There’s been lots of activity in the cryptosphere, from the announcement of a high visibility IPO, the reverberations of Bitcoin’s bull run, but also an ominous note for 2021.

This is probably going to be the last coin collector entry of 2020, because the following two Fridays are the 25th and the first respectively, so Happy Holidays and Happy New Year, and we’ll see you on the eighth.

It’s time for your Friday coin rundown. Let’s see what happened.

Here are your top ten coins.

Bitcoin

market cap $425,771,672,298

Probably the biggest news in cryptocurrency is the mix of Bitcoin bypassing its 2017 all-time high with no signs of slowing down mixed with Coinbase filing their IPO documents with the SEC in the United States.

The all-time high, I have to say, is fairly scary. It’s got a lot of the same hallmarks of 2017, complete with the herd mentality of people showing up without actually understanding what they’re getting into. I’m hoping that the correction leads to a new affordable baseline price. This $24K is too hard on my wallet right now.

Here’s a quicky on the Coinbase IPO:

Source: coingecko.comEthereum

market cap $74,087,225,763

Microsoft and firm Ernst & Young announced that Microsoft’s Ethereum blockchain-based solution will extend to gaming rights and royalties management.

Microsoft’s solution for this use case is being conducted on a private Quorum network based on Ethereum, and the expansion will provide a financial system of record to allow for royalty agreements. It’s a natural fit for Ethereum’s smart contract platform. If your console of choice is Microsoft’s Xbox, then you’re probably going to run into it in 2021. It’s also going to extend its capabilities to its vast network of artists, musicians, writers and other content creators, allowing them increased functionality in terms of tracking, management and payments processing for royalty contracts.

“The solution will let partners know exactly what they’ve earned in real-time, and allows Microsoft to record the transactions in an automated, fully compliant way. Ultimately this project will touch thousands of partners, who all rely on timely and accurate royalty payments, as part of their business model.” Luke Fewel, general manager of global finance operations at Microsoft

What I’m going to be looking for with Ethereum in 2021 is how well this scales, because as I’ve said in previous weeks, if Buterin can’t make good on his promises, there are plenty of other coins ready to drink his milkshake.

XRP/Ripple

market cap $26,190,635,842

Now for your amusement, Bitstamp issues an apology after their most recent report calls XRP, and a few other altcoins, “toxic waste.” It also said fuck a lot and called Bitcoin Cash and Bitcoin SV pieces of shit. And didn’t have anything to say good to say about Stellar Lumen or Litecoin, either.

Naturally it received a backlash from the virgin ears crowd for whom “words are violence” and then fired back with a tweet: “We did not complete a thorough enough review of the 130+ page report before it was published. This is on us, we should have done better.”

The report said:

“These are toxic assets propped up by regulatory capture, and they go against everything that got me into crypto.”

His tone might be a little salty for some, but he’s not actually wrong.

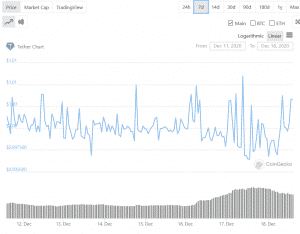

Tether

market cap $20,150,087,197

Tether might be too big to fail, because if it it does, it might take most of the top ten cryptocurrency’s by market cap with it.

Tether was conceived to provide some stability to the cryptocurrency markets. It’s pegged to the US dollar on a one to one basis, and issued by the Hong Kong based company of the same name. It claims to maintain reserves equal to the amount of USDT in circulation.

Tether is commonly treated as a digital version of fiat that can be printed at will, which means large infusions of multiple billions of dollars overnight just magically appear on the doorstep of the Tether offices, or something. Since 2020 started, USDT’s market cap jumped about 500%, from $4 billion to $19 billion, which corresponds to 15 billion coins in less than 12 months.

A lot of those found their way into Bitcoin, Ethereum, and other coins with more to come in 2021. Specifically, over $4 billion worth of USDT were pumped into the cryptocurrrency system in three months, which could be a cause for the bull run and the Bitcoin price increase.

The point of the matter is that the industry’s become far too dependent on USDT. DeFi lives and dies on it in 2021, and if USDT gets banned or goes to zero, then it drags down everything else with it. But here’s another point: December 2, a group of Democratic legislators introduced the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act, which would require any institution issuing tokens backed by a reserve asset to be registered with the banking authority.

If the bill is enacted, USDT will be done because there’s no chance in hell they’re going to get the banking license required.

This is definitely something to watch out for in 2021.

Litecoin

market cap $7,191,418,890

Bitfinex added a token stable today, including Litecoin (and other coins), allowing you to use LTC as collateral on Bitfinex Borrow, a peer-to-peer digital token loan portal.

The numbers are interesting here. Borrows can get loans of up to 80% of the value of their coin holdings, including LTC, or up to 70% of their holdings in DOT, USDT or USD.

“Adding support for XRP, Litecoin, EOS and Polkadot on Bitfinex Borrow will provide our users with more freedom and flexibility when taking out loans from our highly liquid peer-to-peer lending markets. This also provides our users with additional avenues to utilise some of their favourite cryptocurrencies,” according to Paolo Ardoino, CTO at Bitfinex.

Bitcoin Cash

market cap $5,765,546,356

Bitcoin Cash’s claim to fame is that it’s the scaleable, user friendly coin, and capable of making high volume transactions the way that Bitcoin, it’s predecessor and chief rival, can’t. Mostly the BCH community is too busy fighting with itself with one half of the dev-team getting ready to take their ball and go home to actually be worth looking at as a viable investment.

But given the latest developments—wherein BCH has forked yet again—hopefully they’ve lost the ridiculous parts of their organization and can maybe start on fulfilling whatever promise they might have.

In this case, they’re offering a Send Anywhere feature from the wallet offered by Bitcoin.com, giving users the ability to send BCH gifts during Christmas or Chinese New Year. They only ask wallet users to upgrade to the latest client version. After which, you can deposit some funds, and press “send” to create and send a shareable link.

Honestly, if they stopped bickering like schoolchildren and actually focused on putting out improvements and fulfilling their promise of being a medium of exchange, BCH might actually be worthwhile as an investment.

Chainlink

market cap $5,366,447,532

Now in some lighter fare, a technical error caused one Github user to accidentally send 4,005 Chainlink, or roughly $50K, to the Aavegotchi smart contract on the Ethereum blockchain, which doesn’t support operations for the token.

That money’s gone. Naturally, the user took to twitter:

“I’m just recovering from a terrible loss, I’m a father and husband, and a few days ago I lost my life savings due to one small mistake and rush,” said the user. “When I launched the rescue operation, good people came to me who said that there should be a chance to add a LINK sidechain to it, which would allow me to recover all my life savings.”

Nick Mudge, the creator of the smart contract, said the GHSTStakingDiamond where the funds went wasn’t upgradeable, and the tokens were going to be stuck in Ethereum limbo forever. Now both the user and Mudge have called on Vitalik Buterin to hard fork and reverse the transaction.

Since that’s clearly not going to happen, Aavegotchi responded, saying that reversal of the transaction wasn’t feasible but they set up a donation prage to help the user get some of his funds back before the holidays, It’s accrued, at least now, a little north of $1,179 in Ethereum.

Be careful out there when playing with expensive toys in 2021.

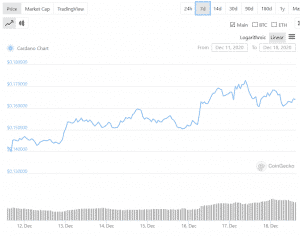

Cardano

market cap $5,099,648,602

Cardano is attempting to build a bridge to Ethereum through the launch of a new KEVM (K Ethereum Virtual Machine). Charles Hoskinson, who founded Cardano and is hte CEO of IOHK, was also a co-founder of Ethereum, but who left after a disagreement on Ethereum’s direction, and instead took a different approach to the development of Cardano, including approaching its scaling issues from a different direction.

The KEVM testnet is completely backwads compatible with Ethereum. Programs are written in Solidity – which is Ethereum’s primary language – and compiled into EVM bytecode to run in KEVM.

“With the launch of the KEVM devnet, smart contract development for the Cardano platform has now begun. Our deep commitment to interoperability is what has led us to develop a series of ‘on-ramps’ into developing applications for the Cardano platform, allowing developers proficient in blockchain development languages not native to Cardano to continue to write, or to port their existing smart contracts into the platform” said Hoskinson.

Polkadot

market cap: $5,042,637,856

Polkadot is starting to get recognized as an alternative to Ethereum.

Decentralized exchange (DEX) SushiSwap has hinted to having cross-chain aspirations in the next few months. The platform is producing features intended to improve the trading experience, which will assist in separating from Uniswap, which is presently the leading Ethereum DEX by volume.

There are plans to open the platform on Polkadot in 2021, according to 0xMake, co-founder of SushiSwap.

At current, SushiSwap is a decentralized exchange based on Ethereum. The platform is rolling out features meant to improve the trading experience, which will help separate it from Uniswap, the leading Ethereum decentralized exchange by volume.

“If you LP’ed past end september you still have 2/3 of your rewards that will be available in 6mo. and you will receive moonSushi when we open on Polkadot.”

Good to know.

Binance Coin

market cap $4,554,266,037

Last but not least—the technical fallout from Bitcoin’s crossing the $20,000 price threshold was an outage for both Binance. The traffic was hitting the servers so hard they buckled under the strain.

Binance coin itself enjoyed the considerable upswing, riding on the ridiculous headwinds leftover from Bitcoin’s run. It’ll be interesting to see how this coin fares in 2021.

—Joseph Morton