Gold, the ultimate mystery wrapped in a riddle inside an enigma.

One would expect in this era of rabid currency debasement and geopolitical uncertainty, gold would be carving out new highs on a daily basis. One would expect a mad rush into the precious metal.

Nope…

Perhaps there’s a reason for this protracted weakness. Perhaps those running the show simply cannot allow gold, the ultimate hedge in times of uncertainty, to assert itself in a meaningful way.

Central banks manipulating & suppressing gold prices – industry expert to RT

Gold to central bankers is like the sun to vampires. They are terrified of it, yet in some ways they are in awe of it. Terrified since gold is an inflation barometer and an indicator of the relative strength of fiat currencies. The gold price influences interest rates and bond prices. But central bankers (who know their job) are also in awe of gold since they respect and understand gold’s value and power within the international monetary system and the importance of gold as a reserve asset.

Turning gold loose at this juncture might lead to a loss of confidence in our financial system. The last thing governments and banks want to see are mile-long lineups at ATM’s, let alone gold coin vendors.

If you view the current global marketplace as a financial house of cards, one which could collapse in the slightest breeze (don’t anyone dare open that damn window!), you know gold will have its day. It only needs a sufficient catalyst: a bank collapse triggering a derivative related domino effect which precipitates a stampede into non-paper assets like gold – a currency you can’t create out of thin air or run through a printing press.

“Gold is the only asset that is not simultaneously someone else’s liability.”

The tinfoil hat brigade…

I’ve been tracking gold for longer than I care to admit – since high school. If you’ve followed gold for any length of time, you’re likely well acquainted with all of the gold price manipulation theories floating around out there. Some of these theories are backed by compelling evidence, like the massive not-for-profit gold dumps during illiquid market hours. ‘Not-for-profit’ in the sense that there’s no logical reason for initiating such a trade.

This is what I mean…

40.5 Tonnes Of Paper Gold Dumped In 4 Minutes

One/some/several “entities” decided at 9:38 a.m. this morning that it was necessary to dump 14,315 contracts of paper gold.

Whether you’re a large trader or institution, if you have a massive position to unload – say 40 plus tonnes worth of gold – common sense dictates that you DO NOT enter a market order. You DO NOT dump it all at once. You feed it to the market gradually in order to capture the best possible price, unless your aim is to inflict as much damage as possible.

11.1 Tonnes Of Paper Gold Dumped In Sixty Seconds

At 9:54 a.m. EST, 3,927 April gold futures contract (paper gold) was dropped on the Comex. Prior to this, the the average number of contracts per minute since the Comex had opened was under 500 contracts. This is 11.1 tonnes of paper gold which hit the Comex trading floor and electronic trading system in a 60 second window. It represents approximately 30% of the total amount of gold the Comex vault operators are reporting to be available for delivery under Comex contracts – dumped in paper form in 1 minute.

There are numerous examples of these not-for-profit gold dumps. Some characterize this trading activity as criminal. But is the yellow metal really in the grips of an organized price suppression campaign? Have the players – a group of rogue investment banks – formed a collusive pact?

Careful here. If you fall in with the gold conspiracy crowd and declare your objections too loudly, too freely, you may find yourself donning new headgear.

If there is an organized campaign to keep gold down, it’s days are numbered. A market’s underlying supply/demand fundamentals have a way of restoring balance. History provides countless examples of this.

The ExplorerCo’s…

The gold stock sector has been ravaged in recent years. It’s a desolate landscape with few bright spots.

Herein lies the opportunity…

“Buy when you can’t find a bull.” Translation: periods of extreme pessimism can be opportune times to move into a sector.

I’ve seen this movie before – after years of depressed activity the market grinds out a bottom and then launches a relentless surge higher. And in every case I’ve witnessed, no one, except for the most steadfast and hardcore of contrarians, sees it coming.

The Agnico Eagle chart (below) illustrates the price action of a gold producer mired in the gold bear market of the early 2000’s. The price action that followed was nothing short of dramatic (track from the extreme left to right).

The price action of many of the better asset-endowed exploration companies – those with ounces in the ground – went on a tear that defied gravity, netting 1000’s of percentage points for those bold enough to load up at the bear market lows.

Many of those smaller companies (Virginia, Francisco, AuEx, Fronteer, Aurelian) were taken out by predators – large producers with equally large appetites.

That’s the beauty of the gold exploration arena: if you’re positioned in a company with a sizeable economic resource, your company’s days are numbered. Large gold producers are predatory by nature, and necessity.

Every day that a gold miner digs ore out of the ground – every day the company is in business – they reduce their inventory in the precious metal. They deplete their reserves. And these ounces are not easy to replace. This is where certain junior exploration companies come in. The premiums handed down to these asset rich juniors is often fat, particularly when multiple predators seek the same quarry.

Endgames…

If a takeover is inevitable, the stock has an endgame. The takeover premium removes all of the guesswork in determining a stocks zenith.

The price the acquiring company lays down often represents the ultimate high point in a junior exploration company’s price chart.

A solid deep discount gold ExplorerCo for your consideration…

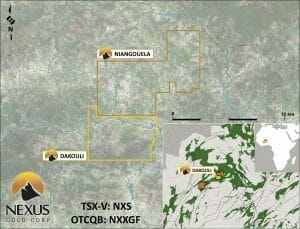

Nexus Gold Corp (NXS.V) boasts over 664-square kilometers (over 256-sq miles) of highly prospective ground along proven gold belts in Burkina Faso, West Africa.

Nexus is a story that has been well covered here at Equity Guru. There are a number of moving parts, all with significant geological potential.

The projects…

Bouboulou – 38-square kilometers comprising no less than five established gold zones contained within three separate 5-kilometer long gold trends. Over 60 holes have been drilled to date demonstrating widespread mineralization.

Rakounga – this 250-square kilometer concession ties in neatly with the Bouboulou concession. The mineralized footprint between the two concessions exceeds 15 kilometers in length. Within the eight known gold zones along this 15-kilometer trend, three have been tested with the drill bit. Drilling at the Koaltenga zone has recently produced lengthy gold intercepts, several with higher-grade intervals.

Niangouela – The Niangouela gold concession is a 178-square km project featuring high-grade gold occurring in and around a primary quartz vein and associated shear zone approximately one kilometer in length.

News released on November 8th brings NXS’s project total to 4.

Nexus Gold Acquires Dakouli 2 Project, on the Boromo-Goren Greenstone Belt, Burkina Faso, West Africa

The Dakouli 2 project adds considerable scale to the company’s high-grade Niangouela concession.

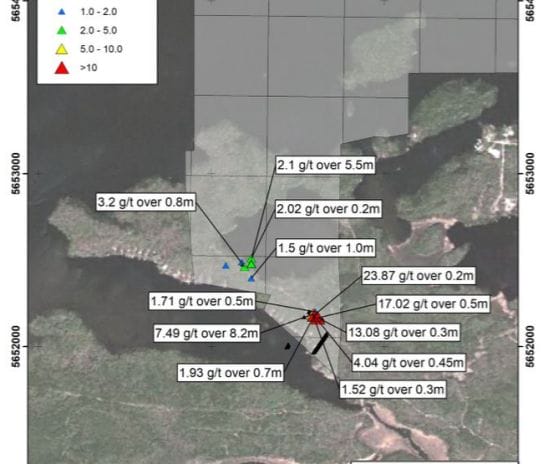

The Niangouela concession has been explored over the past two years. Sampling at Niangouela returned bonanza-grade gold values including 2,950 g/t Au, 403 g/t Au, and 49.8 g/t Au (see NXS news releases dated Jan 11th and Jan 24th, 2017).

A maiden drill program at Niangouela returned significant high-grade intercepts e.g. 26.69 g/t Au over 4.85 meters, including 1 meter of 132 g/t Au (see NXS news release dated March 7th, 2017).

The Dakouli 2 concession, immediately to the south of Niangouela, is located on the Boromo-Goren Greenstone Belt. Significantly, the project is bisected by the Sabce shear zone, a major structural fault which trends southwest-northeast and bisects the entire length of the property.

The Sabce shear zone is the dominant geological feature in multiple gold deposits in the area, including the 3 million ounce-plus Bissa deposit currently being mined by Nordgold approximately 20-kilometers to the northeast.

Interestingly, Nexus has identified a large group of artisanal miners operating along Dakouli 2’s eastern border. Don’t panic. These miners aren’t stealing gold. Their presence on the property adds heaps of validity to the geological prospectivity of the project.

Regarding the Dakouli 2 acquisition, Alex Klenman, NXS President & CEO, stated…

”Dakouli is a promising addition to our portfolio. Our crew knows the area well as our Niangouela project is adjacent directly to the north of Dakouli and has provided some high-grade results in the past. We feel Dakouli may also present some higher-grade opportunities. The property contains some highly developed artisanal sites, which we believe is indicative of significant mineralization. We are immediately going to start testing these zones and get a good idea of what we’re dealing with.”

In conclusion…

Judging by recent price and volume activity in the stock, the market may be waking up to the latent potential in this West African based exploration company.

In a recent Tekoa Da Silva interview, Rick Rule, President, and CEO of Sprott US Holdings declared Africa as “One of The Last Great Exploration Frontiers.”

With only 34.6 million shares outstanding (53.6 million fully diluted), the company’s market-cap sits at roughly $4.15M. The low share count, valuation, and exploration potential make Nexus an intriguing speculation at current prices.

END

~ ~ Dirk Diggler

Postscript: my thanks to Highheat over at Tommy Humphrys’ ceo.ca for his thought provoking insights.

Full disclosure: Nexus Gold Corp is an Equity Guru client. We own stock.

Feature image courtesy of Giphy