another boom, but we’re already there and boom hasn’t exactly been the catchphrase. The Cronos (CRON.T)/Altria (MO.NYSE) deal from last week gave the market a mild kick in the pants, but Altria effectively took over Cronos for a few billion and only walked their value back to where it had been a few months previously. Not exactly a market thundering premium.

If you’re a Cronos stock holder, you like seeing the share price go up, but now there’s 40% more stock out there and an awful lot of folks who are likely to be inclined to cash in.

That same deal in September would have demanded a 30-50% premium to get done, and would have seen the share price to $30. Instead, it’s done in the middle of a big haircut and all you really get is a second chance to dodge that downturn. Hit that reset button and be happy doing it.

But what of everyone else? If you’re a big company shopping for parts, who are you going after?

- WHY IS MY WEED BET DOWN? OVER-VALUATION

Retail investors often point to the prospect of acquisitions as to why it’s okay to be down on their initial investment. But who is going to be bought out by anyone at these valuations?

Aurora (ACB.T)?

Holy shnikies, From $16 to $7 in six weeks. While that’s still $7 billion in market cap, the near one billion shares outstanding makes it heavy lifting to get that share price back where it was. Deals for assets that used Aurora stock as currency are now worth a lot less, and financings done as loans that the company used to buy things now worth less become a little hairier.

I talked to Aurora exec Cam Battley last week in a mostly off the record conversation, and he admitted that his company had overpaid for some things, while justifying that by saying every large company was in the midst of a gold rush for most of the past few years, and to get – and stay – competitive, overpaying was necessary at times.

In years and months past, Aurora has, in my opinion, purchased assets to justify its high share price, and if those deals didn’t come cheap, the market cap rise they were riding made that okay.

With the market cap door a little closed now, Aurora has started cashing things in – like its TGOD stake recently – leading some to wonder if cash is tight, or if the company was just (as we were) cashing out at a high valuation before the onslaught set in.

Battley suggested the latter, which is just good business. Free money is never something to reject.

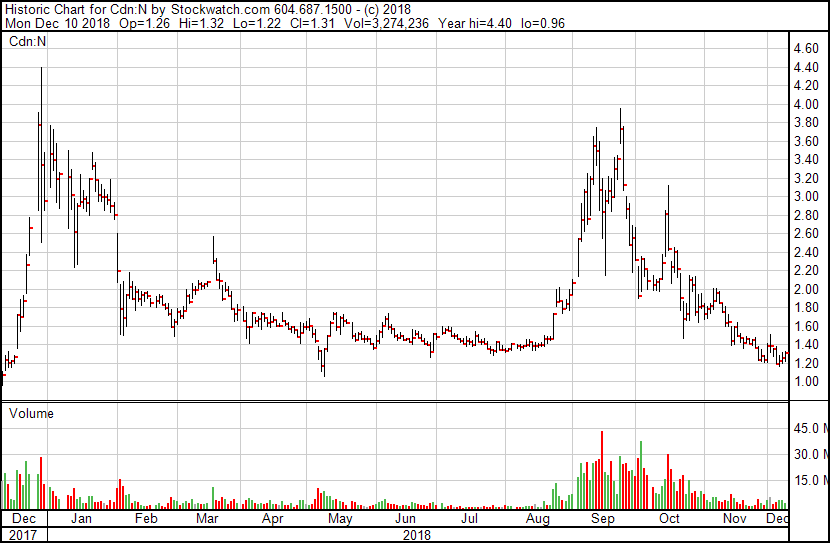

Aurora certainly isn’t alone in the area of buying increased valuation. Hi, Namaste (N.V).

Big ups to the man-bun nuthuggers who insisted, on social media and in our comments, with full throats and no doubt, that when their stock got to $2.80 ‘It’s going to $5 all day, this will be the Amazon of weed!’.

Not so far. Though Namaste is continually pumping out news of more acquisitions at a speed of close to once a day, the stock continues to disintegrate. Nobody cares what they buy anymore, and the continuing purchase stream is only serving to stop the floor from completely falling out on this thing.

That said, even though the stock price is shattered, the value of the company sits just under $400m. That’s because when they buy something new, they print off a few million more shares to pay for it. So while your stock drops in price, and your piece of the company becomes smaller, their company valuation holds.

That’s great for the CEO. Not so much for you.

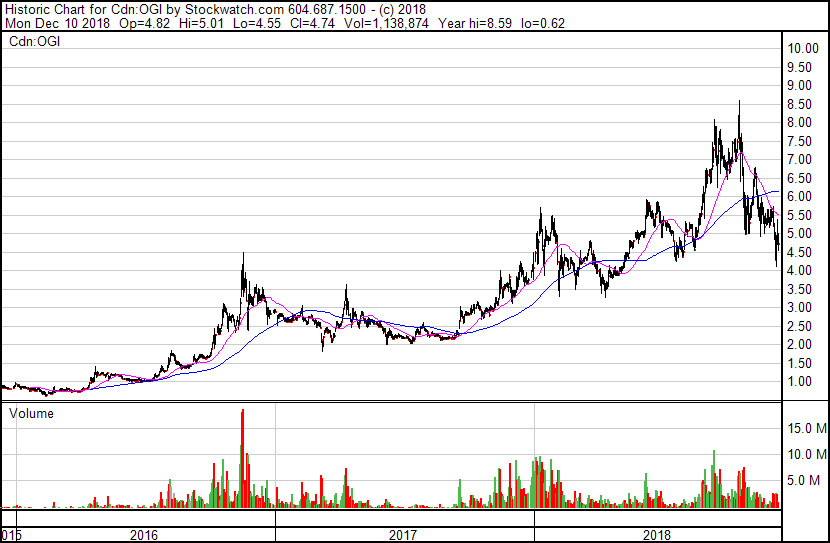

Here’s Organigram (OGI.V), which had its own scandals back when it was allegedly spraying pesticide on its crops and got busted by virtue of Aurora buying infected product and actually testing it – and going public about it.

What I love about the OGI chart is, if you buy it today, you’re getting it for the same price it topped out in in **2016**.

They don’t spray janky stuff on their weed anymore (presumably), and finally got their organic accreditation back, but they’re not the prettiest girl at the dance anymore and will always struggle to shake their origin story.

- WHY IS MY WEED BET DOWN? STUPIDITY AND/OR MALFEASANCE

Down the line in valuation terms, one of our clients, Ascent Industries (ASNT.C) got their hands not just smacked, but cut off by Health Canada a month back when, from what I’m told, an inspector on an unscheduled visit happened upon a notebook on the desk of an employee that showed ‘the other books’, and how much product was going out the door as white label brands for illegal dispensary suppliers, which is way against the rules.

That wasn’t the first time the company had been in trouble with inspectors. Which is not just sloppy, it’s idiotic. Indefensible. Comedically dumb, especially from a group that had got so much right.

As for what happens next, I hear large investors are gearing up to try to take over and right the ship, which would be smart, though another option may be to break it up for parts or sell the whole thing to another LP that can fix the license situation easily.

Yesterday, Ascent officially announced it was ‘looking at strategic alternatives.’ In other words, Clarus Securities has been brought in to broker a deal with someone to save the business, or sell the business, or liquidate the business – whatever option turns out to be most fruitful for investors.

The executive churn at Ascent over the last few weeks has been a good step one, and Health Canada has undoubtedly no reason to revoke their license for good if they properly complete their cleanup. There are a lot of investors, and solid employees, who had no part in anything illegal or immoral, and they should be protected at all costs, but getting their game back on track as a licensed producer may take months or even years without a more trusted proprietor coming in to make the save.

If you’re a long holder of ASNT stock, sorry. Us too.

Either way, at $45m in market cap, there’s likely value for investors getting in today, even if the company ends up in liquidation. My guess is, the parts are worth more than the name.

While the Ascent implosion has been the height of dumb, the implosion over at Aphria has been more about hubris.

For the uninitiated, Aphria pulled the collective market into a completely shat upon bed last week, on seemingly justified allegations from short sellers the company was overpaying on acquisitions acquired from their founding investor.

The market had a little rebound once Aphria bottomed out, and when Cronos announced Altria was coming in for them. In the sessions that followed, weed stocks – APHA included – rose hard.

Indeed, APHA rose 45.7% in one day last week.

REJOICE! SOUND THE HORNS! RAISE YOUR SKIRTS AND RAISE THE ROOF! THE PANIC IS OVER!

Only… maybe don’t do that.

Thing is, that rebound on Aphria was a little thing we like to call SHORTS COVERING.

<market 101>

When a short seller, who has borrowed shares of a company to sell because they think those shares will be worth less when they have to buy them back later – buys his shares back, that’s called a cover.

The short sell drives prices down. The cover drives them back up.

</market 101>

So, for a hot second, Aphria investors had the choice of taking a sigh of relief because they got a moment’s peace, or deceiving themselves once again that the whole controversy was nothing and the stock was headed to $10.

Helping them make the wrong decision on that was Andrew Left, short seller at Citron Research, who came out uncharacteristically bullish this morning on APHA.

Congrats to $CRON. A floor has been established- time to rethink all valuations. $APHA is compelling on all metrics. Cdn footprint too large to ignore. Look past the noise- stock should see US$10. More details to come.

— Citron Research (@CitronResearch) December 7, 20181

Judging by messageboard comments and social media posts, they pretty much all chose the latter.

Not sure why Citron would be so blindly bullish on a company that he’s not connected to – oh wait, yeah I do.

Wonder what kind of dirt $APHA has on Citron? pic.twitter.com/jZwgV6GNE9

— Smart Money Puggaroni (@YoungPuggaroni) December 7, 2018

Meanwhile, Legit Town has had enough of this mess.

BMO has suspended coverage and cancelled their scheduled lunch on the 13th with $APHA mgmt. BMO distancing themselves from the company. @CitronResearch @AmandaLang

— HuntForTruth (@HuntForTruth2) December 7, 2018

While we waited for Aphria to finally reveal how all the dirt the short sellers were digging up was wrong, they instead decided to ‘strike a committee’ to get to the bottom of it, featuring ‘independent directors’ who had already signed off on the deals once.

Promised lawsuits weren’t coming.

Meanwhile, the shorters weren’t done.

The Globe’s Christina Pellegrini and David Milstead write [shorter Nate] Anderson published another report about the company and its ties to a Florida cannabis player Liberty Health Sciences. […] In April, 2017, Aphria said it was pumping $25-million into Liberty to expand its business into the United States. Clarus Securities Inc. helped Liberty raise another $35-million. According to a regulatory form filed with the Canadian Securities Exchange, the money came from dozens of investors, including key Aphria personnel and what appears to be members of their families. The regulatory filing suggests Mr. Neufeld owned shares of Liberty before the financings. Mr. Anderson raised the possibility that Mr. Neufeld invested ahead of Aphria and at a much lower price. A filing in 2017 says Mr. Neufeld bought 280,451 receipts convertible into shares, bringing his ownership to 2.4 million shares.

Oops. I’m sure there’s a great reason for this, Mr Neufeld?

Mr. Neufeld said the regulatory form was completed incorrectly and that an accurate version would be refiled on Thursday.

Worth noting: Altria reportedly considered buying into Aphria before they settled on Cronos, but didn’t like the smell coming from Vic Neufeld’s team.

Frankly, anyone who still thinks Aphria was unfairly beaten about by short sellers is deceiving themselves. This is a multi-billion dollar company and we’re to be expected to believe that now, a week-plus after they first heard the allegations against them, they still haven’t actually produced a rebuttal?

They promised one. They denied the allegations and said they’d come out with a full forced response, they talked about defamation, legal responses – but where are they?

Instead, Aphria yesterday announced this: THEY’RE CHANGING LAWYERS.

The Globe and Mail reports in its Wednesday edition that Aphria and its law firm, Stikeman Elliott LLP, are expected to cut ties after a deal by the cannabis company to buy assets in Jamaica, Colombia and Argentina came under heavy scrutiny from investors. The Globe’s Andrew Willis writes that over the summer, Stikeman lawyers advised Aphria on the acquisition of assets in the three countries from Scythian Biosciences. Aphria and some of its executives, including chief executive officer Vic Neufeld, were shareholders in Scythian, which they disclosed. Scythian netted a large gain on the deal, which was worth $193-million in stock at the time it was announced. On Dec. 3, the acquisition was called into question by two U.S. short-sellers who alleged that Aphria bought assets of questionable value at valuations that were “vastly inflated or outright fabrications.” Aphria initially responded by saying that the allegations were “a malicious and self-serving attempt to profit by manipulating Aphria’s stock price.” On Thursday, the Leamington, Ont., company appointed a special committee to review the Scythian acquisitions.

Sub-text: Is Aphria changing lawyers, or are the lawyers firing Aphria?

The short sellers were right. And Aphria is hoping you forget.

As I said on Twitter yesterday:

2016 Organigram thinks Aphria should get their shit together.

— Chris Parry ™ (@ChrisParry) December 13, 2018

But hey, let’s assume Aphria takes its spanking and moves on, and Ascent fixes its situation, and Altria and Cronos make sweet sweet love, and Namaste sells more weed online than I expect, and everyone starts singing about puppies and sunshine again and all the LPs are trustworthy and NEVER OVERPAID FOR SHIT THEIR EXECS WERE ALREADY INVESTED IN.

Would I get back into weed stocks then?

Nope. Because:

- WHY IS MY WEED BET DOWN? TAX LOSS SEASON

We’re into tax loss selling season as of now. For the uninitiated, that means investors who want to lock in the losses they’ve taken on their investments this year, to lower their tax burden, will sell their loss-making stocks over the rest of December, and not buy those down plays back until a few months into 2019 – if at all.

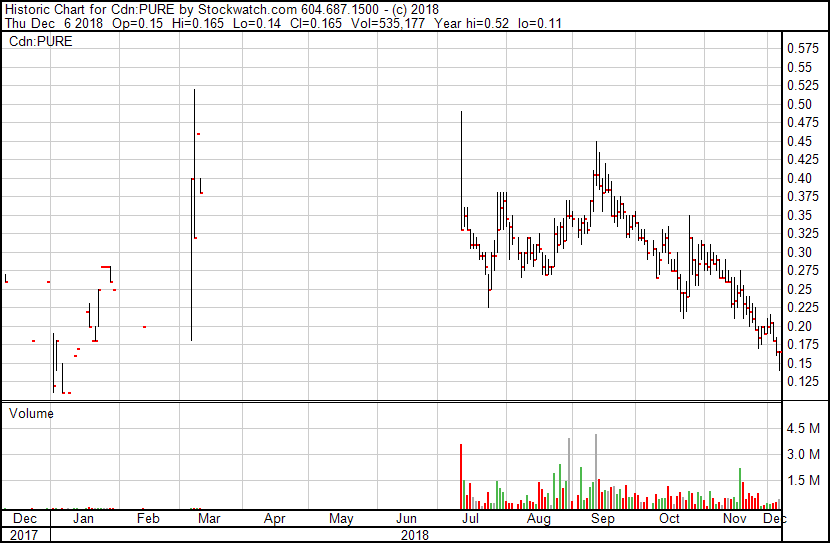

This is why Pure Global (PURE.V) is down to $0.15 right now, giving them a market cap of, wait for it: Just $24 million. Everyone who has ever bought into that stock is down on their investment. December will be painful for them.

It’s one of the reasons why Beleave (BE.C), is down to $0.09 a share – that’s 2/3 down from the day they announced they were splitting their stock to ‘enhance volatility.’

I guess being down 2/3 is volatility.

The other reason they’re down is, they’re stuck in the mud of the Bridgemark investigation. More on that down-page. They also performed a craven stock split to bring their share price down to the $0.15 range, which gave them a short burst of interest that quickly turned to ass when folks realized it was all for nothing.

All of the above takes those companies (and many more) to a dark place, where every investor has them lined up as a tax loss target and won’t be back for months, if at all.

But you haven’t taken your beating yet, shareholders. You’re all still too invested in the naughty list.

That naughty list is getting long, by the way. So very fucking long.

I’d throw out a list of weed companies that are at their 2018 lows for you, to see who are likely to have more downward moves in store, but it’d be a freaking long list.

Off the top of my head: Fincanna, Liht/Marapharm, Nutritional High, InMed, Lifetsyle Delivery Systems, Livewell, Supreme, Matica, Affinor, Abattis, Maple Leaf Green World, MYM, Emerald Health, True Leaf, Newstrike, Cannabix, Canada House, Heritage, Quadron, Rubicon, Wildflower, 1933, TGOD, THC Biomed, Tinley, Vivo, Vodis, Veritas, Wayland Group, WeedMD, Naturally Splendid. That’s a lot of companies that will face hard selling this month and, if they’re smart, won’t waste good news releases on a post-apocalyptic wasteland.

- WHY IS MY WEED BET DOWN? BRIDGEMARK

This is a big fat mess, but let’s back into it with a tale about an old friend of Equity.Guru, though we use that term loosely.

I’ve been beating this schmuck with a figurative tire iron for years now, and long time readers will remember him well. I’m talking about part time guitarist, vertical growing cheerleader, and penny stock player Nick Brusatore.

I first met Nick when I was a consultant for Geonovus, a penny play that had been a mining explorer, then switched to Uruguayan weed play run by Apocalypse Now-style crazy expats, and then moved to ‘entertainment’ when a group of music and movie guys rolled in to finance their demo reels with public markets money.

Affinor Growers (AFI.C), the company Brusatore was running back in 2015, was apparently going to make a fortune using his vertical grow designs, which had been dragged out of previous companies Brusatore had worked with (Terrasphere, Abbatis), leading both times to lawsuit threats about who owned IP he took with him.

@ChrisParry @Jonualjones I am a designer and make another company’s patents do what I need for the marijuana markets

— Nick Brusatore (@NBrusatore) August 2, 2014

He jumped from TerraSphere to Abbatis Bioceuticals (ATT.C) as an exec and ‘vertical farming expert’, and promptly abandoned ship, selling their stock like a toddler on the way out the door

This would not be the last time Brusatore would pull a trapdoor on a company’s stock on his way out. But back then, with IP in hand and lawsuits yet to be filed, Brusatore announced he had big plans for Affinor at a ritzy party at the Vancouver Hotel Georgia, which I attended. At that party, Brusatore announced he’d be taking over a Vancouver downtown parking garage, the roof of which he was going to turn into a vertical garden, with Lululemon boss Chip Wilson as a partner of some kind.

That didn’t pan out so well, and the reason it didn’t pan out was the city of Vancouver took a look at Affinor and said, ‘oh hell no, you don’t get your permits if you’re giving them to this clown car.’

The city alleges that while [Clay] Haeber advised them he planned to sell the business to a third party in April 2014, he didn’t tell the city the identity of the buyer until the following August. When the city did due diligence on Affinor, the response claims, it learned the company was in the business of growing medical marijuana. Affinor’s financial statements “raised concerns with respect to Affinor’s financial circumstances,” according to court documents. “Ultimately, the City rejected the plaintiff’s proposal that Affinor be substituted in place of Haeber,” states the city’s response.

When that deal dropped, Brusatore claimed he didn’t want to deal with weed anymore because he’d make more money from growing A-grade strawberries and selling them to five star hotels for $20 each.

We’re still waiting for Affinor to churn out those strawberries. As I’ve said several times before, I’ve grown more on my patio than they have sold in the last three years.

A few years back, THC Biomed (THC.C) put out news that they’d be trying out Nick’s vertical grow systems for weed. I said at the time that they wouldn’t, that a plant that grows very vertically like cannabis doesn’t work on such a system, where each shelf moves above each other shelf. I was right – THC abandoned the deal early, and AFI announced it late.

$AFI Affinor provides THC BioMed update! #verticalfarming pic.twitter.com/7p0BUqOelE

— Affinor Growers (@AffinorGrowers) February 20, 2017

Other issues I had with the tech: Clearly plants on the bottom of Brusatore’s contraption get less light than those on the top, and those on the inside close to the stem are in shadow from those above them and beside them. I mean, duh. You can see the shadow clearly.

I was never a star in geometry class, but the math on this never looked like it works. When I called Brusatore out on that, on social media, he just denied it, said I was wrong, but wouldn’t say why.

Honest question: why not fill the empty space at the outer edges of each rack with more plants?

And if its to allow more light to plants below, dont plants near the inside get inherently less?— Chris Parry ™ (@ChrisParry) April 27, 2018

Brusatore and I have always been the pro wrestling feud of the Canadian smallcap scene. It’s always been fun for me, but I suspect not always for him.

Only the most amazing in the world? Not the universe? https://t.co/mKHKqaDLMv

— Chris Parry ™ (@ChrisParry) October 21, 2016

That’s fun, but there comes a point where a guy just gets exposed so many times that any further exposing feels like punching down. And if the regulators weren’t going to do anything about it, hell, grow your damn strawberries with god as your co-pilot.

And that’s what Brusatore did for the last few years. Raise a few dollars, keep playing with strawberries, raise a few more, sell a few vertical farming racks to a dude in Abbotsford, stock bleeds out.

But something else he was doing, and has been for years, is sell his own IP to his own pubco, and license it back to himself. That mattered a lot less over the last year or so, since nobody was making any money on AFI stock, or buying it, but:

A few weeks ago, right as he was promising the world his crazy strawberries were coming any day now, Brusatore resigned from Affinor Growers to ‘focus his energies on working with VDA Vertical Designs Aruba.’

That Brusatore ‘works with’ VDA is to understate it. He is VDA.

From the company website:

Vertical Designs Global is helmed by CEO, Nick Brusatore – an innovative eco-entrepreneur, natural capitalist, mechanical designer, and inventor.

So when, as CEO of VDA, he sold 10% of that company to Affinor Growers, of which he was also CEO, in return for an exclusive license to sell Affinor vertical grow towers in the Caribbean, shareholders and regulators should have dug in and maybe complained.

Nicholas Brusatore, chief executive officer of Affinor Growers, commented, “I am very excited about the new agriculture market we are about to access in the Caribbean, this will bring Affinor’s technology, additional jobs and training for Aruba.”

..”And my private company that, as CEO of Affinor, I just bought into,” said Nick Brusatore, never.

A few months back, the company announced it was going to Colombia for a deal and, well:

Affinor retracts claim of $140M (U.S.) profit per year

At the request of Investment Industry Regulatory Organization of Canada, Affinor Growers Inc. has clarified the terms of the letter of intent between licensee Vertical Designs Colombia Inc. SAS, and Petrocol Holdings Ltd., a privately held company which has an application to produce medical cannabis on property currently owned by Petrocol Holdings in Colombia. […] The company has retracted all revenue and gross margin figures referenced in its original press release of April 18, 2018.

Currently, Affinor is a $4.9 million company. And has no strawberries to sell you.

And owns 10% of a company that their former boss is using to get the hell out of the country, right as the Bridgemark scandal is unfolding.

- WHY ARE WE TALKING ABOUT NICK FUCKING BRUSATORE?

Because he’s exactly the sort of rube that ‘the Bridgemark Group’ has come to rely on for the last several years.

AFFINOR GROWERS TO RAISE $4 MILLION

Affinor Growers Ltd. has arranged, by way of a private placement of 25 million units at 16 cents per unit, a financing of $4-million. The company has reserved an overallotment option to increase the offering by up to 100 per cent.

[…]

The proceeds of the offering will be used to finance Affinor’s operations, corporate development and for general working capital purposes.

Nick Brusatore, chief executive officer, commented, “The opportunity to raise a significant amount of funds for Affinor came up and we are pleased to have a new strategic shareholder group involved who will also assist with bringing in additional investors to Affinor.”

Affinor plans to close the financing shortly and may pay commission to certain finders.

Bridgemark finds a company that is, essentially, torches and pitchforks, where the shareholders have given up and the execs are in desperation phase. Then they offer to finance a $4m+ investment round in that company.

Here’s what happens next, three days later:

AFFINOR GROWERS CLOSES FIRST TRANCHE OF FINANCING FOR $3,999,666

Further to the news release dated March 5, 2018, Affinor Growers Ltd. has closed the first tranche for total proceeds of $3,999,666. The company plans to use its overallotment option to close the final tranche for up to an additional $4-million.

There would be no over-allotment, because the $4m deal involved handing $3m or so back to Bridgemark for ‘marketing the stock’, along with $4m worth of free trading consultant stock.

Soon after, the selling of that stock would commence and the company share price would crater.

AFFINOR GROWERS TO RAISE $1 MILLION AND CANCELLATION OF OVERALLOTMENT OPTION

Affinor Growers Inc. has decided not to exercise its overallotment option previously announced on March 8, 2018. The private placement of units of Affinor Growers announced on March 5, 2018, has officially closed.

Affinor Growers is pleased to announce that it has arranged a private placement of 9,090,910 units of the company at 11 cents per unit for gross proceeds of up to approximately $1-million.

He expected to be dealing with a market saying, ‘holy cow, big players have bought into Affinor, we should too!’, which would allow him to raise more money, but with the share price being pounded out and not so much marketing happening, Brusatore would soon move his financing price down from $0.16 to $0.11.

And even that wouldn’t go so hotly.

AFFINOR GROWERS RAISED $352,400

Affinor Growers Inc. has closed the first tranche of its 11-cent-per-unit financing announced on April 10, 2018, for proceeds of $352,400.

Adorable.

No four-month trade hold on that paper because Bridgemark, who financed that deal – who, in fact, hunted down Affinor and offered them the money, would claim to be ‘consultants’ and would receive from Affinor ‘consultant warrants’ which were free trading, instead of being subject to the usual four month trade hold paper that private placement investors usually end up with.

So while Affinor is telling people, holy cow, we just got $4m from an investor, things are sure looking up for old Nicholas!’, the Bridgemark’s boys were selling the shit out of his company.

TL/DR: Bridgemark will give you $4m for stock, you give them back $3m and the stock, and while they beat your company to within an inch of its fucking life and sell it off like Bre-X, you get to enjoy the $1m left over and keep your job a bit longer, even if nobody will ever touch your stock again.

From Business In Vancouver:

As an example of what occurred, BCSC outlined how four of the 11 issuing companies (Green 2 Blue Energy Corp., Cryptobloc Technologies Corp., BLOK Technologies Inc. and New Point Exploration Corp.) raised nearly $18 million by privately placing (selling) shares directly to the various BridgeMark members.

The companies then returned $15.3 million to the BridgeMark members in so-called consulting fees, leaving them with $2.7 million. The members, now down $2.7 million, then sold their shares (which were originally issued on a free-trading basis) for $8.8 million, thus raising about $6.2 million in allegedly illicit profit.

“In addition to being quite bold, it’s quite clever. You get the money and back it goes. It’s simple enough, not overly complicated; but I guess that’s the charm,” said [Stockwatch editor John] Woods of the allegations.

With no assets or viable business behind the shares, most of the stocks plummeted.

“Based on evidence obtained in respect of the other seven issuers (companies), Staff are concerned that members of the BridgeMark Group also executed the scheme with those issuers,” stated BCSC.

The other seven companies include: Kootenay Zinc Corp.; Affinor Growers Inc.; Beleave Inc.; Liht Cannabis Corp. (formerly known as Marapharm Ventures Inc.); PreveCeutical Medical Inc.; Speakeasy Cannabis Club Ltd.; and Abattis Bioceuticals Corp.

The beauty in this instance was, Brusatore used to run this exact scheme, on a bullshit micro level, back in the Geonovus days. ‘Buy my music catalogue, I’ll buy your stock – oops, I didn’t buy your stock, changed my mind, sorry.’

Finally, someone ran it on him.

And the investors at the companies listed above, and about another 20 on top of that who have yet to be hauled in.

To be on the dickhead dummy list that would actually take part in this scheme, one has to either be clueless or a sociopath, and have no either no understanding of how their company was going to get buried, or give no fucks about it.

And yet, there were plenty:

Abattis President & CEO, Robert Abenante provided the following statement:

“Having Abattis named in this temporary order is certainly negative for our company, however we understand the objective of the BC Securities Commission and intend to fully cooperate during the course of their investigation.”

“We would like to make it clear to our shareholders and many stakeholders that since taking over the management of Abattis, our team has and continues to act in the best interest of all its shareholders, with the primary objective to build value by creating a fully-integrated medicinal marijuana company.”

Also:

Abattis CEO, Robert Abenante and CFO, Kent McParland are also officers and directors of Cryptobloc Technologies Corp. (CSE: CRYP), which was also listed as an issuer in the temporary order. Mr. Abenante and Mr. McParland joined Cryptobloc after it had been halted by IIROC and served production orders by the BCSC. Mr. Abenante and Mr. McParland have been working and cooperating with BCSC and the CSE for several months in an effort to turn around the company and return it to good standing.

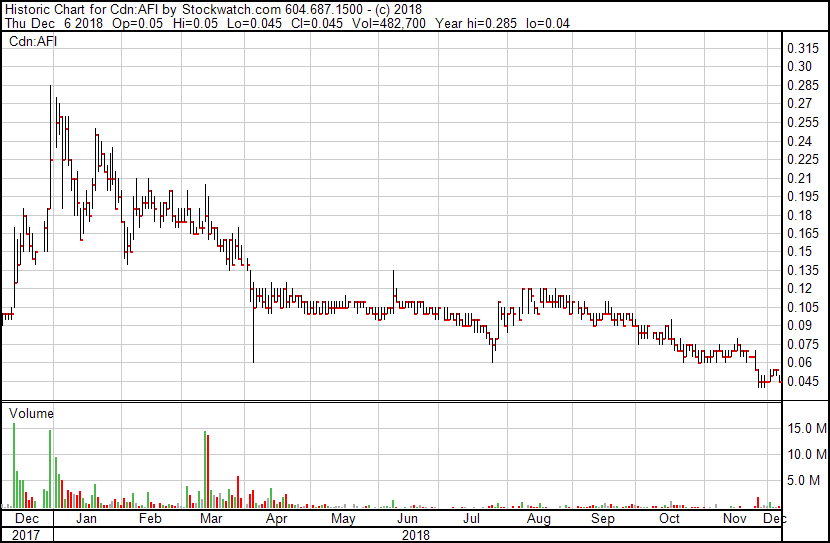

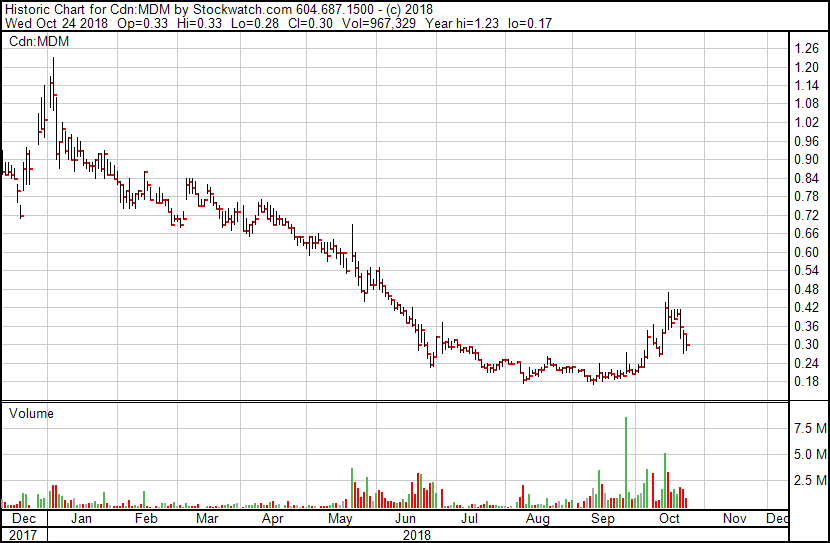

See if you can pick where Bridgemark touched Affinor on this chart:

Mid-March, days after they announced their financing? Great guess!

Hey, just for fun, see if you can imagine why the stock had a big sell-off a few weeks back, right around when Brusatore quit. Bet you can figure it out.

Give you a hint: When a CEO quits, he doesn’t have to file insider documentation anymore when he sells. One last ‘fuck you’ to everyone before he hits the beach.

Left behind, and having to deal with a BCSC investigation into their past, is Beleave, who miraculously closed a $5m financing in three days back in June.

BELEAVE INC. ANNOUNCES $5 MILLION NON-BROKERED PRIVATE PLACEMENT OF UNITS

Beleave Inc. intends to complete a non-brokered private placement of up to 2.5 million units of the company at a price of $2 per unit for gross proceeds of approximately $5-million. The company has already received sufficient interest from individuals to complete the $5-million financing. The company may, at its sole discretion, increase the size of the non-brokered offering.

Stock cratered. Shocker.

Here’s Marapharm, now Liht (LIHT.C), who loved the Bridgemark offer so much, they took two, one on 5/18 and another on 6/04, even as they were being devastated by the first.

From $0.72 down to $0.24, like a straight line.:

Where did all this money come from? Like, the original funds?

We say, here: Inside the Shady World of an Illegal Weed Dispensary.

Justin Liu, who owns the dispensaries in question, is a major player in Bridgemark. Our suspicion is, they’ve been flushing money through the markets, looking for sociopaths and rubes and having no trouble finding both, and not just laundering their cash, but making it grow.

We also think this round of BCSC investigations will be the low hanging fruit, and that dozens of other companies, promoters, dealmakers, and execs will be rolled through, with an RCMP-led kicker at the end.

Lastly, an update from the investigation proper by Tommy Humphreys of CEO.CA:

Friend who attended BCSC Bridgemark hearing today shared a few comments by phone. What follows is second-hand and may not be accurate. If you are new to this story, here’s some background: https://biv.com/article/2018/12/massive-corrupt-bc-cannabis-crypto-mining-and-energy-shares-scheme-alleged The investigation is wide-reaching and in its early stages. The BCSC were apparently able to stop one of these transactions in progress. Apparently some bank accounts have also been frozen. The purpose of today’s hearing was to extend temporary orders blocking CSE-listed companies from using the “consultant exemption” to sell shares to 25 persons and 26 firms listed in the investigation for the public interest. They requested until Feb 19 to conduct the investigation. The hearing was packed with 50+ people and a spillover room had another ~15. Mostly lawyers for the accused. My friend did not think the accused themselves were present at the hearing. Lawyers for the accused hinted at a possible defence strategy citing variations between the transactions and calling the BCSC’s characterization of the group as “the Bridgemark group” prejudicial. They apparently do not refer to themselves this way. BCSC said the group followed the same pattern of purchases and sales, consulting agreements, funds received, etc. Rinse repeat. Two members of the Bridgemark group supposedly handled the consulting agreements for everyone. Apparently they were copying and pasting a consulting agreement and left the same document number on every agreement! Expect further hearings, announcements, and press coverage soon.

These are dark times. But at least I can hear flushing.

ADDENDUM: I hear from a tipster in the realtor community that Anthony Jackson, a central figure in the Bridgemark scandal, reportedly just bought this property in West Vancouver, and that $16m changed hands.

Just in case the BCSC is looking for where the money has gone.

While all this is going on, we’ve put forth a retainer in our defamation suit to be filed against Wayland Group (WAYL.C) and its CEO Ben Ward for calling us ‘extortionists’ and ‘blackmailers‘, with a demand the company make a donation to my kid’s soccer club and apologize publicly if they don’t want to test the courts. Wayland stock is way down since the incident in question, and an Australian asset purchase that the locals are suggesting might not be worth what’s being spent.

Meanwhile, it appears likely that MedMen’s (MMEN.C) CEO and President have paid themselves upwards of $10m in bonuses for getting their enterprise value up over $2 billion. The fact that they did this by cashing in real estate and buying a bunch of stuff with borrowed money is exactly why we objected to their crazy compensation scheme months ago, which appears to give them crazy incentives to blow out company value, while making it hard to actually turn a profit. They subsequently threatened to sue us for $500m if we kept talking about them. Send your usual threats to the usual address, bois.

Weed isn’t the only place you can lose money on this kind of largesse. A while back we wrote about United Battery Metals (UBM.V), which got halted dead after the stock fell off a cliff, when regulators started translating German promo letters and finding lies, outright lies, and outrageous lies that the company couldn’t defend. It’s still halted, nearly a month later.

Then there’s the case of former Nexus Gold (NXS.V) CEO, Peter Berdusco, now head honcho at Guyana Goldstrike, who sold a chunk of his company’s stock and took a year to bother filing insider documentation about it, only doing so when it was time to resign. We’re told there’s a lot more stink in Casa Berdusco, including alleged proxy trading with relatives, feeding himself mega stock deals for ‘debt’, failure to pay sellers of the assets they picked up this year, and an interesting six degrees of separation connection to a downtown eastside drug ring that used to shave the heads of SRO residents who wouldn’t sell product hard enough.

When we asked the BCSC what penalty Mr Berdusco would pay for filing his insider docs late – docs that revealed he sold millions of shares secretly – we were told ‘it might be a fine, maybe $150.’

Exasperated, I asked why the fine would be so little and was told they keep the fines low to encourage late filing over not filing at all because, and I quote, “When they file late, we find out about it, but if they don’t file at all, we don’t.”

Just like Michael Lewis said up top, ‘maybe there ought to be more lawbreaking.’

Maybe there ought to be more laws to break.

— Chris Parry

FULL DISCLOSURE: Some of the companies mentioned in this story are clients.

Are you still a fan of VIVO? It’s seems to be very undervalued

A lot of companies are, but yes, I like VIVO.

Wow, Chris Parry. That was a very fine piece, well researched and sadly mind-blowing. There is a lot of fuel for the fire isn’t there? Well, those of us still at the dance, perhaps against the proper sort of advice, are either still searching for the prettiest girl or think we have her close. This tidal wave of doom announcements reminds me of an historic time when Roosevelt closed the banks for a week and whatever was left standing had a higher prestige. Thanks for this most delightful, funny and insightful piece.

Really appreciate your words, Roy.

Thank you once again for a very captivating and eye opening article

Extremely Informative but Very depressing. What about TGOD, how do they rate?

Chris, that was a awesome article of insight and well worth the wait from you. The weed coaster, still in on a few at the bottom (picked up last few months and adding at these crazy lows – the ligits) but sold all in the first week of Jan this year when there was no more tickets where being sold for the ride. I would say the amusement park is nearing empty and will be a tear down in the future with a smaller rebuild.

Anyway, next article Im looking forward to and as a suggestion, block-chain. Nuclear bombs in this sector of stocks are going off every day. Opportunity or nuclear waste land forever?

Again thanks and keep the truth coming.

Ouff…..truth hurts…..! Thank you for the article…….I guess will have to make a decision in etheir bag holding or tax loss selling my CHV shares…….

Hey Chris, I am curious about your take in the GTEC/GENE merger. Neither company garnered mention in your article. So do you feel they are clean and this is a good move or just more smoke and mirrors? Being on the Island and seeing thes two become a larger regional player her in the west. I am watching this merger with interest. Of course invested in it as well. Great article and a shame at the same time!

Chris, I am a new fan and follower of yours. I would like to speak to you about the Hemp legalization in the USA as well as contribute/support your stance against corruption in the mme sector. I reside in Las Vegas, NV. as well as hold a cultivation and a production license here currently. I recently invested in Preveceutical ($.60) which I now believe is doing some shady shit, but mostly I would like to invest into the Hemp opportunities in the U.S. and would like some advice beforehand. Hope you keep up the great insight and thank you for being a good dude in this fuckery world of crypto and weed

Been looking at Ascent industries corp…..interesting story could hand back huge return in a short period ……is anyone else interested in this stock….