Welcome back to Québec Update, where I troll through the french language news. I analyze and summarize the stories behind the poutine curtain. This installment focuses on the recent coverage of mining activity particularly Graphite.

The Equity Gurus like Graphite. It will make the batteries we need for well… everything. Many of our clients and the companies we follow are in this area. A lot of them have property in Québec as well.

In my last update I noted there was some good coverage of Nouveau Monde (NOU:C) Graphite, and in a broader scan I’m seeing a lot more coverage on Québec Graphite and the companies involved.

This piece is about a local mayor retiring on Québec’s North Shore (along the mighty St. Lawrence). What’s interesting is this bit at the bottom. (Translation mine)

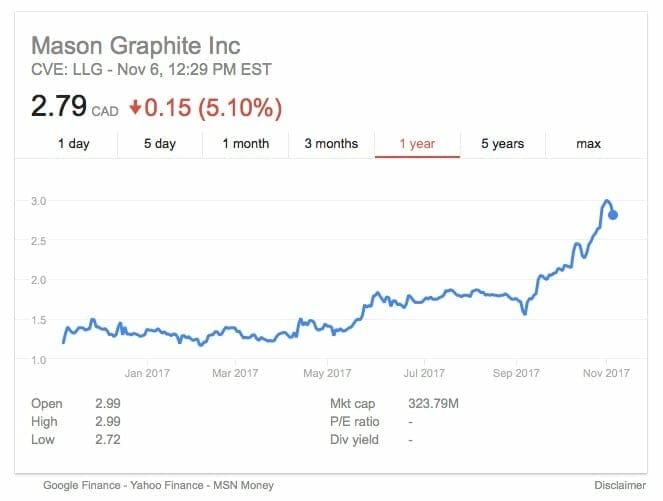

“Mayor Martel is optimistic about the future, the Mason Graphite (CVE:L) mining site should attract other players who will contribute to the economy.”

Keep note of that name (Many of you do already I am sure).

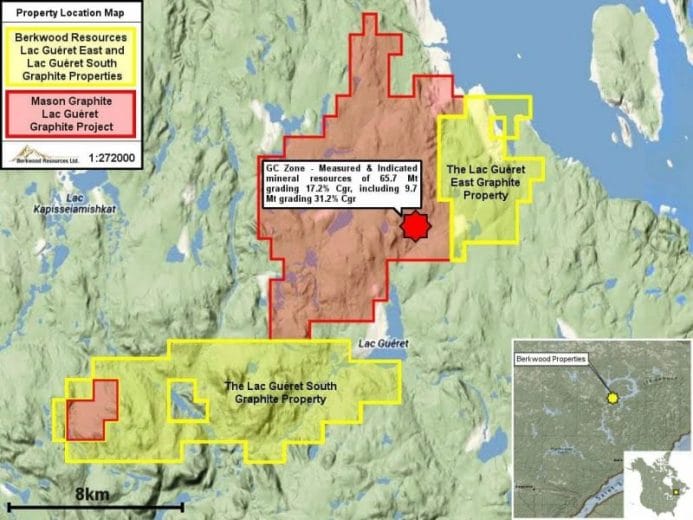

Mason Graphite is one of the players at Lac Guéret site. with another major player being Berkwood Resources Ltd. (BKR.V). According to BKR’s August 22 press release:

“The drilling intersected visually identifiable graphite over intercepts at 40.2m – 45.3m (3.1m) and between 99.48 and 137.77m (38.29m) in BK1-01-17; and over intercepts from 43.6 – 46.3 (2.7m) and from 63.1 – 73.0 (9.9m) in BK1-02-17. These intercepts are as drilled intercepts, and do not represent true widths.”

The map below outlines the site.

Continuing along the graphite road, this piece reports on the opposition Parti Québecois accusing the ruling Liberals of abandoning the North Shore. The government responded with: (Translation mine):

“[The Minister] cited the relaunch of the Bloom Lake mine and the Mason Graphite project proves the North Shore is a strong area…”

This is a clear signal from the government. I spent a few years working in a government communications shop – when the minister uses a company as an example to the press, it’s been vetted carefully.

It also usually meant the industry involved was something the government was going to work to help expand. Especially a natural resource sector in an economically depressed area. This means lots of job grants, tax breaks and subsidies could be on the table.

A rising tide floats all boats, and with Mason Graphite looking like a showpiece for the Province, at the very least BKR will be pulled along in wake. We still think it’s undervalued, but I suspect not for long.

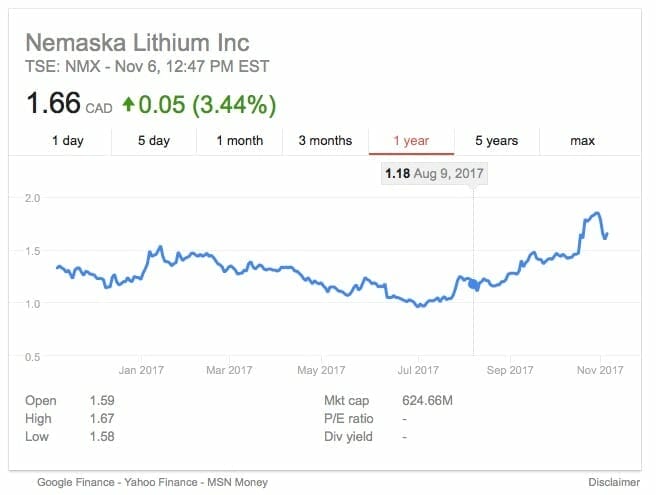

Finally, a TV piece on Quebec Lithium showcases the work being done to develop local sources. Nemaska Lithium (NMX:T) is the company profiled in it’s piece.

The piece goes into breathless detail about the mine in James Bay and the plant in Shawinigan. A professor then explains all the things we all know about lithium’s use in batteries. The end is the obligatory reference to Tesla and how the electric cars of the future will run on Good Ol’ Québec Lithium™.

Tying it all together, there’s a lot of popular and political support for the battery tech mining field. The poutine curtain can keep trends quiet until the gravy sloshes over into English Canada. (For example, When I was 8, and visiting Toronto, my cousins had never even heard of Poutine…. now it’s everywhere).

Québec Graphite, Lithium and Cobalt are going to continue to be big winners. We’re lucky enough one of our clients is in the catbird seat in what is looking to be a mini graphite-rush (carbon-rush?) – BKR looks great to me today. I don’t have a position, but I think it’s time to put my – well, you know.

Bottom line is – this market has legs. When you can invest in a mining operation with positive environmental, political and popular support it’s a no brainer. The question is, what flavour of poutine will you pick.

By poutine I mean minerals. and the picking is you investing.

Is explaining the joke adding to the humour, or does it kill it.

FULL DISCLOSURE: Berkwood Resources Ltd. is a client of ours. I don’t own any stock in the companies mentioned above. Yet.