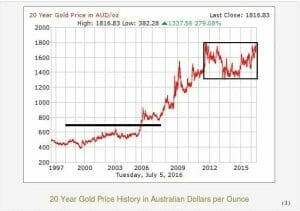

This morning the AUD gold price broke out to a new all-time high. (Currently trading 1832 per ounce.)

A round of applause, if you will.

Gold is back, bitchez.

Yesterday I outlined my thinking behind the inception of the ‘EG Five Arrows Trust‘, the main holding of which is GDX (NYSE:GDX) the Gold Miners ETF.

After looking at the GDX chart today, I realize I’m fairly late to the party. Still want to be long and still super-bullish on the PMs but my buy wasn’t exactly a great entry point. Note the annotations on the chart above.

Here’s what I intend to do:

Sell some GDX Aug 29 dollar calls against my long stock position (GDX160819C00029000) on the market open Wed July 06. This should mitigate against any short-term down-drafts in the SP.

Looking at some of yesterdays quotes I’m confident that I can get the calls away for somewhere in the 275c to 300c region (per contract). This should make the position easier to stick with as it buffers us against short-term volatility.

Contrary to popular opinion, I believe a good entry is everything

Looks like /CL is breaking down as well. Though about a position in SCO, but I’ll sit on the sidelines for now as I expect the negative correlation of Gold/Oil will hold up for a while, so we should get the benefit there, nevertheless.

With the futures red, looks like the Turtle is in for another rough ride.

Update:

Would have easily been filled during the morning session on my short GDX calls. Let’s be conservative and take an assumed fill @ 274c x 2 x 100 = 548 bucks (less commissions) back into the brokerage account.

–// Craig Amos

(1) Source: http://goldprice.org/gold-price-australia.html

NB: As stated in my earlier post, these are not live trades. This is an educational piece on how to actively manage a portfolio.