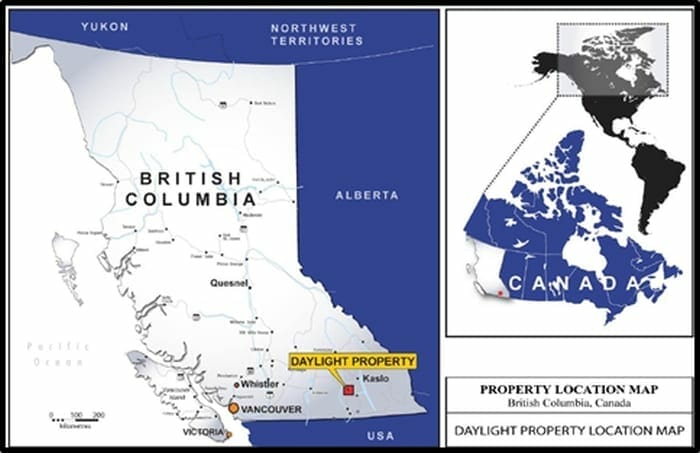

On Aug. 29, 2017, Prize Mining (PRZ.V) released a slew of lab data from its Phase I field program, carried out on the combined Daylight and Toughnut Project areas in its 8,000-hectare Nelson, BC gold camp.

Prize Mining’s asset presses all the right buttons: multiple historical high-grade mines, close to a highway, water and cheap power in a mature mining jurisdiction.

British Columbia’s 1936 gold production was worth $12.3 billion in today’s dollars. It’s a fraction of that now. Gold exploration in BC is ramping up big time.

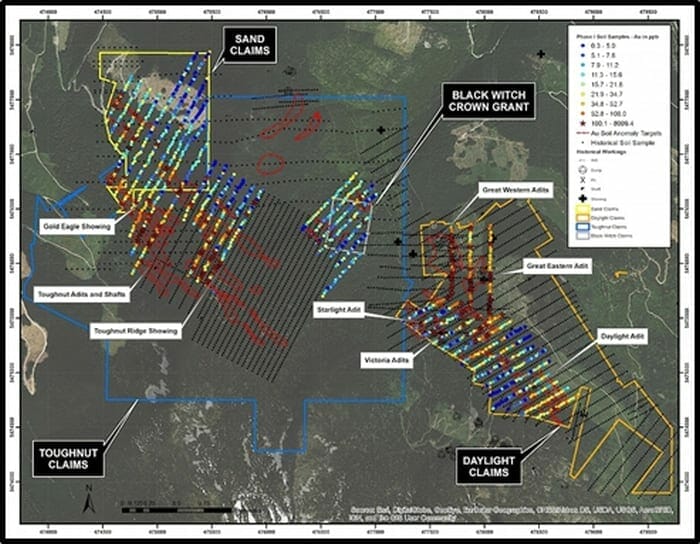

This week, a total of 1266 soil results and 326 rock results were received and interpreted.

Before we get into those results it worth noting that the President and CEO of Prize Mining is Feisal Somji, the founding president of Rio Alto Mining.

Somji oversaw the construction of a mine in Peru which achieved annual production of 150,000 oz. gold. That little Canadian company was sold in 2015 for $1.3 Billion.

The final Prize Mining batch of 2017 soil results included 27 samples greater than the 100 ppb threshold, with up to 577 ppb Au (0.57 grams per tonne of gold). Results from the Toughnut trend returned 38 samples over 100 ppb, including a maximum of 1005 ppb Au (1.0 gram per tonne of gold).

According to the press release:

“The net combined database, comprising 5418 soil sample results has been utilized to define 41 gold soil anomaly targets in the Toughnut and Daylight properties. These soil anomaly targets will be instrumental in prioritizing future trenching and drilling programs.”

Here is a map of the soil results. It’s a pretty picture (remember this is just what’s lying around on the surface).

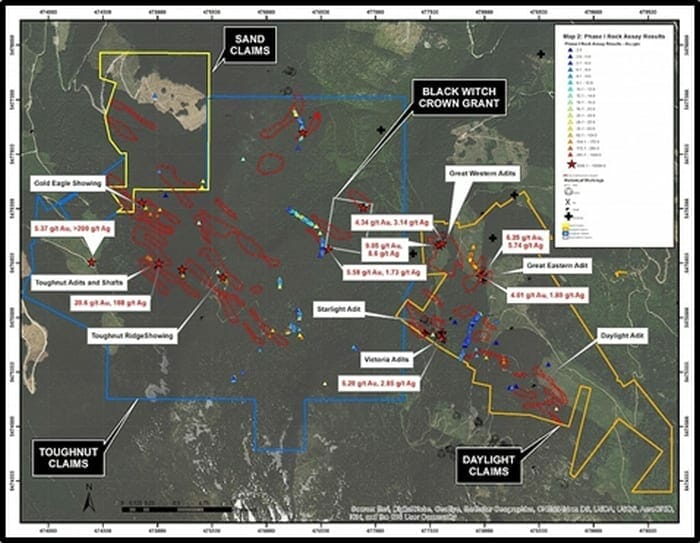

The 2017 Phase-I program also included the collection and analysis of 326 rock samples.

Two rock sample types were collected:

- 92 grab samples collected from known showings and new veins of interest, in order to verify gold grades and to determine the accessory metal contents (copper, silver, lead and zinc).

- 234 composite samples were collected along existing road cuts to assess the metals content of 9 large-width shear systems.

Grab sampling is a collection technique in which is a single sample is taken over as short a period as is possible

Composite samples are defined as the collection of regularly-spaced, fist-sized rocks over sample intervals of between 1 to 10 meters in length.

Highlights from the various showings are as follows:

| Toughnut Ridge | 2.45 g/t Au | 33.4 g/t Ag; |

| Toughnut Adit | 20.6 g/t Au | 188 g/t Ag; |

| Victoria Adit | 5.28 g/t Au | 2.85 g/t Ag; |

| Great Eastern Adit | 6.25 g/t Au | 5.74 g/t Ag; |

| Great Western Adit | 9.05 g/t Au | 8.6 g/t Ag; |

| Black Witch | 5.58 g/t Au | 1.73 g/t Ag; |

| Gold Eagle showing | 2.87 g/t Au | 8.59 g/t Ag. |

Here is a map of the rock results.

”

“The results of the Phase 1 program have given more strength to the Companies’ objective of focusing on high-grade targets” stated Somji. “We see soil samples well above the 1 g/t Au range with a high of 8.0 g/t Au and rock samples over 5 g/t Au with one resulting in over 20g/t Au. These great results have created 41 targets which will be followed up on our Phase II and Phase III programs.”

Prize shareholders should be particularly encouraged by the composite rock results obtained from the Great Eastern road-cut area. 47% of composite samples returned strongly anomalous gold (over 0.1 g/t Au) with the best result of 4.01 g/t Au over 1.5m.

“Several strongly anomalous composite samples were also returned from a new road-cut near the north limit of the Toughnut claims, including one that returned 2.14 g/t Au over 9m. This area of the property has seen very little historical exploration and represents an exciting new target area.”

Prize is going to combine the rock and soil sample data with pending ground magnetic and VLF-EM results to refine and direct trenching and diamond drilling programs planned for later this year.

The two current goals are to 1. Locate and define ore shoots beneath known working and trenches in support of completion of bulk sampling planned for 2018. 2. Define new mineralized zones.

PRZ recently issued 14.3 million non-flow-through units at $0.35 and 2.22 million flow-through units at $0.45 per unit to raise a total of C$6 million. So the company has enough cash to meet its exploration goals.

A technical report on the Prize asset states: “Four gold-bearing targets, the Great Eastern Porphyry Gold Zone, the Starlight Shear Zone, the North Star Shear Zone, and the Silver King Gold Corridor, require further exploration. Geological indications suggest the potential for more than 3.0 million ounces of gold in the four target areas.”

Was Feisal Somji’s success in Peru a one-off?

Maybe.

But it’s funny how the home-run hitters often have more than one good season.

Prize Mining has a market cap of $17.5 million. It’s a 76-bagger to get PRZ to the sale valuation of Rio Alto.

Only a madman would predict that is going to happen – but you better believe this stock can go higher.

Full Disclosure: Prize Mining is an Equity Guru marketing client. We also own stock.