Predictions about looming commodity shortages are frequently overstated because as the commodity price goes up, sub-economic (unprofitable) projects are revitalized to meet the growing demand.

Potash, graphite, almonds and oil – are examples of commodities with over-hyped supply challenges.

Which brings us to cobalt. Flash quiz: what is cobalt?

If you said: “A notoriously violent bar in a sketchy Vancouver neighborhood” – you would be correct – but off topic.

Cobalt is a critical ingredient in lithium-ion batteries.

In 1992 very few people owned cellphones or laptops. Batteries ate up 1% of global cobalt demand. A quarter of a century later, batteries account for 50% of cobalt consumption,

Tesla’s Gigafactory in Nevada will eat 7,000 tonnes of cobalt a year at full production in 2018.

So you’re thinking: “Okay great – let’s build some more cobalt mines”.

Here’s the problem: most of the known cobalt is in sitting in the ground in Democratic Republic of Congo (DRC).

In fact, 65% of global cobalt supply currently comes from the DRC.

But there is an endemic child labour problem in the DRC, which is causing companies like General Motors (GM.NYSE), Apple (AAPL.NASDAQ), Toyota (TM.NYSE), and Ford (F.NYSE) – to look for alternative supplies of cobalt.

Cobalt is in the midst a perfect storm of surging demand and constrained supply. Even if the global cobalt shortages turn out to be significantly over-hyped – that’s a good place to be.

First Cobalt (FCC.V) is Canadian-based cobalt junior, jostling for position in this brave new world of cellphones, iPads and electric vehicles.

FCC controls 7 cobalt properties in the DRC. If that African country can solve its labour issues – drill baby drill.

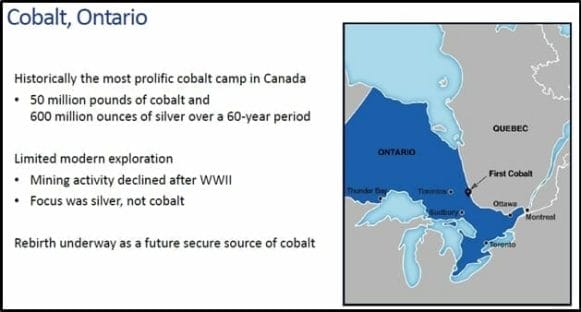

But in the short and medium term, FCC’s 3,000 hectare Cobalt camp in Ontario, Canada is likely to attract more institutional and retail investor interest.

FCC’s Canadian operation includes an option for the former producing Keeley-Frontier high-grade cobalt mine that spat out 3.3 million pounds of cobalt. The company also has a joint venture on a fully permitted cobalt refinery in Cobalt, Ontario.

First Cobalt is a very new company. But it came roaring out of the gate. This is what the 1st 100 days looks like:

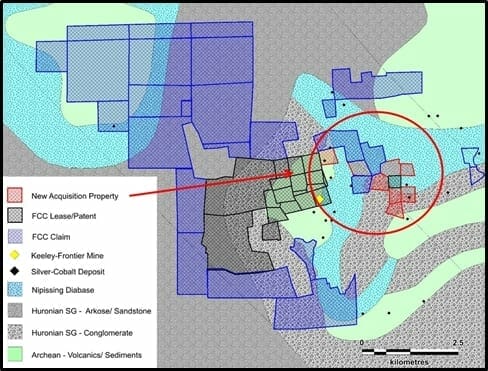

The last item is of particular interest: on June 7, FCC acquired 22 mining claims in Cobalt Ontario – increasing First Cobalt’s footprint in the cobalt district by 40%.

The land FCC controls now includes the former producing Bellellen Mine, which is adjacent to the Keeley-Frontier Mine.

That’s like dating two attractive people who live next door to each other but never get jealous. It turns promiscuity into convenience.

In 2017, First Cobalt plans to test for continuity between the two properties. The latest transaction gives FCC the green light to test for eastern extensions of the Keeley-Frontier mine. Previously the company was constrained by a property boundary.

The increased land package also gives FCC a significant land position at the north end of the camp, next to Agnco Eagle’s properties.

The historic Bellellen Mine consists of a 70-foot shaft that accesses four levels of underground workings. Historical production records indicate that the mine produced 28,481 pounds of cobalt, 38,027 ounces of silver and 13,404 pounds of nickel.

That doesn’t sound like a lot, but remember the Bellellen mine opened over 100 years ago when they were using cast iron spatulas to scratch at the walls of the tunnel.

The possibility of employing modern exploration techniques to connect the Keeley-Frontier vein system to the Bellellen mineralization adds zip to FCC’s Canadian cobalt project.

With the EV market growing at 25% a year, the impending cobalt shortage isn’t just hype and doomsday rumblings.

China’s “Shanghai Chaos Hedge Fund” (SCHF) recently purchased 6,000 tonnes of cobalt, drove it to a warehouse and locked the door. SCHF will bring it out later when the price of cobalt is higher.

It is extremely unusual to find an emaciated 7-year-old working there in an underground mine in Ontario.

That makes First Cobalt’s Ontario project attractive to big corporations like Tesla, who are scrambling to secure ethical cobalt supply chains in North America.

FULL DISCLOSURE: First Cobalt is an Equity Guru marketing client.