In Part 2 of Equity Guru’s practical guide to blockchain companies we use a few filters to get us down to the businesses that are presently worth considering from an investment perspective. It’s guaranteed to be current and relevant until the moment it’s not. For the backstory, read Part 1.

Contents

State of the Tech

Coarse Filter: Beware The Buzzword

Fine Filter: Potential Costs of Operation

Finer Filter: Potential Costs of Implementation

Finest Filter: Practicality, Suitability, Utility.

The Goods

State Of The Tech

Mainstream finance is all nerves around blockchain. They’re hanging around the edges of the cocktail party conversation and listening carefully… nodding in agreement about the great potential of this new frontier… carefully selecting questions so that they’re worded as expressions of interest. Questions worded as requests for information would be a defacto admissions that they, much like the rest of us, have no idea what’s going on here, but won’t stand for missing out.

In February of 2018, a sustained valuation of cryptocurrencies at levels that are impossible to ignore has created three important, related conditions:

- An appetite at all levels of equity and currency markets for trade-able cryptocurrency products,

- The widespread consensus that blockchain, the encryption-based ledger engine of cryptocurrencies is an exploitable technology, and

- a fundamental lack of certainty surrounding the ultimate utility or even likely application of this technology.

There isn’t anything wrong with any of that, exactly. It’s the reason we’re here. Opportunities exist in knowledge gaps. Since the most immediate of those opportunities is to append “-on blockchain” to pretty much anything to get a lift, we’re going to let you in on what we’re doing to sort these companies out.

I’m on record as a believer in potentially major disruption that could come from blockchain, and right about now I feel like the kid watching his Mom buy herself Nirvana’s MTV Unplugged album, a few years after telling him to turn off that racket when he was bumping Bleach on cassette. But never mind how I was into it before it was cool. Let’s hear from someone who knows what they’re talking about.

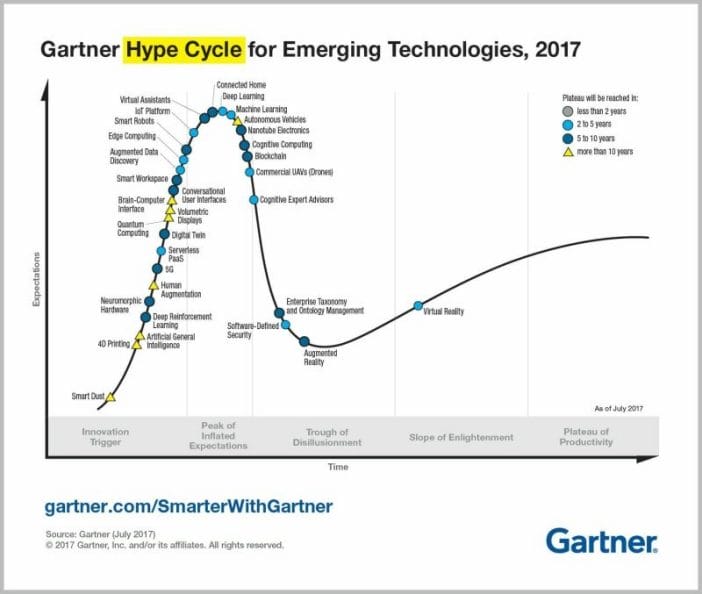

This is the Gartner Hype Cycle. Note that while the X-axis is labelled “Time,” it does not map on a linear scale. Gartner marks the various hyped techs with shapes that correspond to the amount of time until they’re likely to be in-service in the real world. They have blockchain on the expectation down-slope, 5-10 years out from the productivity plateau.

It’s important to note that 1) the hype cycle is obviously an illustration. Gartner will be be the first to admit that they don’t know either, and 2) it’s meant to illustrate a tech’s buzz vs. its functionality. Not its value to the companies developing with it or trading in it, which is ultimately what we’re interested in, so why bring it up?

Gartner is in touch with tech in ways nobody else is. They have no vested interest in blockchain or any other emerging tech, and make their living in publishing and research. Their wheelhouse is impartial and exhaustive reviews of gadgets and software. The hype cycle comes out about once a year and is really popular. It’s taken as seriously as something that vague can be, because Gartner is one of few enterprises qualified to render an opinion. Their best guess is the relevant one.

This version of The Cycle was published last July, but the company’s assessment Blockchain’s hype level hasn’t wavered. Yesterday Gartner VP John Lovelock channelled Allan Greenspan in a blog post titled The Irrational Exuberance of Blockchain. Lovelock gives a better summation of the ultimate potential than we ever could, laments the hucksterism that’s using it to sell paper, and finishes off with a look at the landscape:

Most current uses of blockchain are not disruptive, because the majority of organizations that undertake blockchain projects find it hard to conceive of systems that are outside of their legacy, centralized models (both business models and technology platforms). As with other waves of technology-driven business transformation, disruption will likely come from small risk-taking ventures rather than established, risk-averse companies.

You hear that, guys? That’s US! That’s small cap! Bold pioneers! Futurists sewing disruption!

It’s venture-stage tech that’s going to come up with the goods and, with a landscape full of future failures looking to cash in on your optimism, EG is here to show you how to pick ’em.

A note on Miners:

Cryptocurrency mining is, at this point, an established business archetype. A miner’s success is a function of turning low-cost power into hash cycles efficiently. These companies are going to live or die by the relationship between their overhead and the value of the cryptocurrencies they mine. We’ll look into getting some heads on the EG Twitch stream to talk about mining ops, but crypto mining ops are not part of this guide to blockchain ventures.

Coarse Filter: Beware The Buzzword

The RIOT Blockchains and Long Island Iced BlockTeas of the world aren’t hard to spot. They have pitches built around buzzwords, with no discernible narrative. It usually starts with something like “This is the Future.” These companies will be “acquiring high-leverage mining assets, developing technology, positioning ourselves to be first movers in the space,” but somehow never get around to telling anyone how.

I don’t really have any sympathy for anyone buying stock in a company who can’t make themselves understood. Sure, there are companies out there with good plans and trouble articulating them, but no way to tell them apart from a messy articulation of no plan at all. If you buy something nobody can understand it, who are you planning to sell it to?

Fine Filter: Potential Costs of Operation

It’s fun to imagine and popular to sell a future where all home appliances and self-driving cars run seamlessly through automated, decentralized blockchains. In practice, that will happen when it’s affordable. Presently, it isn’t. The business end of cryptography is power-hungry. That’s why miners are always on about how cheap they get their power. Each new block is a new version of the ledger created by a cryptographic proof. Each unit in the ledger and its state is re-drawn, and put where it belongs in each successive iteration. Making a whole new proof at regular intervals to keep track of when a case of yogurt is about to expire has to be worth the cost of mining. Many real-time tracking and status jobs (especially ones that don’t require a trust element) can be accomplished the way they are now: by updating a regular, conventional, CRUD database.

Finer Filter: Potential Costs of Implementation

A blockchain ledger that underpins a cryptocurrency is an easy, cheap thing to make compared to one that tracks and verifies objects in the physical world. Coins are virtual constructs; numbers entered in a ledger. Real things will have to be somehow married to tokens on ledgers, and a full complement of custom or customized software and hardware will have to be developed for that purpose. That process is a long way from being generally or specifically optimized and, until it is, blockchain tech won’t be able to give physical objects in real space the kind of ironclad trust and verification that it uses to make cryptocurrencies work.

A reliable way to pair real items with tokens and then keep them in touch with the cloud as they move along a supply line would be lucrative if it were scalable. There is a great sub-opportunity here, but it’s hard to imagine it being successfully tackled by a venture-stage deal. Walmart and IBM labs are doing a pilot program that tracks food using a blockchain in China. It’s coming along well if you ask them about it, but there’s a good reason they didn’t try it out in America: it isn’t needed there. In America, consumers trust the food at the store.

Finest Filter: Practicality, Suitability, Utility.

Sure. A pair of vice grips will undo that bolt. But is that really how you want to do it?

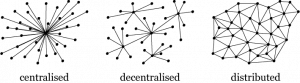

The barriers broken down by this allegedly disruptive technology are the ones created by trust and centralization. A bitcoin is in its current wallet by virtue of the fact that that wallet is where the ledger says the coin is. People trust the ledger because it’s tamper proof. Besides, there’s nobody to argue with. The coins weren’t put there by a central authority, it was proven to be there by a network of distributed nodes that verified the approvals of the sender and receiver.

Accordingly, the disruption is a fit for situations that require verification from a central authority to establish trust. That’s why the beachhead is money. But for the disruption to stick, that central authority has to add an un-needed cost or hassle.

Payment systems are such a situation, but bank accounts and debit cards aren’t going anywhere so long as people are using plain, regular fiat currency for transactions. As long as transactions remain cheap and easy, payment systems are in the same place as grocery supply lines; there’s no problem worth solving.

By our estimation, the easiest and most un-necessary money being made off of trust and centralization is being made by the authorities that facilitate the operation of capital markets, which puts our readers in a great position to understand that disruption, because they are market people.

The Goods

Market People already get it, because they see it every day. Brokers – licensed to act as avatars for investors by a central authority are allowed access to a centralized platform by a stock exchange, where they trade paper issued on behalf of companies by centralized transfer agents known as trusts, that is ultimately moved around by other trusts like the DTC in centralized securities depositories.

If anything is ripe for blockchain disruption, it’s the finance ecosystem. Similarly, opportunity exists to create blockchain-based systems for markets that previously didn’t exist or weren’t liquid for lack of centralized exchanges.

Large financial institutions have been sniffing around blockchain for quite some time. It was considered a branch of “FinTech,” before a Bitcoin was worth as much as new Kia, and institutions like Barclays and Blackrock kept rooms full of pet math nerds in “incubators”. So far, they’ve yet to cough up any real-world, in-service applications but one can infer that it isn’t for a lack of trying. The financial establishment isn’t really interested in any kind of innovation that doesn’t further entrench their interest. Luckily for them, there are plenty of angles with that sort of promise, and they’re keen on letting us know about it.

Our local stock exchanges live in the same venture-stage small cap world that our readers do, and most definitely see the writing on the wall. Both the CSE and the TSX have announced partnerships and programs that are meant to integrate blockchain ledgers into their operations and are in the process of excitedly telling the world all about how great they’re going to be when they exist.

Brady Fletcher, managing director of the TSX Venture Exchange, is among the voices screaming from the rooftops about the great decentralized, distributed future, and he ought to be. It’s best for TMX Group that everyone understand that they have blockchain projects for both proxy voting and natural gas delivery, and that the natural gas one is even in functional beta. Venture stage equity exchanges like the one Fletcher runs may well end up being the centre court of these disruption hunger games.

Follow Brady Fletcher on LinkedIn.