TSX Packs It In After “An Incident,” Detour Gold’s Re-Plan Is Poorly Received By Analysts And Critics, And The Abbreviated Trading Day Is Focused on The Venture Tech Sector

Here’s What Happened April 27, 2018

The front page of this morning’s Globe and Mail Report on Business was an all-time one day carnage lineup. They had mortgage lender FMP Investments giving up its licence in the wake of the RCMP having booted down the door of their client co Fortress Capital last week while they looked into shadow loans that financed the mushroom sprouting of unaffordable Vancouver and Toronto condos. It was set above a picture of a Husky Energy refinery in Wisconsin that blew up yesterday, and next to David Ebner tying Canadian billionaire Paul Desmarais Jr. to a deal that cement company LafargeHolcim is alleged to have done with “Syria,” but really with ISIS.

Market Detours, Then Just Stops

Against that backdrop, the Toronto business world was tuning in to the Detour Gold Q1 earnings call with interest, and not liking what they heard. DGC.T had sunk 30% on the open on a multi million share torrent of volume, the bulk of it coming as Detour CEO Paul Martin and new COO Frazer Bouchier tried to explain to a sighing group of Toronto mining analysts that revising their 2018 guidance to include less total production, more total cash costs per ounce, and more all-in sustaining costs per ounce was actually a good thing.

Detour is re-planning their namesake low-grade, high tonnage operation in Northern Ontario to get more out of it in 2019-23, but the street wasn’t having it. Compound the guidance revision with a broken rope shovel and an inability to get on the same page as the Moose Cree First Nations, and nobody wanted to wait around to see how long it was going to take Detour to get squared up and moving.

Mines are difficult to plan, finance and run efficiently under any circumstances. They’re slow, plodding machines whose true efficiencies and payouts are only ever known once they’re over. By contrast, the stock market is a quick-moving, erratic, ill-tempered beast who doesn’t want to hear about how much better a mine is going to be three years from now.

Detour’s sell-off triggered the automatic “single stock circuit breaker” 5 minute halt that is described in the TMX groups orders and functionality guide as:

a five-minute halt of trading in a security will now automatically trigger across all Canadian marketplaces if the price of the security swings 10% or more within a five-minute period.

It’s unclear whether or not the early tripping of the breaker had anything to do with the ongoing problems that eventually shut the exchange around 10:30am PST. The exchange is blaming a “technical problem,” but isn’t saying what it is.

Living The Good Life In an Attention Economy, And You’re Going to Need A Scoresheet To Keep Up with This Blockchain News – Tech Was On Before Everything Got Turned Off

Before everyone bounced to get an early start on their weekend, the tech sector was where the action was on the Venture, with ad platform company Good Life Networks in the volume lead. GOOD.V traded 2.7 million shares, and would have likely gone on to outpace their all-time volume high of 2.6m shares, set on the day of their RTO listing Jan 31, 2018, had we not packed it in early.

Goodlife announced financial results in the morning that had the $17M market cap company netting $1.7M in EBITDA in 2017 off of $9.7 million in sales. GOOD.V reports a “gross profit” line in their financials (their receipts less the expense of their ad server platform and media buys) to come up with $4.3 million for the period. The single largest line in the $3.1 million operating expenses that aren’t counted in that ops calculation is $1.2M in “consulting fees,” roughly half of which appear to have gone to management, to companies controlled by management, and to close family members of the CEO.

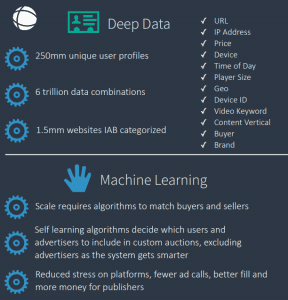

Goodlife bills themselves as a hyper-efficient ad middleman. They run a server that pushes relevant ads into digital media on behalf of their clients. Their deck talks about using “patent pending machine learning algorithms,” to better target ads to people in the “massive” $25 billion video advertising market, $14 billion of which exists outside of Facebook and Google.

This company is built around a platform that takes a bunch of user profiles, machine learns what they might want and whips them an ad for a dating site or a Budweiser or something at lightning speed. It’s unclear how these user profiles are generated or how accurate they are, but the company says the machine learning is making it better all the time.

Goodlife’s messaging is trying a little too hard to be hip, and they sure want to talk to you! See, they only “disrupt” the ad industry during bankers’ hours. Otherwise they’re “kicking it,” at their Vancouver HQ or jet-setting at conferences.

This is an ad company, it understands what profile and it’s trying to get it. We’ll see if we can’t find some time to go and “kick it” with the Goodlife crew down at Headquarters in the coming weeks, and ask them about user data based targeting in the era of #deletefacebook and the growth of user wokeness.

If Software Financing Hasn’t Jumped The Shark with This, It Never Will

The other tech standout on the abbreviated day was cloud security company Nubeva Technologies NBVA.V, whose buzzword-heavy pitch sent us to the technical dictionary more than once. As near as we can tell, this $85M market cap company sells software that gives companies a better look at the traffic in their cloud computing environments. Basically, a company who uses a web application that just runs on some AWS cloud server somewhere has almost no control over or ability to monitor the in-out traffic in their environment. Nubeva promises a fully transparent, auditable security environment powered by blockchain.

The all-guts move that appears to have got this thing trading today was – not a token offering, per se, but (get this): a “Future Token Offering”. It’s a crypto-token offering for crypto-tokens that give the buyers the right to receive future crypto-tokens!

From their April 24 press release:

As an initial step in the token offering, the token issuer plans to complete an initial offering of rights to receive future tokens. The objective of the initial sale of future token interests will be to raise approximately $3.0-million (U.S.). The proceeds of this initial presale will be used to finance costs associated with the token offering and to enable the token issuer to purchase from Nubeva a limited purpose open-source licence for its blockchain routing IP software in connection with the development of the token network. If completed and if the token offering proceeds, the future token interests will automatically convert into tokens for no additional consideration upon the launch of the token network.

But that isn’t all. If the first pre-sale goes well, the company reserves the option to do another one, then use the money to pay themselves to build a network. It’s unclear if that network would be an asset of Nubeva shareholders, or the tokenholders, or nobody. A community asset like the wind.

Nubeva also contemplates that a second pre-sale of future token interests will be completed in advance of the Token Offering. The objective of the Second Pre-Sale will be to raise funds to provide for development of the Token Network. All development of the Token Network will be completed under service agreements under which Nubeva would be paid fees in exchange for the completion of the development work.

Somehow, this offering is going to make Nubeva’s services more affordable, opening them up “to a broader customer base that Nubeva believes are presently unable to access cloud-based security services due to cost.” The release doesn’t explain how that works, but we surmise that if demand drives the value of the tokens, the token holders and rights-to-token holders will have more money to spend on cloud security? Or, it could be that a successful and widespread token launch will somehow allow NBVA.V to scale better? A careful reading of the release was unable to decode exactly how that part is supposed to go, but we are glued to this move. We’ve emailed the company and will update if they get back to us.

The release is clear that the initial sale is happening in Singapore, and that the tokens are not for sale to people in the US or Canada, who are governed by securities regulators who might take a dim view of this sort of thing. We’re on record as believers that the securities world is the one most likely to see the first true “disruption” from blockchain tech, so NUBEVA may well be in the right wheelhouse here. If so, they’re surely hoping to be there at the right time.

Nubeva traded 1.6 million shares on the shortened day, 16 times its average volume, and finished down 6.3% at $1.50.

Have a good weekend.