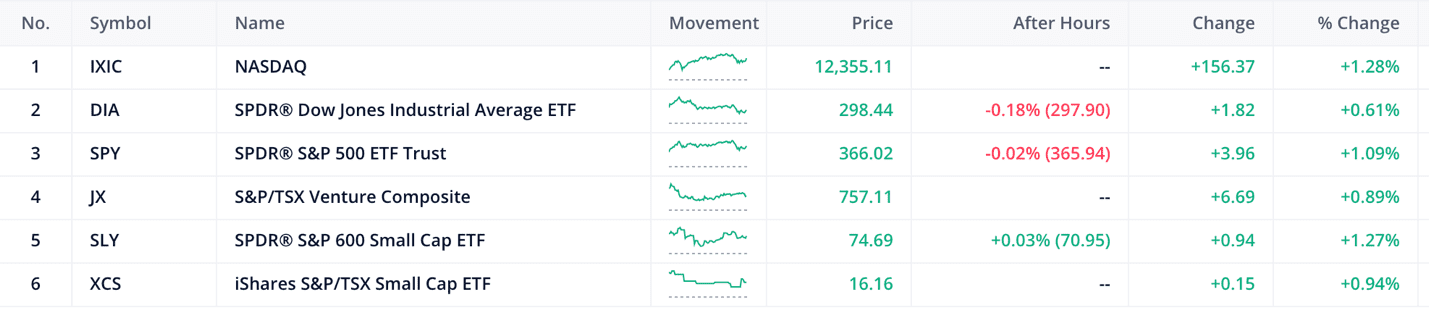

- The S&P 600 & TSX20 are up by 1.27% and 0.94% respectively

- The Canadian 10-year bond up by 0.06% and the US 10-year bond up by 0.09% as investors move capital out of these safer asset classes

Today’s stock pick of the day is International Petroleum Company (IPCO.T) a Vancouver – based oil and gas exploration company that is focused on upstream oil and gas, with a portfolio of exploration and production assets in Canada, Malaysia, and France.

As of the nine months ended September 30, 2020, IPCO was able to generate a grand total of $ 220 million in revenue utilizing an average of $760 million in net tangible assets.

IPCO has been blessed by the market with a new valuation of $430 million today as the market reacts to global news optimistically.

Here are some quick and notable highlights from their latest report(Q3 2020 HIGHLIGHTS):

- Strong production performance with a faster than forecast production ramp-up and good reservoir performance at the major oil assets in Canada.

- Full-year net average daily production now expected to exceed the high end of Q2

guidance. - Free cash flow yield 1 for Q3 2020 greater than 8%, calculated as the USD 22.8 million free cash flow for Q3 2020 as a percentage of IPC’s USD 280 million market capitalization as of September 30, 2020.

- Net debt 1 decreased from MUSD 341.4 as of June 30, 2020, to MUSD 322.1 as of September 30, 2020.

- First IPC Sustainability Report published.

Now we go into the fun stuff and analyze the business to try to come up with our own business valuation. To know how much IPCO should be we need the story of the business and the numbers of the business to make sense. This is the only way a true investor can come up with a business valuation that meets British economist John Maynard Keynes standard that :

It is better to be roughly right than precisely wrong.

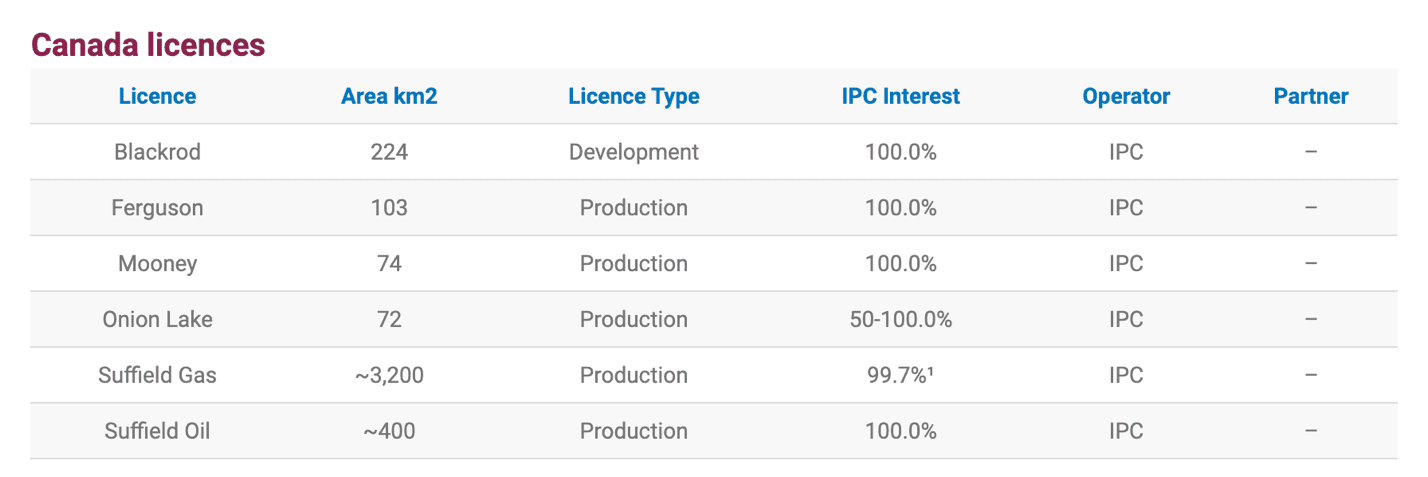

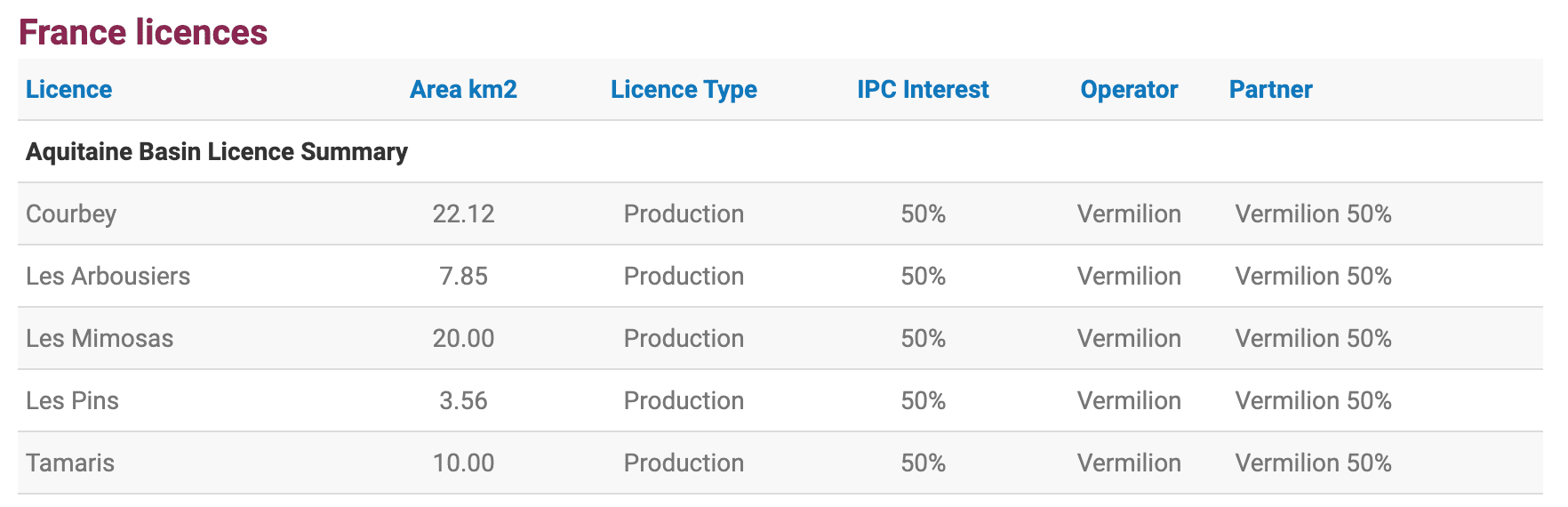

IPCO operates within several geographical areas :

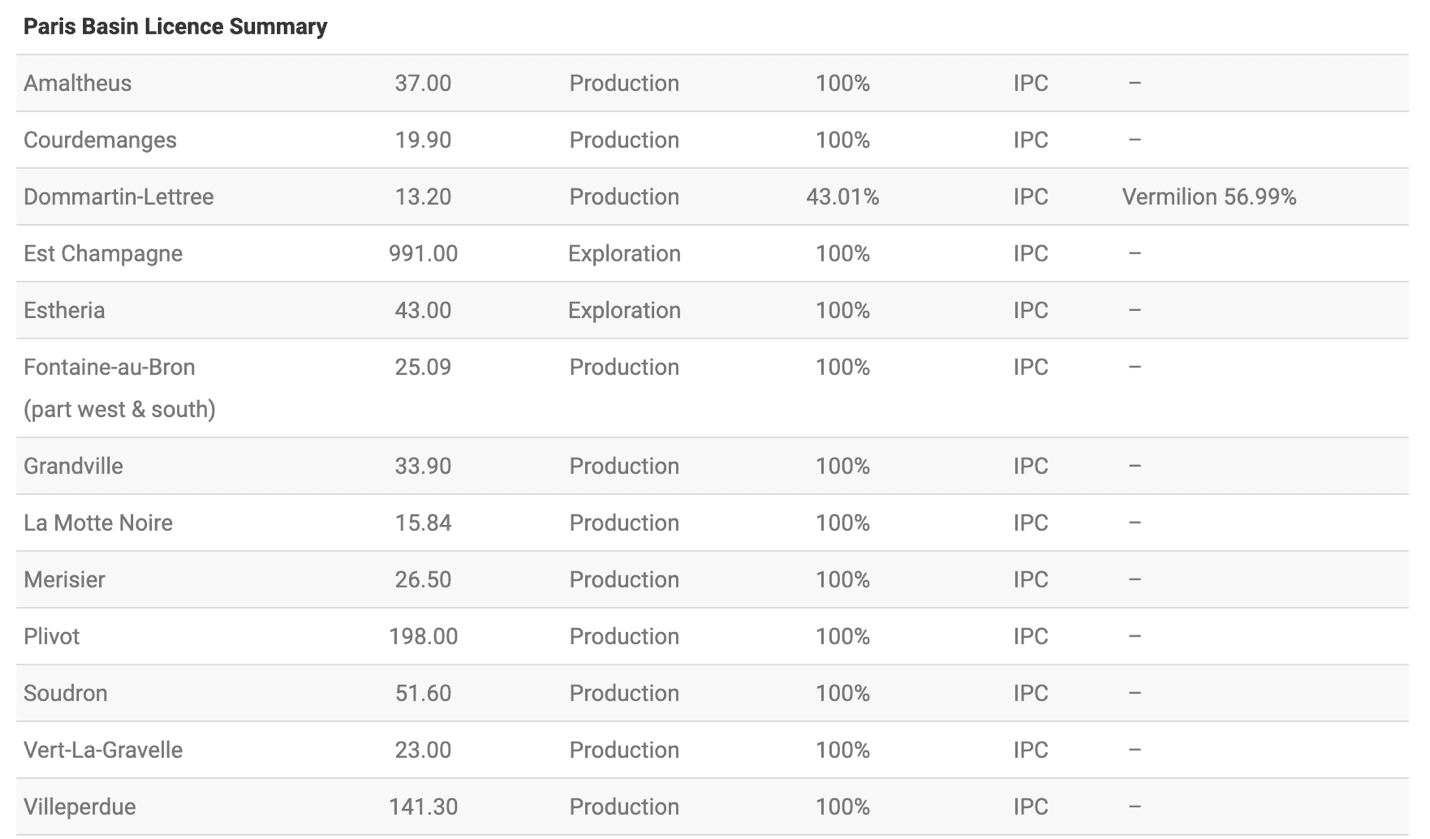

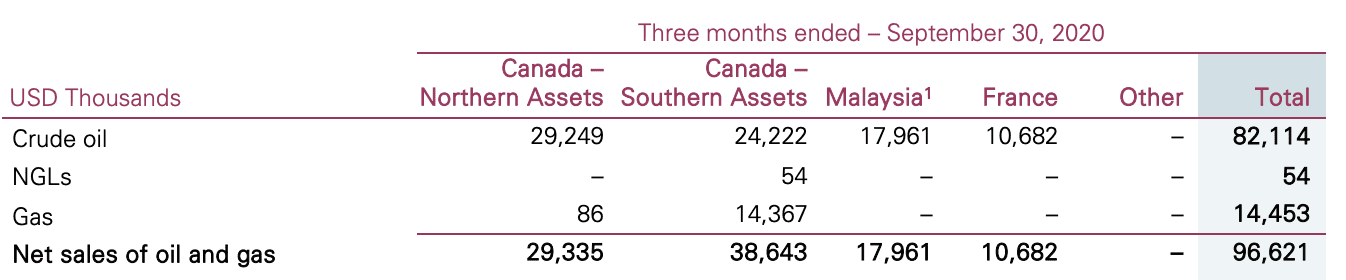

Canada is by far the largest geographical segment contributing 2/3 of the total revenue in 2019.

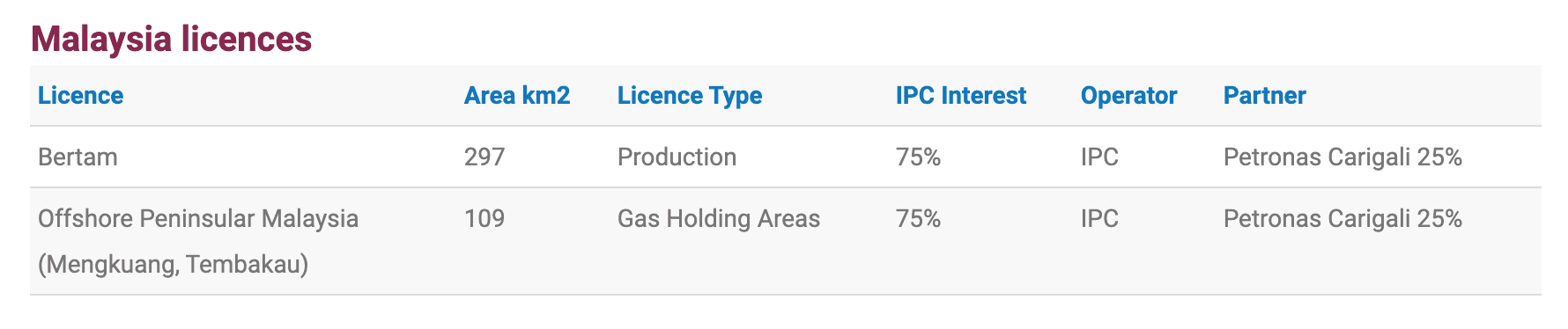

The second is in Malaysia. This segment includes the FPSO Bertam which is owned by IPCO. Malaysia contributed $129 million in revenue in 2019, which was about 22% of the total business that year for IPCO.

Lastly, we have France that contributed less than 10% of the total revenue in 2019.

IPCO is in the business of production and exploration of commodities. This exposes it to the price fluctuations of these markets and usually, the stock price, earnings, revenue, and cash flows have a strong positive correlation to the price of the main commodities.

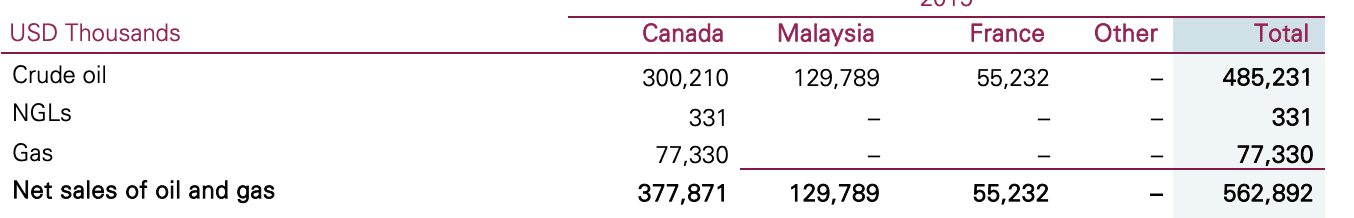

Crude Oil is by far their largest product. In the three months ended September 30, 2020, they produced $82 million from crude oil sales. This was 85% of the business they generated in that quarter.

Crude oil is the base for many products. These include transportation fuels such as gasoline, diesel, and jet fuel. They also include fuel oils used for heating and electricity generation.

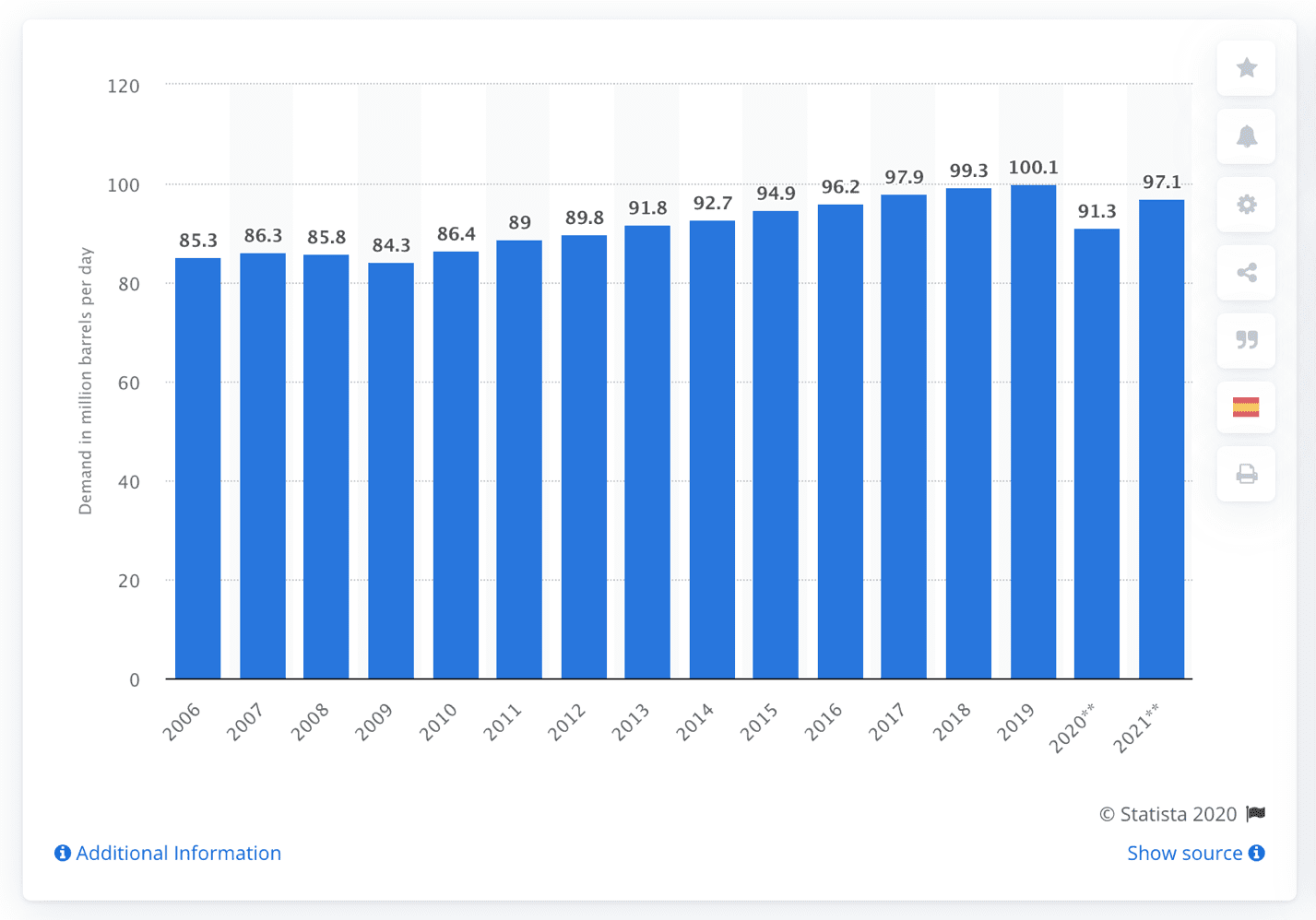

The graph above is the Daily demand for crude oil worldwide from 2006 to 2021 (in million barrels) and is the best indication of a consistent demand for the product by global consumers. Since 2006 the daily demand has grown by a CAGR of 1.23% which is in line with the average growth of the global economy.

The graph above is the Daily demand for crude oil worldwide from 2006 to 2021 (in million barrels) and is the best indication of a consistent demand for the product by global consumers. Since 2006 the daily demand has grown by a CAGR of 1.23% which is in line with the average growth of the global economy.

Natural Gas is their second product and contributed $14 million in revenue, about 14% of the total in 2019.

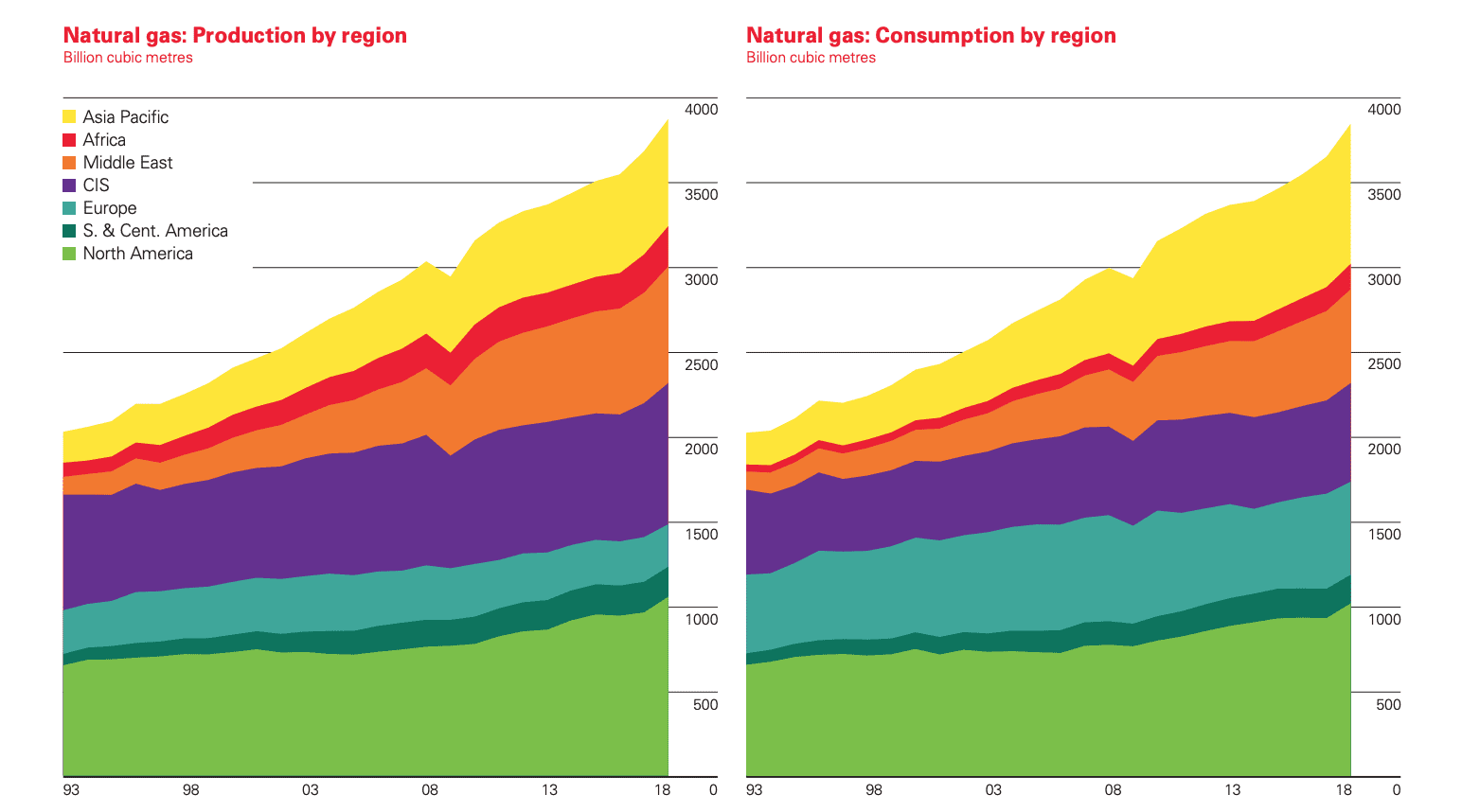

Natural gas consumption has shown significant increases in all regions that IPCO operates in since 1993. Natural gas is an important part of Canada’s energy resources. More than six million Canadians use natural gas to light, heat, and cool homes and businesses, to heat water, and for cooking.

In the US the main uses are( Source: U.S. Energy Information Administration, Monthly Energy Review, June 2020. The Sum of shares may not equal 100% because of independent rounding) :

- 36% in electric power

- 33% in industrial use

- 16% in residential homes

- 11% by for commercial use

- 3% transportation

So, there is obviously a high demand for the product. There is a large consumer base of close to 7 billion people who demand the products daily. The only issue, outside of the quality of production, is that oil and natural gas are commodities. This means the cost of the new entrance is low.

This lower barrier of entry means the industry can be very competitive and only the strongest companies can survive. Those who survive either have strong financial positions run efficiently and manage costs or have unique business models.

IPCO’s strategy is twofold. Firstly, it invests organically in the assets in Canada, Malaysia, and Europe, ensuring that the full resource and value potential of these assets can be realized. Secondly, they are seeking to acquire additional reserves and resources in the production and/or development stage, investing in those assets and maturing the resources through time so that they can add significant shareholder value.

They state that :

Our primary focus will be to acquire quality assets as opposed to having a particular geographical focus, as this has been the recipe for success within all the Lundin group primary resource companies.

To implement this strategic plan IPCO needs a management team that has a lot of experience with the day-to-day operations of an oil and natural gas firm. This experience comes with an ability to manage capital and invest in projects that will create shareholder value and to find opportunities to cut costs to be more competitive in the industry.

Leading the team we have Mike Nicholson the Chief Executive Officer. Between 1994 and 1996, Mr. Nicholson worked as a consulting economist for AUPEC ltd a firm that provides expert benchmarking and consultancy services for the global oil and gas sector.

Mr. Nicholson joined Lundin Petroleum in 2005 as Group Economics and Commercial Manager. He became General Manager of the Malaysia business in 2008 and Managing Director of the South East Asia business in 2012. He was appointed Chief Financial Officer in 2013.

Managing the capital and financial affairs for IPCO we Christophe Nerguararian the Chief Financial Officer.

From 1998 to 2011, Mr. Nerguararian worked in various banking and finance roles for BNP Paribas in Paris and Geneva, most recently as Head of the Upstream Finance team for Central and Eastern Europe.

Mr. Nerguararian joined Lundin Petroleum in 2012 as Head of Corporate Debt and Commercial Manager and was appointed Vice President of Corporate Finance in 2016.

And finally, Mr. William Lundin who is the Chief Operating Officer. Mr. Lundin has worked in the upstream oil and gas business with IPC, and previously with BlackPearl Resources Inc., since 2016.Mr. Lundin is currently a director of ShaMaran Petroleum a Canadian incorporated oil and gas exploration company.

The executive team seems to have the experience to run IPCO efficiently and meet their strategic goals. Over time the investor would want to see ROA, ROE, and ROIC numbers that are high, consistent, and growing. At the same time, a WACC or cost of capital that is consistent or low.

Now with a better understanding of how competitive the industry can be, the experience that the management team has to run the day-to-day operations, and how relatively difficult it can be to understand the IPCOs business model with little to no experience in the commodities sector. We can now try to use this information to come up with a conclusion of how much we think the stock will be worth in the future as a potential investor.

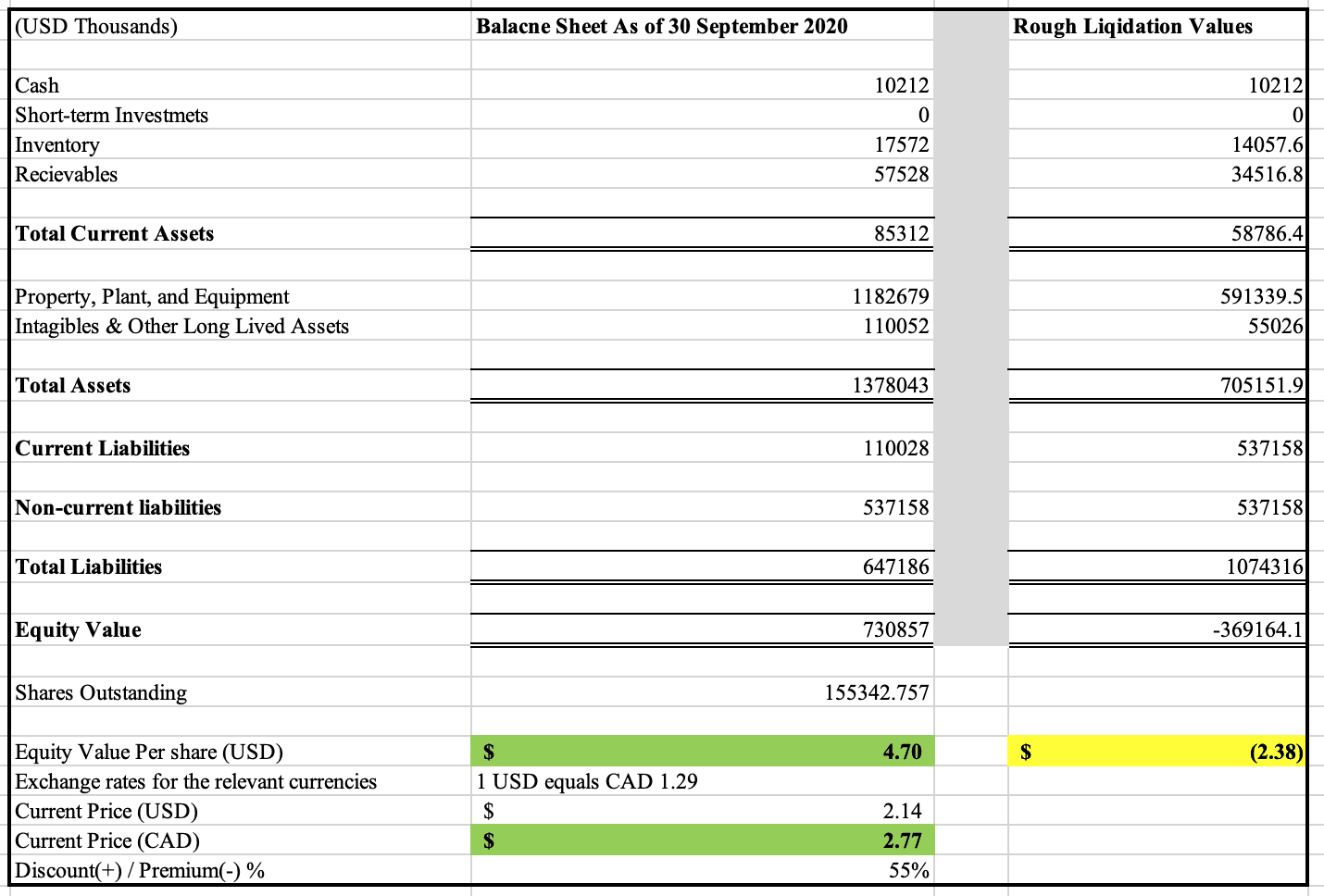

Since we have cash flows that are very inconsistent, we are forced to use alternative valuations. The fact that they are secondary measures means we will need a larger discount as a purchase price to be compensated for the added risk and uncertainty. This discount can be seen as a margin for error, just in case, our brief analysis is dead wrong.

Balance Sheet Analysis

- Cash Assumptions: Cash and cash equivalents include only cash at hand or held in bank accounts so we take 100% of the cash to be fair value

- Receivables Assumptions: Since receivables are less liquid we have to assume a portion of them might be illiquid of default due to the current economic climate.

- Inventory Assumptions: We assume the same for inventory as we did for receivables.

- Property Plant and Equipment assumption: Property in the oil and gas industry is very niche and difficult to repurpose. This makes it difficult to sell, and when there is a chance to sell the large infrastructures it is usually through a fire sale that depresses the fair value by a large percent

- Total Liabilities Assumptions: A business has to pay all its liabilities so we take them at face value.

Our price range from our analysis puts the price of the business between negative $USD 2.38 per share(rough recession liquidation value) and $USD 4.70 per share (reported value as of September 30, 2020). This range can be room for many errors by itself but compared to the current market price of $USD 2.14 or $2.77 per share seems to be trading at a 55% discount relative to book value.

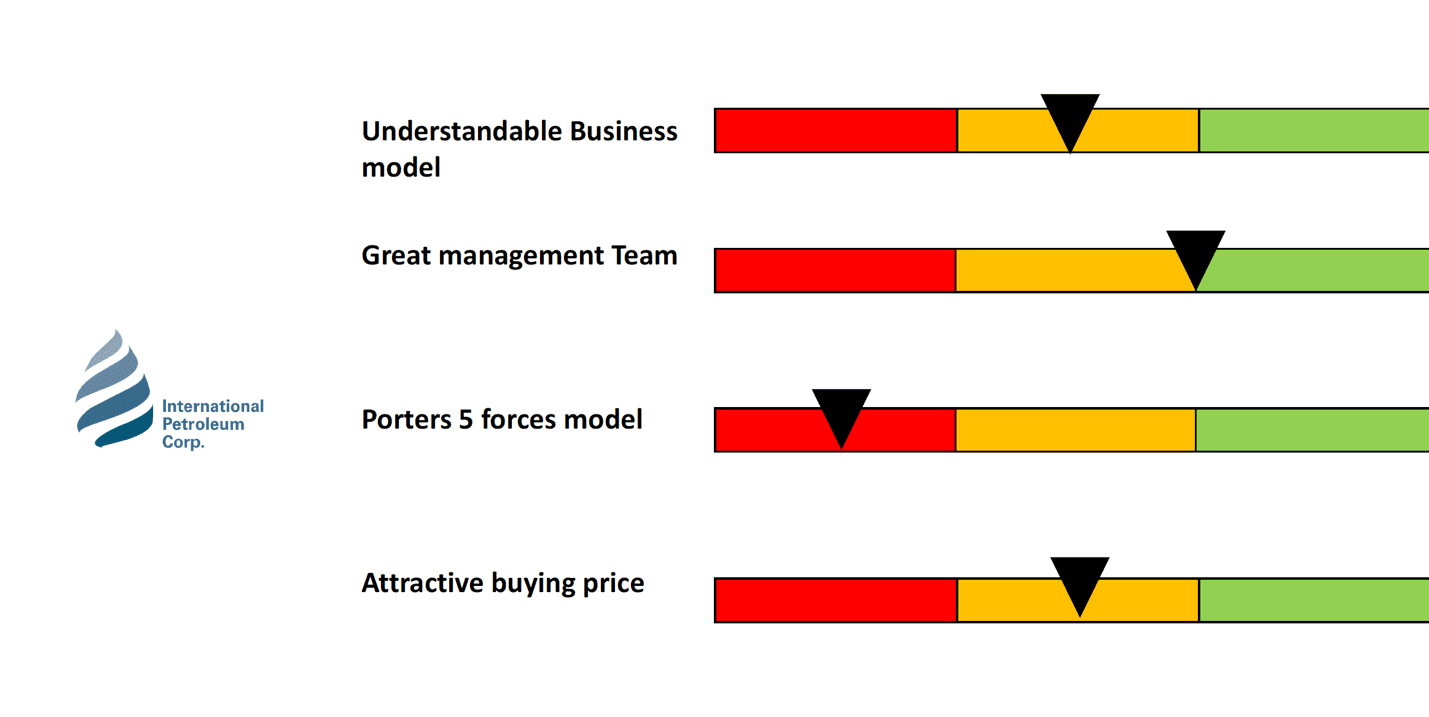

Below is a great visual summary of our analysis and shows how subjective the investment analysis process can be.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.