Discovering that your gold property is dotted with artisanal (Mom & Pop) mines is a mixed blessing. On the one hand, it suggests someone has been surreptitiously removing trout from your lake with a hand-line. On the other hand, it proves there are fish in your lake.

This is the situation Nexus Gold (NSX.V) finds itself in.

On June 6, 2017, NXS announced the presence of a new mineralized zone at its Bouboulou Project in Burkina Faso – a landlocked West African nation.

Company geologists noticed increased artisanal mining activity on a previously unexplored part of the property.

The new zone is a kilometer west of the main workings at the Rawema site. The artisanal mine shaft appears to have a depth of about 20 metres.

The new zone is termed “Rawema West”.

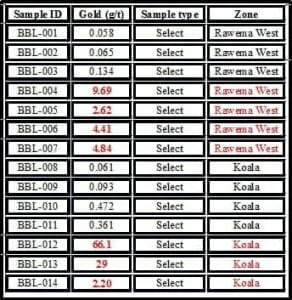

Company geologists collected seven select rock samples of from a pile of waste left by the Rawema West Mom & Pop mining operations. Of the seven samples collected there, four returned values greater than 1 g/t Au, including BBL-004 which returned 9.49 g/t Au.

This fifth zone adds to the four identified zones (Rawema, Bouboulou 2, Pelatanga and Koala) at the concession.

The June 6, 2017 sampling results from both Rawema West and Koala are tabled below:

On June 8, 2017 Nexus announced that it had mobilized a drill rig crew to the Bouboulou gold concession, located 75 kms north-west of the capital Ouagadougou.

On June 8, 2017 Nexus announced that it had mobilized a drill rig crew to the Bouboulou gold concession, located 75 kms north-west of the capital Ouagadougou.

The phase one Bouboulou diamond drill program includes 2,000 metres targeting previously identified mineralized zones. The drill crew will then swing over to Rawema West zone – and the Koala zone that returned the eye-popping sample of 66 grams-per-tonne.

Firstly, let’s deal with the elephant in the room: if you like the “ou” letter combination hot & heavy in clusters – Bouboulou is your man.

In fact there’s no close facsimile – except to move laterally into French where “ou” means “or”.

So if you are jonesing to bark out multiple “ou”s – you’d have to move to Paris, wait for someone to say in [in French]: “Get over here now or…” – then you could interject: “Ou…ou…ou…quelle [what]?”

The point I’m getting at is that Bouboulou is unusual – in its spelling and its combination of mineralogy and location.

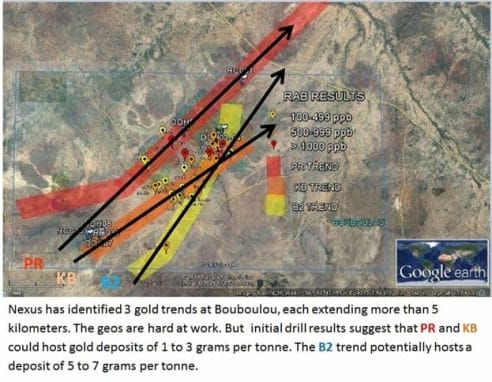

About five years ago, Roxgold completed a diamond drilling program which created the groundwork for Nexus to identified three distinct five-kilometer gold trends at the Bouboulou concession.

Each Bouboulou trend is dotted with the Mom & Pop mine shafts. The reported gold grades fall within normal parameters for economic deposits – but Nexus has a big advantage over many gold juniors: Location.

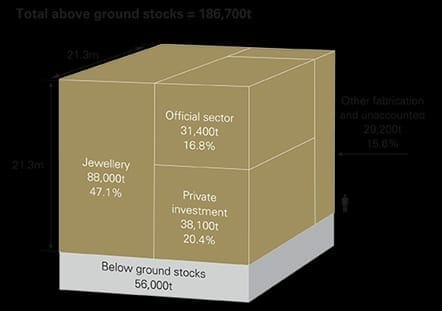

Here’s the thing. Gold’s not that easy to find. Throughout human history, a total of about 185,000 tonnes of gold has been mined. That’s a cube: 60’ by 60’ by 60’. Given all the chatter, the drilling, the blasting and the digging – that’s not a massive object.

Here’s the other thing: There are 7.5 billion people on this earth. Which means, where there’s gold, there’s often a crowd. Or just a smattering of noisy people who don’t want a crater dug into their neighborhood. So they mobilize politically and financially against the mine. As they are entitled to do. And we get scenes like this:

Economic arguments do not always win the day. I was involved with an innovative Spanish gold company attempting to build a modest underground mine in an area with 55% youth unemployment. 80% of the townsfolk demonstrated for the mine. One Spanish resident described the mine as the Pied Piper – bringing its children back home. But the mining permit was denied by the federal Spanish government for reasons unknown [hint: it always has something to do with money].

Every gold junior investor should pose the question: is this project in a location that wants a gold mine?

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years.

According to the Nexus website: ‘Burkina Faso has undergone less than 15 years of modern mineral exploration, remaining under-explored in comparison to neighboring Ghana and Mali.”

Endeavour Mining (EDV.T) – a $2.1 billion market cap gold miner – is building the Houndé project in Burkina Faso, scheduled to begin production in Q4-2017 with annual production of 190,000 ounces at an All-In Sustaining Cost of US$709/oz.

Burkina Faso has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

The Bouboulou property looks like this:

I’ve high-rezzed the photo, blown it up, scanned, and I still can’t find any hippies wearing sensible shoes holding up signs that say: “Ours – Not Mines”.

In April, Nexus completed a Phase 1 diamond drill program at a second Burkina Faso project: the Niangouela concession.

Eight of the first nine drill holes successfully intercepted gold, with highlights including 26.69 g/t gold over 4.85m (including 1m of 132 g/t gold), and 4.00 g/t gold over 6.2m (including 1m of 20 g/t gold). All mineralization in these first nine holes was present at depths of 57m to 124m below the surface.

It’s encouraging to see the locals pull fat trout out of the lake. As a Nexus investor, it’s good to know we’re in a country that hands out commercial fishing licenses.

Keep your eyes on African Gold.

FULL DISCLOSURE: Nexus Gold is an Equity Gold marketing client.