Let’s recap:

- September, we said it was a good time to buy into weed stocks. It was.

- December, we said it was a good time to take some profits off the table. It was.

- January, we said it was time to cash out of weed, but for three stocks (DOJA, IMH, ABCN). It was.

- Later in January, we said it was time to cash out of everything. It was.

So what now?

That depends on your risk tolerance, but we’re starting to like how the charts are leveling out and, in some cases, beginning a march up.

There’s still ample opportunity for further correction, as weed stocks in general are still inflated, and the massive amount of dough that entered the market in December/January, including a boatload of institutional dough, is well underwater and likely to look for a drainpipe as soon as its stock is free trading.

Financial Post’s Mark Rendell:

“Even with all the red that we’re seeing on the screen today [Feb 1], the peer group that we look at is still trading at almost 17 times 2019 EBITDA (based on consensus estimates), so that’s still a very healthy growth multiple for the space,” [said Russell Stanley, equity analyst with Echelon Wealth Partners].

One reason for the pullback may be the recent flood of financing deals, said Daniel Pearlstein, an analyst with Eight Capital. There were “a number of very large financings in the space over the last few weeks, and there was a lot of new capital issued that the markets have to churn through,” he said.

Supply of new stock, in other words, appears to be outstripping demand, explained Martin Landry, managing director of equity research with GMP Securities.

“There’s been more than $1 billion raised in January for cannabis producers … so it’s sucked a lot of demand. It is healthy, in a sense, to see a pullback, it brings back a new wave of investors for the next leg up,” Landry said.

It’s wildly optimistic to think that buying weed stocks today will return you to the ‘double every week’ mentality that dominated the markets in early January. But there may be some value to be had, even as the bigger players (who took most of the big financing money mid-rally) may feel gravity pulling them down for a while.

Personally, I’ve always been happier to miss an upswing by a day than to hit a downswing a day early, so I’m unlikely to launch back into the weedco stocks with everything I have for a while.

But if you can’t help but buy back in, if you’re getting the vapors at the thought of missing a green day in the green sector, there are some interesting deals about that appear to have either missed most of the downswing, or started a shift up early.

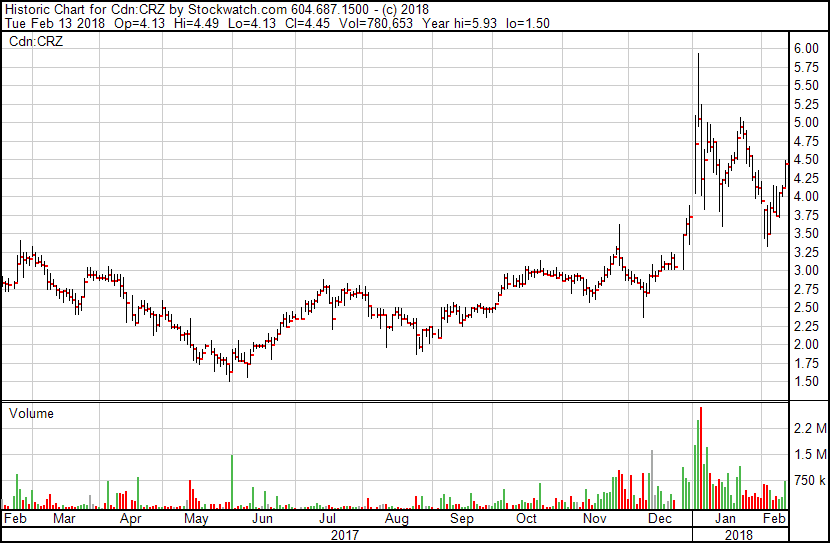

THE SWEET SPOT: CannaRoyalty (CRZ.C)

Man, if you got this for under $2 back in June of last year, you’ve done very nicely, downswing be damned. Though the stock did touch almost $6 during the mad times, if you take away the outliers, it’s been almost a consistent upward roll, even if it has moved an inch at a time.

In a market dominated by wild swings and weird charts, I really like the sanctity that CannaRoyalty’s vertical integration and branding strategy has provided, with US exposure that is now without significant Canadian regulatory problems, and an industry shift that is beginning to properly value the likelihood of good branding bringing higher value in a retail-focused world.

Added bonus: CRZ boss Marc Lustig is on the board of National Access Cannabis (NAC.C), which is surging as it begins to take its private weed retail/clinic model forward.

Recent news: The launch of a new Canadian market debt financing subsidiary, and expansion of it’s Bhang vape vertical in Southern California by way of one of its other verticals.

CRZ’s modus operandi has always been to use assets in one state as a foot in the door for its other products from elsewhere, and the Bhang deal is a great example of that in action. When federal rules and state regulatory differences make it near impossible to build true national US weed brands, CRZ’s business model brings effective brand building closer to fruition.

THE DISPENSARY PLAY: National Access Cannabis (NAC.C)

While Chuck Rifici’s Cannabis Wheaton (CBW.V) has done well to secure streaming cannabis deals that secure it a lot of LP weed going forward, the question has always been, where will they sell it?

Rifici’s NAC, to me, looks the likely vehicle to do so. The company has been doing deals for medical clinics as a ‘reason for being’ when dispensaries were forbidden, but is now starting to launch retail stores in places where such things are permitted.

Rifici was cagey with me when I asked months back if dispensaries were NAC’s big plan, but I’d bet dollars to donuts that’s exactly what we’re going to see, which will make NAC and CBW both far more backable plays. The Lustig connection brings in a lot of CRZ assets as plug-in-able options going forward. And the chart? A correction-free rocket.

NAC was up 15% again today.

THE BOOZE PLAY: Tinley Beverage Company (TNY.C)

When Canopy Growth Corp (WEED.T) found itself being bought into by Constellation Brands (STZ.NYSE) for big money, the market was swept up in a booze mania for a brief time, with edible players like Nutritional High (EAT.C) and Tinley Beverage (TNY.C) feeling the lift.

EAT has used that bump to raise some money and buy things, while Tinley played it a bit quieter. They’ve got a few SKUs of de-alcoholized cocktails (with THC replacing the booze) on the way, which would play ever so well with a big booze approach, and have been putting the pieces in place to make that business real for some time.

In late January they announced they’d found a bottling plant to lease in California, which would bring down costs. In early February they announced that plant had received a conditional use permit for pot drinks, something they’d been quietly waiting for but couldn’t talk about. And a week later – today in fact – they announced the lease is signed and they’re taking possession.

The Tinley Beverage Company Inc. has entered into a lease agreement for a 20,000-square-foot facility in Long Beach, Calif., for cannabis beverage production. The company’s temporary facility in Riverside county, California, has successfully completed all remaining inspections required for cannabis operations, and it has accordingly received a certificate of occupancy.

Word.

The facility operator has submitted its certificate of occupancy and other materials to the California Department of Public Health’s manufactured cannabis safety branch for issuance of a temporary manufacturing licence. Upon receipt of this temporary licence, the company intends to go into immediate production, and believes the initial batches will take two to three weeks to complete at that time. Initial products include the Tinley Margarita and the Tinley ’27 Coconut Rum.

This release has a lot more to it, like the potential for third party deals to maximize use of the facility, and a distribution network designed specifically for cannabis products. Go read it.

We’ve been working with TNY for some time and, though we like the deal a lot, we’ve taken a cautious approach as state rules have whirled and changed and Canadian investments in US assets were at times in question due to exchange fears. Added to that, the stock flew hard recently, as high as $2 during hype-o-rama.

A week ago, however, you could grab it for $0.70, which was a nutty fallaway during the correction, taking it back to value territory. Today it’s at $1.19, which we think is very easy to justify considering the steps they’re taking, the assets they’re building, and the likelihood Big Booze is going to come knocking at some point.

When the Tinley ’27 weed-booze products launch soon, we figure there’s going to be intense interest. Definitely keep an eye out. For now, green days are building.

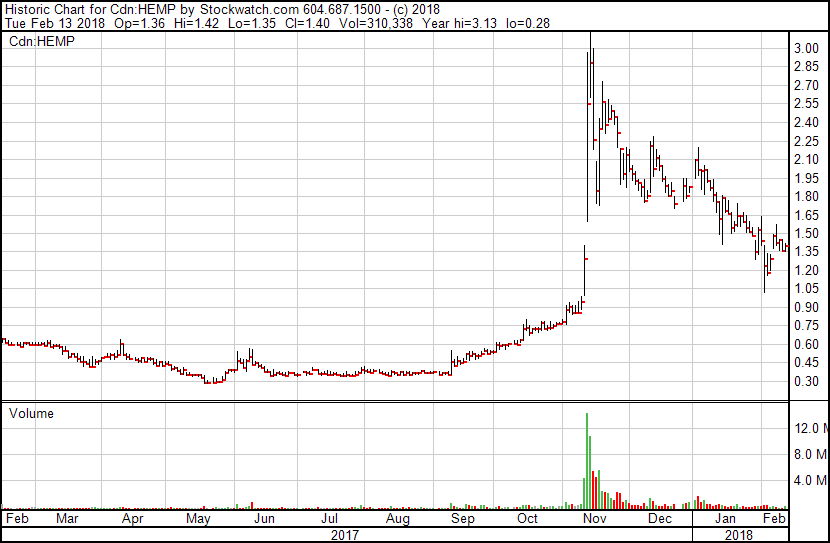

THE HEMP STORY: Hempco (HEMP.V)

When Aurora Cannabis (ACB.T) took out a big chunk of Hempco, the stock went berko as true believers piled on, convincing themselves and each other than it was headed to ten bucks.

Look, nobody gave a damn about Hempco before Aurora came along, which was an injustice because it’s a decent little company doing all the right things when suddenly the ACB mania turned it into an unwitting promo deal.

But it was never a $3 stock, even if that’s what some were paying for it.

Now that things are a bit more sane, at the price of $1.40 post-stupidity run (and $1.00 last week, wows), a good case can be made for a long hold. The chart appears to have solidifiied and it appears to have found a fair base, even as ACB stock has fought hard against the weight of institutional selling and short seller beatings.

Over the last two months, HEMP’s chart looks terrible, mostly because it was so absurdly priced in November. But over the last two weeks, it looks terrific, with a decent uptick of around 35% from the low.

If you were to bet on which of Hempco and Aurora might double first, I say it’s Hempco all day. But, also, stop looking for doubles for a bit and be happy with less volatility for a while.

THE DICE ROLL: Namaste Technologies (N.C)

Hey, don’t look at me like that. I’ve been saying Namaste was overpriced and destined for a plunge for months, and I nailed it RIGHT ON THE MONEY (come at me, Facebook fanboys).

When the thing hit a $700m valuation, it couldn’t possibly be justified, especially considering what it actually did for business. It had to plunge and it did, hard.

But a funny thing happens with companies that suddenly find insane valuations – they invariably go raise some money at the absurd price, and maybe use their absurdly high stock to buy some things, and after the crash comes and share prices get back to normal, they’re actually kinda worth something all of a sudden.

Namaste’s $30m bought deal financing on Feb 1, which quickly jumped to a $35m deal by the end of the day, was dumb money following dumber money. At $2.55, anyone swept up in that deal got wrung out, as shown by the $1.90 share price two weeks later. Falling knives for everybody!

But Namaste has now grabbed a piece of Cannbit, it’s working on an ecommerce platform with Emerald Health (EMH.V), it got a chunk of Atlas Growers, it’s partnered with Isodiol (ISOL.C -which has some fans) and Phivida, and has a patient referral deal with Aurora, and a supply LOI with Supreme (FIRE.V), and all of that is after its main business of selling vapes online, for which it has actual revenues.

Here’s my issue with Namaste right now: It doesn’t know what it is, and has been manic in partnering up with everybody under the sun to justify what was an unjustifiable market cap.

Now the share price has slid back, what exactly will it do with all those moving parts?

If you thought it was a good buy at $3.25 (and you were publicly bitching me out for not agreeing), then having it sit sub-$2 now should be a red rag to a bull. WHERE IS YOUR GOD NOW?!

I’m not buying, because I don’t think one needs to play craps with real money, and I can maybe see a few earlier stock-as-cash deals coming undone with the price of N stock now so much cheaper. But if you like to gamble and believe in the dream, this is your time to gird your loins.

THE BC BUD BRAND: Hiku Brands (HIKU.C)

I said as far back as 2014, farming is a mug’s game. Just growing weed will be like just growing barley and hops and expecting to become a post-prohibition billionaire. If you must grow, let it be to secure your own consistent genetics and supply for value-added products that you will send to market at a 90% margin to what it costs to produce.

Hiku Brands, formerly known as DOJA, gets this. In fact, I had long conversations with Team Kitsch back before they went public about how branding will mean more than square footage, and they were in agreement – perhaps owing something to do with branding their family winery and an upstart underwear brand, to great returns.

DOJA became Hiku when it sucked down Canada’s only retail weed brand of note, Tokyo Smoke, which just doesn’t make money (yet) but which is known by the demographic that DOJA aims to go hard after.

It was a good deal, a company maker even, because other, bigger entities immediately took interest. and they followed it up by taking out the Quebec equivalent, Maitri.

Pursuant to the LOI, shareholders of Maitri will receive upfront consideration of $550,000 in a combination of cash and Hiku shares and up to an additional $1.2-million in Hiku shares in earnout payments, based on certain performance milestones being met. Completion of the proposed acquisition of Maitri remains subject to conditions, including the entering into of a definitive agreement.

At the 2017 Lift Cannabis Awards, Maitri was a finalist for Brand of the Year. Tokyo Smoke beat them. Hiku has locked down the field, which is a boss move.

Potential downside: BC has made it clear that retail stores, of which it will allow some to operate alongside BC Liquor Board stores, can not be connected to growers.

This will mean Hiku will need to figure out soon whether it’s future is as a grower, or as a distribution brand. Frankly, I’d rather be selling it than planting it.

I bought DOJA back at $0.80, sold some around $4 and some more at $3.45 when I wrote it was time to take profits off the table. I still hold some, equivalent to my initial outlay. No plans to dispose and, at $2.65 (compared to the $4.75 crazy times high), it may make sense to put some of that cash back in. Will be watching how prices break over the coming days.

THE COMEBACKER: Organigram (OGI.V)

Yep, I made much hay beating on these guys as they just battered themselves in the face again and again over the last few years. Organigram missed a lot of the crazy run up, mostly because a hefty slice of the market (retail and financial) doesn’t want to do business with a team that was so shady in its dealings with both.

But the thing is, OGI dropped harder post January than it ran up pre-January, and the company proper hasn’t changed much. The product recall days hit them and left a mark, and there mighty yet be some legal issues left to be dealt with on that front, but other LPs roared past Organigram late last year in terms of market cap, which leaves the outfit looking like maybe a value pick.

In late 2016, when it was trying to negate the negative impact of its sneaky pesticide use and looking at class action lawsuits, OGI hit $3.90. Today? $4.33.

Old foes be damned, that’s a value proposition to me – especially if they’ve learned their lesson not to play fast and loose with their customer base.

I’m not about to put my mortgage payment on an OGI revival or anything, but there’s precious little good reason for OGI to hurtle downwards right now, and every good reason to view them as a cash-holding (they launched a $115m debenture in late January) entity with an opportunity to go shopping.

To be sure, there’s still the feint whiff of extreme douchebaggery around the thing, but there’s an opportunity here for Organigram to reinvent itself as an honest player with room to run.

Here’s hoping.

THE MYSTERY BOX: Emblem Cannabis (EMC.V)

I can’t even, when it comes to this mob.

There is no company in the weed space that has fallen as hard, while everything else was heading up, as EMC. Seemingly allergic to sharing news with the public, seemingly unwilling to go to the market to buy new parts, seemingly churning through several IR firms, and earning an alarming five figures in Q3, Emblem had a marketing deal with us that they appeared to have no interest in fulfilling, even as the share price cratered.

When we have to give negative coverage of a client company, it’s never our favourite time, yet there we were warning folks against buying into a company with an apparent fear of investors.

So why are they on this list?

Because they’ve raised $110 million-plus in the last year and be damned if I can see what they may have spent it on so far outside of a modest (in comparison to other LPs) facility expansion.

The company says it’s sitting on $87 million. That’s a fair amount of runway.

Meanwhile, you can buy it at a 60% discount from what it cost a year ago.

In fact, as the chart shows, you could have bought this stock cheaper during the middle of the weedco boom times than you could have when those boom times were just starting. Only a late December “Oh, look at EMC, we forgot about that one” run gave it any life at all.

Post-crash? You can get it cheaper than pre-boom.

I’m not going to tell you I have any faith in management to do what they said they would eighteen months back, or twelve months back, or last week. Frankly, the company has let investors down consistently, which is why it has a significantly lower market cap today, when it’s basically breakeven, than when it was a new business losing $5m per month.

It just seems to me that, eventually, EMC will fall ass backwards into a positive news release that will bring eyeballs to a cheap ass stock.

And this is, legitimately, a cheap ass stock. We’re watching, but not anticipating. Show you’ve learned some things, EMC execs.

THE LATE BOOMER: Invictus MD Strategies (IMH.V)

We take absolute credit for IMH going on a run. During the whole weed boom of October to December, the stock had barley nudged up, despite having one sales licensed producer and a piece of another freshly getting their license – and other assets.

We said in early January it was one of three companies that were under-boomed and under-valued, and it duly launched within a day.

The ensuing dip in early February took it right back to undervalued territory and, despite a recent uptick, we still think the IMH valuation is sensible in a sector where sensible is rare.

The stock is showing broad support, if low volume, but remains cheaper today than it was last April, with a whole lot more in hand in terms of cash and assets now. Worth spending some time on during your due diligence activities.

THE GLOBAL PLAY: Abcann Global (ABCN.V)

When this bad boy came to market, with a rep for high quality organic product that other LPs had been buying to resell, Joe Weed Investor didn’t get into it because some of the guys involved were ‘markets guys’ rather than weed guys.

That was dumb, and gave folks like me a chance to buy in ultra cheap.

Another company that largely missed the December weed run, until we pointed out how cheap it was in early January, ABCN’s run to $4 needed a correction, and a correction it has had.

But the drop off has not been vicious at all – in fact, it has come back to where it was mid-January, a level that many other weedcos would love to have leveled off at.

Abcann is making moves in other markets, which is a strong shift, and has Cannabis Wheaton money paying for its local expansions, which is a good non-dilutionary way to compete with the big guys, even if it will leach from future revs.

An Australian import license is no small deal, an their acquisition of Harvest Medicine medical clinics is solid business with a small up-front cost. Their $70m financing at $3.55 per share was a nice grab, right before the stock dropped to today’s $2.65.

For a change, you little guys get the better end of the deal than the institutional guys. We like that. Strong upside.

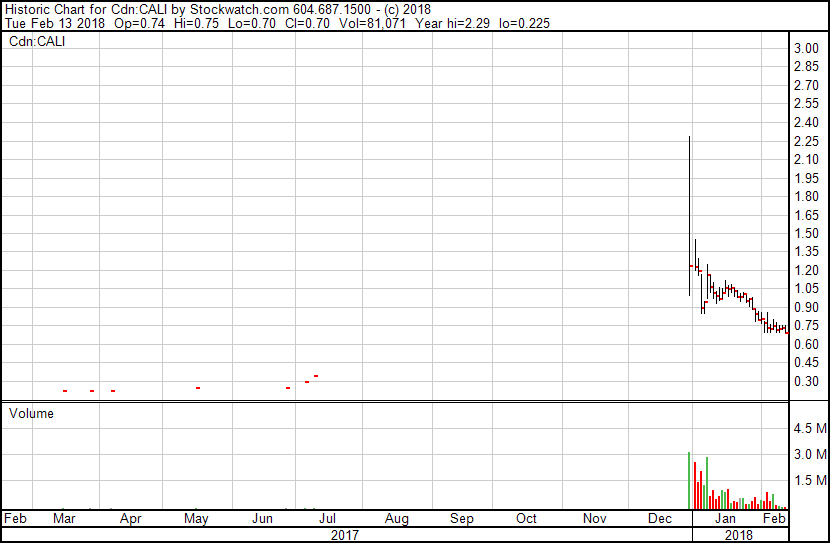

THE QUIET ONE: Fincanna (CALI.C)

If I told you I was starting a company that would finance Californian growers and extractors, that had a royalty deal on compliance software, that had a 50% share of oil extractions and were helping to finance a big fat Californian grow facility, you’d probably say that was interesting deal.

Well, hi Fincanna.

This company hit the market too late for the December to January wild ride, and has seen a steady slump as the market got weird with US deals, what with the TSX and Jeff Sessions saying dumb things about the business.

But the regulators have since given thumbs up to proper Can-Am weed deals, and CTI (the company CALI is helping finance in California) just got its hands on some very valuable California power allotment, so things are looking good for the financiers.

You just wouldn’t know it from the share chart, because nobody has heard the story.

Now, for this to turn into a winner, the company needs to get really swinging on the news front, which hasn’t been their strong suit to date.

The recent news that they’d taken a perpetual 10% royalty in the ezGreen compliance software suite in return for $3m in tranches over the next year was positive and understated, something that isn’t the usual stock in trade of the cannabis sector – especially in the US.

But as the US medical marijuana industry is increasingly required to adhere to HIPAA medical data handling rules, they’re going to need what CALI is hooked into.

And as for their other agreement:

Pursuant to the financing agreement between Fincanna and CTI, Fincanna has agreed to finance certain amounts of capital to CTI to purchase a royalty equalling up to 14 per cent of CTI’s revenues generated by the Coachella campus. On Jan. 15, 2018, Fincanna announced that the original structure was adjusted to provide 14 per cent of revenues of the Coachella campus paid as a royalty (previously 10 per cent to be paid as a dividend).

Grown up story with a pre-teen share price.

THE SHOE SET TO DROP: Green Organic Dutchman (TGOD)

It’ll be public real soon, with a fat retail investor base of over 4000 holders, with nine figures raised before it goes to market, with a license in hand and a team that has been running on fumes building the biggest, most expectant market debut in the weed space in a long time, if not ever.

We’ve said plenty about TGOD already in the year we’ve been telling you about it. If you got in on that initial raise, the likelihood that you’re going to be riding profits is strong. If you got in a few months back, ditto.

Just, please, don’t buy it in the first five minutes it hits the market. That’s dangerous play on any deal. You’ll have plenty of time to chart your course once it’s live.

—

AS ALWAYS: Do your own due diligence and be aware that in the days and weeks after a major slump, there’s a high probability of another slip or two. Nothing we’re talking about in this article is a lock down guaranteed profit maker.

In fact, we’re being very careful about buying into anything right now. But if you must buy – if you just can’t avoid it and have to have some action in the game, get yourself some value and don’t fall for hype.

Or people on Facebook who insist their stock will double by next month.

— Chris Parry

FULL DISCLOSURE: Invictus MD Strategies, Tinley Beverage, Hiku Brands, Fincanna, and Abcann Global are Equity.Guru marketing clients. The author owns stock and/or warrants in Tinley, Hiku, Green Organic Dutchman, and Fincanna and may, as opportunity arises, buy other stocks mentioned in the days ahead. Emblem Cannabis and Organigram are former clients. TGOD is not a client but a program has been discussed.

Equity.Guru does not buy stocks prior to writing about them, nor sell stocks prior to suggesting they may indeed sell. See our disclosure statement for more information.