Can Gold Go Sideways Forever? Definitely Maybe! Here’s a Way To Play It.

The traders got on board the gold train the other day when Trump felt apocalyptic, but it sold back down to $1270/oz when they realized that the equity markets weren’t going to collapse just because Captain Toupee started flapping his gums. An overbought condition and historically high P/Es haven’t meant anything so far, and nobody is really keen on ruining a good thing. I don’t think the market doesn’t believe Trump will hit the button, it just understands his motivations – The guy will do anything to be adored. If taking Kim Jong out into the alley for show was going to move him over to the cool kids table at the G-20, he’d have done it already. He felt it out, realized it would be a total buzzkill, and went back to trying not to lose the only friends he’s got left – the skinheads out in the smoke pit with bad tattoos and a complex that’s hard to pin down. Those guys are always trying to build him up.

That economy is all he’s got right now and, luckily, despite what he’d have us believe, Trump isn’t in a position to affect it materially. It’s the central banks who have the meaningful input, and they’ve made their position clear: cheap money. That’s the ticket. Keep rates low, make sure banks have access to capital and keep it all moving. That causes inflation and inflation drives the gold price. It doesn’t drive it all at once along with the price of gas masks, it’s a steady, gradual pressure that builds until everyone and their brother climbs on the bandwagon. Sideways in the high $1200s, low $1300s suits the gold sector just fine.

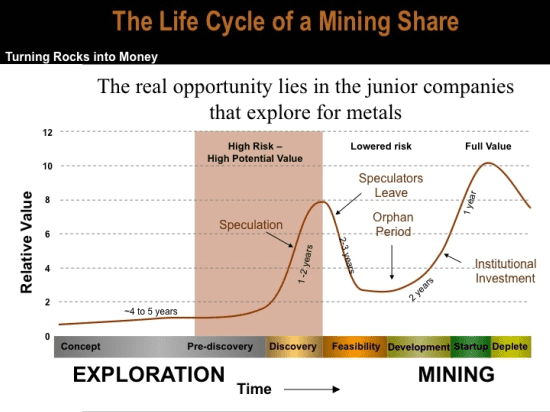

As I’ve written previously (after stealing it from Brent Cook) the highest alpha in the resource sector is in discovery stocks. Companies who can control their costs as they establish significant land positions on high potential properties, then de-risk those properties are in a position to create value in short order. Pros are quick to point out that the juniors are erratic as a sector, and that’s true. That might be why nobody has ever created a resource discovery stock ETF. It takes work to handicap these companies and sort them out.

EG Editor Chris Parry sent me out to take a look at a few gold companies who are doing all of the right things in this kind of gold environment. These companies are giving their shareholders exposure to the upside that comes from the ability to make something out of nothing, and here’s how they’re doing it.

Nexus Gold

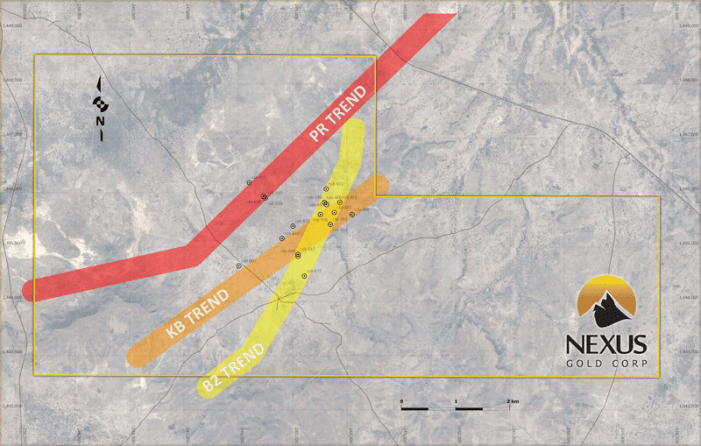

There is a gold rush in Burkina Faso, and Nexus Gold (NXS.V) has built their company around a strategy designed to put themselves in the middle of it. The greenstone belt they’re in is the host to numerous producing projects and discoveries. It’s the type of West African quartz-hosted gold belt that has made great fortunes for many explorers and developers, and $1200 gold is the type of price that can carry a deposit for as long as it takes.

The playbook here is a familiar one. Send people in to scout the camp, and jump on the best parts of it when opportunity arises. They’ve just inked a deal that gives them control of an on-trend extension of the trend they’re on. Expansion is a wise tactic early on, especially in areas where the bedrock is exposed. Nexus has chosen to pursue deals during the rainy season when there’s less competition for the ground. Beside making deals easier, it’s a good way to show the locals, who have surely seen many Western mining companies with a dream come and go, that Nexus is serious.

The company has been able to tie up a section that is being worked by artisanal miners, which is a good sign. And, indeed, initial sampling is showing the geologists gold grades where they expect gold grades to be.

Nexus has plans for a diamond drill program to test these trends. Their $2M cash position should be enough to see how deep these well-defined trends go, and give the market and some larger gold companies a better look at what we’re dealing with. That’s a fine position for a $19M market cap gold company to be in.

One thing I love about West African gold deals is that there’s always a corporate market for them. Any gold company that doesn’t need reserves to keep operating at the moment is going to soon. Buying up African quartz-hosted gold trends is practically a sport for mid to large cap European mining companies, so a company like Nexus can gain a lot of ground in a hurry if they’re able to de-risk a project like this in their first few cracks at it.

Chief Geologist Warren Robb has a great deal of experience in Burkina Faso, including with RoxGold, and local operating experience is something one has to look for in companies operating in West Africa… or anywhere else for that matter.

Prize Mining

We’ve spilled a lot of pixels over Prize Mining (PRZ.V), and that’s because there’s a lot to like. Prize is diligently working on a million-plus ounce deposit up in the BC Kootenays, and doing the exploration on a really interesting consolidated land position that just screams blue-sky.

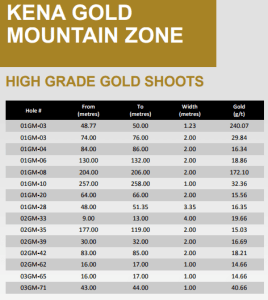

The Kena-Gold Mountain deposit is a porphyry deposit that, despite legitimately passing the 1M oz inferred bar, hasn’t yet shown an end. Gold deposits are characteristically erratic, both in shape and grade. That’s why it’s so hard to get them above a million ounces at a decent cutoff grade. Prize has done a great job of building a commercial deposit surrounding high grade shoots, and that’s an important step. The nature of production decisions in the gold world is as such: prove that there is enough pay grade so as we don’t lose money at a decent gold price, and let’s see how it comes out. See, high grade portions of gold zones are skinny and gangly – walking through the raindrops, all knees and elbows. Gold likes to nugget up and hang out in small, high grade pockets. Since the nature of mining equipment and physics don’t yet allow for the extraction of only the high grade, mining companies have to do testing that shows a potential for an average pay grade of a price that’s higher than the gold price. BUT! High-grade sections in a low grade zone, makes for a reasonable bet that the zone pays more in aggregate than one might expect once the mill receipts are all totaled up.

Prize is showing high grade shoots, with between 14 and 240 grams per ton of gold in sections above a meter all over the inferred zone at their Kena project. The intersections come at different depths in various different holes. In a deposit like this, it’s tempting to look at the upside. There’s a better than average change that a production decision designed to yield a million ounces could yield 1.5 million in the drilled zone, and that ongoing production from an open zone could yield much more. In rising gold markets, majors sometimes elbow each other out of the way for position on deposits like that because they come with the real world equivalent of Mario question boxes.

Ounces-in-the-ground with upside are a great bedrock for an exploration company, but I like an idea that makes me dream big.

Prize announced some great results from a soil sampling program on their Daylight property the other day. It’s next door to the Kena. Geochem in and of itself is tough to get excited about, but it pays to look at the context. The property was the home of four different known high-grading operations. These are the kind of mining projects that you see in HBO’s Deadwood. They were places where the high grade shoots in the system crested on the surface. The operations dug and milled until the vein quit paying and moved on to the next one. For perspective, these mines mined 35 tonnes, 327 tonnes, the largest mined about 3000 tonnes, all high grade, and all in fits and starts over more than 50 years. Bulk tonnage operations and modern exploration methods just weren’t a thing yet.

The simple treatment here is that Prize Mining has tied up some very high potential ground, including known resources, in the very mining-friendly Kootenay region. Moreover, they have the guts and money to go after it. The company had $4 million in the bank at their last filing, which should be enough to move the ball forward. CEO Fesial Somji is fresh off of building a producer in Peru, and that’s the kind of feeling that a guy likes to chase. IR Manager Walter Spagnuolo is a guy I know from a previous life. He’s a great promoter with a great work ethic, and I think I’m going to see if he’ll join us on the twitch livestream one of these days.

Prize has a $17M market cap, and it’s tough not to consider that cheap. Chris Parry wrote recently about how a gold stock that held its own weight at .75 is a bargain at .28, and that’s certainly one way to look at it. The stock was sold off as a bunch of cheap paper lost its restriction and got blown out. That’s the kind of thing that one can expect from a gold junior, and Parry is absolutely right when he says that you’ve got to be ready for the big swings in these stocks – it comes with the territory. This is Howe Street, and that means that anyone with cheap paper is unlikely to value the long-term potential of a gold deal over the short term potential of an August running their jet boat. I’d be worried if it was the insiders dumping paper, but an issuer search on SEDI search shows that they’re all still long and haven’t sold into this slide.

I agree with Perry. $17M is cheap for Prize and, if gold goes on a tear, it’s going to look really cheap.

Ashanti Gold

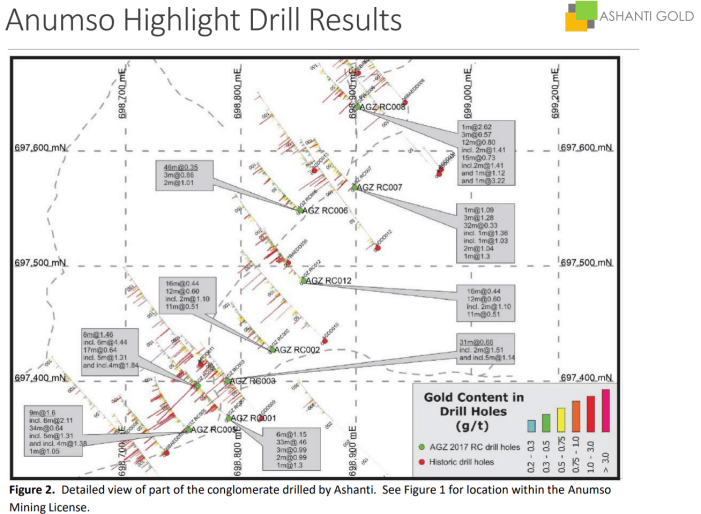

It may seem like a funny place to start, but the people over at Ashanti Gold (AZG.V) are really good at graphical displays of information. Have a look at this map that I clipped from their presentation:

It looks cluttered at first, but it remains clear with no wasted strokes. The 100M grid puts the spacial overlay in context. The colored histograms draw a picture of how this trend shapes up, where it’s swelling, how it’s shaped, etc. This isn’t the only one, either. Their presentation could be a case study in how to lay out a mining story so that it’s well understood by both novice and sophisticated investors. A pat on the back for design chops probably isn’t what Ashanti wants out of me, especially since they’ve got so much else going on, but I think that the ability to convey a story correctly and efficiency is under rated, at least from an investor’s perspective. A company could hit the lost city of El Dorado and have it not make a lick of difference if they can’t explain it. It turns out that CEO Tim McCutcheon is an ex mining analyst, so I surmise that he understands that and I can certainly appreciate it. I take it back, this was a great start.

Ashanti’s Anumso project is in Ghana, where a contingent of majors are in the process of producing from bulk tonnage gold projects. Newmont has a 470,000 ounce per year project that has been operating since 2013. The project is about 10 Kilometres from Ashanti’s Anusmo project.

Major mining camps are operated by major mining companies, and those companies bring infrastructure. They build roads, run power and water and take care of other necessities mostly to feed their flagship operations, but also to facilitate the development of the region. Newmont’s Akyem project is a bulk tonnage operation that is bound to run out of reserves sooner or later and, when it does, Newmont may elect to buy a well-developed asset in close proximity, and continue on operating.

Shareholders have already watched Ashanti’s team put together a 250,000 oz sketch from 2 km of historical drilling, and conduct an aggressive (and economical) RC drilling campaign to give themselves a better handle on what they have at Anusmo. I can’t say enough about this style of aggressive development in a bulk gold area. I’m told they’re in the process of doing the metallurgical testing to further advance the project, while they’re doing the initial trenching and soil work on potential extensions.

Meanwhile, drill results on their Kossanto project (north of Anusmo, in the namesake Ashanti camp) are confirming and further de-risking a zone that historic work has sized up at 247,000 ounces. The appeal up at Kossanto appears to be that a limited amount of work will either put a 250,000 oz – 500,000 oz deposit in a place to be produced from, or find a high grade zone that makes it something much much larger.

Effective mineral exploration reduces to project management and resource allocation. Great operators assess what they have in terms of money and manpower, and allocate it accordingly to de-risk the areas they control. I see a lot of that kind of pragmatic, methodical approach in Ashanti. They know what they’re after and have a realistic path forward, so they march ahead and don’t try to skip steps. Provided the geology and the gold markets co-operate, it’s easy to imagine the company as a fully owned subsidiary of a major in short order.

Ashanti is a tight deal, with only 24 million shares outstanding and a $17M market cap. They’ll likely need to finance soon, and I don’t imagine they’ll have much trouble.

— Braden Maccke

FULL DISCLOSURE: Prize Mining, Nexus Gold and Ashanti Gold are Equity.Guru marketing clients, and the company owns stock in each.