Sunniva (SNN.C) dropped 42% today after they announced another several-months delay in construction of their Cathedral City, California glasshouse.

Making matters worse, their proposed sale of their Okanagan-based Sunniva Medical facility to CannaPharmaRx (CPMD.Q) has also suffered a delay, and it’s put some severe limitations on the available cash they were hoping to use to continue financing the glasshouse.

“Today’s announcement of the deferral of our previously planned operational date is disappointing; however, we do not feel that this setback will have an impact on the long-term value that may be created from the glasshouse, and we remain confident that the cannabis grown in this facility will be of the highest quality in the industry,” said Dr. Anthony Holler, chief executive officer of Sunniva.

The company had been allocating available capital to finishing the glasshouse and reduced the amount they use to buy third-party flower and biomass for their extraction facility. The delay left them short, and the company won’t be able to meet their proposed revenue benchmark of $55 million to $60 million from sales.

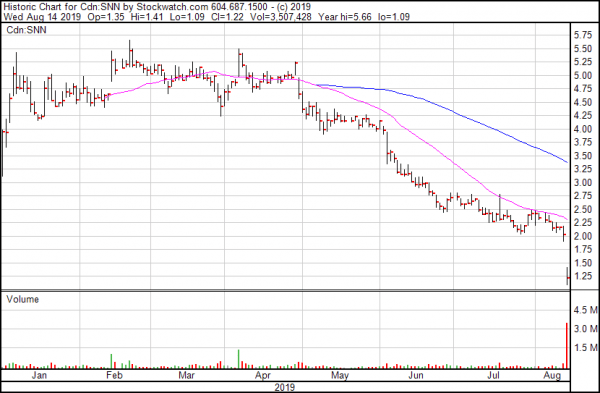

Here’s how the market responded:

Sunniva, a vertically integrated medical cannabis company, received their final approval to build a 489,000-square-foot cultivation and production facility in Cathedral City, California in 2018.

It would come in two phases.

Phase I: They will build a greenhouse that is 246,000 square feet with 78,000 square feet of header house and breezeway for a total of 324,000 square feet. This buildout alone is expected to produce 81,000 kilograms per year of cannabis, and approximately 50% of the initial production is going to be converted to cannabis extracts.

Phase II: They will increase the greenhouse by 180,000 square feet. Within this kind of increase, production is estimated to grow to 45,000 kg per year.

In April 2019, the company announced that the completion of the greenhouse would be delayed, and the capital costs would be boosted to $95 million due to additional costs expected for the temperature control and lighting systems and additional infrastructure on phase 2.

The above chart indicates that Sunniva’s investors are a forgiving type, but in May when the company bailed on their Okanagan cultivation facility, enough was enough. The company promised to focus on its California asset, and now they’ve suffered through another delay.

Compared to some of the loss-makers operating in the cannabis space right now, Sunniva’s fortunes still aren’t horrible.

The company brought in $5.3 million in revenue for the quarter, an improvement over 18% from the same time last year.

“We are pleased with the performance of our operations in the first half of the year. The $19.5 million in revenue is greater than the total revenue generated in all of 2018. We have demonstrated our ability to produce large volumes of cannabis products, and combined with our distribution and packaging capabilities, we have been able to successfully deliver that product into the California market,” said Kevin Wilkerson, president of Sunniva.

At least that’s something to work with, because as it stands right now, those holding the line don’t have much else.

—Joseph Morton