These men are from the government (via Bay Street), and they’re here to help.

(feature image “reach” by flickr user Kanaka Rastamon.)

Here’s what happened May 29th

Canada’s business headlines this morning were all pipeline, as Minister of Finance Bill Morneau came over the top, dispensed with comfort letters and stately indemnity clauses meant to facilitate and orderly transfer of the mid-expansion TransMountain pipeline from its current owner and builder Kinder Morgan to someone else (anyone!), and just straight bought it with taxpayer money.

The $4.5 billion purchase price does not include the cost of finishing the expansion. The Globe and Mail reports an estimated cost for the total buildout at $7.4 billion. The paper had sources from the same government that just put down the money calling it over-budget last week. Kinder Morgan hangs around to continue the build, but gets to send the bill to its new owner, and Bill Morneau heads to the Petroleum Club for a good laugh and a few slaps on the back. Drinks are on him.

Using government largess to mitigate risk is a time honoured corporate tradition, and we’ve got to hand it to Morneau for taking out the middle man. Here’s Campbell Clark with some perspective:

But even if Ottawa loses its proverbial shirt in a worst-case scenario, the billions in losses that could end up on the federal ledger won’t have a material impact on the bottom line of a federal government that spends $338-billion a year.

Politically, it’s a massive gamble. It’s no longer about a few B.C. seats or a few Alberta seats. The Liberal government has just taken on a project that defines its competence. Mr. Morneau must hope it comes good quickly.

What Comrade Morneau may not realise is that the Federal government lacks the many of the essential elements native to a good infrastructure project (a series of subcontractors to use as fall guys, an aggressive litigation department, someone to bail them out without taking a pound of flesh…), but Morneau remains un-worried. The government is its own bailout fund.

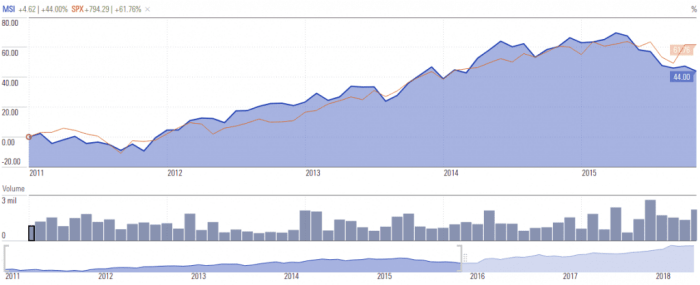

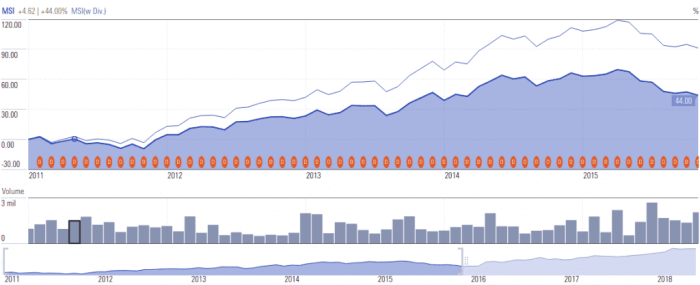

Trading hasn’t been this easy for Bill Morneau since… well, actually it always has been this easy. A young Bill Morneau got a job at HR & benefits consulting firm Morneau & Associates as soon as he was done at private school. He rose through the ranks to become the Chairman and CEO of the company that his dad founded (doubtlessly based on pure merit) just before the financial crash of 2008. Morneau had just completed the acquisition of Shepell-fgi when that crash hit, the latest in a series of large acquisitions that consolidated businesses that fit nicely into the unique type of consulting that the company did. MSI has been a growing, dividend paying earner ever since its prodigal son took it public. They were a $447 million company with $600 million in assets and a healthy multiple in ’08. It never got tight. This type of thing comes naturally to him.

And from one perspective, it should have. 2008-2018 is one of the greatest 10 year bull markets that we’ve ever seen, and labour strategy and consulting never go out of style. MSI was then and continues to be a steady-eddy yielder. 7 cents a quarter, rain or shine. Shareholders of companies like that don’t like surprises. They like guarantees. And Morneau, whose Toronto Centre riding includes the heart of Bay Street, is giving his constituents what they want.

But this isn’t the move of the steady-hand CEO who quietly made clever accretive investments in companies whose synergies made them more than the sum of their parts, paid out a clockwork dividend, and floated on the rising tide with the rest of the boats. This has the feel of a move Morneau always wanted to make. The minister has been clear that the government doesn’t plan to own this pipeline for long. It’s the masters-of-the-universe-style gunslinger trade that he never quite got a chance to pull off. Buy the infrastructure cheap, put a few bucks into it, make the flip… hero.

But the resource business isn’t the human resources business. Professional workforces are a fact of life in Canada, and any business who can afford it will kindly pay to have them managed accordingly by MSI. There are few variables. That’s why it’s such a steady business.

By contrast, oil is a price-sensitive commodity. It has to be mined from the depths of the earth at great cost and delivered through large, capital-intensive infrastructure. The companies who produce it are under no obligation to produce it, or ship it through a pipeline if it doesn’t make economic sense for them to do so. The masters-of-the-universe trade is made possible through volatility, and volatility swings both ways.

Winners and Losers

Winners: Suncor (SU.T), Canadian Natural Resources (CNQ.T), and Cenovus Energy (CVE.T)

Those companies own the largest reserves in Alberta’s oil sands. They didn’t move much on this news, Federal support of the pipeline having been already baked in for some time. Look for them to go on a run if current leader of pipeline opposition BC Premier John Horgan is defeated in court or comes to an agreement that he can sell to his poster-waving constituents. If we expand out of the realm of Canadian pubcos, we can add Connoco Phillips, Exxon Mobile and Petro China to reserve-owner winners.

Winner: Kinder Morgan

We see Kinder Morgan as the clear winner on this news, but the market doesn’t agree with us. At least it hasn’t yet made up its mind. Kinder Morgan traded six million shares today, 6x its average volume to finish down $0.49 at $16.10 (-3%). Clearly, this represents the believers in TransMountain’s upside as a midstream asset leaving the KML party, but is the company in that bad a place? They still get to manage the project’s construction, but this time they do it on the government’s dime. Cost over-runs aren’t KLM’s problem anymore. It isn’t as sexy as a tripled capacity, but the $37 billion company will just have to grow a little more organically. The gunslinger upside is all the taxpayer’s now, courtesy of Wild Bill.

Winner: Bill Morneau

If government operates the pipeline at loss, so what? He had your best interests in mind the whole time. Jobs! Don’t you ingrates want jobs!? The worst case scenario for Bill is an oil crash, and that’s its own excuse. Nobody could have seen that coming. It’s a built in political hedge. If he has to tearfully fall on his sword, there will surely be a few board openings available on Bay Street.

Loser: The Federal Balance Sheet

$4.5 billion, $7.5 billion… it doesn’t look like a lot relative to a $338 billion budget but, as the old saying goes; “A billion here, a billion there… next thing you know we’re talking about real money!”

Corporations exist, in part, to separate their shareholders from liability. There is a non-zero risk to operating a pipeline, and the value that any stakeholder tries to extract from a project’s owner/operator fluctuates with the owner/operator’s size and means. KML acted like their very involvement in the project was a favour because they could afford to walk away. They DID walk away! Nobody has anything against a private enterprise protecting itself. If that means that it can’t afford that level of spill protection, or this or that First Nations group isn’t being a reasonable negotiator, so be it. It’s just business and if these weird Maple Syrup commies don’t understand how to create a business friendly environment, it’s their problem!

The government can apply no such measures to control their costs. They are now pot-committed and everybody in line to cash one of their checks is dreaming up ways to add zeros to it. We wonder if Bill has an all-in cost in mind for this trade.

As we pointed out in HWH May 25th when some chatter from the Saudi’s and Russians made the oil price tank: there is no immutable law that says these heavy oil assets are going to be worthwhile forever.

Loser: The Canadian Economy

We’re over being disappointed in government waste, and not inclined to become pre-disappointed in it. The real action is in being disappointed in this handout’s lack of imagination.

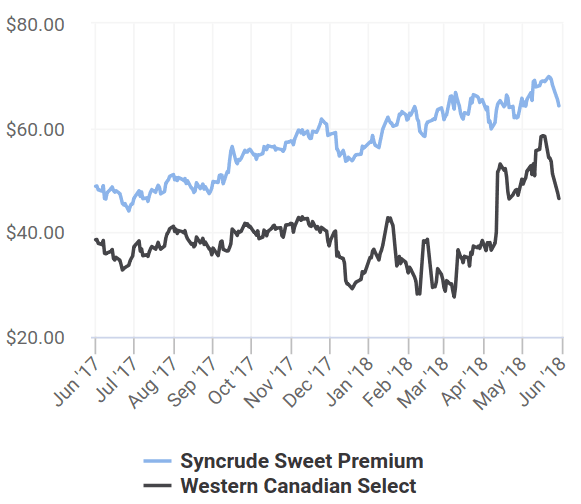

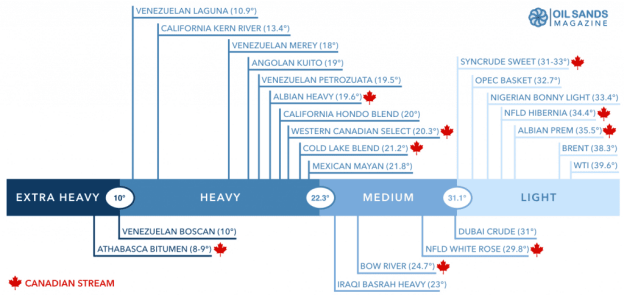

The bitumen being extracted from Canada’s oil sands is a thick, high-sulphur pitch that’s easier to tar a road with than to make into fuel. Canadian oilsands co’s mix this pitch with diluting agents and various forms of natural and synthetic crude oil to make a product that American refineries can handle, then ship it in the Keystone XL pipeline.

Synthetic crude is made by the upgrading of bitumen in large, capital intensive facilities. Earlier this month, Shell sold its oilsands reserves to Canadian Natural Resources, but kept their Scotford Upgrader.

The upgrading process creates a product that commands a premium (that’s why it’s called “upgrading”). It’s a process that has to happen one way or another if the bitumen is to be used as anything other than roof tar.

Upgraders are indeed capital intensive, and oil companies haven’t shown much interest in building any in Canada lately. Why would they? It’s far cheaper to agitate for a pipeline, then dilute the stuff and ship it. “Let China can tie up their capital making upgrade capacity,” seems to be the consensus among Canadian oil companies. “We’ll use ours to dig out more bitumen and fill ’em up.”

If Morneau was actually being a businessman instead of playing one on CPAC, he might consider making full upgrading a condition for exporting Canadian oil. Pipeline construction jobs are temporary, and the twinned project won’t take very many more hands than it already does. It is entirely reasonable for him to ask for some kind of buy-in by the companies who stand to receive the most benefit from a project he’s backing.

This capital-obsessed government already set up its own infrastructure bank, and it isn’t like these oil companies don’t have access to capital, they’re just allergic to spending it on things that don’t have margin. BC’s objection to this project has always been that there isn’t enough economic benefit, and that dilbit is environmentally dangerous to ship. Pushing a WTI- like synthetic crude would solve both problems.

But Morneau doesn’t have the imagination to do that kind of deal, let alone the mettle to tell oil companies who balk at spending money in Canada that they can sell their stake and go dig a hole in Azerbaijan for all he cares. Their balance sheet isn’t the government’s problem. Shell’s got no problem with owning Canadian upgraders, and they’re bigger than all the oilsands companies put together.

He’s busy doing it like he always has; spending an enormous pile of cash that has always been there and will never run out, and letting the market take care of itself.