What a time to be alive! ..If you’re running a small gold company that, for the last three years, has been kicked about by anyone and everyone.

As a sector, resources is, straight up, coming back hard right now, and as the big kahuna of the dig-dug crowd, gold is leading the run. Smallcap explorers like Integra Gold (ICG.V) and mid-tiers like Newmarket Gold (NMI.T) alike are picking up big time on share price, and going hell for leather on volume.

Ongoing political troubles around the globe haven’t hurt, as apocalypse gamblers see gold as a safe haven in times of trouble. And the need to put all that formerly oil-invested cash in a place that won’t collapse has also boosted the shiny somewhat.

But what’s really putting the upward pressure on metals is that the crunch of the last five years has shut down too much supply. Eventually, you just flat out need ore to be dug out of the ground to keep our appetite for new phones and electric cars and ever larger McMansions sated.

Name me a mineral that isn’t in a state of undersupply, or at least a nearing undersupply right now, that doesn’t rhyme with ‘schmickel,’ and I’ll show you a rarity.

New mines are few and far between, and to get a new mine going now means perhaps five years of permits and drilling and negotiations with government and first nations peoples and… admittedly, this has been the case for some time, but the pendulum has swung so far into the ‘shut her down’ side of the equation that it’s now become a case of “I don’t care if war is coming or China collapses or real estate is a bubble, someone get me a gold mine close to production – stat!”

Trust me on this, I was the last one to come to this conclusion. Gold bugs and silver foxes and copper pigs and graphite grunts have been yelling this for a long time, and I’ve generally laughed in their general direction.

“I’m telling you,” said CEO.ca honcho Tommy Humphreys to me six months ago, “mining is coming back.”

“This is it. It’s going to go nuts,” he said. “Cool story, bro,” I replied, running my finger along all the tech stocks in my portfolio, like Dr Evil looking over his plans for world domination using sharks with fricking laser beams on their heads.

“I’m telling you,” said Tommy. “Get on board now.”

Well, he was right. I still like my tech stocks but.. oh, who am I kidding. With the mess the likes of Valleant have made in the biotech space and the continuing resistance of Canadian investors to recognize the words ‘growth phase’ as a valid reason for profits to be absent for a quarter or two, and with oil companies looking as healthy as the kid in school whose mother kept him out of sports because he couldn’t eat dairy, resources are it.

That’s not say every resource sub-sector is healthy. You wouldn’t want to be buying coal or steel or aluminum right now, as an example. Or ever again. And graphite had a mini-boom based on Tesla’s grand plans, that has since been overtaken by the reality that lithium will be far more important.

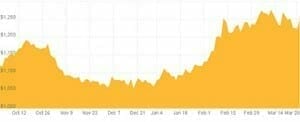

But gold is up big time, in price and volume.

Silver is up the same.

Copper, zinc, platinum, even diamond spot prices are on a charge.

So where does that leave you in terms of jumping in? Well, the old rules that have applied during the trying times (2012-now) still apply. Let’s not get all romantic that the only thing that matters is a company is an active participant in an industry. If you spend the time looking for those companies that actually moved upwards during the down times, you’re going to find they dominate during the strong times.

Strong candidates IMO:

Newmarket Gold (NMI.T): A newsletter writer darling, Newmarket went from private obscurity to a public listing when it took out Australian producer Crocodile Gold, a move that required some finagling due to overlapping deals with Aurico Gold. The Australian dollar is not so high against the US buck, which brought instant value from an outfit producing solid revenues in a country that LOVES miners.

Newmarket Gold (NMI.T): A newsletter writer darling, Newmarket went from private obscurity to a public listing when it took out Australian producer Crocodile Gold, a move that required some finagling due to overlapping deals with Aurico Gold. The Australian dollar is not so high against the US buck, which brought instant value from an outfit producing solid revenues in a country that LOVES miners.

The Crocodile assets include three producing mines which is EXACTLY what you want now, when nobody has been starting new mines for a while and demand for the end product is picking up. On the other side, Newmarket is drilling like fury at its founding properties, so the potential for expansion is real, and the stock price is reflecting that.

Last September, NMI was at $0.82. Today it’s busting through $2.30 and showing no signs of being affected by psychological barriers. It blew through $2 like it blew through $1, and the volume has been popping.

After an upward move like that, you might wonder if the value has already been extracted out of the deal, but Frank Holmes was predicting a $4 share price six months ago, so if his opinion holds water (and it usually does), you’re still a potential double away from ‘meh’ time.

Integra Gold (ICG.V) is another Holmes favourite, and has been one of mine forevs. A plucky band of contrarians, Integra has been engaging in ‘let’s do the opposite of what everyone else does’ for a few years now, and it’s working for them. They’ve worked their way through a large share sale by one investor, which depressed the price for a while, but now it’s starting to slingshot; $0.27 in September last, $0.47 now. By giving away terabytes of drilling data for free and offering $500k to the person who came up with the best targets, they stole the show at PDAC and ran the first ‘marketing can be fun’ campaign to the general public, I think, ever.

And the big boys are taking notice: Eldorado jumped in with a $16m buy, and there’s been much talk about how that may have been just a taste for what’s to come. Interestingly, Eldorado has been late to file this quarter… something moving?

Richmont Mines (RIC.T) has positively blasted off over the last eight months, moving from a flat (read: healthy in the context of the market over the last few years) $3.80, and now into the mid $7 range on the back of the fact that it just found a boatload more gold under its existing, producing mine.

Consider this: If you see gold on the rise and believe it will continue to do so, where are you going to get real value? Out of a junior explorer that’s five years from getting a mine up, or a company that is already pulling it out of the ground, already has a mill and infrastructure, and just fell ass backwards into a mineralization that’s twice as thick, and twice as pure?

And if you’re a major, looking to take advantage of what you see coming, what makes most sense – buying Richmont at $10 and adding it’s revenue and potential, or buying three geos and a dog at $0.23 and hoping they can get permits… soonish?

Claude Resources (CRJ.T) is another company that is churning higher quickly, or at least was until Silver Standard (SSO.T) came along and made them an acquisition offer. The deal gave them a premium of 20% to share price and would turn the combined company into a $330m cash holding, gold producing, $735 per ounce all-in costing, exploration hastening bad boy – but some shareholders wonder if the stock wouldn’t have long passed the premium price if the offer had never happened.

If you’re the type that likes the potential for multiples that the penny stocks bring, rest assured, a rising tide will still lift the boats at the long term development and exploration end of town too.

In fact, my canary in the coal mine (ugh, coal) for the real health of the resources sector has long been Riverside Resources (RRI.V). A true prospect generator, led by the Energizer Bunny of mining, John-Mark Staude, Riverside never stops acquiring, flipping, and partnering, and has been doing so for years. When folks were talking up the sector last year and Riverside was moving downward, I went and focused on tech and weed because, as goes Riverside, so goes the market.

But look at Riverside now. A double since late January.

Sure, that’s because the company has been doing deals but listen to what I just said – RIVERSIDE IS DOING DEALS. Companies that want to get in on the coming wave NOW, and need to acquire actively explored, affordable, promising slates are running through Riverside’s offerings and making deals, and Staude, who has cash and has done well preserving it, so doesn’t have to move with desperation, is taking those deals. Because the deals are good.

The market is turning upwards. Mining is turning upwards. This will be the moment where, if you play it smart, you’ll make bank going forward. Wait it out a few more months and you’ll miss, as most did over these last few months, the next doubling. Choose your targets based on solid management, track records through dark times, and the ability to be nimble moving forward, and we’ll be eating steak this time next year.

–Chris Parry