On March 20, 2019 VitalHub (VHI.V) announced that it has acquired 100% of The Oak Group assets.

The Oak Group has developed proprietary software called ‘Making Care Appropriate for Patients’ (MCAP) System. 22 hospital groups use MCAP daily across the U.K and in the Middle East representing over 10,000 hospital beds.

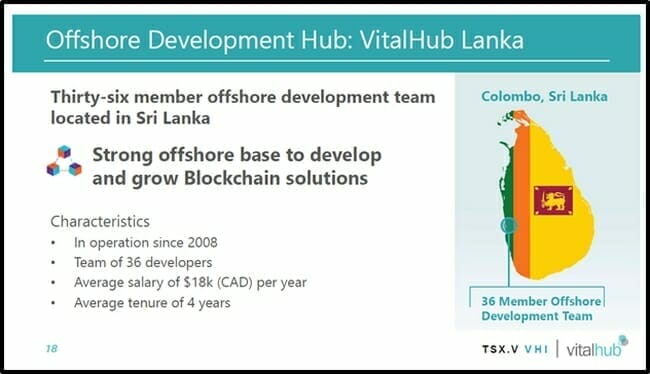

VitalHub is committed to centralising healthcare information systems in the Mental Health, Long Term Care, Community, Home Health and Hospital sectors – employing Blockchain, Mobile, and Web-Based solutions.

VitalHub’s super-objective is to enable interoperability among existing health data systems.

Interoperability is the ability of different information systems, devices or applications to connect in a coordinated manner.

According to a 1997 U.S. National Library of Medicine report, “sources of electronic patient information reside on many isolated islands that are difficult to bridge.”

“As an intern at Boston City Hospital in 1965, I spent enormous amounts of time chasing and managing patient information,” recalled one veteran physician, “At the time, computers offered major assistance to financial bookkeepers. It seemed a small stretch to imagine they could do the same for clinical chart management.”

Yet – here we are – half a century later – Electronic Health Records (EHR) are a messy patchwork of data management protocols.

In an era when you can shoot and edit a feature film on a Smart-Phone, Boston nurses are still faxing CT-Scan reports to their colleagues in other medical institutions.

How could this be?

5 stubborn arguments against EHR:

- Privacy Issues: EHR systems are vulnerable to hacking, sensitive patient data could fall into the wrong hands.

- Inaccurate data: Data entry errors could be introduced and then compound by machine learning.

- Patient Fear: Because EHR enables patients to access their own medical data, it can create a situation where a patient becomes unreasonably panicked.

- Malpractice Liability: EHR gives doctors greater access to medical data, making it easier to sue a doctor for malpractice if he/she fails to access all available digitized information.

- Doctor income retention: EHR makes is easier for patients to change doctors, therefore disincentivizing some doctors to adopt the technology (for fear of losing patients).

All technology is not created equal.

The EHR software, eClinicalWorks – used by 850,000 U.S. health professionals has attracted a lawsuit and a dossier of troubling reports – suggesting “the company’s technology didn’t work the way it said it did.”

Some 30,000 prescriptions lacked proper start and stop dates, introducing the opportunity for under- or overmedication. The eClinicalWorks system did not reliably track lab results. The lawsuit claims 1,884 medical tests did not generate coherent outcomes.

The takeaway: VitalHub is fighting headwinds – and winning.

VHI’s robust two-pronged growth strategy, targets growth opportunities within its product suite while pursuing an aggressive M&A plan.

VHI tackles $900 billion problem

VHI streamlines mental health in Yukon

VHI sells medical info system to Toronto Hospital

VHI sells B Care Electronic Health Record

VHI sells TREAT EHR solution

VHI acquires Roxy Software

VHI tackles $900 billion Patient Flow Problem

VHI strikes gold

The Oak Group’s MCAP software is used to place and identify patients for admission or continued stay at the most appropriate level of care. Its data-gathering and reporting system is used in the medical, surgical and mental health environments.

According to Canadian Centre for Addiction and Mental Health, the economic burden of mental illness in Canada is estimated at $51 billion per year.

With the mentally ill, the need for EHR is amplified, because the patients are often incapable of summarizing their own clinical histories.

On August 21, 2018 VHI announced the sale of the TREAT EHR solution to a Toronto-based young adult mental health agency.

According to the Decision Research Group, “Industry projections expect the global Blockchain Healthcare market to grow to $2.3 billion by 2021, up from roughly $340 million in 2017.”

On November 26, 2018 VHI released its Q3, 2018 financials (ended September 30, 2018).

Q3, 2018 VHI Financial Highlights (figures rounded):

- Revenue of $2.1 million

- Revenue increase of 1,224% over the same period last year.

- Revenue increase of 14% over Q2, 2018

At end of January 2019, Oak Group had a trailing 12-month revenues of $847,000 of which $751,000 is recurring in nature, representing a gross margin of 74%.

The acquisition of Oak Group was an arm’s length transaction for which no finder’s fees were paid.

“Utilization of healthcare beds is a timely issue not just in Canada but around the world,” stated Dan Matlow, CEO of VitalHub, “We believe we have the ability to grow this asset in an organic fashion.”

Vital Hub paid $1.64 million for the acquisition, comprised of $751,000 cash and

4 million common VHI shares @ .22, worth $887,000 to the Oak Group.

Full Disclosure: VitalHub is an Equity Guru marketing client, and we own the stock.