Copper right now is going through a renaissance, and that’s great news for Los Andes Copper (LA.V), which is sitting on a big pile of it and has been quietly wondering when the world would realize it for a while now.

Well, it appears the duck’s feet were working hard under the water for all this time, as the company has put out an announcement that is big news. BIG. NEWS.

And it appears nobody saw it.

The headline read: Los Andes seeks to raise up to $9 Million

Great. I’m seeking Charlize Theron on a day when she’s suffering from low self esteem. ‘Seeking’ isn’t news. ‘Sorted’ is news.

And the big news here isn’t that LA wants to raise $9m, it’s that IT ALREADY RAISED $8M by virtue of a wack of cash from an insider.

That’s right, their shit is financed. They’re going forward. They’re dropping drill bits into the ground like Kanye dropping benzos.

The Company is arranging for the sale of up to 30,000,000 units (the “Units”) priced at $0.30 per Unit, with each Unit consisting of one common share of the Company (a “Unit Share”) and one detachable share purchase warrant entitling the holder thereof to purchase one additional common share of the Company (a “Warrant Share”) at a price of $0.45 per Warrant Share for a period of 3 years.

$0.30 per unit on a stock that’s currently trading around $0.20. That’s interesting. What else you got?

Turnbrook Mining Ltd. (“Turnbrook”), the Company’s largest shareholder, has committed to purchase 26,800,000 units for a total amount of $8,040,000.

Whaaaaaaaaaa?

Turnbrook is an insider group that owns 51% of LA.V, and with this placement will be up over 60%. Is that just based around the high interest in copper right now as it charges up the price charts, or is it confidence in LA.V’s copper play proper? I’d lean to the latter.

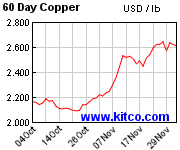

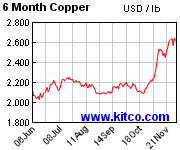

Copper finally took a turn to the upward a few weeks ago as a result of the Make America Great Again campaign, and a general bullish turn on base metals. Today, copper is trading around $2.68, up $0.07, and is running past its signal to a technical break out buy.

The argument for the move is that Chinese demand and new interest in infrastructure spending in America will make for steadily increasing copper demand in North America. While copper has been the red-headed stepchild of the investing markets for a while now, charts can be your friend.

The biggest miners on the planet produce copper. Freeport McMorRan (NYSE:FCX), Glencore (LSE: GLEN), BHP Billiton (NYSE: BHP) all derive the bulk of their fortunes off copper mining, and though the market has taken a downturn for several of the last few years, copper is still in demand. In fact, as the economy goes, traditionally, so goes copper. As a predictor of future prosperity, it is a vital ingredient in the building out of the modern world.

The biggest miners on the planet produce copper. Freeport McMorRan (NYSE:FCX), Glencore (LSE: GLEN), BHP Billiton (NYSE: BHP) all derive the bulk of their fortunes off copper mining, and though the market has taken a downturn for several of the last few years, copper is still in demand. In fact, as the economy goes, traditionally, so goes copper. As a predictor of future prosperity, it is a vital ingredient in the building out of the modern world.

The largest copper producer on the planet is a Chilean state owned company called Codelco, which produced 1.893 million tonnes of the stuff last year to send to, guess where?

I can go on and on about China and their appetite for global financial domination and their insane commodity buying sprees and real estate cornering and odd old man fan dances, but none of that is news. Let’s focus on how we can make money of the recent turn in copper.

I can go on and on about China and their appetite for global financial domination and their insane commodity buying sprees and real estate cornering and odd old man fan dances, but none of that is news. Let’s focus on how we can make money of the recent turn in copper.

The first place to look is one Lucas Lundin, the billionaire mine finder and global financier who just financed Filo Mining Corp (FIL.V) with a $20 million placement at $2.00 a share. As global billionaires usually do, some family trusts in Luxembourg subscribed for the lion’s share of that placement and they now own collectively 20% of the approximately 51 million shares outstanding. Lundin’s is a top quality company and lists an inferred resource on its website of 3.3 billion lbs Cu; 4 million oz Au, and 149.8 million oz Ag.

FIL trades at approx. $1.60 and, knowing the Lundin machine, it will probably go to $10. Do you remember Redback Mining back in the last commodity cycle? Lundin sure does.

When the Lundin’s of the world start throwing down $20 million on a base metal that, until recently, you couldn’t sell for beer money, it’s time to pay attention. And while Lundin is messing about in Chile, so too is Los Andes.

They own the Vizcachitas Property, a porphyry copper-molybdenum deposit that offers potential for a low strip, open pit operation in an area of low elevation with excellent infrastructure, including water and power. The Vizcachitas deposit occurs in the same metallogenic belt as the large copper- molybdenum porphyries Rio Blanco-Los Bronces, Los Pelambres-El Pachon and El Teniente, so it has pedigree.

Los Andes filed a PEA and an updated resource estimate on the Vizcachitas Property that resulted in a nice increase in indicated resources The updated estimate was based on a total of 146 drill holes and 40,383 metres drilled, including a total of 16 drill holes and 5,128 metres of drilling completed after the June 9, 2008 estimate.

At a 0.3 % copper equivalent (Cu Eq) cut-off, the Indicated Resources are 1,038 Mt at 0.434 % Cu Eq (0.373 % copper and 0.012 % molybdenum), containing an estimated 8.5 billion pounds of copper and 281 million pounds of molybdenum, and the Inferred Resources are 318 Mt at 0.405 % Cu Eq (0.345 % copper and 0.013 % molybdenum) containing an estimated 2.4 billion pounds of copper and 88 million pounds of molybdenum.

Don’t you love it when you have to go back and read again to make sure you saw ‘billions’ right and that it wasn’t actually ‘millions’?

When nobody cared about copper exploration and all the major mining companies were taking massive write-downs, Los Andes did something crazy and actually went out and drilled.

Their results were incredible. The most impressive was 502.0 metres of 0.631 % copper, 209 parts per million molybdenum and 1.3 grams per tonne silver from 130 m downhole, including 54.0 m of 1.023 % Cu, 128 ppm Mo and 1.4 g/t Ag from 130 m downhole, and 396.3 m of 0.566 % Cu, 233 ppm Mo and 1.2 g/t Ag from 235.8 m downhole.

If you’re not a mining guy, uncross your eyes and read the above as “found good stuff.”

And this: The inferred resource of 318 million tonnes is massive for a company with a $50 million dollar market cap.

Los Andes has a multi-billion dollar in-ground opportunity, if it’s worked the right way. I can’t tell you if that work has been happening, but I can say it’s been dead silent for a long time, which makes folks think the execs are out playing golf when, in actual fact, it appears something has been happening with the major investor in the company.

If you’re looking for a reason to hate, you’ll rarely struggle in the resources space, and LA isn’t shy of ‘and but’s. The big criticism here: 218 million shares outstanding and limited daily trading volume.

I imagine that will change, in time. How much time is the question.

— Chris Parry

FULL DISCLOSURE: The author has bought Los Andes Copper shares on the open market.