Lots to read these days about lithium. Tesla, cobalt, graphite, Powerwalls, Lithium Triangle. Brine, and Clayton Valley, Nevada. Lots of lithium, though most uneconomic (at the moment) to extract. Bottom line: In the unlikely event that lithium can be excluded or replaced in just about everything electronic, exposure – even a small amount – is likely warranted.

There are no lithium futures, options, ETF’s or mutual funds. To get exposure, you have to make stock choices appropriate for your risk tolerance.

After some necessary and hopefully pithy background info, investors may well conclude that to invest in the lithium market through the Clayton Valley, Nevada juniors such as Cypress (CYP.V) at $C0.10 a share, could well turn out to be a reasonable speculation particularly given recent share price weakness (down from C$0.20 in August 2016).

Of all the areas, Clayton Valley in Nevada offers speculative investors the best chance to add quality early-stage companies to their portfolio: in the case of Cypress Development, at a mere 10 cents a share.

Let’s be clear: Lithium is not, as Goldman Sachs suggests, “The New Gasoline.” The metal is more accurately characterized as “Critical to battery power storage and agnostic as to the source; solar, wind, water etc.”.

These are the facts:

- Lithium is abundant in hard rock, brine and clay deposits. To date, ironically, there are very few accessible economically viable deposits.

- Demand will outstrip supply for decades.

- Traditional global fossil fuel companies are buying battery assets.

- Lithium production is dominated by three global companies. 2016 production already sold out.

- As carmakers increase demand for batteries, there’s going to need to be lots of gigafactories. Just to supply auto demand you need 200 gigafactories. (Elon Musk, 2014)

- Lithium inclusion is years ahead of any competing metal.

- The annual lithium market will grow 259% by 2025, representing a compound annual growth rate of 14% across all demand sectors. Lithium-ion battery-based electric vehicles will be a key driver of this demand.

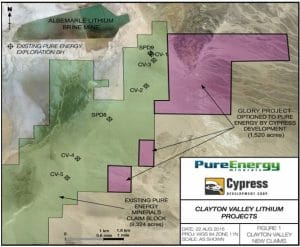

The best way to show the investment potential is to highlight both the Clayton Valley in Nevada, four hours from the completed Tesla gigafactory, and the savvy activities of two relatively small players, Cypress Developments and Pure Energy Minerals. CYP and PE have market caps of C$2.64 million and C$52.5 million respectively.

Global lithium gorilla Albemarle’s (NYSE: ALB) market cap is pushing US$9.4 billion.

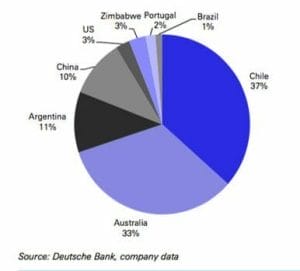

Seventy percent of the world’s lithium comes from three countries in South America. Bolivia and Chile are very difficult to gain exposure due to nationalist policies, which leaves Argentina. Most lithium is produced in Australia and Chile, while most of the reserves are in Chile, Bolivia, and Argentina.

Here is the current definitive, dynamic list of the lithium companies in all countries. Except Cypress. Let’s get to the salient points.

PE approached CYP to negotiate an Option Agreement for the right to acquire up to 70% undivided interest in the 1,520-acre Glory package of Federal mineral claims. The Cypress Glory Property adjoins Pure Energy’s Clayton Valley South Lithium Brine Project on the eastern side of the valley.

Other deals were available to CYP but the Company wanted a deal with PE because it shares PE’s vision of building new lithium mines in the Clayton valley using new technologies and doing it as rapidly as possible.

In order to fully exercise the two-stage option, Pure Energy is to make the following cash and share payments and associated exploration investments in the Property:

Cash and share payments of US $75,000 and 350,000 shares within five business days of the date of Exchange acceptance for the agreement:

- Exploration expenditures of at least US $300,000 before the first anniversary;

- Cash and share payments of US $100,000 and 750,000 shares on or before the first anniversary;

- Additional exploration expenditures of US $500,000 before the second anniversary;

- Partial vesting of 51% undivided interest is reached upon satisfaction of the above;

- An additional 1 million shares and US $1 millions of exploration expenditures before the fourth anniversary to complete vesting at 70%.

The agreement allows CYP to advance its Glory Project while working with and utilizing the geological expertise of the Pure Energy team. Unlike standard mining processes, lithium exploration and production technology plays a greater role.

With the final goal to produce significant Lithium Carbonate Equivalent (LCE) methods are constantly being improved, refined, made more cost effective and most importantly, environmentally friendly. It would be prudent to factor a company’s technology commitment, development and practices into any investment discussion.

The three aspects to this tome for investors is lithium supply and demand, primarily dealt with above, the relationship between Cypress and Pure Energy and the potential fate and future ownership of the Clayton Valley. And why Cypress makes a quality speculative vehicle for junior metal portfolios.

1. Cypress Development’s flagship 1,520-acre Glory Lithium Project, totaling 76 placer/lode claims, is located in the heart of the Clayton Valley lithium exploration area of Esmeralda County, State of Nevada, USA. (under option agreement to Pure Energy)

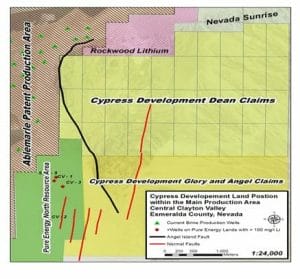

2. In September 2016, Cypress reached an agreement to acquire a 100% interest in the 2,700-acre (35 association placer claims) Dean Lithium Project located in the heart of the Clayton Valley lithium exploration area of Esmeralda County, State of Nevada, USA: Adjoining the CYP/PE Glory Lithium Project.

3. Cypress Development has acquired a 100% interest in the 1,780-acre Alkali Valley Lithium Brine Project, totaling 89 placer claims, located in Esmeralda County, Nevada. These properties represent both brines and clays, but it is important to note that these clays are not hectorite – which are extremely difficult and costly to extract lithium – but lithium-rich claystones uplifted portions of the stratigraphy within which the lithium brines of the basin are found and produced.

“Additional assay methods are proving the lithium in the mudstones and claystones, and the uplifted lake basin sediments, is highly leachable at low temperature, proof positive that the mineralization is not contained in hectorite,” said CYP PGeo, Robert Martin. “Hectorite must be heated to >1000 degrees centigrade for a period of time before it can be leached using a highly caustic, concentrated acid treatment. So by early March 2016, Cypress knew we had made a serious discovery in terms of not only well-mineralized rock but also had to some extent stumbled onto the fact the mineralization was amenable to leaching with very dilute acid at room temperature. And this meant, and means, that these mineralized rocks can be treated at much lower cost due to vastly decreased energy requirements and with much more environmentally friendly solutions.”

Cypress’ 2016 extensive surface sampling programs have yielded grades (up to 3830 ppm Li) that are the highest in the Clayton. The Company’s 2700-acre Dean Claim Group is located adjacent to producing lithium brine wells belonging to the Albemarle Silver Peak Mine on its west boundary, Pure Energy’s resource area on its southwest boundary and Cypress’ existing Glory Clayton Valley Project, optioned to Pure Energy, on its southern boundary.

The Phase 3 program, announced late September, was to allow the Company a propertywide view of lithium distribution contained in the surficial volcanoclastic, calcareous mudstone material that covers the property.

Donald Huston, President, Cypress Development Corp commented, “Cypress is excited and very pleased to have our land position in Clayton Valley recognized as a value add to both companies through this Option Agreement with Pure Energy Minerals. Cypress already has Federal permits in place, so the Clayton Valley Lithium Property offers an immediate opportunity to drill for additional lithium resources. Planning for the field program is well advanced, and we should see field crews mobilizing for a systematic sampling program in the next two weeks. We look forward to working with and utilizing the geological expertise of the Pure Energy team.”

Segueing to Pure Energy

“We are excited to expand our presence in Clayton Valley through this option agreement with Cypress Development Corp.,” said Pure Energy Minerals CEO Patrick Highsmith. “Once the option is fully exercised it will add significantly to our contiguous mineral rights, bringing the total to more than 11,000 acres. Cypress already has federal permits in place, so the new property offers an immediate opportunity to drill for additional lithium resources. Planning for the field program is well advanced, and we should see field crews mobilizing for a systematic sampling program in the next two weeks. We look forward to leveraging our productivity in the field by working with the Cypress team.”

Pure Energy is a lithium-brine resource developer that is driven to become the lowest-cost lithium supplier for the burgeoning North American lithium battery industry. Pure Energy is currently focused on the development of our prospective CVS Lithium Brine Project, which has the following key attributes:

- A large land position with excellent existing infrastructure in a first-class mining jurisdiction: Approximately 9,544 acres in three main claim groups in the southern half of Clayton Valley, Esmeralda County, Nevada;

- Adjacent to the only producing lithium operation in the United States (Albemarle’s Silver Peak lithium brine mine);

- An inferred mineral resource of 816,000 metric tonnes of Lithium Carbonate Equivalent (LCE), reported in accordance with NI 43-101;

- Metallurgical and process studies underway to better understand the feasibility and economics of using modern environmentally-responsible processing technology to convert the CVS brines into high purity lithium products for new energy storage uses.

More than just an option relationship, PE brings a very robust technology plank to the arrangement. And of course, there is always the possibility that the relationship will grow.

From PE’s website: Pure Energy’s objective is to develop and demonstrate an innovative, sustainable and enhanced lithium extraction process as an alternative to the conventional evaporation based technology.

PE is working with global technology and mining services provider Tenova Bateman Technologies (TBT) at the process testing, engineering, and design stage on the Clayton Valley South Project. Early indications at the lab scale and beyond are that the TBT process may outperform conventional and other alternative technologies for lithium recovery from certain brines.

After researching and evaluating several approaches to the challenge, Pure Energy has advanced through laboratory trials and into a mini-pilot plant evaluation of some exciting new technology.

- Brine pre-treatment (LiP) testing exceeded expectations for lithium recovery and rejection of magnesium and calcium. Two membranes have been short-listed and are undergoing additional testing;

- Confirmed initial favorable results from the solvent extraction lithium recovery circuit (LiSX) — highly efficient lithium recoveries into solvent and very low levels of lithium in residual brine;

- Successful conversion of lithium sulphate into lithium hydroxide by electrolysis (LiEL) — achieving higher current efficiencies than anticipated.

The technology to make lithium extraction more environmentally friendly, cost effective and faster is the goal of companies like PE.

Contiguous to enhanced mining technology are several companies making lithium use more effective and safer. Panasonic has developed a Flexible Li-Ion battery with enhanced charge life and safety; it is targeted to card type and wearable tech. Twisting does not affect the functionality or charge time.

“Yuan Yang, assistant professor of materials science and engineering at Columbia Engineering, has developed a new method to increase the energy density of lithium (Li-ion) batteries. He has built a tri-layer structure that is stable even in ambient air, which makes the battery both longer lasting and cheaper to manufacture. The work, which may improve the energy density of lithium batteries by 10-30%.”

A team from the Berlin-based HZB Institute for Soft Matter and Functional Materials headed by Prof. Matthias Ballauff found that after discharge, about one lithium ion per silicon node in the electrode remained in the silicon boundary layer exposed to the electrolytes. Seidlhofer calculates from this that the theoretical maximum capacity of these types of silicon-lithium batteries lies at about 2300 mAh/g. This finding is more than six times the theoretical maximum attainable capacity for a lithium-ion battery constructed with graphite (372 mAh/g).

Conclusion: Whenever one reads an article regarding lithium companies, it’s a good bet Cypress is not included. Shame, really. CYP put together a series of quality properties including its Glory Clayton Valley Project, which is within a 0.5 mile of lithium brine wells belonging to the Albemarle Silver Peak Mine. CYP shares its western boundary with the lithium resource area of Pure Energy’s Clayton Valley South project.

Albermarle recently purchased Rockwood Holdings, a leading global developer, manufacturer and marketer of technologically advanced and high value-added specialty chemicals for $6.2 billion. It is a leading integrated and low cost global producer of lithium and lithium compounds used in lithium-ion batteries for electronic devices, alternative transportation vehicles and future energy storage technologies,

Cypress has also delivered samples with the highest grades in the area (3830 ppm Li) and an average 95% Li recovery rate. All that remains now is to execute – with and without Pure Energy – a comprehensive drilling program.

Given CYP’s location and quality of lithium found so far, it’s likely one of the behemoths, such as Albermarle will consolidate the area or at the very least there will be more JV’s, PE type option deals etc. Very soon, if not already, virtually all of the current production (Albermarle is the only current lithium producer in Clayton Valley) has or will be sold to Tesla. Likely there will be more M&A and JV deals for future production once reserves are proved up.

As mentioned, lithium is not a price play. Since there are no true or standardized pricing mechanisms, it can fluctuate wildly in various countries including China.

Continuing development of new extraction technologies through companies such as Pure Energy will continue to lower costs and increase production particularly in softer claystones that populate a portion of the CYP/PE lands as well as CYP alone.

So in conclusion, for investors who feel that lithium is a way to participate in exploration, production and technology advances, Cypress at around 10 cents a share is likely a reasonable addition to a speculative portfolio.