The pot sector harvest continues, gold is coming to life… again… but this time is different! This time it’s the evil money printers! Relatedly, Deutsche Bank may have a method to their madness.

Here’s what happened May 24th

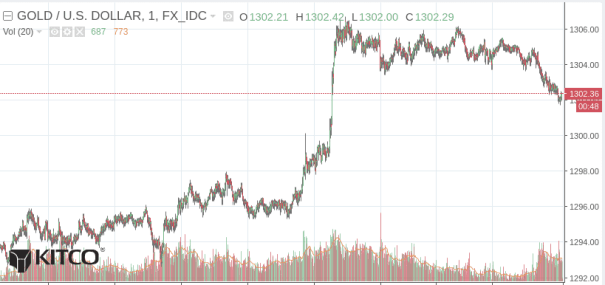

It’s hatch time for gold bugs as the prolonged battle of (dim)wits going on between the US and North Korea causes the spot gold market to price in global annihilation. But laying gold’s break above $1,300 on geopolitical tensions is for MSNBC anchors and squares. Those of us with koolaid in our veins know that the gold market is reacting to the US government taking the shackles off the banks.

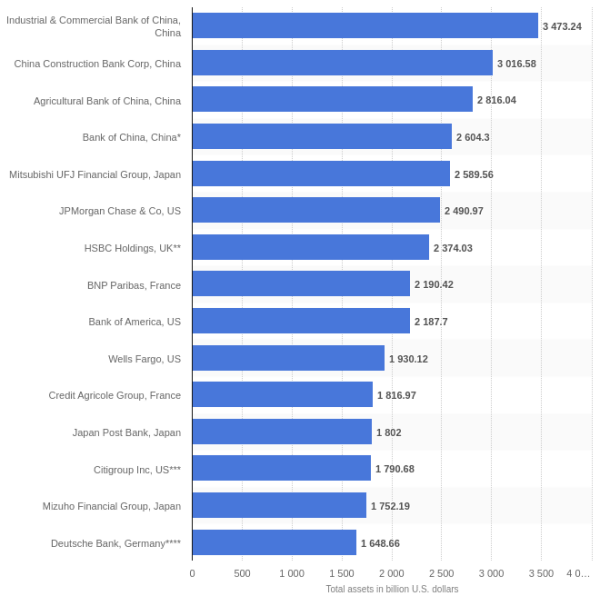

Reason’s Hit and Run has the skinny on the passing of this partial rollback of the Dodd Frank Act, which exempts US banks under the FED’s purview from increased capital requirements and restrictions on speculative investment, provided those banks have under $250 billion in reserve assets. Dodd Frank, of course, was the legislative response to the US banking and financial industry’s (large) part in the 2008 financial crisis. Post crash, lending ratios of 40:1 and 50:1 were considered a really bad idea, at least for structurally important banking institutions. The small banks didn’t complain about it at first, partially because they were being rapidly bought up by the large banks who screwed everything up and were flush with bailout money at the time. More recently, smaller banks have ben complaining about the paperwork that it takes to stay compliant, and today they got their way.

If the big US banks don’t find a way to have this bleed over and apply to them, look for them to figure out if it’s worth spinning divisions out to stay under the reserve cutoff while re-classifying some assets so that the growth doesn’t bump them over.

Don’t look now: zee Germans might be a bargain

The immediate winners here, by our read, are the foreign banks with US operations. Deutsche Bank AG (DB.N), for example, is a German entity, not under the purview of American regulators. That doesn’t get its American business division (DB USA Corporation) a free pass on the Dodd Frank rules, but so long as that US company is under $250 billion in reserves, they should be treated like any other small bank. Unlike a subsidiary of a US chartered lending giant like (for example) JP Morgan Chase or Citibank, DB USA’s consolidation onto Deutsche Bank AG’s German balance sheet shouldn’t matter from the regulators perspective.

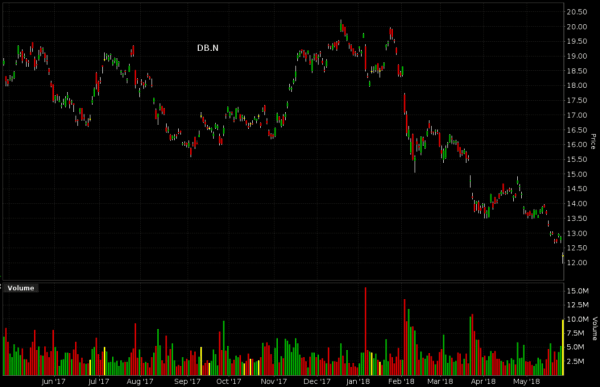

Deutsche Bank proper lists €1.4 trillion in assets, and just today announced that they would be cutting 7,000 – 10,000 trading jobs “Mostly in New York and London.” DB trades on the NYSE as a foreign issuer, and has been pretty beat up lately. They’re having their lunch eaten in trading by US competitors, and are down to $25 billion market cap, representing a price:book ratio of 0.4. DB looks beat up, and it’s the margins that are killing them. DB lost money last quarter and barely squeeked through a €120 B net last quarter for a 1.75% margin.

EG wonders if a de facto Dodd Frank exemption to their US operations could help them get up off the mat.

Comparatively, the Royal Bank (RY.T) trades at a $111 billion market cap which is a 1.7 price to book ratio. RY has CAD$1.2 trillion in assets, and just reported $3.0 billion in net for the latest quarter, a 30% margin. RY was down $1.95 today to close at $76.91 (-2.47%), indicating that the street expected more.

But this banking shift isn’t about the banks, it’s about gold. Since the gold exploration companies that the TSX Venture market used to live and die by don’t mean as much to the market as they used to, we have to talk about pot stocks first.

Harvest season continues, Hip show edition

Today, Venture volume is done mainly by the pubco equivalent of Instagram flexers. Dope slingers by reputation only, never missing a chance to flash some cash.

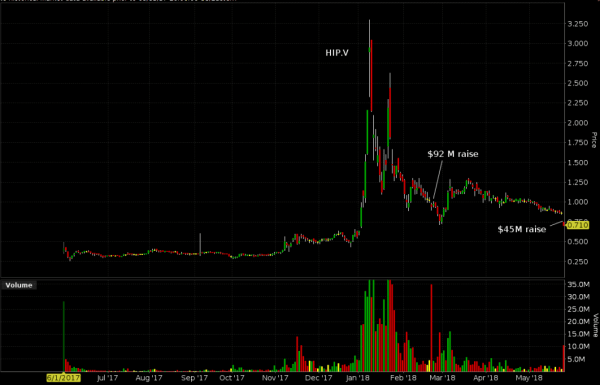

The buzz today was all about Newstrike Resources (HIP.V).

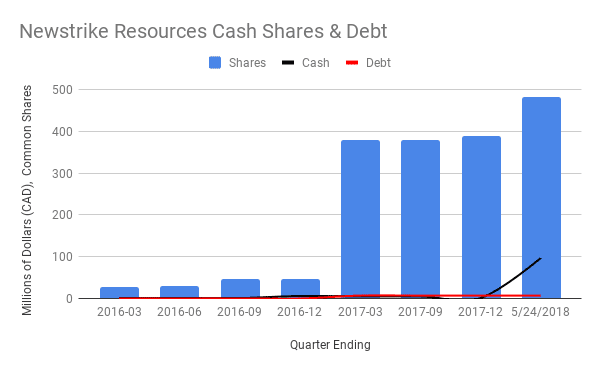

Newstrike announced today that they would be raising $45 million in a bought deal co-led by Cormark Securities and INFOR Financial. If they make the $1 warrants stick and the brokers take the whole over-allotment, it’ll be good for $51.75 million all told.

The raise comes almost 3 months to the day after the last HIP raise, a $92 million bought deal also led by Coremark and INFOR.

Today’s 1 share + 0.5 warrant units are being sold for $0.75, a six cent discount to the previous day’s closing price, and the market didn’t like it one bit. HIP finished the day off $0.16 (-18%) at $0.71 on 8.23 million shares, about 1.5x average.

Today’s 1 share + 0.5 warrant units are being sold for $0.75, a six cent discount to the previous day’s closing price, and the market didn’t like it one bit. HIP finished the day off $0.16 (-18%) at $0.71 on 8.23 million shares, about 1.5x average.

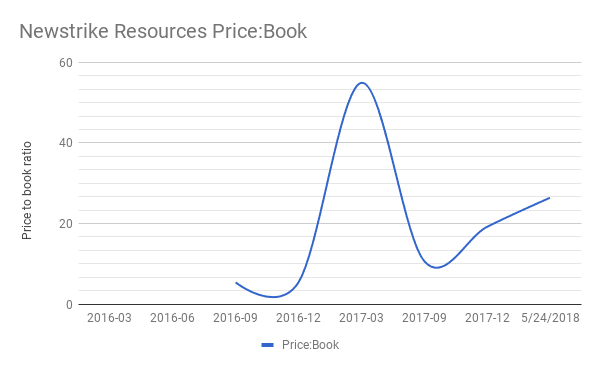

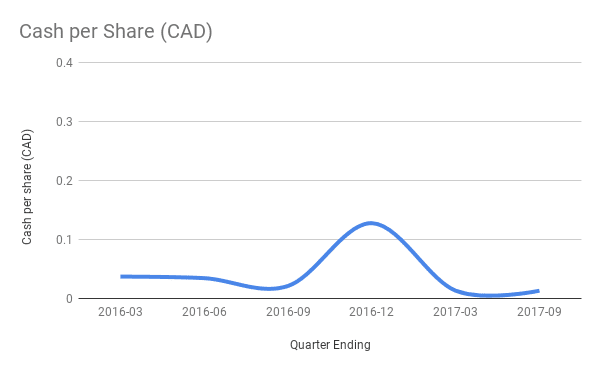

Figuring in all the new cash, and the shellacking that HIP took today, we make their enterprise value at $255 million, and their price to book at a heavy-even-for-the-pot-sector 21.3. (This chart shows it higher, and that has to do with different ways of calculating book value. At any rate, it’s high)

We count Newstrike’s current active production space at 7,600 square feet, but they’d much rather talk about the 167,600 square foot facility that is being “retrofitted” and should be ready by the end of the year.

As they build, HIP has joined the chorus of LPs telling the market about how good they are at both the marketing and the retail distribution of a product that they have yet to grow or sell a single gram of. HIP has brought aboard an ex Loblaw VP as a board member. Stephen A. Smith has board experience at a “brand strategy consultancy,” in Toronto. Their branding division UP Cannabis just entered into a mutual handy with Inner Spirit Holdings, who purports to “builds amazing brands with substance.” The presser is full of marketing buzzwords and doesn’t appear to say anything meaningful. We watched Inner Spirit CEO Darren Bondar speak at the recent Acview investment conference, and he sounded a lot like that press release. His favourite band is Phish.

The flurry of big dollar raises doesn’t speak much of the pot sector and brokerage sector’s opinion on the longevity of this pot “boom.” Ahead of the much fabled retailization, they’ve yet to run out of on-paper innovation. We’ll see if we can’t squeeze in a bit tomorrow about Organigram’s LOI that appears to give them the inside track on some sort of weed kombucha, because if we don’t get to this gold market before it’s over, the tinfoil hat crowd is going to figure the Fed has us on the take.

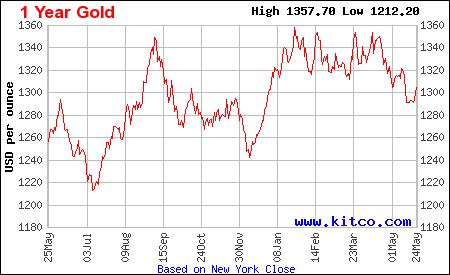

Everyone loves a good gold rally, and to the faithful this looks like the early stages.

Ok… so it doesn’t exactly look like a breakout on the 1 year, but check the daily.

And just you wait ’til those banks get going!

The gold story working the best right now is the one out of the Pilbara region of Western Australia. We wrote on May 11th about Pacton Gold, (PAC.V) who has a land position in the area, but wasn’t saying much of anything at the time. Pacton announced an acquisition Tuesday that they claim makes them “The third largest landholder in the Pilbara.”

At the time, PAC was trading at $0.55. The company finished today down five and a half cents at $0.64 on 3 million shares worth of volume.

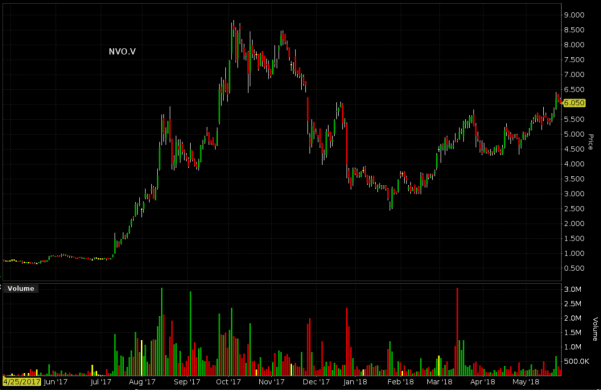

Pacton is drafting their momentum off of bulk sampling activity by adjacent claim holder Novo Resources (NVO.V), who closed at $6.05 today, which is up +13% since our last item about the Pilbara.

While the market continues waits for news about the bulk sample. The geological conglomerate out of which it is being taken is already producing narratives like it’s fishing season. Australian site Stockhead quotes the area’s original discoverer as having found gold nuggets weighing as much as 10 ounces, but you shouldn’t believe anything you read on a website that covers the stock market.

There is not yet any commercial production out of the Pilbara, but the presence of large nuggets in a conglomerate has geologists and goldbugs wondering anxiously wondering not whether it is a paleo-placer deposit, but rather how big it is.

Paleoplacer deposits are ancient riverbed deposits not unlike the gravel deposits mined in small operations in the rivers of BC, The Yukon and Alaska, the difference being age, time they took to form, and often scale.

The most famous paleoplacer deposits are in the Witwatersrand basin of South Africa. It’s estimated that they have produced 1.5 billion ounces of gold so far.

(Feature image The Tragically Hip, courtesy flickr user Brian McKechnie)